Elio D’Amato, Stockopedia

BUY RECOMMENDATIONS

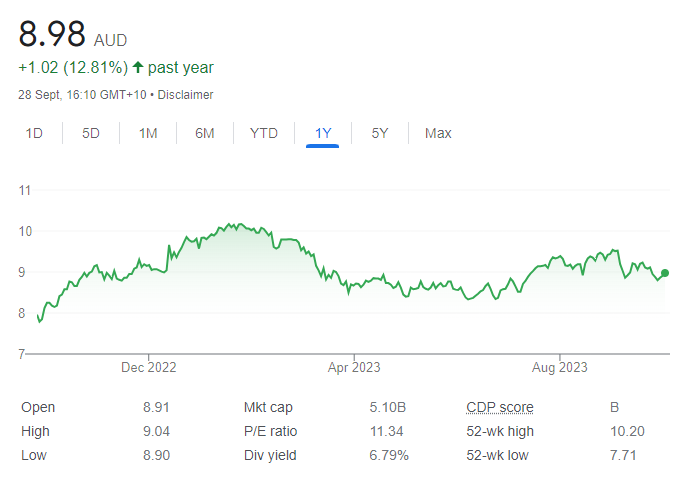

BUY – Bendigo and Adelaide Bank (BEN)

The bank was a standout in the recent earnings season.The company generates a solid return on equity and capital, and is cash flow positive. BEN also lifted earnings, improved its net interest margin, grew its customers and its dividend. Agribusiness and business banking generate about 30 per cent of the group’s total earnings. The company’s digital banking presence continues to improve.

BUY – Johns Lyng Group (JLG)

The building services group operates in the restoration space in Australia and the US. The latest annual result showed its pricing model is in order, which is encouraging given the work-in-hand pipeline in fiscal year 2024. Defensive earnings flow from the company generating revenue from insurance companies and government departments.The quality of the business has improved significantly in the latest period.

HOLD RECOMMENDATIONS

HOLD – AMP (AMP)

This diversified financial services company is embarking on a massive business transformation, and was one of the big improvers this reporting season, in our view. Challenges remain, but the company is enjoying improving price sentiment and an uptick in analyst earnings expectations. The shares have risen from 99 cents on July 10 to trade at $1.255 on September 28. Our momentum score has increased by 60 per cent in the past month.

HOLD – Magellan Financial Group (MFG)

The fund manager retains a strong return on capital and equity. Margins remain strong and the significant share price decline leaves solid value in the stock. The company needs to generate consistent inflows, rather than outflows, to attract more investor attention. Sustaining and building momentum moving forward is a key to a brighter outlook.

SELL RECOMMENDATIONS

SELL – Viva Energy Group (VEA)

Refining margins in the past 12 months have been strong. However, earnings fell in its energy and infrastructure businesses due to operational issues. In our view, the stock’s valuation has been negatively impacted. Investors may want to re-examine their objectives, particularly after news oil trading giant Vitol Investment Partnership has sold a 16 per cent stake in the company. We have reduced our quality ranking in response to weaker returns on equity and capital when benchmarked against the market and its peers.

SELL – Credit Corp Group (CCP)

For many years, CCP was held in the highest regard by fundamental investors and earned its reputation as a rock solid quality business. However, the latest fiscal year 2023 results showed flatlining debt purchases and lending had impacted the bottom line. As a result, both operating and free cash flow turned negative in the latest period. Perhaps it’s time for investors to re-consider their previously held perceptions of the business.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Jabin Hallihan, Morgans

BUY RECOMMENDATIONS

BUY – Treasury Wine Estates (TWE)

The global wine company has a diversified premium wine portfolio, a robust distribution network and generates consistent revenue growth. We believe TWE offers a good buying opportunity. Short-term catalysts for a re-rating include demand for the renowned Penfolds brand and the possible removal or easing of steep Chinese tariffs on wines from Australia. Expect strong returns driven by strategic advantages and market dynamics.

BUY – Pilbara Minerals (PLS)

PLS is one of our top selections among lithium stocks. PLS offers a long resource life and growth prospects. With a forecast strong fiscal year 2024 cash balance of more than $3.3 billion and robust cash flow, the company can drive capital management initiatives and expansion. Our add rating comes with a $5.60 price target. The shares were trading at $4.24 on September 28.

HOLD RECOMMENDATIONS

HOLD – Telstra Group (TLS)

The telecommunications giant has achieved returns above its cost of capital, distinguishing it from competitors. TLS and the sector is benefiting from favourable trends, including rational market behaviour, price increases and operational cost reductions. Telstra offers defensive qualities in volatile markets and during times of macroeconomic concerns. We have a $4.20 price target. The shares were trading at $3.85 on September 28.

HOLD – National Australia Bank (NAB)

NAB enjoys strong relationships with small and medium-sized businesses. Investors are attracted to its dividend yield. However, economic weakness could impact NAB’s business customers, and the bank’s costs are rising. The shares are cheaper than Commonwealth Bank, but more expensive than ANZ and Westpac. We retain a hold recommendation at this point.

SELL RECOMMENDATIONS

SELL – Fortescue Metals Group (FMG)

The iron ore producer is trading at a substantial premium to our price of $16.20 a share. Consequently, we hold a reduce recommendation. The company is a strong producer, shipping 192 million tonnes in fiscal year 2023. But we need more clarity about its future strategy and capital allocation framework as it transitions to a greener energy company. The shares were trading at $20.64 on September 28.

SELL – Woodside Energy Group (WDS)

The energy giant produces and distributes natural gas and liquefied natural gas (LNG). Woodside has reported solid earnings and dividends in line with market expectations. While WDS remains a strong company, the stock price has exceeded our target of $33.50. Therefore, investors may want to consider trimming holdings. We believe Woodside is fully priced. The shares were trading at $36.47 on September 28.

Niv Dagan, Peak Asset Management

BUY RECOMMENDATIONS

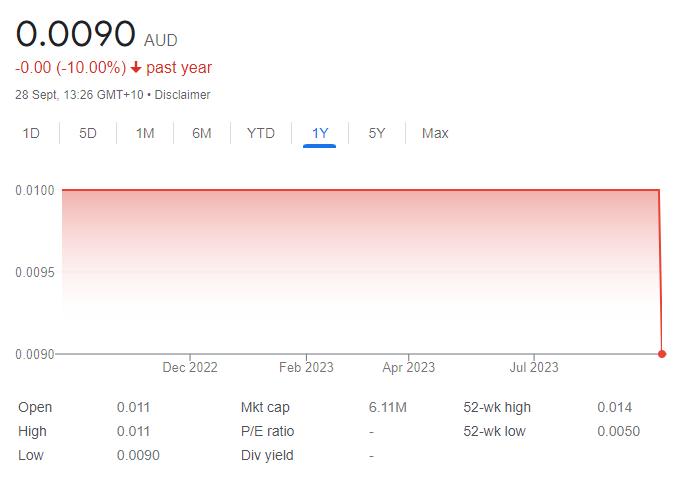

BUY – Alderan Resources (AL8)

Alderan has executed a binding agreement to acquire seven lithium exploration projects.The agreement includes 24 exploration licences within the Minas Gerais state of Brazil. AL8 reached the agreement with Parabolic Lithium. All projects are within the Lithium Valley and cover 472 square kilometres with known spodumene occurrences. Post the acquisition, AL8 emerges as one of the biggest landholders in the highly prospective region.The shares were trading at a cent on September 28.

BUY – Eden Innovations (EDE)

The company makes and markets concrete admixture and a retrofit dual fuel kit for diesel generator sets. The global sales target for all Eden products is $5.3 million in fiscal year 2024. If the company is able to sell its 65 acre industrial property in the US state of Georgia, the reduced secured debt and ongoing interest payments would significantly increase the chances of achieving positive group cash flow. A speculative buy.

HOLD RECOMMENDATIONS

HOLD – Castle Minerals (CDT)

The company operates the Kambale graphite project in Ghana. CDT recently announced more wide, high-grade and near-surface intercepts obtained from the final 21 holes of a recent 43-hole RC (reverse circulation) drilling campaign. It also announced that the increase in drill density of newly identified mineralisation would enable it to be included in a mineral resource estimate update. Keep up to date with the news flow.

HOLD – AdAlta (1AD)

AdAlta is a clinical stage biotechnology company. AdAlta’s lead drug candidate is AD-214. It’s being developed as a first-in-class therapy to treat debilitating and fatal fibrotic diseases, including idiopathic pulmonary fibrosis.The company completed a healthy volunteer enrolment for its AD-214 phase 1 extension study. The company announced all participants had successfully received at least their first dose. No safety concerns had been reported by study investigators as at September 20, 2023, which is encouraging news and paints a brighter outlook.

SELL RECOMMENDATIONS

SELL – JB Hi-FI (JBH)

The consumer electronics giant has a strong performance record. It recently reported total sales of $9.626 billion in fiscal year 2023, up 4.3 per cent on the prior corresponding period. The share price has been volatile this year. However, the stock has risen from $41.55 on June 26 to trade at $45.82 on September 28. According to our analysis, JBH’s financial metrics are trading at a premium compared to sector peers. Investors may want to consider cashing in some gains.

SELL – Healius (HLS)

HLS, a pathology and diagnostic imaging services company, is subject to a proposed takeover from Australian Clinical Labs. In July, the Australian Competition and Consumer Commission outlined significant preliminary competition concerns about the proposed acquisition. COVID-19 testing revenue declined substantially in fiscal year 2023. The shares have fallen from $3.18 on June 30 to trade at $2.38 on September 28. Other stocks appeal more at this stage of the cycle.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.