Christopher Watt, Bell Potter Securities

BUY RECOMMENDATIONS

BUY – Woolworths Group (WOW)

Shares in the supermarket giant have fallen from $37.51 on January 2 to trade at $33.25 on March 28. Sales moderated in the first seven weeks of the second half of fiscal year 2024 in response to lower inflation and a more cautious consumer. However, group sales of $34.6 billion in the first half of fiscal year 2024 were up 4.4 per cent on the prior corresponding period. Group net profit after tax of $929 million was up 2.5 per cent. We believe the weaker share price provides a buying opportunity as we expect Woolworths shares to recover.

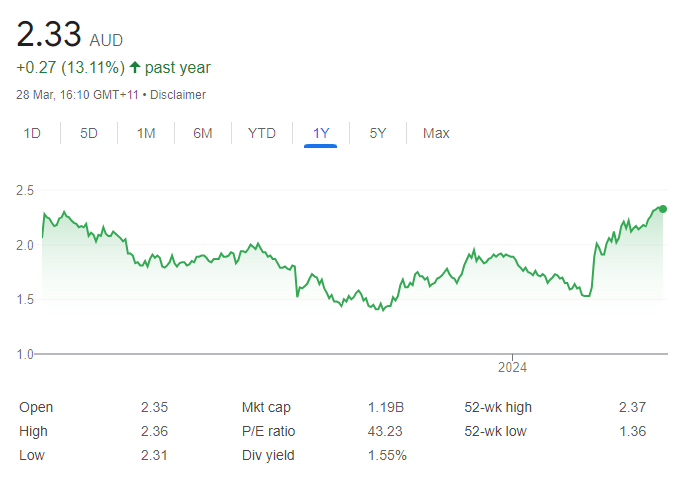

BUY – IDP Education (IEL)

The company provides international student placements. It co-owns the world’s most popular English language tests. The company generated record revenue of $579 million in the first half of fiscal year 2024, up 15 per cent on the prior corresponding period. Revenue was driven by strong student placement growth. We believe the market has over-reacted to the Canadian cap on student visa applications. We view IEL’s tests as superior and believe the cap will disproportionately impact competitors, while only mildly impacting IEL’s earnings per share in the short-term. In our view, IEL is trading at a discount.

HOLD RECOMMENDATIONS

HOLD – Life360 Inc. (360)

This information technology company provides a mobile networking app for families. Introducing a new advertising and data model in calendar year 2024 is positive and should earn the company a higher multiple over the longer term. We retain a hold recommendation given the share price has risen from $8.16 on February 29 to trade at $13.02 on March 28.

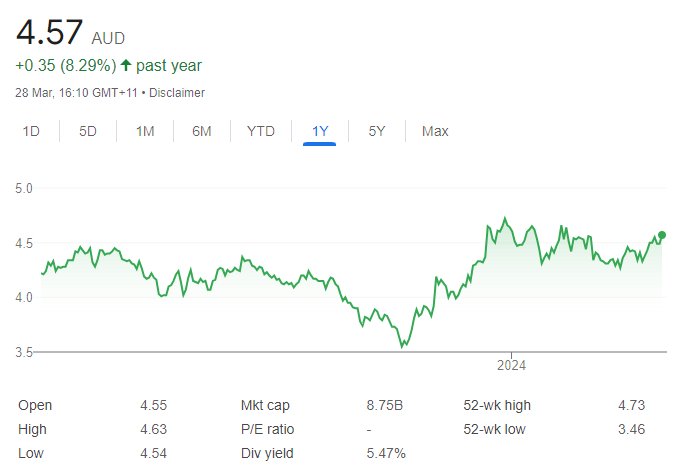

HOLD – GPT Group (GPT)

GPT is a diversified property group. The fiscal year 2023 result was encouraging, although the office portfolio remains challenging. We believe there’s upside in real estate investment trusts due to potential interest rate cuts. GPT is one of our preferred stocks in the sector due to an increasing mix of industrial assets. Combined office and retail assets enjoy above average occupancy rates.

SELL RECOMMENDATIONS

SELL – Altium (ALU)

This multinational is an electronic design software company. The Altium share price has soared from $51.26 on February 14 to trade at $65.37 on March 28. The price rise was driven by a takeover bid for Altium by Renesas Electronics Corporation at $68.50 a share. Investors can lock in profits now and avoid any potentially unforeseen issues arising from conditions attached to the scheme implementation agreement. The transaction, expected to close before the end of calendar year 2024, has been unanimously approved by the boards of both companies.

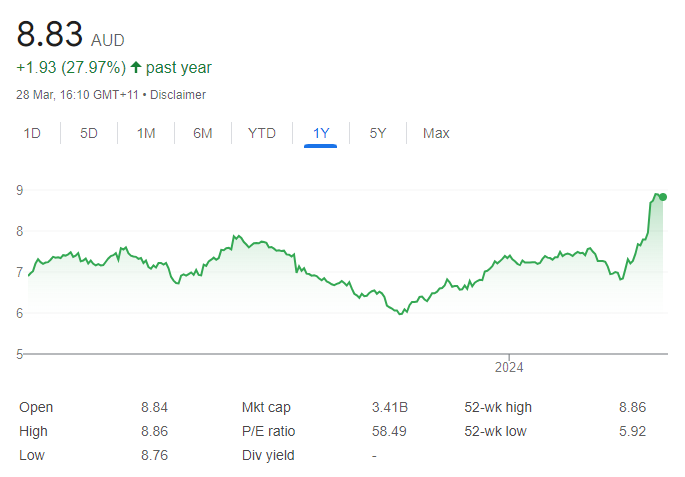

SELL – CSR (CSR)

This building products group has agreed to a takeover bid from French group Saint-Gobain at $9 a share. CSR has entered into a binding scheme implementation deed with Saint-Gobain. The CSR board recommends shareholders vote in favour of the scheme in the absence of a superior proposal. CSR shares have risen from $6.77 on February 20 to trade at $8.83 on March 28. Investors may want to consider cashing out now given limited upside potential.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Damien Nguyen, Morgans

BUY RECOMMENDATIONS

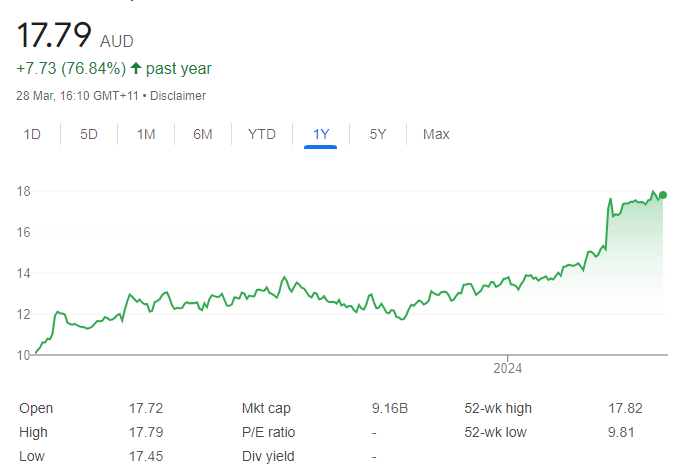

BUY – NextDC (NXT)

NextDC is Australia’s largest independent data centre operator. We believe NXT is well placed to benefit from significant and ongoing structural growth, which is accelerating demand for data centres. We expect NXT to expand its footprint substantially as it continues to win new business. Our 12-month price target is $20.

BUY – Treasury Wine Estates (TWE)

TWE is one of the world’s largest vertically integrated wine companies. It has more than 70 brands in its portfolio, including Penfolds. The company is trading on an attractive valuation. The company is poised to benefit after China recently announced it would scrap tariffs on imported Australian wine. Our 12-month price target at this point is $14.03.

HOLD RECOMMENDATIONS

HOLD – Goodman Group (GMG)

Goodman is the largest industrial property group on the ASX. GMG is a high quality business with a robust balance sheet. It continues to benefit from structural demand within the digital space. Our hold recommendation is based on valuation grounds. The shares have performed strongly in calendar year 2024 to recently trade at a premium to our valuation.

HOLD – Wesfarmers (WES)

WES is an attractive long-term investment, with a diversified group of popular retail and industrial brands. It has a healthy balance sheet and an experienced leadership team. The company’s retail businesses are poised to benefit due to their scale advantage and strong value proposition. Despite our positive view over the long-term, we believe WES is fully valued in the short term.

SELL RECOMMENDATIONS

SELL – Commonwealth Bank of Australia (CBA)

Australia’s biggest bank enjoys a loyal retail investor and customer base. However, we believe potential medium term returns are too compressed at current prices considering its earnings outlook and elevated trading multiples. The shares were recently trading at a substantial premium to our 12-month price target of $91.28.

SELL – Woolworths Group (WOW)

We see limited upside potential in the supermarket giant’s share price during the next 12 months. WOW’s first half result in fiscal year 2024 was in line with expectations. But commentary on sales for the first seven weeks in the second half of fiscal year 2024 was softer than anticipated. Investors may want to consider cashing in some gains.

Please note: Woolworths Group is recommended as a buy and a sell this week as sharemarket experts take different views about the future.

Arthur Garipoli, Seneca Financial Solutions

BUY RECOMMENDATIONS

BUY – Webjet (WEB)

The online travel agency recently reaffirmed earnings guidance for fiscal year 2024. WEB expects underlying EBITDA to be above the midpoint in a range of between $180 million and $190 million. The WebBeds business has generated significant growth. First half revenue of $171.8 million was up 50 per cent on the prior corresponding period. The WebBeds business is on track to deliver $5 billion in total transaction value in fiscal year 2025. The share price offers upside potential if the company continues to win market share.

BUY – Life360 Inc. (360)

The company’s international technology platform provides tracking and location services. The company generated revenue of $305 million in calendar year 2023, an increase of 33 per cent on the prior corresponding period. A net loss of $28.2 million represented a $63.5 million improvement on the prior year. Positive adjusted EBITDA was well ahead of forecasts. The company announced it was creating a new advertising revenue stream in calendar year 2024.

HOLD RECOMMENDATIONS

HOLD – Imdex (IMD)

This global mining technology company recently reported a solid first half result in fiscal year 2024. Group revenue of $235 million was up 18 per cent on the prior corresponding period. The company’s acquisition of Norwegian company Devico is a positive fit and performing above expectations. Devico generated revenue of $36.1 million. The company can drive earnings going forward via an improving product mix and cost synergies.

HOLD – Tuas (TUA)

Tuas operates telecommunication services in Singapore. The company’s 2024 first half result was ahead of consensus. EBITDA was up 56 per cent on the prior corresponding period and revenue grew by 38 per cent. We believe the company can continue to grow mobile subscriptions. In our view, TUA offers upgrade potential on higher mobile and broadband sales.

SELL RECOMMENDATIONS

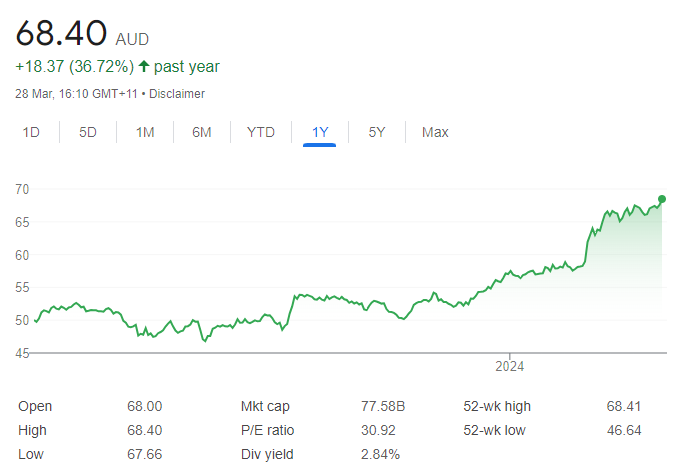

SELL – Wesfarmers (WES)

This industrial conglomerate reported first half 2024 results above market expectations. Hardware giant Bunnings has proven to be resilient in a challenging economy. Retail store chain Kmart has been a strong performer. The shares have risen from $58.94 on February 14 to trade at $68.18 on March 28. We suggest investors consider taking a profit at recent levels.

SELL – KMD Brands (KMD)

This apparel retailer’s brands include Rip Curl, Kathmandu and Oboz. Sales of $NZ468.6 million in the first half of fiscal year 2024 were down 14.5 per cent on the prior corresponding period. The company reported a statutory loss after tax of $9.7 million. KMD faces a challenging second half, so we see better investment opportunities elsewhere.

Related Articles:

- Australian Stock Trading Apps

- CFD Trading in Australia

- How to Start Forex Trading in Australia

- How to Start Day Trading in Australia

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.