John Athanasiou, Red Leaf Securities

BUY RECOMMENDATIONS

The A2 Milk Company (A2M)

This infant formula company has been sold down in response to the stage 4 lockdown in Melbourne causing disruption to its diagou sales channel. The company announced falling sales in September that’s likely to continue during the first half of 2021. However, we believe the share price will start recovering as Melbourne’s restrictions ease. A2M may be a good buying opportunity at these levels. The shares closed at $14.67 on October 15.

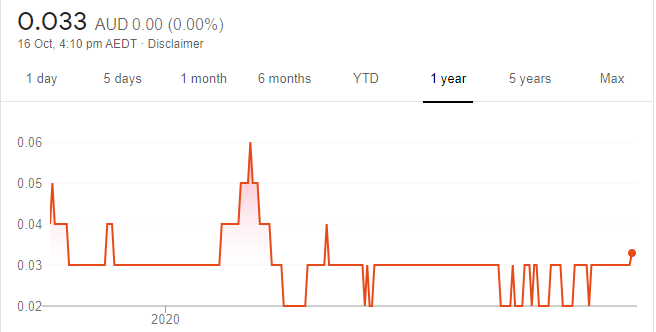

Kalina Power (KPO)

KPO is developing technology with an objective to convert waste heat from industrial processes, such as steel or cement making, into electrical power. As KPO progresses its technology, we believe it may gain wider appeal. KPO has about $8 million in cash. KPO is a speculative buy for those with an appetite for risk. The shares closed at 3.3 cents on October 15.

HOLD RECOMMENDATIONS

Coles Group (COL)

Supermarkets have done well during the pandemic as it’s forced more people to eat at home. We believe most of the capital upside has been priced in, but the company’s stable earnings are attractive. In our view, COL is worth holding for its defensive nature.

The Star Entertainment Group (SGR)

The company operates casinos in Sydney, Brisbane and on the Gold Coast. Closures, then fewer visitors and travel restrictions due to COVID-19 severely impacted fiscal 2020 revenue. However, a recovery in visitor numbers can be expected as travel restrictions across Australia ease.

SELL RECOMMENDATIONS

Insurance Australia Group (IAG)

The insurance giant has agreed to pay $138 million to settle a class action brought against its subsidiaries Swann Insurance and Insurance Australia. The settlement is subject to approval by the Federal Court of Australia. The settlement relates to add-on insurance products sold through motor vehicle and motorcycle dealers. We expect insurance margins to remain under pressure.

Whitehaven Coal (WHC)

Speculation is mounting that China may limit coal imports from Australia amid trade tensions between Canberra and Beijing. We expect the WHC share price to remain under pressure until a clearer picture emerges from Chinese authorities beyond October 15. The WHC share price has fallen from $2.57 on January 2 to close at $1.06 on October 15. In our view, the risk of holding WHC in the interim outweighs the potential upside.

Michael Gable, Fairmont Equities

BUY RECOMMENDATIONS

Appen (APX)

The share price of this language technology and data services company was punished after releasing its half year results in August. However, the company has rallied and is now enjoying a good level of support. We believe the business offers attractive long term value, so at current levels we regard APX as a buying opportunity. The shares closed at $35.70 on October 15.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

ResMed Inc (RMD)

This medical device maker recorded a double bottom on the chart at its $23 support level, and has now broken free of its recent range. We believe the stock will continue to rally. The shares have risen from $23.15 on September 21 to close at $25.12 on October 15.

HOLD RECOMMENDATIONS

Goodman Group (GMG)

GMG is our preferred stock in the real estate investment trust sector. It’s performed well over the long term. During the past two months, the share price traded sideways to consolidate its prior rally. It’s now breaking free of consolidation and we believe the stock will continue to rally higher.

Sydney Airport (SYD)

We continue to like the travel sector and believe it’s well placed for a recovery. SYD shares have been rallying recently, as travel restrictions in most of Australia start to ease. SYD’s significant advantage compared to other travel stocks is much fewer competitors.

SELL RECOMMENDATIONS

Myer Holdings (MYR)

COVID-19 had a major impact on the department store giant as outlets were forced to close. While group online sales rose 61.1 per cent to $422.5 million in full year 2020, total sales were down 15.8 per cent on the prior corresponding period to $2.519 billion. The share price is struggling and closed at 21 cents on October 15. MYR is up against fierce retail competition, so we believe there’s better value elsewhere.

Whitehaven Coal (WHC)

WHC shares remain in a long term downtrend. We don’t see any evidence the share price has bottomed. In our view, the risk remains to the downside. Speculation on and prior to October 15 that China may reduce coal imports from Australia creates uncertainty. The shares have fallen from $2.57 on January 2 to close at $1.06 on October 15.

Chris Conway, Marcus Today

BUY RECOMMENDATIONS

Adbri (ABC)

This construction materials company posted better than expected half year results in August. A positive cost-out program, improving residential demand and a pipeline of infrastructure work paint a bright outlook. ABC appears to have passed the low point for margins in its core cement division.

Bapcor (BAP)

This automotive aftermarket parts provider delivered a solid first quarter trading update. Group revenue was up 27 per cent on the prior corresponding period. BAP expects to deliver a strong first half. However, the second half remains unclear so BAP was unable to provide a full year earnings forecast. The update was good enough to sustain positive share price momentum.

HOLD RECOMMENDATIONS

Coca-Cola Amatil (CCL)

In our view, the worst of the COVID-19 impact is most likely behind this beverage maker. Expectations exist that CCL may deliver double-digit earnings per share growth during the next two years. The on-the-go sales channel is recovering where COVID-19 restrictions have been relaxed. A solid balance sheet and a $120 million cost-out program during the next four years are also positives.

Kogan.com (KGN)

The online retailer’s trading update in August was strong. Gross sales were up by more than 117 per cent year on year. Customers grew by 152,000. Adjusted EBITDA grew by more than 466 per cent year on year. We expect the momentum to continue.

SELL RECOMMENDATIONS

The A2 Milk Company (A2M)

Contraction in the daigou sales channel and subsequent downgrade has been attributed to COVID-19. In our view, the daigou channel may remain under pressure for longer than expected, as Chinese nationals are unable to travel to Australia. Our concern is Chinese consumers may find alternatives in the meantime.

Dexus (DXS)

Some may argue this diversified real estate group is trading in deep value territory, and the potential sale of several key properties is imminent as of October 15. This may be valid, but we believe the next year is likely to be tough. We expect commercial rents to be squeezed due to the impact of COVID-19.

> Please note The A2 Milk Company is recommended as a buy and a sell this week as market experts offer different views about its outlook.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.