Stuart Bromley, Medallion Financial Group

BUY RECOMMENDATIONS

Audinate Group (AD8)

This technology business enables audio and visual equipment to shift from analogue to digital networking. A recent business update confirmed a strong finish to the financial year, with a 74 per cent increase in fourth quarter revenue compared to last year’s prior corresponding period. The company has a strong pipeline of orders in fiscal year 2022, which we believe can drive the share price higher from here.

Alcidion Group (ALC)

ALC provides a suite of software products, with the objective of lifting efficiencies in hospitals. Revenue grew from around $3 million in fiscal year 2018 to $18.6 million in fiscal year 2020. We’re encouraged by the prospect of big contract wins continuing in the future. We’re optimistic that its recent acquisition in the UK will enable Alcidion to cross-sell it’s core offerings to a new client base.

HOLD RECOMMENDATIONS

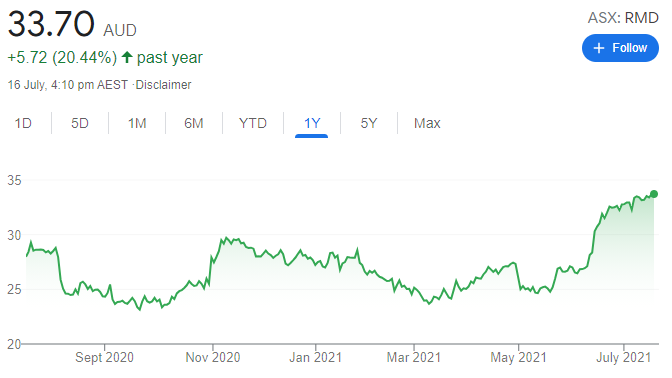

ResMed Inc (RMD)

Management of this medical device maker did well to focus on ventilator sales during COVID-19 to offset weakness in its core sleep apnea segment caused by the pandemic. We expect the company’s sleep apnea division to recover from treating a build-up of undiagnosed cases during the pandemic. A new device, expected to be released towards the end of calendar year 2021, provides a tailwind in fiscal year 2022.

Aristocrat Leisure (ALL)

Investing in the high margin, mobile gaming space in recent years is paying dividends. This was particularly evident during the pandemic as physical gaming machines were subjected to lockdowns. Aristocrat continued to invest in physical gaming machine design and development during COVID-19, while listed New York Stock Exchange competitors reduced spending. We believe Aristocrat’s decision to invest will pay off, as pubs, clubs and casinos move towards increasing patron capacity.

SELL RECOMMENDATIONS

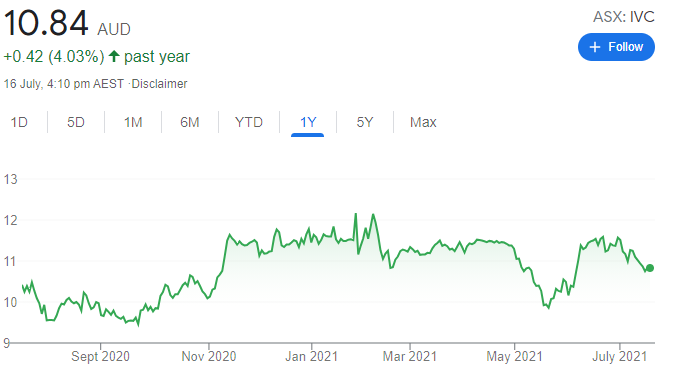

InvoCare (IVC)

This funeral company grew between 2015 and 2020 in response to acquisitions and improving facilities. But, in the short term, new social distancing measures in New South Wales cut the number of funeral mourners and reduces earnings potential. Demand for funeral services is impacted by a reduction in death rates, due in part to social distancing and COVID-19 vaccinations.

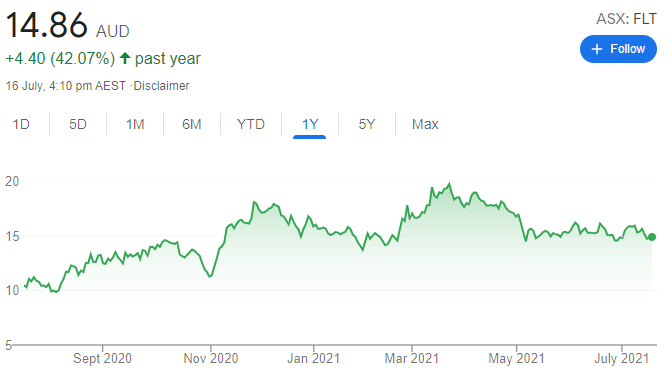

Flight Centre Travel Group (FLT)

Challenges remain from lower domestic travel margins when compared to international margins, an uncertain outlook for international travel and a slow COVID-19 vaccine rollout in Australia. While FLT has a strong balance sheet with good liquidity, we would prefer to wait until uncertainty subsides.

Niv Dagan, Peak Asset Management

BUY RECOMMENDATIONS

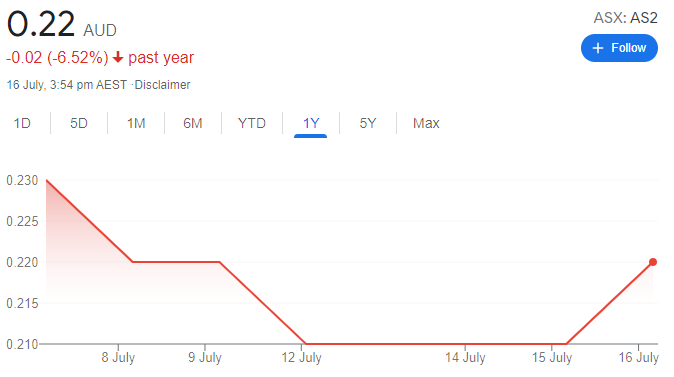

Askari Metals (AS2)

Following the recent and well supported listing, we believe AS2 is well positioned and funded to grow its portfolio of copper and gold projects in New South Wales and Western Australia. The Horry Copper project in Western Australia appeals, as it’s located along strike of the Halls Creek copper project owned by Cazaly Resources, which is said to have reported high grade drilling intersections. The shares finished at 20.5 cents on July 15.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Lion Energy (LIO)

This exploration and development company has operated in Indonesia for more than 20 years. We like the company’s strategy of seeking opportunities in green hydrogen production, storage and distribution in Australia. The green hydrogen space is generating increasing investor interest. The company recently signed a memorandum of understanding (MOU) with Wagner Corporation to explore opportunities in developing green hydrogen facilities and infrastructure at Wagner’s Wellcamp Business Park and Pinkenba Wharf in Brisbane. A speculative buy for those with an appetite for risk.

HOLD RECOMMENDATIONS

Sydney Airport (SYD)

The shares soared earlier this month in response to an indicative takeover proposal for SYD at $8.25 per stapled security. However, the SYD board believes the offer undervalues the company and isn’t in the best interests of shareholders. The bid is below the pre-pandemic share price. We believe the suitor may need to increase its offer, or perhaps another bidder may emerge.

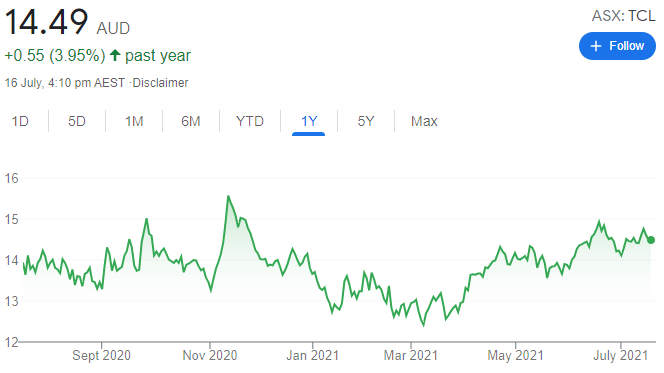

Transurban Group (TCL)

The company operates toll roads in Melbourne, Sydney, Brisbane, Washington and Montreal. It also develops innovative tolling and transport technology. The company’s earnings are defensive. The shares have risen from $13.80 on June 1 to finish at $14.61 on July 15. We believe a takeover proposal for Sydney Airport establishes a positive tone for infrastructure assets in Australia.

SELL RECOMMENDATIONS

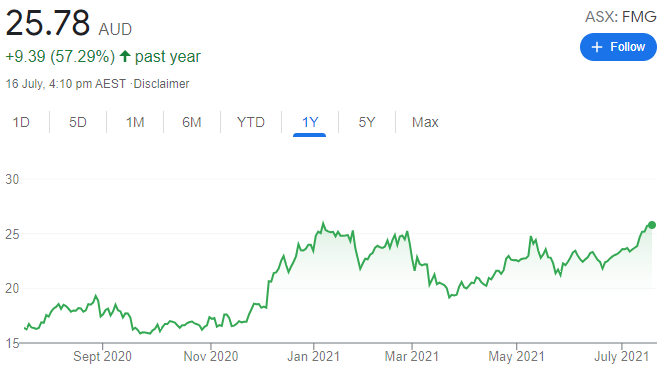

Fortescue Metals Group (FMG)

The iron ore producer’s share price has risen from $16.11 on July 16, 2020 to finish at $25.72 on July 15, 2021. We’re expecting a strong June quarter production result and a record final dividend during the reporting season. We rate FMG a sell on relative valuation grounds. Investors may want to consider taking a profit.

Commonwealth Bank of Australia (CBA)

The CBA has been a strong performer in the past 12 months. The company’s shares have risen from $72.64 on July 16, 2020 to finish at $98.31 on July 15, 2021. However, the share price did close at $105.91 on June 17, 2021. Other banks are providing stiffer competition and enjoying growth momentum. Investors may want to consider taking a profit from trimming or selling their holdings.

Julia Lee, Burman Invest

BUY RECOMMENDATIONS

Healius (HLS)

An increasing number of COVID-19 tests will boost earnings, offsetting a marginal fall in diagnostic volumes while lockdowns are in place. COVID-19 tests are expected to remain at elevated levels in coming months before retreating as vaccination rates increase. In the medium to longer term, valuation is driven by the diagnostics business, where the outlook is positive as volumes and margins bounce back.

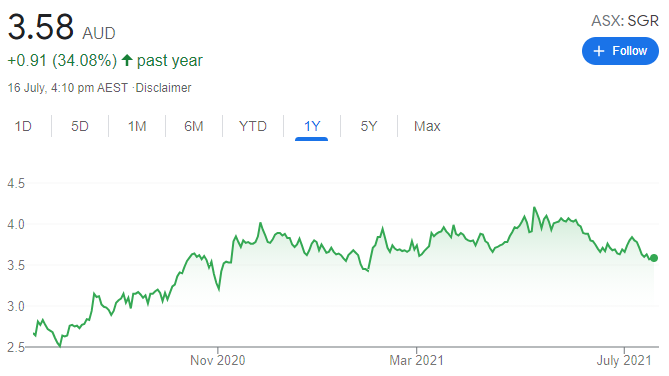

The Star Entertainment Group (SGR)

Extended lockdowns in New South Wales are having an impact on this casino operator. But we expect a recovery after lockdowns are lifted. US casinos have been resilient. Despite short term challenges, the company’s medium term outlook is improving on the back of rising vaccination rates. With continuing cost out initiatives in place, margins should improve and beat expectations. Long term licences are valuable as they are difficult to obtain.

HOLD RECOMMENDATIONS

Ansell (ANN)

Elevated demand for personal protective equipment (PPE) continues. The industrial business offers a bright outlook. ANN has been able to pass on increasing input costs to their customers. In our view, the positives are already reflected in the company’s share price and ANN’s valuation is fair.

Sydney Airport (SYD)

The SYD board has concluded that an indicative takeover proposal at $8.25 per stapled security isn’t in the best interests of shareholders, as it undervalues the company. However, the proposal reveals that long term infrastructure assets are appealing. The general rule of thumb with takeovers is to buy on the first bid and wait to see if any other bids materialise. Given the scarcity of quality long term infrastructure assets, it’s possible a competing bid for SYD may emerge, so we retain a hold recommendation.

SELL RECOMMENDATIONS

Kathmandu Holdings (KMD)

This outdoor clothing and equipment retailer has been impacted by lockdowns in New Zealand, Victoria and New South Wales. On a positive note, its Rip Curl business has been resilient offshore. But total group sales in fiscal year 2021 are anticipated to be below original expectations. We remain cautious on KMD ahead of the reporting season in August. But we will re-assess our position after the reporting season if improving vaccination rates result in retail conditions returning to normal.

InvoCare (IVC)

Lockdowns have impacted spending on funerals. Social distancing and hand washing have resulted in a mild flu season and below trend death rates. Death rates should return to normal in the medium term. According to our analysis, IVC is likely to emerge from the crisis in a weaker position as fierce competition potentially erodes market share.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.