Peter Day, Sequoia Wealth Management

BUY RECOMMENDATIONS

BUY – Jupiter Mines (JMS)

The company previously released a strategy update, outlining a five-year plan to become the leading manganese producer in the world. The company has a long life, open pit manganese mine with an integrated ore processing plant in South Africa. Mining volumes in the first half of fiscal year 2024 were up compared to the prior corresponding period. The share price can be volatile, so the stock is more suited to investors with an appetite for risk. The shares were trading at 17.5 cents on March 14.

BUY – The Star Entertainment Group (SGR)

The New South Wales Independent Casino Commission is holding another inquiry to investigate whether SGR is suitable to hold a Sydney casino licence. A final report is due on May 31. The company generated net revenue of $865.7 million in the first half of fiscal year 2024, down 14.6 per cent on the prior corresponding period. Shares in SGR have risen from 44.5 cents on February 23 to trade at 52 cents on March 14. However, the shares closed at $1.35 on March 17, 2023.

HOLD RECOMMENDATIONS

HOLD – Transurban Group (TCL)

The toll road operator reported average daily traffic of 2.5 million trips in the first half of fiscal year 2024, an increase of 2.1 per cent on the prior corresponding period. Proportional toll revenue of $1.763 billion was up 6.3 per cent. The company retained full year distribution guidance of 62 cents a share. The New South Wales Government is examining the findings of an independent toll review interim report, with a final report expected later this year. In our view, TCL is fully valued.

HOLD – Ramsay Health Care (RHC)

The company’s global health care network extends across eight countries. RHC is Australia’s biggest private hospital operator. Group revenue from contracts with customers of $8.1 billion in the first half of fiscal year 2024 was up 13.8 per cent on the prior corresponding period. We note positive trends in the UK, with revenue increasing 28.5 per cent. The shares have risen from $51.19 on February 28 to trade at $54.26 on March 14. We see valuations as fair at current levels.

SELL RECOMMENDATIONS

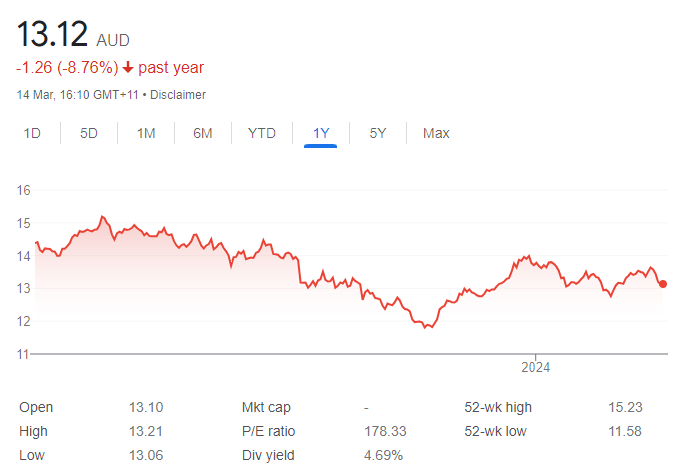

SELL – Platinum Asset Management (PTM)

The fund manager experienced net outflows of about $285 million in February 2024. It included net outflows of about $240 million from the Platinum Trust Funds. Net profit after tax of $35.6 million for the half year ending December 31, 2023, was down 5.3 per cent on the prior corresponding period. We retain an underweight rating on the stock at this stage of the cycle.

SELL – Atlas Arteria (ALX)

The company owns and operates and toll roads in France, Germany and the US. It has a 31.4 per cent interest in a toll road group in France. The French Government has introduced a new tax, which ALX is challenging. We’re not expecting any meaningful dividend growth. The company reported net profit after tax of $256.3 million for the year ending December 31, 2023, an increase of 6.3 per cent on the prior corresponding period. The shares have fallen from $6.81 on March 16, 2023, to trade at $5.29 on March 14, 2024. Other stocks appeal more at this point.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Tony Locantro, Alto Capital

BUY RECOMMENDATIONS

BUY – Saturn Metals (STN)

Saturn is developing the Apollo Hill gold project in Western Australia. A pre-feasibility study is progressing at the gold resource of 1.84 million ounces following a study revealing gold may be amenable to a heap leach process. With a strong gold price, there’s been little investor interest in the junior gold sector. While highly speculative, STN offers good upside potential on any advancements towards production amid considerable exploration in the Apollo Hill region and at the West Wyalong gold field in New South Wales.

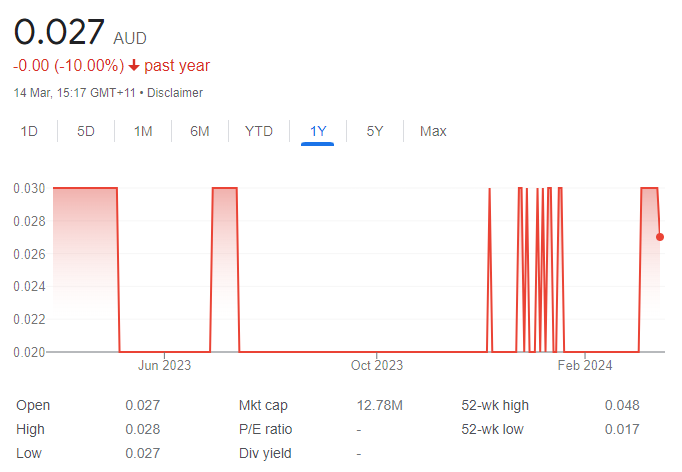

BUY – AdAlta (1AD)

AdAlta is a clinical stage drug company. Its lead candidate AD-214 is a molecule designed to treat idiopathic pulmonary fibrosis. Encouraging results from the AD-214 phase 1 extension study established the safety and tolerance for the planned phase 2 dose. Advancing to phase 2 trials could provide a new option for patients with the debilitating and fatal disease, while providing a return on AdAlta’s investment. In our view, AdAlta is a high-risk investment with transformational potential.

HOLD RECOMMENDATIONS

HOLD – Red Metal (RDM)

RDM recently reported encouraging initial metallurgical results at the Sybella rare earth oxide project near Mount Isa in Queensland. Pending further positive advancements, Sybella has the potential to emerge into a significant project, but with a high-risk profile. RDM has increased its holding in listed emerging resources company Maronan Metals (MMA), which has a suite of diversified exploration projects in its portfolio.

HOLD – Copper Search (CUS)

The diversified junior explorer recently announced a significant drilling target had been identified at the Paradise Dam Prospect, with about 3 kilometres of strike. A heritage survey is planned this month, with drill testing to occur as soon as practical subject to heritage survey results. Exploration carries risk, and this company’s share price can be volatile. CUS best suits investors with an appetite for risk.

SELL RECOMMENDATIONS

SELL – CAR Group (CAR)

The group operates digital marketplace businesses in Australia and internationally. CAR posted a strong half year result in fiscal year 2024, delivering double digit earnings and revenue growth in all key segments. The shares have performed strongly since December 1. We believe the shares are trading at a premium, so investors may want to consider taking a profit by selling into strength.

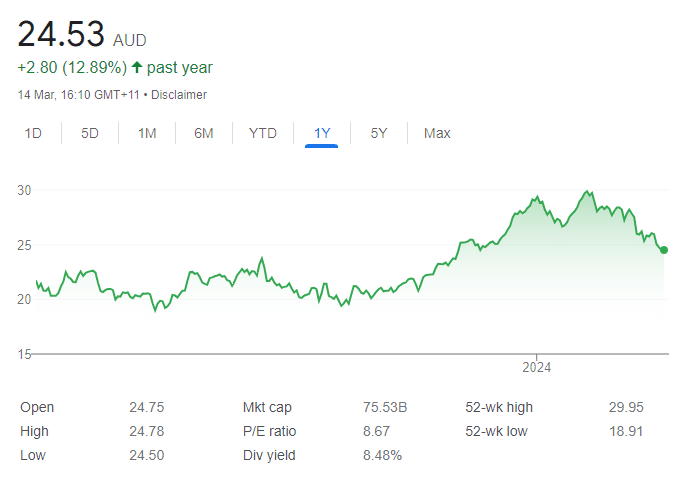

SELL – Fortescue (FMG)

The FMG share price has been under pressure following a correction in the iron ore price. Given potential for further price weakness amid risks in the Chinese economy, FMG could be sold with a view to switching to more diversified resource producers, such as South32 and BHP Group.

Toby Grimm, Baker Young

BUY RECOMMENDATIONS

BUY – AGL Energy (AGL)

The energy giant’s share price has continued to languish despite releasing better than expected first half earnings in fiscal year 2024 amid upgrading full year guidance. Traders have been factoring in weaker wholesale electricity prices in 2025. Stronger earnings provide a solid foundation to fund renewable energy investments. Taking a longer term view, we believe the stock is materially undervalued.

BUY – Amcor PLC (AMC)

The global packaging giant reported a soft set of results for the six months ending December 31, 2023, as customers in key markets delayed inventory re-stocking amid tougher retail conditions. However, we see potential for a recovery later this year, as the company cuts costs and customer re-stocking improves. We view Amcor PLC as attractive value at current levels.

HOLD RECOMMENDATIONS

HOLD – Mader Group (MAD)

The mechanical services contractor delivered first half results in fiscal year 2024 that marginally lagged lofty market expectations. However, it continued to generate strong revenue growth, particularly in higher margin US operations. The company delivered net profit after tax of $24.2 million, an increase of 38 per cent on the prior corresponding period. The company also reduced net debt.

HOLD – Chrysos Corporation (C79)

The company’s share price has significantly declined from highs earlier this year due in part to subdued demand from mining firms for its more efficient and environmentally friendly mineral assay technology. With gold prices hitting all-time highs, we expect demand to recover amid an improvement in C79 utilisation rates in the second half.

SELL RECOMMENDATIONS

SELL – Eagers Automotive (APE)

Eagers is an automotive retail group operating in Australia and New Zealand. Revenue was up 15.3 per cent in full year 2023 compared to the prior corresponding period, but statutory profit after tax from continuing operations was down 7.8 per cent. The shares have risen from $12.87 on October 31, 2023, to trade at $14.05 on March 14, 2024. The stock is trading well above our long-term valuation, so investors may want to consider cashing in some gains.

SELL – Zip Co (ZIP)

This consumer finance firm delivered better than forecast half year results in fiscal year 2024. Measures to improve profitability drove a rebound in underlying earnings. The shares have risen from 80 cents on February 27 to trade at $1.242 on March 14. The stock is trading at a significant premium to our fair valuation. Investors may want to consider taking profits at these levels.

Related Articles:

- Day Trading in Australia – A Beginners Guide

- The Best Auto Trading Platforms in Australia

- The Best CFD Trading Platform in Australia

- How to Start Stock Trading in Australia

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.