John Athanasiou, Red Leaf Securities

BUY RECOMMENDATIONS

Transurban Group (TCL)

Apart from the Sydney Harbour Bridge, TCL owns all toll roads in Sydney and most of the toll roads in Victoria and Queensland. The share price of TCL should re-rate higher, as investors seek high quality infrastructure assets that are likely to benefit from an easing of interstate travel restrictions.

Humm Group (HUM)

This buy now, pay later company is profitable and it has also paid a dividend. In our view, the company has been overlooked by its more fancied peers, but we believe the market will see value in HUM given it’s trading on a modest price/earnings multiple.

HOLD RECOMMENDATIONS

Bapcor (BAP)

This automotive aftermarket parts provider has continued to benefit from motorists fixing their vehicles during COVID-19 lockdowns. The challenge is to sustain strong growth as normal life resumes. We suggest investors keep a close eye on future announcements to assess forecasts and gauge trends.

Lynas Rare Earths (LYC)

LYC is the only large-scale rare earths producer outside of China. Consequently, LYC is a preferred resource stock. COVID-19 disrupted operations in Malaysia in the September quarter. Work on Lynas 2025 foundation projects is continuing. Share price momentum has been favourable between October 22 and November 11.

SELL RECOMMENDATIONS

Domino’s Pizza Enterprises (DMP)

The fast food giant benefited from lockdowns in Sydney and Melbourne. We expect pent-up demand for hotel and restaurant dining to reduce home deliveries. A recent trading update was concerning, as it showed a weaker performance in Japan in the first quarter of fiscal year 2022 after the hospitality industry re-opened. Network sales in Japan were negative on a year-on-year basis. The share price has fallen from $142.30 on November 3 to trade at $121.95 on November 11.

Marley Spoon AG (MMM)

Marley Spoon delivers fresh ingredients to the door, so people can cook at home. Full year net revenue growth has been revised down in response to volatile consumer behaviour. People are starting to eat out more often. The prospect of higher ingredient and employment costs may pressure margins moving forward, in our view. The share price has fallen from $2.98 on July 1 to trade at 83 cents on November 11.

Braden Gardiner, Tradethestructure.com

BUY RECOMMENDATIONS

Air New Zealand (AIZ)

The airline has been trending up since August on a brighter outlook. New Zealand Government support for the airline to March 2022 should attract buyer interest. The shares have risen from $1.365 on August 19 to trade at $1.615 on November 11. Increasing COVID-19 vaccination rates across the globe will open more travel destinations in future. I expect the shares to move up to $1.90. AIZ suits investors with a higher appetite for risk.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

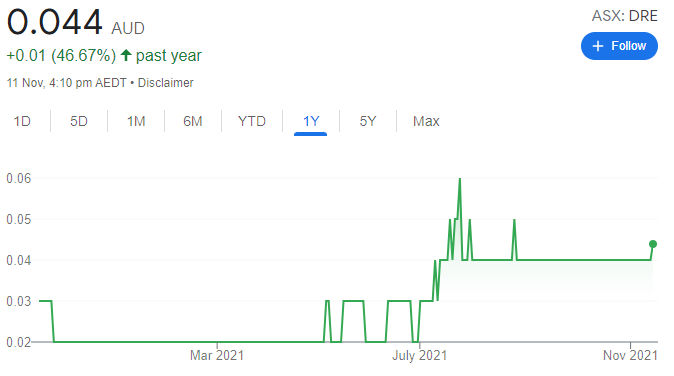

Dreadnought Resources (DRE)

This mineral explorer sparked investor interest following a positive update on its drilling program at the Tarraji-Yampi project in Western Australia. A spot gold price rising above $US1800 on November 8 provides investors with more confidence. DRE is a speculative buy, but I see more upside from here, particularly if gold price momentum is sustained in the medium term.

HOLD RECOMMENDATIONS

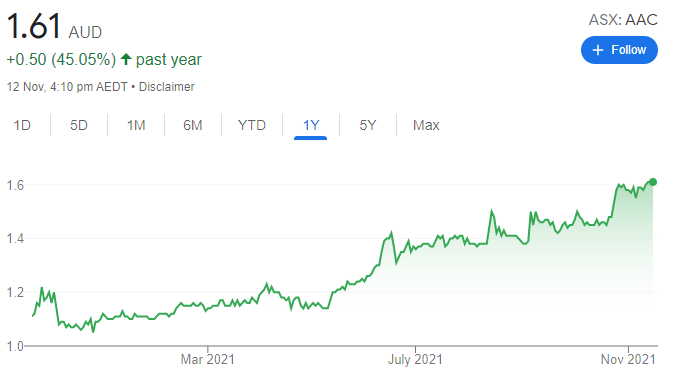

Australian Agricultural Company (AAC)

The company delivered a solid earnings report earlier this year. I expect the steady rise in beef prices to continue in the near term on increasing demand. My technical analysis suggests the share price will find more buyers on any retreat to $1.50. I expect the shares to trend higher. The shares were trading at $1.595 on November 11.

Panoramic Resources (PAN)

The company owns the Savannah nickel project in Western Australia. First shipment of concentrate is expected to leave port in December 2021. The share price has retreated from 24.5 cents on October 26 to trade at 21 cents on November 11. We suspect investors are waiting on more news flow before taking on any additional risk. Any positive news could result in a rising share price from here.

SELL RECOMMENDATIONS

Cannindah Resources (CAE)

The share price of this copper and gold explorer rose from 14.5 cents on October 1 to 57 cents on November 8. The share price was trading at 30 cents on November 11 after the company delivered an assay update on its Mt Cannindah project on November 9. In our view, the share price moved too fast too soon. Investors may want to consider locking in some gains.

Galan Lithium (GLN)

The lithium sector is benefiting from increasing sales of electric vehicles across the globe. GLN is developing lithium brine projects in South America. The share price of GLN has risen from 37 cents on January 4 to trade at $1.565 on November 11. The rapid share price rise leaves little room for error, in our view. Investors may want to consider taking some profits.

Michael Gable, Fairmont Equities

BUY RECOMMENDATIONS

Fortescue Metals Group (FMG)

The iron ore producer has retained cost guidance and its operational performance is solid. We believe there’s limited downside in the iron ore price, and expect FMG to benefit from any price increases moving forward. The technical chart recently indicated good buying support at current prices. The share price has fallen significantly since the end of July, so the stock provides a potentially good buying opportunity for the longer term.

Commonwealth Bank of Australia (CBA)

In our opinion, the CBA is the highest quality bank compared to the other three majors. Any move to higher interest rates will have a positive effect on CBA’s net interest margin. From a charting perspective, CBA was recently trading above major resistance near $108 a share. It traded below $108 on November 11, but we expect it to rally.

HOLD RECOMMENDATIONS

Computershare (CPU)

This share registry business should benefit from any moves to higher interest rates, which may lead to a positive re-rating and a rise in share price targets from analysts. The shares are trending up, rising from $15.60 on July 30 to trade at $19.50 on November 11. Investors are getting behind the stock.

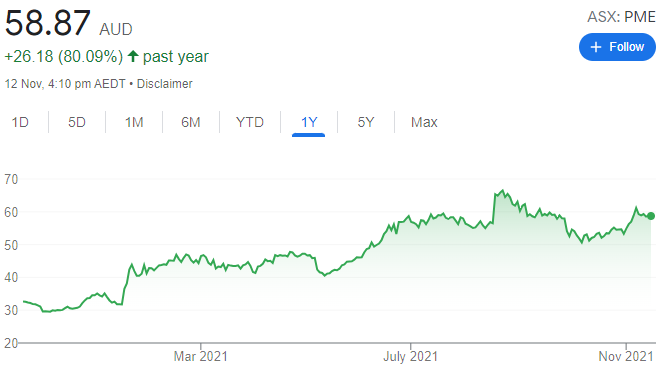

Pro Medicus (PME)

This medical imaging company continues to win new contracts amid expanding its overseas footprint. Earnings per share are impressive, and the company has no debt. Recent share price action has resulted in solid buying on any dips and the stock is retaining its long term uptrend.

SELL RECOMMENDATIONS

PolyNovo (PNV)

Shares in this medical devices company have fallen from $3.93 on January 4 to trade at $1.495 on November 11. Company managing director Paul Brennan recently resigned. In our view, this adds to uncertainty about the company’s direction. We expect the shares to remain under pressure – at least in the short term. We find other stocks more appealing.

Sezzle Inc. (SZL)

The buy now, pay later platform provider operates in a crowded, but consolidating sector. Competition in the sector remains fierce. We can’t identify a catalyst at this point that will reverse the downtrend of the past three months. The shares have fallen from $8.29 on August 13 to trade at $4.61 on November 11. We prefer others.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.