Stuart Bromley, Medallion Financial Group

BUY RECOMMENDATIONS

BetMakers Technology Group (BET)

Investors slashed the share price after BetMakers lodged a $4 billion cash and scrip bid to acquire Tabcorp’s wagering and media businesses. Irrespective of the outcome for TAH, we consider BET a buy at these levels as the company grows its wholesale offerings to bookmakers, with a specific focus on the rapidly expanding US market, where we see great potential.

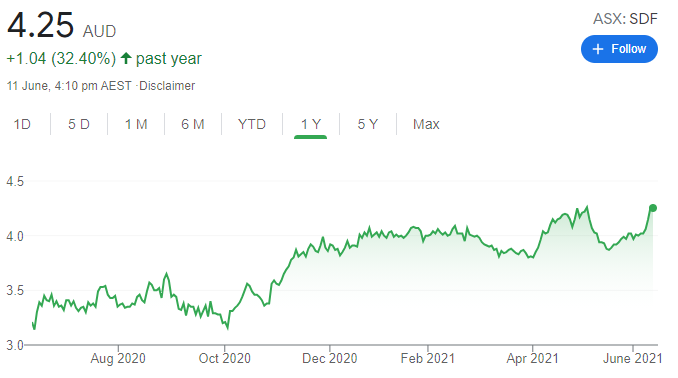

Steadfast Group (SDF)

This powerful network of insurance brokers has held up well during COVID-19, with the company upgrading fiscal year 2021 guidance in April. It lifted underlying net profit after tax to between $127 million and $132 million. SDF has a consistent track record of growing its gross premiums over a long period. We view Steadfast as a long term proven performer with a relatively defensive nature.

HOLD RECOMMENDATIONS

Alcidion Group (ALC)

Alcidion develops software products for the healthcare sectors in Australia, New Zealand and the UK. We’re optimistic the share price can keep rising if the company can continue to generate new contracts. The National Health Service trusts in the UK provide an exciting opportunity. Investors will take notice if the company can build revenue.

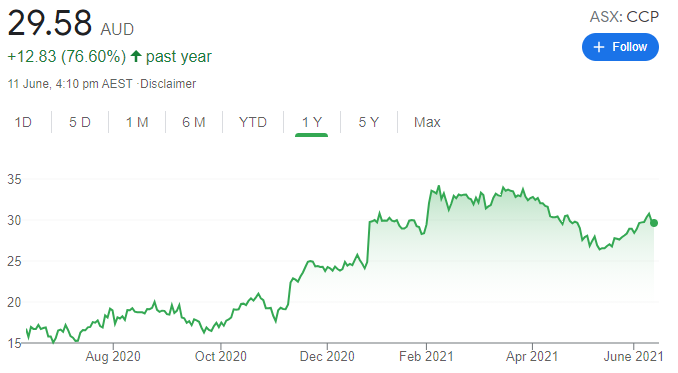

Credit Corp Group (CCP)

The company reported a first half 2021 net profit after tax of $42.3 million, a 10 per cent increase on the corresponding period. The company makes a success out of purchasing debt ledgers – it recently purchased a debt ledger from Collection House. It’s focusing on the US market and has about $400 million in cash and undrawn lines of credit to pursue future opportunities.

SELL RECOMMENDATIONS

Zip Co (Z1P)

In our view, growth stocks, such as Z1P, will remain under pressure in the fiercely competitive buy now, pay later (BNPL) sector. Big companies, including PayPal and Commonwealth Bank, are moving into what we consider an over-crowded space. Sustaining customers and margins will be challenging, in our view.

Mesoblast (MSB)

The company is developing allogeneic cellular medicines to treat inflammatory diseases. The company raised $US110 million in March. Upside potential remains from products at various stages in clinical trials. The company reported total revenue of $US1.9 million in the 2021 March quarter. Total revenue in last year’s March quarter was $US12.2 million. MSB reported a loss after tax of $US26.5 million in the 2021 March quarter. In our view, the downside risk is possibly more capital raisings in the future.

Niv Dagan, Peak Asset Management

BUY RECOMMENDATIONS

ReNu Energy (RNE)

RNE recently completed a heavily subscribed placement to drive its clean energy incubator strategy. The company announced it’s fully funded to take strategic stakes and nurture renewable energy projects, including hydrogen. The placement enables the company to take a controlling interest through to an initial public offering process, or exiting via a trade sale. The market may re-rate the company on its first investment. We acted as a corporate adviser and lead manager to the capital raising.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Lion Energy (LIO)

This oil and gas company’s primary asset is a production sharing contract in Indonesia. The company recently signed a memorandum of understanding (MOU) with Wagner Corporation to explore opportunities in developing green hydrogen facilities and infrastructure at Wagner’s Wellcamp Business Park and Pinkenba Wharf in Brisbane. Wagner is an Australian property and infrastructure development company. Any positive news flowing from the MOU may lead to a re-rating. But it remains a speculative buy for those with an appetite for risk.

HOLD RECOMMENDATIONS

Flight Centre Travel Group (FLT)

Much depends on COVID-19 restrictions across the globe. International bookings generate attractive revenue margins. Performance will improve when more global economies open in response to increasing COVID-19 vaccinations. The risk is further COVID-19 outbreaks closing international borders. The northern hemisphere summer paints a cautious, but brighter outlook.

Wesfarmers (WES)

Retailers Bunnings and Kmart have been driving outperformance. The potential risk to revenue is further COVID-19 outbreaks across Australia temporarily closing stores. But the industrial conglomerate’s diversity leaves WES as a solid long-term proposition, backed by an attractive dividend yield when compared to term deposits.

SELL RECOMMENDATIONS

Commonwealth Bank of Australia (CBA)

The housing boom means people need to borrow more. The risk is increasing mortgage stress, as we expect higher interest rates moving forward. Interest rate increases could pressure net interest margins in the banking sector, leading to stiffer competition. The shares have enjoyed a strong run above $100, so investors can consider taking some money off the table. The shares finished at $101.85 on June 10.

Westpac Bank (WBC)

The bank recently delivered a strong first half result. Statutory net profit rose 189 per cent on the prior corresponding period to $3.443 billion. The shares have recovered from $19.63 on January 4 to close at $26.59 on June 10. The bank is following the CBA and marginally lifting some fixed home loan rates for owner-occupiers paying principal and interest. As a result, borrowers may choose other lenders possibly offering better deals as competition intensifies. Also, we believe the share price is expensive at this point. Investor may want to consider taking a profit.

Samuel Crompton, Shaw and Partners

BUY RECOMMENDATIONS

Plenti Group (PLT)

PLT is an innovative company, offering automotive, renewable energy and personal loans delivered by proprietary technology. In our view, PLT presents a compelling opportunity to invest in a financial technology lender with a quality loan book, accelerating and diversified originations, favourable net interest margins and a high return on equity at scale. Our price target is $1.74. The shares finished at $1.28 on June 10.

Dubber Corporation (DUB)

DUB is globally recognised as a cloud call recording and data capture platform. DUB’s unique technology turns voice calls into data, enabling artificial intelligence services to be deployed at scale directly from a carrier network. DUB announced an agreement with Cisco, giving it access to a model that potentially enables millions of users. Expect DUB to do more agreements with multiple global carriers. We recommended DUB as a buy on TheBull.com.au in November last year when the shares were priced around $1.56. The shares finished at $2.97 on June 10. Our next price target is $3.23.

HOLD RECOMMENDATIONS

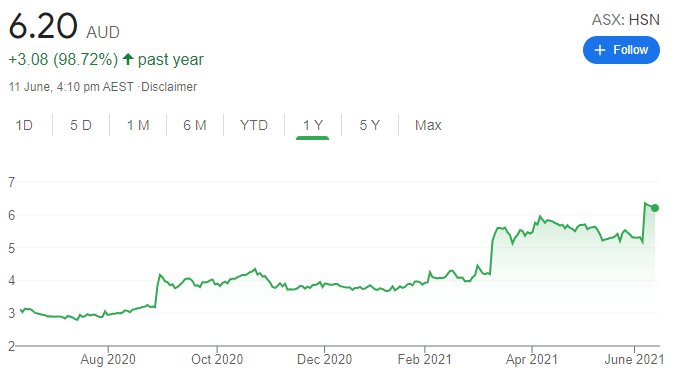

Hansen Technologies (HSN)

On June 7, BGH Capital lodged a takeover bid to acquire Hansen at $6.50 a share. The price for this billing software provider represented a 25 per cent premium to the closing price on June 4. The board determined that progressing the proposal is in the interests of shareholders. The announcement says the cash consideration price will be reduced by the value of any dividends or other distributions declared, proposed or paid after the date of the offer letter.

Bingo Industries (BIN)

This waste manager announced in late April that it had entered into a scheme implementation deed with Macquarie Infrastructure and Real Assets and its managed funds (MIRA) to acquire 100 per cent of the Bingo shares by way of scheme of arrangement. Shareholders can choose $3.45 cash for each Bingo share, or a mixed cash and unlisted scrip alternative. In our view, $2.80 a share is fair value. Shareholders will vote on the scheme in July. So, the risk versus reward appears skewed to the upside.

SELL RECOMMENDATIONS

McPherson’s (MCP)

This health and beauty products supplier has received another takeover bid. The latest bid is from Arrotex Australia Group at $1.60 a share. It remains uncertain whether this highly conditional bid will proceed. We have moved to a sell rating. The shares finished at $1.405 on June 10.

Nickel Mines (NIC)

The company’s share price enjoyed a strong run, rising from 55 cents on June 11, 2020 to $1.49 on February 24, 2021. Since then, the share price has continued to struggle and closed at $1.055 on June 10. We’re concerned that increases in nickel pig iron prices will impact nickel demand for use in electric vehicles. We need to see a short-term catalyst that will potentially move the price higher. Until then, we retain a sell recommendation.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.