Arthur Garipoli, Seneca Financial Solutions

BUY RECOMMENDATIONS

Johns Lyng Group (JLG)

The company provides insurance building and restoration services in Australia and the US. First half 2023 group sales revenue of $635.6 million was up 71.2 per cent on the prior corresponding period. Catastrophe work significantly contributed to group revenue. Other divisions were also ahead of forecasts. The company has upgraded revenue and EBITDA for the full year.

Steadfast Group (SDF)

The company provides general insurance brokerage services and underwriting agencies. Steadfast delivered a solid first half 2023 result. Underlying EBITA of $188.6 million was up 22 per cent on the prior corresponding period. Underlying net profit after tax and amortisation of $111.1 million was up 18.8 per cent. The company has the capacity to grow via acquisitions. The premium rate cycle remains strong. Steadfast is a candidate for further upgrades going forward.

HOLD RECOMMENDATIONS

Woolworths Group (WOW)

The supermarket giant’s recent half year 2023 result was marginally ahead of analyst forecasts. Group sales of $33.169 billion, before significant items, were up 4 per cent on the prior corresponding period. Earnings before interest and tax of $1.637 billion rose 18.4 per cent. Food sales were up and the performance of the Big W department store chain improved. In our view, the company is fully valued at this point.

Endeavour Group (EDV)

Endeavour operates liquor outlets, hotels and gaming facilities. Group sales of $6.5 billion in the first half of fiscal year 2023 were up 2.6 per cent on the prior corresponding period. Group earnings before interest and tax of $644 million were up 15.8 per cent. The liquor industry is resilient regardless of the economic cycle.

SELL RECOMMENDATIONS

Adbri (ABC)

This construction materials company posted underlying net profit after tax, excluding property sales, of $77 million in fiscal year 2022. This represented a decrease of 31.2 per cent on the prior corresponding period. The company didn’t declare a final dividend due to capital expenditure requirements. We have lowered our profitability assumptions. A potential downturn in construction activity due to higher interest rates may see a decline in sales going forward.

Aurizon Holdings (AZJ)

This rail freight commodity transporter posted a weaker first half 2023 result, in our view. Underlying EBITDA of $673 million was down 7 per cent on the prior corresponding period. Underlying net profit after tax of $169 million was down 34 per cent. Weakness was due to an 8 per cent fall in coal volumes from wet weather and lower contract rates. The company has cut EBITDA guidance for fiscal year 2023.

Top Australian Brokers

- IG – Extensive product array and user-friendly platforms – Read our review

- eToro – market-leading social trading platform – Read our review

- IC Markets – experienced and highly regulated – Read our review

- Quadcode Markets – multi-asset CFD broker – Read our review

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Tim Haselum, Catapult Wealth

BUY RECOMMENDATIONS

Xero (XRO)

This accounting software provider is trading at a discount to prior earnings multiples since the price has fallen from its highs. The company has a strong track record of compound sales growth and penetrating key markets. The shares have fallen from $107.66 on March 30, 2022 to trade at $86.68 on March 9, 2023. We consider XRO a top quality company.

Lynas Rare Earths (LYC)

The share price of this rare earths miner has fallen from $9.70 on February 1 to trade at $7.39 on March 9. The company posted higher revenue in the first half of fiscal year 2023, but the cost of sales also rose. The company also experienced water supply disruptions at its Malaysian plant. In our view, Tesla announcing a plan to eliminate rare earths from next generation electric vehicles also impacted the share price. But we believe investors over-reacted to the Tesla news given continuing demand for rare earths. Consequently, we believe the shares are trading at a discount.

HOLD RECOMMENDATIONS

Carsales.com (CAR)

This online automotive classifieds giant posted adjusted earnings per share of 34.9 cents in the first half of fiscal year 2023, up 14 per cent on the prior corresponding period. The interim dividend of 28.5 cents a share was up 12 per cent. It was a resilient performance. The valuation appears undemanding under existing conditions.

Ramsay Health Care (RHC)

The private hospital operator enjoys a dominant position in Australia. Statutory net profit after tax and minority interests of $194.4 million in the first half of fiscal year 2023 was up 22.3 per cent on the prior corresponding period. Private health insurance participation appears to be growing, and a backlog of activity supports a recovery of normal operating margins.

SELL RECOMMENDATIONS

Brambles (BXB)

This integrated supply chain logistics giant lifted profit after tax to $US331.1 million in the first half of fiscal year 2023. However, cash flow from operations fell $US42 million to $US140.4 million. The shares have risen from $11.95 on January 3 to trade at $13.47 on March 9. Investors may want to consider taking a profit.

New Hope Corporation (NHC)

This coal company has been trading at a premium to its net asset value, according to our analysis. We expect coal prices to soften to more normal levels moving forward. The share price has risen from $2.80 on March 10, 2022 to trade at $5.74 on March 9, 2023. Investors may want to consider cashing in some gains.

Angus Geddes, Fat Prophets

BUY RECOMMENDATIONS

Rox Resources (RXL)

RXL is a gold exploration and development company with assets in Western Australia. RXL is advancing its Youanmi project. Assays from Youanmi South reinforced our positive view on the prospective nature of the project. Youanmi South returned a bonanza intercept of 28 metres graded at 34.81 grams a tonne of gold from 204 metres, with three sweet zones peaking at 138.07 grams a tonne of gold from 218 metres. Youanmi continues to post high grade gold assays from successful exploration.

Praemium (PPS)

This wealth management technology company has sold its international operations. This has freed up capital to support a rapid expansion of innovative services in Australia. Praemium is positioned to secure more market share to grow funds under administration.

HOLD RECOMMENDATIONS

BHP Group (BHP)

The share price of this global miner had recently continued to re-test record highs. This is a response to China re-opening its economy following COVID-19 lockdowns. China’s growth estimates appear sustainable. The US dollar is prone to weakness, so this should also assist in sustaining, or pushing up the share price.

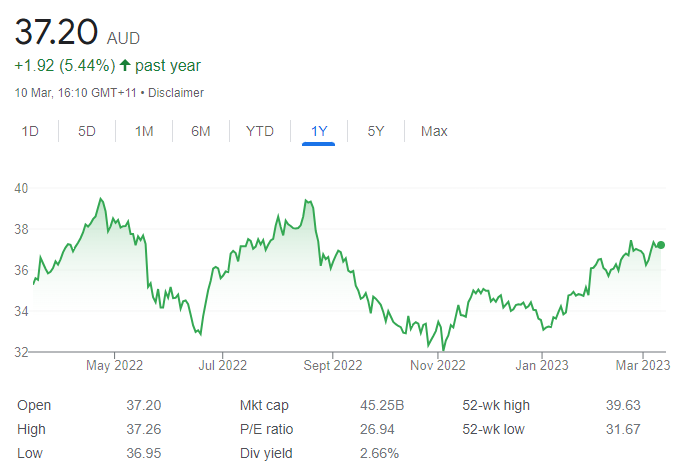

Westpac Bank (WBC)

The bank’s mortgage portfolio is delivering higher yields from increasing interest rates. The company’s total Australian mortgage portfolio marginally grew between September 2022 and December 2022. We expect the bank’s net interest margin to benefit from any further increases in interest rates.

SELL RECOMMENDATIONS

Domain Holdings Australia (DHG)

Domain is a digital real estate listings company. The company generated revenue of $186.6 million in the first half of fiscal year 2023, up 6.5 per cent on the prior corresponding period. However, expenses of $137.3 million were up 20.2 per cent on a reported basis. Net profit of $15.9 million was down by 38.9 per cent. Our concern is rising interest rates leading to a potential slowdown in the residential housing market.

Blackmores (BKL)

The share price of this vitamins and supplements company has fallen from $87.17 on February 14 to trade at $77.53 on March 9. Group revenue of $338 million in the first half of fiscal year 2023 represented a fall of 1.6 per cent on the prior corresponding period. Sustaining revenue will be a challenge as shoppers have less to spend given higher interest rates and soaring cost of living expenses.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.