Tony Locantro, Alto Capital

BUY RECOMMENDATIONS

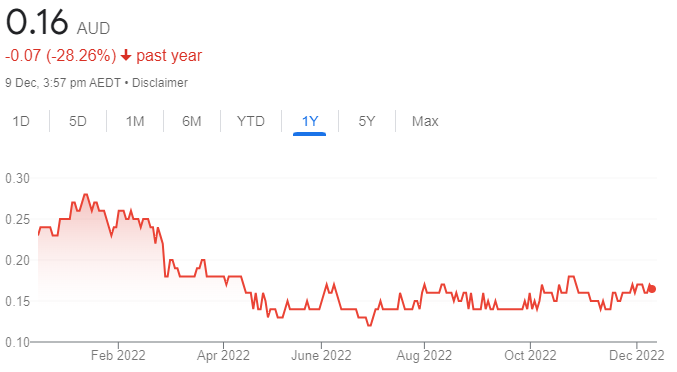

Nyrada Inc. (NYR)

NYR is a pre-clinical stage drug development company. It has announced the design protocol for the phase 1 trial of the PCSK9 cholesterol inhibitor set for the clinic in fiscal year 2023. The trial will involve healthy volunteers and others with high cholesterol. Further toxicology studies are required prior to starting the trial. NYR is highly speculative, but a potentially rewarding long-term play depending on progress. It’s more suited to investors with a high risk appetite.

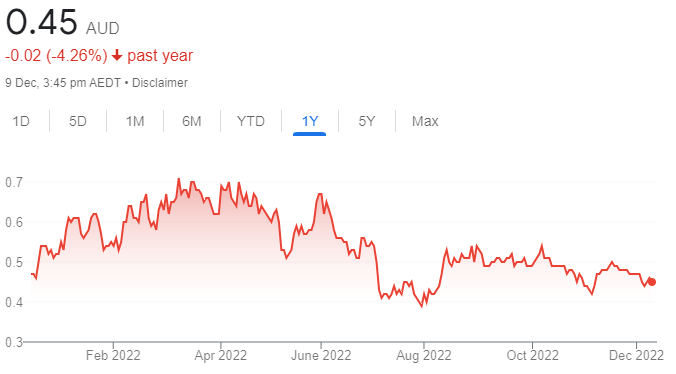

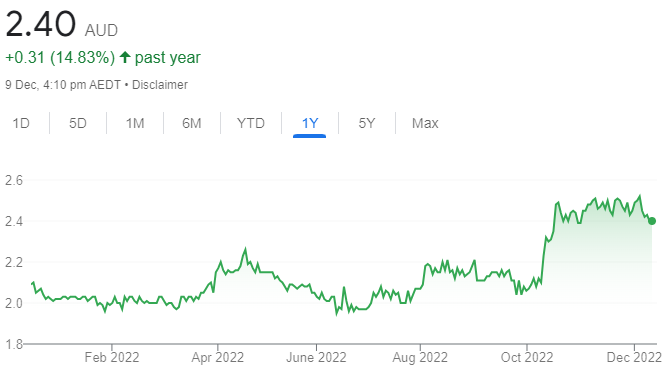

Dimerix (DXB)

The biopharmaceutical company is recruiting across 70 global clinical sites for its phase 3 trial of drug candidate DMX-200, targeting Focal Segmental Glomerulosclerosis (FSGS), a rare disease that can lead to renal failure, dialysis and possibly a kidney transplant. DXB intends to partner the program and is engaged in continuing discussions. It’s also focusing on treatments for kidney and respiratory diseases. In our view, DXB offers a high risk/reward opportunity.

HOLD RECOMMENDATIONS

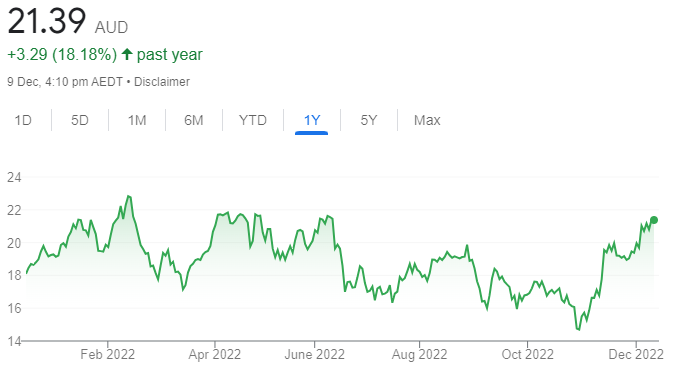

AIC Mines (A1M)

AIC Mines recently announced a compulsory acquisition notice after securing 90 per cent of Demetallica (DRM) shares. This provides AIC Mines with the Jericho copper resource only 4 kilometres from A1M’s Eloise copper mine and processing facility. It significantly expands the production profile and growth potential for AIC Mines in the emerging Cloncurry copper district of Queensland.

Eagle Mountain Mining (EM2)

The Arizona focused copper explorer continues to progress the Oracle Ridge project towards feasibility, with a 12 per cent increase in measured and indicated resources. Underground drilling is aimed at further upgrading mineral resources.

SELL RECOMMENDATIONS

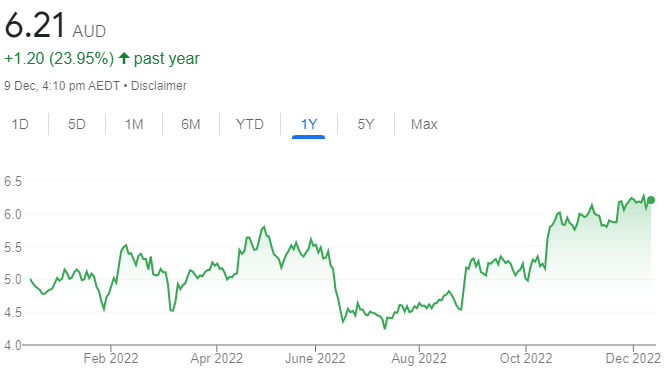

Qantas Airways (QAN)

The airline recently upgraded profit expectations for the first half of fiscal year 2023 in response to strong travel demand. The shares have risen from $4.54 on August 24 to trade at $6.16 on December 8. The buy-back is positive for the share price. Our concern is the potential threat of industrial action. Investors may want to consider cashing in some gains.

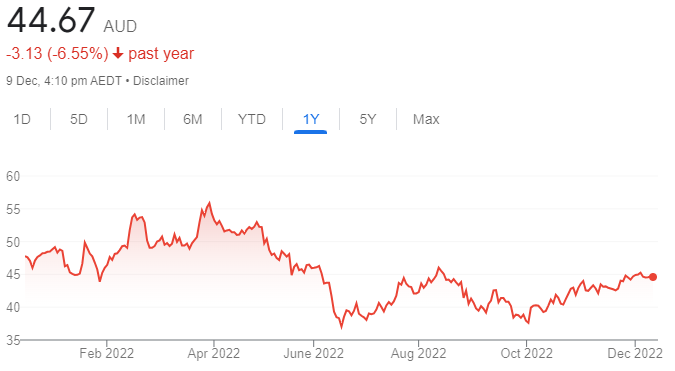

JB Hi-Fi (JBH)

Total sales for JB Hi-Fi Australia grew by 14.6 per cent in the first quarter of fiscal year 2023. Total sales for JB Hi-Fi New Zealand grew by 27.7 per cent. This consumer electronics giant is up against higher interest rates possibly impacting consumer spending and sentiment in coming months. Investors may want to consider taking a profit.

Layton Membrey, Marcus Today

BUY RECOMMENDATIONS

Fortescue Metals Group (FMG)

The share price of this iron ore miner has risen from $14.70 on October 31 to trade at $20.84 on December 8. A stronger iron ore price and easing of COVID-19 restrictions in China have contributed to the price rise. In our view, FMG’s rally should continue if China continues to ease COVID-19 restrictions and further open its economy in calendar year 2023.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

WiseTech Global (WTC)

WTC provides software solutions to the global logistics industry. At its annual general meeting, management forecast total revenue growth in fiscal year 2023 to range between 20 per cent and 23 per cent. The company outlook is bright as it expects EBITDA to grow between 21 per cent and 30 per cent.

HOLD RECOMMENDATIONS

Smartgroup Corporation (SIQ)

Smartgroup offers salary packaging and fleet management services across Australia. The company posted revenue of $113.6 million in the 2022 first half, up 4 per cent on the corresponding period. The company recently renewed its services arrangement with New South Wales Health. The company may again be a takeover target, but it’s mere speculation at this point.

Metcash (MTS)

This wholesale distribution and marketing company recently reported first half fiscal year 2023 results marginally above consensus. According to our analysis, the group has outperformed rivals Woolworths and Coles in the past six months. Highlights included growing sales, an underlying profit increase and a bigger interim dividend.

SELL RECOMMENDATIONS

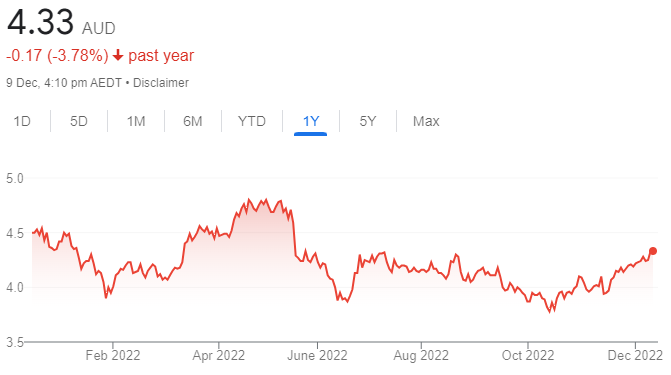

Infomedia (IFM)

This software provider to the automotive industry has reduced revenue growth guidance for fiscal year 2023. The company has been experiencing product delivery and implementation delays of signed contracts. In our view, the outlook appears more challenging than previously expected. The share price has fallen from $1.375 on November 14 to trade at $1.082 on December 8.

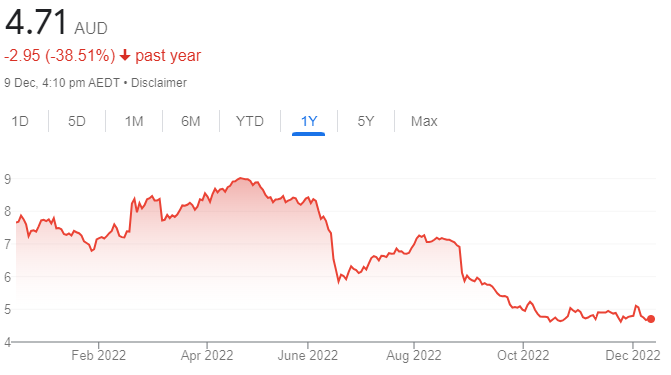

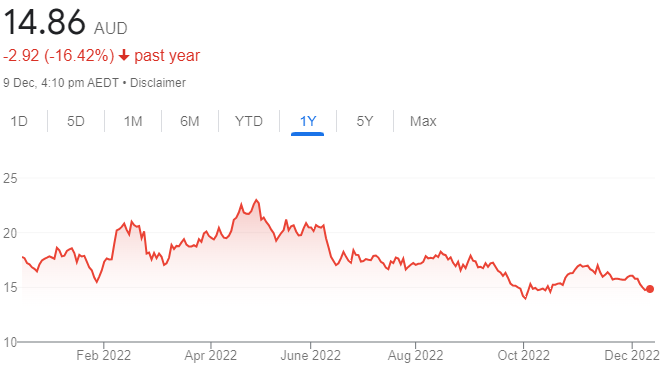

Flight Centre Travel Group (FLT)

This global online travel agency expects a gradual recovery for the industry in fiscal year 2023. The company expects underlying EBITDA to range between $70 million and $90 million in the first half of fiscal year 2023. FLT’s revenue margin was impacted by reduced front-end commission payments in the first four months to October 31. The share price has fallen from $17.01 on November 11 to trade at $14.93 on December 8.

Christopher Watt, Bell Potter Securities

BUY RECOMMENDATIONS

Monash IVF Group (MVF)

MVF is a fertility services company. It offers a wide range of assisted reproductive technology services, including in vitro fertilisation and pathology. Infrastructure supports services on a large scale. We expect new clinic openings and increasing ultrasound services to generate increasing revenue during this financial year.

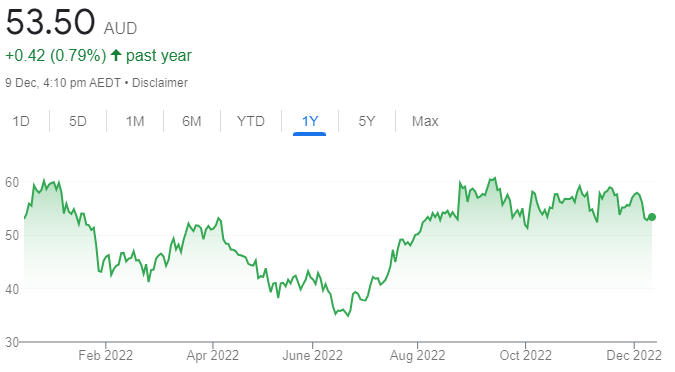

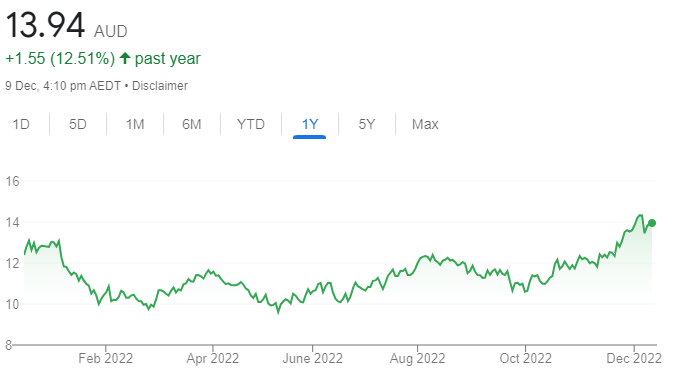

Dalrymple Bay Infrastructure (DBI)

The company operates a metallurgical and thermal coal export terminal and port facility. DBI is the world’s biggest metallurgical coal export terminal and accounts for about 15 per cent of global export metallurgical coal volumes. DBI recently signed a new 10-year agreement, which outlined terminal charge increases of 23 per cent in fiscal year 2022 and 29 per cent in fiscal year 2023. The company also offers stable dividend income.

HOLD RECOMMENDATIONS

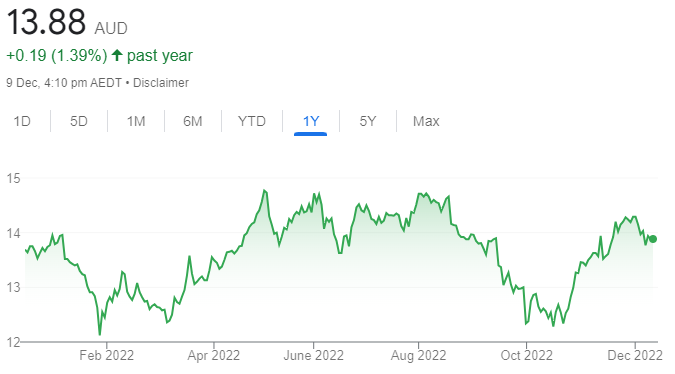

Transurban Group (TCL)

TCL owns and operates toll roads in Australia, the US state of Virginia and in Montreal, Canada. Core Australian roads generate defensive revenue that grows with traffic volumes and toll price increases, which, at a minimum, are pegged to inflation. Solid revenue growth and a high fixed cost base translate to strong cash flows and distribution growth.

Technology One (TNE)

Recent fiscal year 2022 results revealed software as a service annual recurring revenue grew by 43 per cent and total annual recurring revenue grew by 25 per cent. A strong company outlook leaves TNE on track to surpass its total annual recurring revenue target of $500 million by 2026. We retain a hold rating based on a recent rally in the share price.

SELL RECOMMENDATIONS

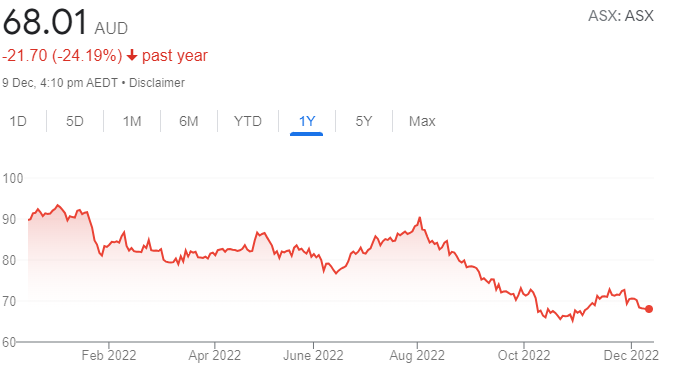

ASX Limited (ASX)

ASX remains a quality business, in our view. Earnings growth is underpinned by long term growth in the stock market. The failed project to replace the CHESS system will result in substantial after-tax write-offs in the first half of fiscal year 2023, and raises questions relating to future capital expenditure on technology. In our view, the stock also looks expensive at recent levels.

Boral (BLD)

This construction materials company faces a potential slowdown in Australian residential housing activity. It may also be up against likely delays in infrastructure projects due to funding and supply constraints. Also, further weather concerns remain a potential headwind with high input cost inflation.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.