Braden Gardiner, Tradethestructure

BUY RECOMMENDATIONS

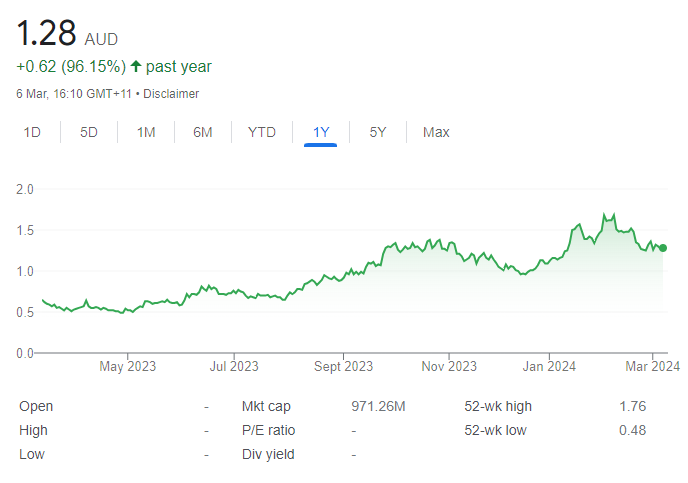

BUY – ARB Corporation (ARB)

ARB makes and supplies 4-wheel drive accessories to Australian and international markets. The company lifted sales revenue, profit after tax and earnings per share in the first half of fiscal year 2024 when compared to the prior corresponding period. The share price has risen from $32.16 on January 16 to trade at $40.79 on March 7. I expect this favourable momentum to continue as it chases previous highs above $52.

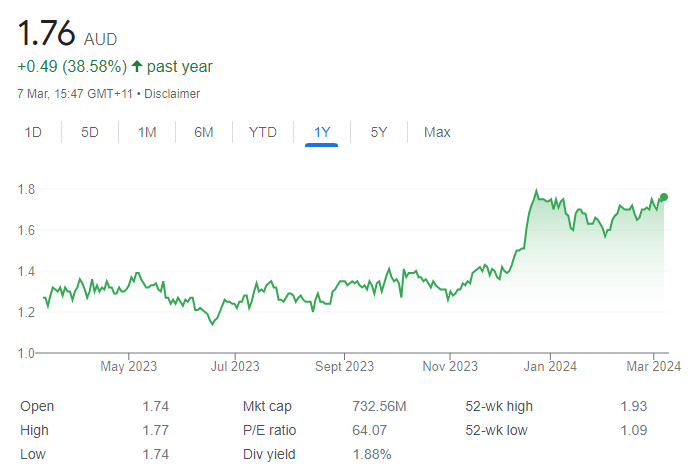

BUY – Cobram Estate Olives (CBO)

CBO is a leader in sustainable olive farming, with operations in Australia and the US. Group sales revenue of $113.8 million in the first half of fiscal year 2004 was up 59 per cent on the prior corresponding period. Cash flow from operations of $32.1 million was up 198 per cent. The company reported a $7.2 million loss. The shares have risen from $1.265 on October 31, 2023, to trade at $1.75 on March 7. The company appears poised to test $2 before potentially moving higher.

HOLD RECOMMENDATIONS

HOLD – Aristocrat Leisure (ALL)

This company is involved in designing and developing gaming content. The share price has been in a technical trend higher since closing at $31.47 on January 2, 2023. In the lead up to half year results due on May 16, I expect to see continuing support for the share price into $50, where investors may want to consider locking in some gains. The shares were trading at $46.43 on March 7.

HOLD – HUB24 (HUB)

This financial services company has been a strong performer. The share price has risen from $30.77 on November 1, 2023, to trade at $41.07 on March 7, 2024. The group generated total revenue of $156.7 million in the first half of fiscal year 2024, up 14 per cent on the prior corresponding period. Total funds under administration grew to $91.2 billion. During the half, HUB delivered record net inflows of $7.2 billion. The company offers a bright outlook driven by superannuation and pension products.

SELL RECOMMENDATIONS

SELL – CAR Group (CAR)

The group operates digital marketplace businesses in Australia and internationally. The company posted adjusted revenue of $531 million for the half year ending December 31, 2023, up 60 per cent on the prior corresponding period. The share price has risen from $28.10 on December 1, 2023, to trade at $35.83 on March 7, 2024. In my view, recent price strength provides investors with an opportunity to reduce risk and lock in some gains.

SELL – Lovisa Holdings (LOV)

This fashion jewellery and accessories retailer posted a strong half year result in fiscal year 2024, with double digit growth in revenue, gross profit and net profit after tax when compared to the prior corresponding period. It also lifted its interim dividend to 50 cents a share. The shares have risen from $24.73 on February 21 to trade at $30.35 on March 7. In my view, the share price is trading in extended territory, which may trigger some profit taking.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

John Athanasiou, Red Leaf Securities

BUY RECOMMENDATIONS

BUY – Atlas Pearls (ATP)

The pearl producer recently reported better than expected half year results in fiscal year 2024. ATP also declared a special dividend of 1.5 cents a share, which reflects financial strength and confidence in the business. The company generated total revenue of $26.849 million, up 115 per cent on the prior corresponding period. Management has proven itself and we believe ATP offers potential upside.

BUY – Platinum Asset Management (PTM)

The investment manager recently appointed Jeff Peters as managing director, and the company has embarked on a turnaround strategy. An immediate priority is to reduce costs across the business, while reviewing existing product offerings and distribution channels. The recent dividend yield was above 10 per cent. We believe PTM is primed for a recovery under new management.

HOLD RECOMMENDATIONS

HOLD – Cettire (CTT)

Cettire is an online luxury goods retailer. The company posted a strong half year result for the six months ending on December 31, 2023. CTT lifted revenue from ordinary activities by 89 per cent and net profit after tax by 60 per cent. Company founder and chief executive Dean Mintz recently sold 27.5 million shares in CTT at $4.63 a share by way of an underwritten block trade. He retains about a 30 per cent shareholding in CTT. The shares were trading at $3.98 on March 7.

HOLD – HUB24 (HUB)

HUB24 operates an investment and superannuation platform. The company posted a strong first half year result in fiscal year 2024. Group underlying EBITDA of $55 million was up 10 per cent on the prior corresponding period and statutory net profit after tax of $21.5 million was up 39 per cent. The shares have been performing well, but now appear to be close to full value at this point.

SELL RECOMMENDATIONS

SELL – Life360 Inc. (360)

This information technology company provides a mobile networking app for families. The company posted a 33 per cent increase in total revenue in calendar year 2023 when compared to the prior year. However, operating expenses were up 4 per cent. The shares have surged from $8.16 on February 29 to trade at $11.91 on March 7. In our view, the shares have moved too rapidly in a short time, so investors may want to consider cashing in some gains.

SELL – Temple & Webster Group (TPW)

TPW is an online furniture and homewares retailer. The company generated revenue of $254 million in the first half of fiscal year 2024, up 23 per cent on the prior corresponding period. The company was recently trading on a huge price/earnings ratio above 170 times. The share price has risen from $9.17 on February 6 to trade at $12.08 on March 7. Chief executive and co-founder Mark Coulter recently sold 886,785 shares in TPW, or about 8 per cent of his total shareholdings. He retains more than 90 per cent of his holdings. Investors may want to consider taking a profit.

Jabin Hallihan, Auburn Capital

BUY RECOMMENDATIONS

BUY – Silk Logistics Holdings (SLH)

This integrated logistics provider generated revenue of $276.5 million in the first half of fiscal year 2024, an increase of 9 per cent on the prior corresponding period. The company is forecasting revenue growth for the full year. It has provided revenue guidance of between $540 million and $560 million provided there’s no further adverse changes in economic conditions. The company has completed the acquisition of port logistics business Secon, consolidating its position in the bulk logistics market amid generating a new revenue stream. The company is well managed. In my view, SLH is trading at a substantial discount for a company offering upside potential.

BUY – Deep Yellow (DYL)

Deep Yellow is a uranium exploration and development company, with operations in Namibia and Australia. The company boasts a substantial resource base and aims to achieve uranium production capacity of more than 7 million pounds a year. The company’s experienced management team, coupled with its ambitious production targets and favourable cost projections, make it a speculative buy. The company requested a trading halt on March 7, as it was in the process of finalising arrangements in relation to a capital raising. DYL will resume trading following an announcement.

HOLD RECOMMENDATIONS

HOLD – APM Human Services International (APM)

This human services provider assists people to find meaningful employment, supports others with disabilities and provides innovative health solutions. APM generated revenue of $1.116 billion in the first half of fiscal year 2024, an increase of 31 per cent on the prior corresponding period. APM recently received a revised, conditional, non-binding acquisition offer of $2 a share from CVC Asia Pacific. We suggest holding, pending further developments.

HOLD – Telstra Group (TLS)

The telecommunications giant offers solid defensive qualities for investors. While we advocate holding Telstra for now, we suggest seizing opportunities and buying on dips. A lower price generates more value on your investment. As Telstra continues to navigate the market, its stability and resilience appeal during volatile times.

SELL RECOMMENDATIONS

SELL – James Hardie Industries PLC (JHX)

This building products maker posted net sales from ordinary activities of $US2.931 billion for the nine months ending December 31, 2023, an increase of 3 per cent on the prior corresponding period. The shares have risen from $51.61 on December 18, 2023, to trade at $61.44 on March 7, 2024. The company’s price/earnings ratio is considerably higher than the market average. In our view, the shares are trading ahead of fair value, so investors may want to consider pocketing a profit.

SELL – Pro Medicus (PME)

The company provides medical imaging software and services to hospitals and health care groups across the world. Despite its strong product portfolio, the stock was recently trading on a lofty price/earnings ratio, leaving little room for error, in my view. The shares have risen from $62.49 on March 9, 2023, to trade at $97.79 on March 7, 2024. Investors may want to consider cashing in some gains.

Related Articles:

- Australian Stock Trading Apps

- Stock Trading in Australia

- CFD Trading for Beginners

- A Guide to Day Trading ASX Shares

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.