Chris Conway, Marcus Today

BUY RECOMMENDATIONS

Wesfarmers (WES)

Chart: Share price over the year

WES has solid defensive businesses in Officeworks and hardware giant Bunnings. These businesses should perform well during the crisis, as more people are working from home or improving them. WES still owns 4.9 per cent of supermarket giant Coles after recently selling a 5.2 per cent stake. Coles is boosting revenue in response to consumer stockpiling of groceries. Wesfarmers has one of the strongest funding positions in the market.

Macquarie Group (MQG)

Chart: Share price over the year

Management has the skills and experience to navigate troubled times. Low interest rates and cheap debt assists the infrastructure and real asset management business, which now accounts for 75 per cent of revenue. The capital market arm may take a hit, although we expect a good number of companies will need to raise capital. MQG was trading above $150 before the market crash. It closed at $88.06 on April 2. We believe this diversified financial services group provides a good buying opportunity.

HOLD RECOMMENDATIONS

Ansell (ANN)

Chart: Share price over the year

Makes protective clothing, such as face masks and rubber gloves. Demand for its hospital and industrial protection products should remain strong for an extended period. We see further upside, despite the recent jump in the share price after the company reaffirmed fiscal year 2020 guidance.

Woodside Petroleum (WPL)

Chart: Share price over the year

If you haven’t sold your oil plays already, now is not the time. Crude oil prices have plunged during this global meltdown amid a price war between Russia and Saudi Arabia. Global growth will recover at some point and, along with it, crude oil prices. WPL has been sold down sharply and is now trading at a discount to valuation. It also has the strongest balance sheet of the major Australian oil plays.

SELL RECOMMENDATIONS

Flight Centre Travel Group (FLT)

Chart: Share price over the year

The company suspended its shares on March 23. The suspension was extended on March 30 to assess the impact of the Coronavirus on its business. On April 2, the shares remained suspended pending a future announcement. The company may raise capital. I hope this great Australian company recovers. But purely from an investment perspective, we see no reason to own the stock given the global travel industry has been decimated. Consider selling when the shares return to official quotation.

Scentre Group (SCG)

Chart: Share price over the year

Owns a huge shopping centre portfolio in Australia and overseas. The shares have been slashed from $3.73 on February 20 to close at $1.705 on April 2. People are avoiding shopping centres and outlets are closing. Commercial tenants are struggling to meet the rent. Most people are staying at home other than to shop for essentials. A growing number of people are shopping online for discretionary items.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Jabin Hallihan, Morgans

BUY RECOMMENDATIONS

BHP Group (BHP)

Chart: Share price over the year

We believe this mining giant is well positioned to benefit when the global economy and financial markets start to show signs of a recovery. We believe governments around the world are likely to implement infrastructure stimulus to deal with huge job losses. This would bolster an already strong outlook for iron ore. BHP has fallen from $38.52 on February 20 to close at $29.85 on April 2.

Collins Foods (CKF)

Chart: Share price over the year

Owns fast food chains KFC and Taco Bell. Some of the recently announced Coronavirus related government stimulus might actually be spent on takeaway food. KFC remains open via takeaway, drive through and home delivery. The earnings outlook remains strong. CKF shares have fallen from $9.89 on February 20 to close at $5.73 on April 2.

HOLD RECOMMENDATIONS

CSL (CSL)

Chart: Share price over the year

This global blood products company is a fantastic performer but, in our view, the shares appear expensive. However, CSL remains in a strong position and has an enviable history of delivery and success. Trading in CSL is most volatile, with big price swings up and down. CSL is worth holding at this point, in our view. The shares finished at $308.27 on April 2.

Commonwealth Bank of Australia (CBA)

Chart: Share price over the year

Like other major banks, the CBA share price has been slashed. CBA shares have fallen from $87.85 on February 20 to close at $61.24 on April 2. If CBA decides to raise additional capital via issuing new shares, existing holders would be invited to buy at a discount. We retain a hold on the stock.

SELL RECOMMENDATIONS

Apollo Tourism and Leisure (ATL)

Chart: Share price over the year

Global travel bans have negatively impacted the business, with the share price falling from 29 cents on February 20 to finish at 15 cents on April 2. The company has operations in Australia, New Zealand, North America, Germany and the UK. In our view, earnings will clearly be impacted for the foreseeable future.

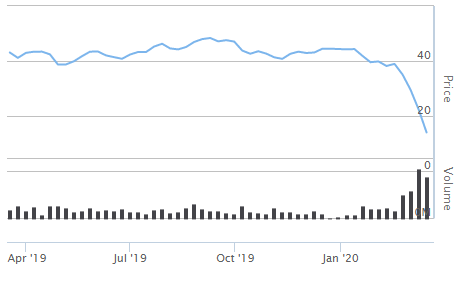

AMP (AMP)

Chart: Share price over the year

Shares in this financial services company have fallen from $2.05 on February 20 to close at $1.33 on April 2. In late March, AMP withdrew fiscal year 2020 guidance given uncertainty created by the Coronavirus. It didn’t pay a final dividend in fiscal year 2019. The earnings outlook is flat at best, in our view. Well prior to the Coronavirus outbreak, AMP suffered reputational damage from the banking Royal Commission. We believe AMP is likely to continue trading at a discount to peers for some time.

Tony Locantro, Alto Capital

BUY RECOMMENDATIONS

Exopharm (EX1)

Chart: Share price over the year

Several impressive announcements by this clinical stage regenerative medicine company appear to have been overshadowed by the Coronavirus. The shares have fallen from 31 cents on February 20 to trade at 16.5 cents on April 2. The company’s exosome products may potentially treat a range of medical conditions, including erectile dysfunction, the later stages of acute respiratory distress syndrome and improving bladder control. The stock is illiquid and volatile, but in our view, provides a high risk opportunity at the current price.

Proteomics International Laboratories (PIQ)

Chart: Share price over the year

PIQ has announced it’s expanding a study with Janssen Research and Development (part of Johnson and Johnson) on ProMarker D and diabetic kidney disease. The collaborative study is testing the performance of ProMarker D in predicting kidney function decline and drug response in patients from a completed clinical trial. PIQ also announced its intention to patent biomarkers – protein fingerprints in the blood – for diagnosing endometriosis, which affects one in nine women. In our view, PIQ is a high risk/high reward play.

HOLD RECOMMENDATIONS

AdAlta (1AD)

Chart: Share price over the year

The company is working towards a mid-year clinical trial of AD-214, a drug for treating idiopathic pulmonary fibrosis. The company is also in collaborative partnerships to advance the development of its i-body platform. It has an agreement with GE Healthcare for diagnostic imaging agents against several drug targets. 1AD is a high risk/high reward play.

Red Metal (RDM)

Chart: Share price over the year

RDM focuses on exploring, evaluating and developing Australian copper-gold and base metal deposits. It has an interest in highly prospective exploration projects. RDM is financially backed by Oz Minerals to search for large scale mineral deposits. RDM isn’t for the risk averse. However, investors with an appetite for risk should consider holding or even accumulating at these levels. The shares were trading at 5.9 cents on April 2.

SELL RECOMMENDATIONS

Westpac Bank (WBC)

Chart: Share price over the year

The shares have bounced back strongly after recording a 52 week low of $13.47 on March 23. The shares were trading at $16.02 on April 2. The property market is likely to be negatively impacted as the economic crisis deepens across the nation. The share price rebound provides a selling opportunity in times of uncertainty.

Coles Group (COL)

Chart: Share price over the year

The share price recently came off a record high. Supermarkets are trading like growth stocks. The COL share price rose from $14.21 on February 28 to a 52 week high of $18.09 on March 19 in response to consumer stockpiling. The shares were trading at $16.40 on April 2. Investors should consider taking part profits.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing.

Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.