Free Knigthsbridge Trading Academy worth $2750 with Axitrader

Peter Moran, Wilsons

BUY RECOMMENDATIONS

ReadyTech Holdings (RDY)

Chart: Share price over the year

Provides a range of software services to more than 3600 employers and educators. The client base is growing. ReadyTech’s services are cloud based and typically provide high levels of recurring revenue. In our view, the recent Bendigo TAFE contract win is evidence of a quality offering. We expect profit to continue growing strongly. We retain an overweight recommendation.

ARB Corporation (ARB)

Chart: Share price over the year

ARB has built a dominant position as a developer, manufacturer and supplier of 4-wheel drive accessories to the Australian market. ARB has a net cash position on its balance sheet, enabling it to continue developing new products to enhance growth. ARB is also looking to grow internationally, and recently announced it’s collaborating with Ford to jointly develop new products. We retain an overweight rating.

HOLD RECOMMENDATIONS

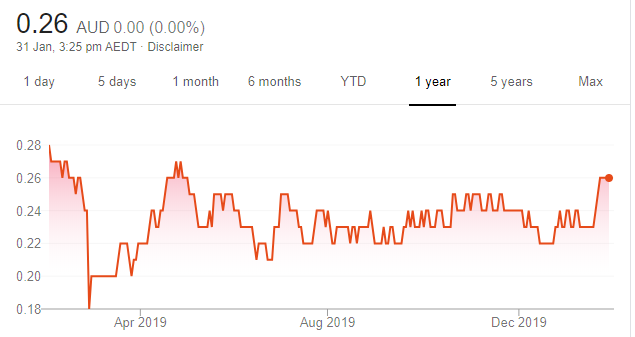

Capitol Health (CAJ)

Chart: Share price over the year

This diagnostic imaging services provider recently announced it had acquired its first clinic in South Australia. The acquisition is a move in the right direction. It was reasonably priced and paves the way for further growth in the South Australian market. In our view, CAJ management needs to continue working on improving margins and profitability. This is likely to take time. We retain a market weight recommendation.

Bubs Australia (BUB)

Chart: Share price over the year

BUB has done well to build a business that’s ready to benefit from growing demand for infant formula in China. The BUB brand is supported by its niche goat formula and key relationships with suppliers, such as Chemist Warehouse and Alibaba. However, the market is highly competitive and BUB still has work ahead to build profitability. The shares are appropriately priced around these levels and finished at 94 cents on January 29. We retain a market weight rating.

SELL RECOMMENDATIONS

HUB24 (HUB)

Chart: Share price over the year

As a non-bank investment platform provider, HUB has generated solid growth in funds under management. However, our analysis shows costs are increasing. And, fees are under pressure due to a competitive environment and lower interest rates, which may pressure cash management earnings within its portfolio going forward. In our view, the share price appears to be ignoring the negatives. Our recommendation is under perform.

Nanosonics (NAN)

Chart: Share price over the year

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

The company specialises in preventing infection. The share price more than doubled last year, as investors anticipated a new product launch to add to NAN’s trophon device. However, we believe the potential benefits from the new product are already priced into the share price. We expect the company to under perform going forward. The shares finished at $6.86 on January 29.

Tim Montague-Jones, ASR Wealth Advisers

BUY RECOMMENDATIONS

OZ Minerals (OZL)

Chart: Share price over the year

This copper producer should benefit from any global growth. An electric vehicle requires about 65 kilograms of copper, and is the core ingredient in an electric engine. The structural shift to electric vehicles will gather pace as international markets increasingly take the required action to reduce carbon emissions. This paints a brighter outlook for OZL.

Jumbo Interactive (JIN)

Chart: Share price over the year

The share price of this online lotteries business fell sharply after providing a recent trading update. We believe JIN, like many other companies, is experiencing a growth glitch, requiring the company to reinvest more capital in its operations to manage increasing scale. The migration to mobile applications remains a strong tailwind for ongoing revenue growth. High operating margins deliver the cash flow to leverage its technology platform into developing offshore markets. We view recent share price weakness as a long term investment opportunity.

HOLD RECOMMENDATIONS

GPT Group (GPT)

Chart: Share price over the year

GPT is a big diversified property group. The listed real estate market in 2019 benefited from a significant fall in global interest rates. Lower borrowing costs frees up cash flow for these asset rich businesses to pay increased distributions. However, we believe re-allocation of capital to the sector is mostly finished and we expect limited capital upside from here. Shares in GPT have risen from $5.67 on January 2 to trade at $6.005 on January 30.

Dexus (DXS)

Chart: Share price over the year

Dexus is a large real estate group. A softer Australian economy is reflected in weaker car and retail sales and subdued wage growth. Consequently, we don’t see any significant growth in capital values for the listed property sector at this point. Property values are trading at recent highs. Defensive property stocks are expensive, in our view. Shares in Dexus have risen from $11.81 on January 2 to trade at $12.60 on January 30.

SELL RECOMMENDATIONS

Lendlease Group (LLC)

Chart: Share price over the year

This international property and infrastructure group has entered into an agreement to sell its engineering business. We’re concerned the agreement excludes several of the more troubled LLC contracts, such as the Melbourne Metro Tunnel project. In our view, this project adds significant investment risk for LLC shareholders. Negotiations to resolve the issues continue with the Victorian Government. However, we’re expecting more disappointing news, leaving LLC’s troubled projects to potentially impact profit margins.

Premier Investments (PMV)

Chart: Share price over the year

Owns and invests in retailers. Premier embarked on an aggressive store rollout program to fuel sales growth and drive operating margins and profits. As retail scale expands, the inherent operating leverage of a company also builds to support a growing store base. PMV has delivered strong comparable results, which makes it increasingly difficult to further lift expectations. We prefer to take profits and re-allocate capital to lower risk investment opportunities.

Michael McCarthy, CMC Markets

BUY RECOMMENDATIONS

Costa Group Holdings (CGC)

Chart: Share price over the year

The share price of this horticultural company has plummeted from mid-2018 highs at $8.38 on a perfect storm of drought, operational issues and low prices in key produce markets. The stock touched a low of $2.32 in late 2019. After raising capital at $2.20 late last year, the share price recovered towards $3. The long term pure foods theme, defensive share price positioning and potential for an export kicker from overseas virus fears could see investors taking a closer look. The shares were trading at $2.735 on January 30.

Bendigo and Adelaide Bank (BEN)

Chart: Share price over the year

This regional bank is capitalising on the space left by major banks as they deal with the fallout from banking Royal Commission issues. During mid 2019, BEN’s home lending grew at more than double the rate of the industry, supported by a marketing push. The share price was recently at the lower end of a two year trading range. Investors may wish to move ahead of the interim report on February 17 and the anticipated dividend of 35 cents a share in March.

HOLD RECOMMENDATIONS

Evolution Mining (EVN)

Chart: Share price over the year

While some suspect the gold price is vulnerable to a correction, it remains at record highs in Australian dollar terms. EVN fell heavily on production at the lower end of the estimated range and rising costs. A lot of bad news is already factored in the share price at current levels. Shares in this gold miner were trading at $3.68 on January 30.

Treasury Wine Estates (TWE)

Chart: Share price over the year

The share price was slashed by 26 per cent on January 29 after updating the market on its interim result. A miss on production and a cautious outlook statement were the main culprits, in my view. Investors could form the view that the savage sell down is overdone. Shares in this wine company were trading at $12.875 on January 30.

SELL RECOMMENDATIONS

Commonwealth Bank (CBA)

Chart: Share price over the year

The lift in CBA’s share price to above $85 is impressive given the concerns and costs raised by the banking Royal Commission. I suspect some shareholders are hanging in for the February dividend. Given the share price on January 30, investors may be better off locking in some profits ahead of the ex-dividend date. The shares were trading at $85.22 on January 30.

CIMIC Group (CIM)

Chart: Share price over the year

The 52 week high was $51.50 on April 29, 2019. Shares in this engineering-led construction giant were trading at $28.63 on January 30, 2020. Following a strategic review, CIM is taking a $1.8 billion write down after deciding to divest its business in the Middle East. Investors should consider their options. Thin margins in the construction industry may mean there’s no reason to hold CIM despite the lower share price.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing.

Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.