Elio D’Amato, Spotee.com.au

BUY RECOMMENDATIONS

AMA Group (AMA)

This smash repair company generates almost $1 billion in revenue following the acquisition of ACM Parts. The share price fell at the start of the pandemic in response to fewer cars on the road. But traffic levels are improving and compounded by commuters avoiding public transport. We expect the company to pursue opportunities to acquire struggling competitors.

PKS Holdings (PKS)

PKS utilises artificial intelligence to provide clinical support to practitioners. Its acquisition of audit and risk application business Pavilion Health provides exposure to new markets, technology and further global expansion. With its software in 170 organisations across the world, PKS achieved a maiden profit this year and we expect this trend to continue.

HOLD RECOMMENDATIONS

Senex Energy (SXY)

Sells gas to major players and demand on the east coast underpins future operations. SXY is free cash flow positive and likely to be net cash in two years as it pays down debt. This is a premium gas play and we expect investor patience to be rewarded in response to new contract wins and de-risking of the Surat Basin project.

Tyro Payments (TYR)

As Victoria opens and aims for COVID-19 normal, TYR, as the largest payment terminal provider outside the major banks, is positioned to continue its march towards further market penetration. Also, its recent announcement to create a merchant acquiring alliance with Bendigo Bank should contribute to future growth.

SELL RECOMMENDATIONS

Adore Beauty Group (ABY)

The online retailer listed on the ASX on October 23. The IPO price was $6.75 and the shares closed at $6.92 on the first day of trading. In our view, listing on an EV/EBITDA multiple of between 14 and 16 times (varying on estimates and price) was going to be a stretch. The shares finished at $5.80 on October 29.

McPherson’s (MCP)

MCP sells health, wellness and beauty products in Australia and abroad. Recently, the company announced an agreement to acquire Global Therapeutics from Blackmores for $27 million. This is $4 million more than what Blackmores paid for Global Therapeutics in 2016. MCP is raising capital to fund the acquisition. The stock had broken below the 200-day moving average and we expect more selling pressure after the new shares are issued.

Angus Geddes, Fat Prophets

BUY RECOMMENDATIONS

Praemium (PPS)

Operating leverage at this financial services platform is compelling, in my view. Strong momentum in global funds under administration reached $31.2 billion at the end of the September quarter, propelled by the addition of Powerwrap. Organic inflows were a robust $733 million, complementing around $377 million in market-driven gains. The company has continued to innovate and enhance its platform, winning it further favour with customers in Australia and the UK.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Mainstream Group Holdings (MAI)

MAI recently reported a 15 per cent increase in funds under administration on a year ago to $210.9 billion at the end of the September quarter. Net inflows account for about 87 per cent of the increase in funds under administration. US private equity funds under administration surged 85 per cent during the quarter to $20 billion. Mainstream’s share price has enjoyed solid gains in 2020. Recurring revenues add to the investment case.

HOLD RECOMMENDATIONS

Coca-Cola Amatil (CCL)

The recent takeover approach by Coca-Cola European Partners is a welcome development for CCL shareholders. But, in my view, the bid for CCL at $12.75 a share is opportunistic. A takeover at $12.75 may not proceed given CCL was trading above $13 in February before COVID-19 rapidly spread. CCL has been making good progress on streamlining distribution and growing its brand portfolio.

Domino’s Pizza Enterprises (DMP)

Delivery and takeaway services during the pandemic were robust. There’s a good chance of further growth. In my view, expanding the store footprint will be financially facilitated by falling commercial rents. But the company’s valuation isn’t as compelling as it was in the past.

SELL RECOMMENDATIONS

Afterpay (APT)

This buy now, pay later company recently broke through $100. A digital platform deal with Westpac boosts the firm’s prospects. But I believe valuations in the sector aren’t just priced to perfection, but are irrationally exuberant. Also, high multiple stocks are likely to be pressured if broader market volatility increases.

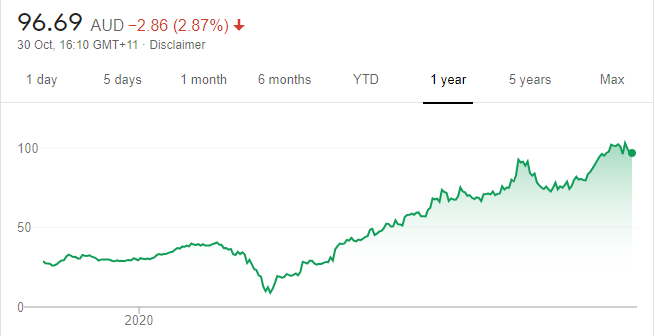

Zip Co (Z1P)

The stellar rise in this buy now, pay later company looks well overdone from a valuation perspective, in my view. Westpac has sold its 10.7 per cent stake in Z1P for a massive $367 million on a $49 million investment. Westpac sold Z1P for $6.65 a share, which was a 6.07 per cent discount to the last Z1P closing price on October 21. Z1P shares closed at $5.98 on October 29.

Disclosure: Interests associated with Fat Prophets hold shares in Praemium, Mainstream Group Holdings, Domino’s Pizza Enterprises and Coca-Cola Amatil.

Peter Day, Sequoia Wealth Management

BUY RECOMMENDATIONS

Rhipe (RHP)

RHP is a leader in cloud and technology solutions. It provides partners with sound business advice and technical expertise in a growing cloud market. Earnings are recurring, predictable and compounding. RHP has a quality management team. We have upgraded forecast earnings growth by 28 per cent in 2021 and another 29 per cent in 2022.

REA Group (REA)

REA is a multinational digital advertising business specialising in property. In Australia, REA is the market leader, generating huge traffic to its sites. REA also holds a significant shareholding in property websites realtor.com in the US. It owns leading portals in Malaysia and Hong Kong. The key to historical success has been the company’s first mover advantage and high margins. We’re forecasting earnings growth moving forward.

HOLD RECOMMENDATIONS

Telstra Corporation (TLS)

Flat earnings are predictable, but this telecommunications giant has a sound balance sheet. The company’s valuation is undemanding, and there’s some upside to the consensus share price. In our view, the primary reason for owning the stock is income as bank dividends shrink compared to past years.

Tabcorp Holdings (TAH)

The pandemic had a significant impact on the fiscal year 2020 result, as hotels, clubs and TAB agencies were closed for significant periods. A capital raising and a re-basing of dividend expectations were a positive response to navigating the pandemic along the path to a brighter outlook, in our view.

SELL RECOMMENDATIONS

Capitol Health (CAJ)

This radiology services provider delivered a 3 per cent increase in revenue to $153.8 million for fiscal year 2020. Operating EBITDA was up 22 per cent to $27.8 million. The company raised capital at 16 cents a share in April. The shares finished at 25 cents on October 29. Investors may want to consider taking a profit.

Rural Funds Group (RFF)

RFF is a real estate investment trust. It’s well diversified, with 61 properties across five agricultural sectors. There has been a planned move from poultry and almond assets towards macadamia, cattle properties and water rights. The shares have performed well since March to close at $2.44 on October 29. Investors can consider taking profits.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.