Free Knigthsbridge Trading Academy woth $2750 with Axitrader

John Athanasiou, Red Leaf Securities

BUY RECOMMENDATIONS

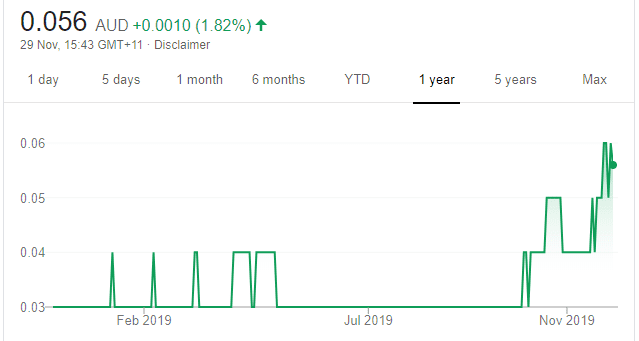

Dropsuite (DSE)

Chart: Share price over the year

Dropsuite is a global cloud software company that backs up, recovers and protects critical business information. IT company annualised revenue is in an upward trend and projected to reach between $4.8 million and $5 million by the end of the year. We expect the market will positively re-rate the stock if these projected numbers are met. The shares finished at 5.5 cents on November 28.

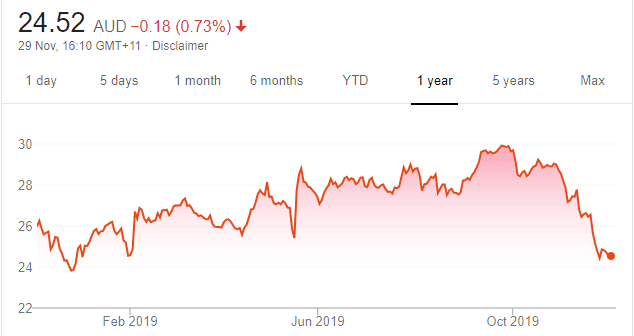

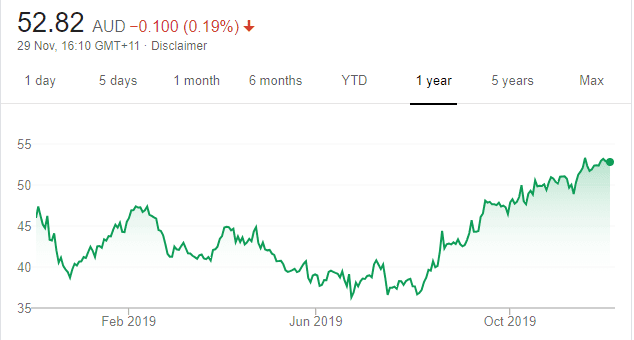

Westpac Bank (WBC)

Chart: Share price over the year

Investors have hit the sell button on WBC after financial intelligence unit AUSTRAC commenced civil proceedings against the bank. AUSTRAC alleges Westpac contravened the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 on more than 23 million occasions. We believe panic selling presents a buying opportunity, as WBC is trading near its 52-week lows and paying a dividend yield above 6 per cent.

HOLD RECOMMENDATIONS

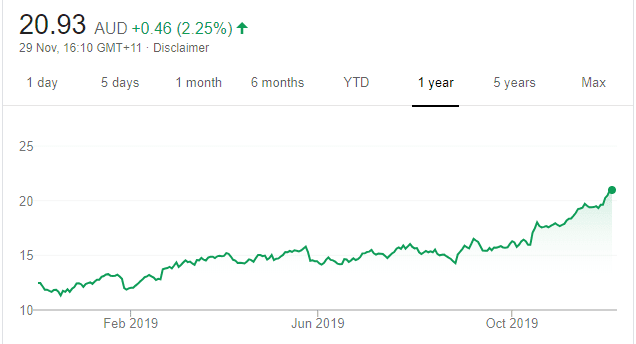

Collins Foods (CKF)

Chart: Share price over the year

Collins Foods has been a strong performer in 2019, with its share price surging more than 40 per cent. The share price of the fast food operator has rallied on the back of strong performances at its KFC and Taco Bell divisions. The company recently reported a strong interim earnings result from revenue growth.

Fisher & Paykel Healthcare Corporation (FPH)

Chart: Share price over the year

The medical device company recently reported a strong half year result. Profit after tax rose 24 per cent to a $NZ121.2 million. Total operating revenue rose 12 per cent to $NZ570.9 million. Hold to see if its strong performance can continue for the full year. But keep a close eye on the stock in case of a pull back. The share price has performed strongly in 2019.

SELL RECOMMENDATIONS

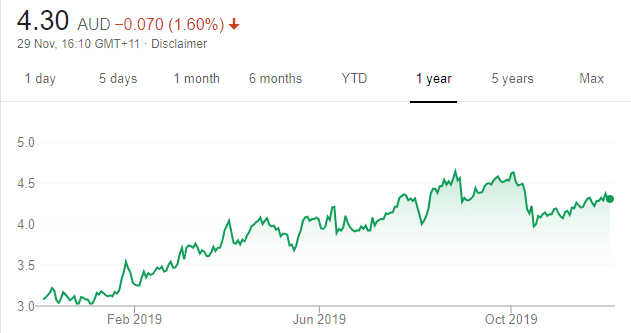

Harvey Norman Holdings (HVN)

Chart: Share price over the year

Shares in the retail giant have been in an uptrend lately, rising from $3.97 on October 15 to finish at $4.37 on November 28. We believe the price may be trading ahead of itself given a recovery in the housing market. Retail competition remains fierce in a slow growth economy, with cautious consumers careful about spending. Prefer others.

Seek (SEK)

Chart: Share price over the year

This jobs listing company is under earning in fiscal year 2020 given more investment amid weaker macro economic conditions. It affirmed fiscal year 2020 guidance, including net profit after tax of between $145 million and $155 million. But it warned guidance may be impacted if macro economic conditions deteriorated. SEK acknowledged macro economic conditions are weak in a number of its key markets, including Australia, New Zealand and China.

Julia Lee, Burman Invest

BUY RECOMMENDATIONS

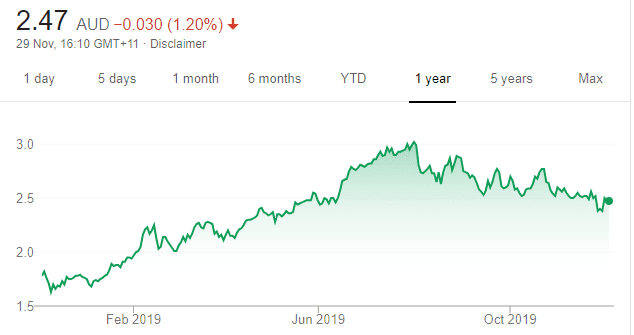

Credit Corp Group (CCP)

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Chart: Share price over the year

Credit Corp buys distressed debt from banks and finance companies, which make up about 80 per cent of its business in Australia. Collections are increasing. The company has moved to the US, which has a purchase debt ledger market about 10 times the size of Australia. It generated its first profit in the US in fiscal year 2018 and profit accelerated in fiscal year 2019. The company continues to grow here and in the US.

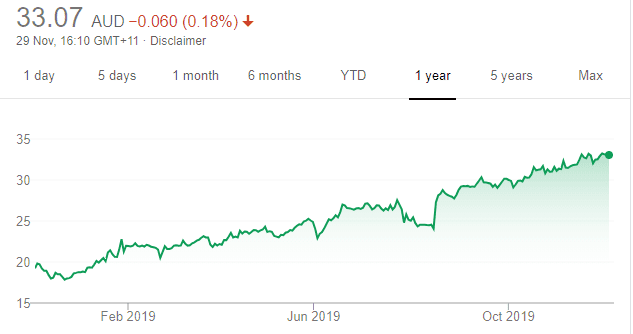

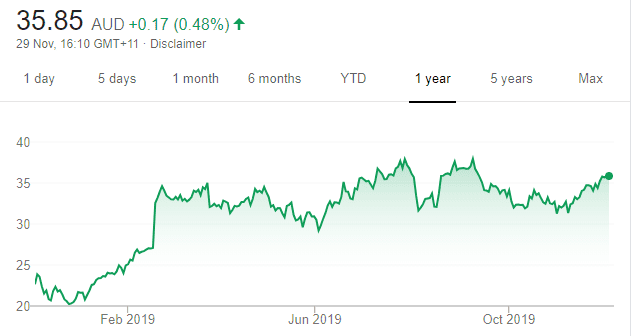

Technology One (TNE)

Chart: Share price over the year

It’s software as a service division grew by 44 per cent last financial year, which drove profit growth. A key catalyst will be its annual general meeting in February, where TNE usually provides guidance on the business outlook. The profit before tax margin is expected to grow to 35 per cent over the next few years. A combination of rising margins and a reasonable valuation leaves this company poised for growth.

HOLD RECOMMENDATIONS

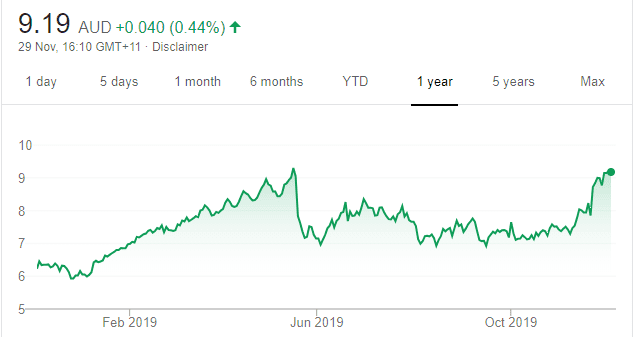

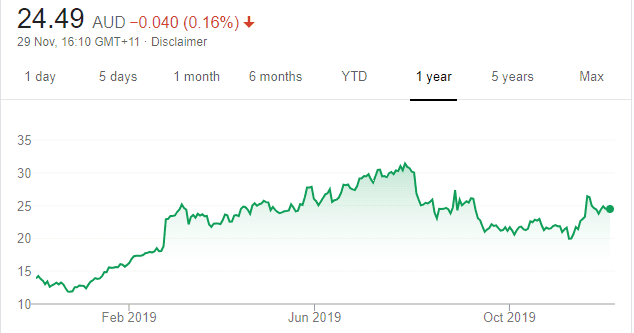

AMA Group (AMA)

Chart: Share price over the year

Operates in the automotive after care market. The Australian market is fragmented, so AMA’s acquisitions have contributed to a rising share price during 2019. Expect more acquisition opportunities to arise in the accident repair market, as AMA’s share is about 5 per cent. The company is aiming for a $1 billion revenue target by fiscal year 2021.

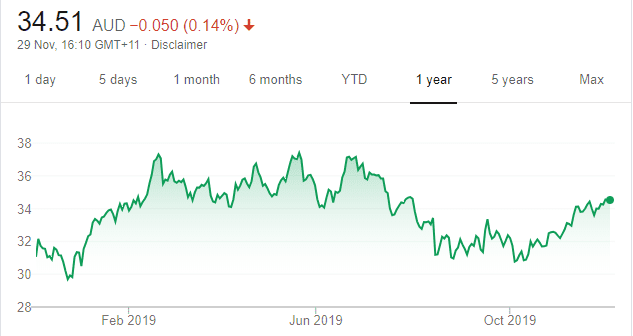

Mineral Resources (MIN)

Chart: Share price over the year

Iron ore stocks have performed well in the past three months, but MIN is lagging as a higher cost iron ore producer. However, the share price is still highly sensitive to moves in lithium prices. MIN is one to buy once lithium prices start rising.

SELL RECOMMENDATIONS

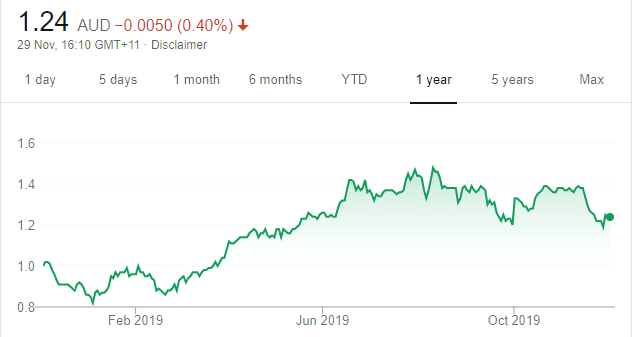

Westpac Bank (WBC)

Chart: Share price over the year

The bank stands accused of failing to comply with the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (AML/CTF Act). Australia’s financial intelligence unit AUSTRAC alleges Westpac contravened the AML/CTF Act on more than 23 million occasions. AUSTRAC has applied to the Federal Court of Australia for civil penalty orders against Westpac. The bank faces the prospect of a fine of more than $1 billion, increasing compliance costs and a hit to growth if it agrees to breaches of the Act, or they are proved. The bank is under immense pressure as more investigations unfold.

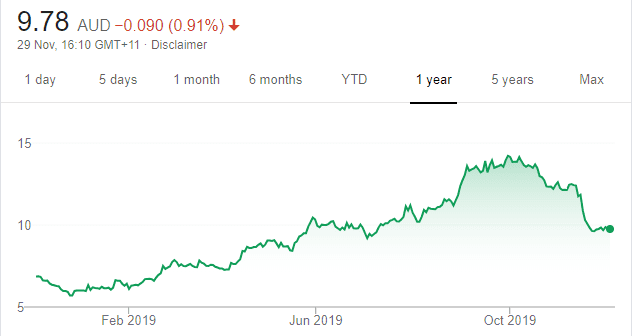

Service Stream (SSM)

Chart: Share price over the year

Provides network services to the telecommunications, gas, power and water sectors. In the last financial year, NBN Co accounted for more than 40 per cent of SSM revenue. Telstra accounted for more than 10 per cent of revenue. In my view, SSM revenue relies too heavily on NBN Co. The risk for SSM is the 5G network attracting a growing number of customers from the national broadband network.

Tim Montague-Jones, ASR Wealth Advisers

BUY RECOMMENDATIONS

Altium (ALU)

Chart: Share price over the year

This software company has evolved into becoming an international standard for the design of printed circuit boards. ALU is our preferred Australian technology company. Technology companies are hard to value because of the structural shift causing a rapid acceleration in demand for software as a service. We expect ALU to exceed market expectations, as it continues to take market share within a growing market.

Appen (APX)

Chart: Share price over the year

Machine learning or artificial intelligence is experiencing a growing shift in technology innovation to streamline processioning and save on administration costs. Appen has delivered strong revenue growth from selling its data to enhance the relevance of third party learning and artificial software. We expect third party data providers, such as APX, will remain the preferred choice for enhancing functionality of evolving software development.

HOLD RECOMMENDATIONS

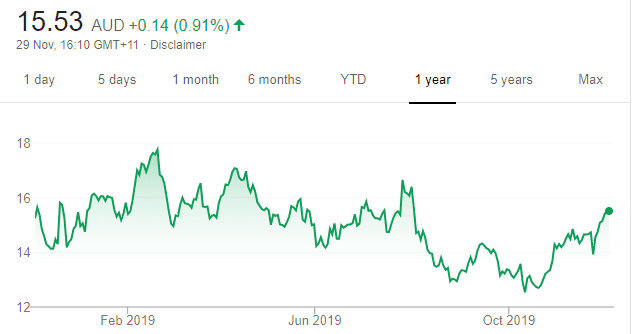

Santos (STO)

Chart: Share price over the year

The share price of this oil and gas company was recently trading around its 52 week high. We like STO given long term demand for natural gas from Asia, comparable low cost of production and proximity to market. However, contracts are largely based on an oil price. Oil inventories have been building in the US, reflecting a slowdown in global demand for energy combined with escalating production from US fracking companies. In the near term, we see little in the way of an investment catalyst to drive the share price higher.

Woodside Petroleum (WPL)

Chart: Share price over the year

Woodside is also one of our preferred oil and gas investments in Australia. The company is entering an expansion phase to increase production from its investment in the Scarborough gas field. Resource from this field will flow into a planned investment of an additional Pluto LNG train, lowering the combined unit cost of production, lifting profit margins and returns for shareholders.

SELL RECOMMENDATIONS

Domino’s Pizza Enterprises (DMP)

Chart: Share price over the year

Technology has lowered the barriers of entry within the food delivery industry, with brands like Uber Eats, Menulog and a host of other digital apps taking a growing share of consumer expenditure. Domino’s has used a combination of technology, speed and price to build a share of the market. The total market is becoming increasingly fragmented. Choice is great for consumers. But it increases pressure on incumbents as they lose sales volume, while price competition escalates. We expect market fragmentation will lower returns on capital for DMP shareholders over time.

AP Eagers (APE)

Chart: Share price over the year

AP Eagers is an automotive retail group. Month on month new car sales in Australia have declined at a rapid rate, reflecting falls in consumer expenditure. We believe APE is impacted by this slowdown. We expect motorists will keep their cars longer before upgrading. In our view, lower transactional volumes will add pressure to APE’s operating margins and potentially lead to lower earnings guidance.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing.

Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.