Toby Grimm, Baker Young

BUY RECOMMENDATIONS

BUY – Worley (WOR)

Major shareholder Sidara, formerly Dar Group, recently sold 19 per cent of Worley stock. The underwritten block trade ends an extensive and potential takeover play. The transaction doesn’t impact WOR’s operations or valuation. Recent share price weakness presents an opportunity to buy a quality engineering services company at attractive levels.

BUY – ALS Limited (ALQ)

This global leader in laboratory testing services should benefit from increasing mineral exploration activity amid surging key commodity prices, such as copper and gold. Taking full ownership of European-based contract research organisation Nuvisan is a strategic fit for ALQ, providing growth opportunities as the company further develops its pharmaceutical platform.

HOLD RECOMMENDATIONS

HOLD – Sonic Healthcare (SHL)

Sonic Healthcare (ASX: SHL) is Australia’s largest pathology testing firm but remains out of favour as it loses prior windfall COVID-19 revenues amid an elevated operating cost environment. However, we see fiscal year 2024 as the low point for earnings. Moving forward, we expect growth across its global core business as a prime reason to consider holding the stock.

HOLD – TPG Telecom (TPG)

TPG’s agreement to share regional mobile infrastructure with Optus could assist in generating a return on expensive spectrum without having to fund a potentially high-risk network construction strategy. But the agreement still requires regulatory approvals. In our view, TPG’s competitive position remains challenging, but progress on the agreement could see the stock close its recent 32 per cent discount to our valuation.

SELL RECOMMENDATIONS

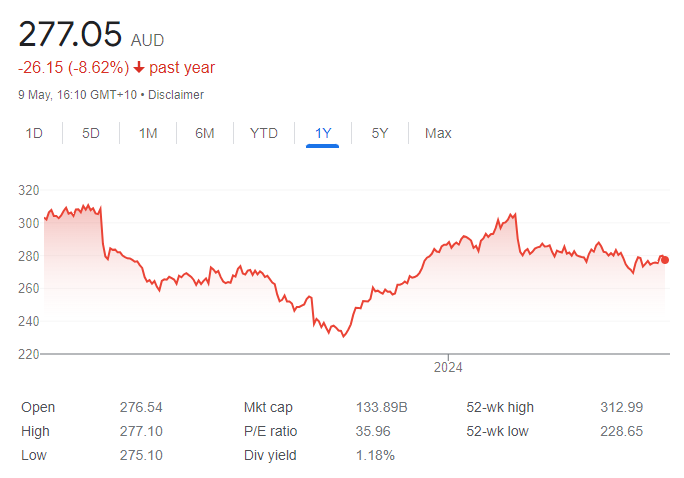

SELL – Wesfarmers (WES)

This industrial conglomerate is among Australia’s most successful corporate operators. While potential exists for a large scale transformative acquisition, we believe the share price has rallied to levels which we consider overvalued. High interest rates and cost of living increases may pressure the company’s key retail segments. Investors may want to consider taking a profit.

SELL – ResMed Inc (RMD)

The sleep apnoea device maker delivered impressive third quarter results in fiscal year 2024. RMD’s share price has surged relative to the market and its peers. While long term growth is likely, the impact from new weight loss drugs remains uncertain, so we suggest investors consider reducing exposure and cashing in some gains.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Jed Richards, Shaw and Partners

BUY RECOMMENDATIONS

BUY – CSL (CSL)

This well managed blood products company offers compelling long-term tailwinds. CSL is steadily growing its dividend stream. The company usually under-promises and over-delivers when it comes to profit. The stock has underperformed on the back of a slower recovery in margins. Also behind a weaker share price was a phase 3 study which found its CSL112 drug was unable meet its primary efficacy endpoint of reducing the risk of major adverse cardiovascular events in patients at 90 days following a first heart attack. The recent share price presents an attractive entry level for investors.

BUY – Treasury Wine Estates (TWE)

The removal of Chinese tariffs on imported Australian wines is positive for TWE. The iconic Penfolds brand remains prominent in China. As the world’s second largest economy, China is a most attractive market for TWE, enabling this wine giant to diversify its revenue base moving forward. Share price weakness provides an attractive entry point.

HOLD RECOMMENDATIONS

HOLD – Macquarie Group (MQG)

This diversified financial services company has typically delivered strong returns over time, with management enjoying a good reputation for deploying capital in a value accretive way. The business has strong positions in sectors that we believe will generate growth, such as green energy, infrastructure, technology and commodities.

HOLD – Coles Group (COL)

Major supermarkets are caught in the unenviable political crosshairs ahead of a tight general election. The supermarkets stand accused of price gouging when cost-of-living pressures are extreme. However, Coles was recently trading at a discount to its historical norm and should hold up relatively well in a softer economic environment. The company’s market share gives it scale advantages and bargaining power.

SELL RECOMMENDATIONS

SELL – BlueScope Steel (BSL)

BSL’s first half result in fiscal year 2024 was disappointing. Underlying earnings before interest and tax (EBIT) of $718 million was down $133 million on the prior corresponding period. Underlying EBIT in North America was down 15 per cent on the second half of fiscal year 2023, Australia was down 2 per cent, while Asia was up 17 per cent. The outlook appears challenging in the second half. The dividend yield was recently 2.22 per cent, so we see better opportunities elsewhere.

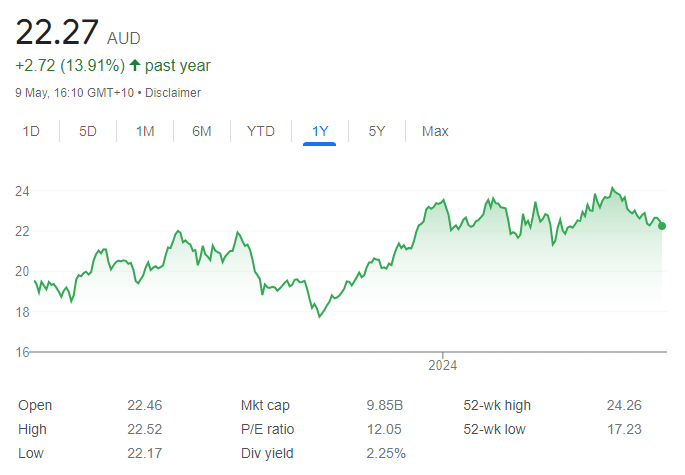

SELL – Bendigo and Adelaide Bank (BEN)

The bank is making progress in areas, such as digital mortgages and information technology consolidation. However, in our view, it remains a price taker in a highly competitive revenue environment. We believe BEN clearly lags the big four major banks, which limits potential growth from these levels.

Tony Locantro, Alto Capital

BUY RECOMMENDATIONS

BUY – Triangle Energy (Global) (TEG)

The TEG joint venture, involving Strike Energy and New Zealand Oil and Gas, has contracted a rig to drill the booth-1 well in the North Perth Basin in late June or July. There’s potential for oil and gas, with a prospective resource range of between 113 billion cubic feet of gas and 540 billion cubic feet. TEG expects to drill the Becos oil prospect in the September quarter of 2024 subject to approvals. Oil and gas exploration carries significant risk, but success can bring strong share price upside. The shares were trading at 2 cents on May 9.

BUY – Syntara (SNT)

Syntara is a clinical stage drug development company focused on haematological malignancies. It’s planning to deliver results from four phase 2 studies by mid 2025. A focus is on SNT-5505 designed for treating Myelofibrosis, a rare type of bone marrow cancer that disrupts the body’s production of normal blood cells. Interim data for 15 patients is expected later in calendar year 2024. SNT is highly speculative and suited to investors with an appetite for risk. The shares were trading at 1.6 cents on May 9.

HOLD RECOMMENDATIONS

HOLD – Spartan Resources (SPR)

The company has raised capital to significantly expand exploration at the Dalgaranga gold project in 2024/25. A quarterly activities report ending March 31 revealed multiple high grade gold intercepts from drilling at the Never Never gold deposit, extending mineralisation to a depth of more than a kilometre. The share price has risen from 39.7 cents on January 24 to trade at 57.5 cents on May 9. Consider holding for further drilling results and gold production strategies.

HOLD – Mayfield Group Holdings (MYG)

Mayfield provides electrical and telecommunication solutions across Australia’s power infrastructure. Revenue for the half year to December 31, 2023, was down on the prior corresponding period, but profit was significantly higher. The shares have performed well this calendar year, with the price rising from 56.5 cents on January 2 to trade at 89 cents on May 9. The company is poised to generate organic growth.

SELL RECOMMENDATIONS

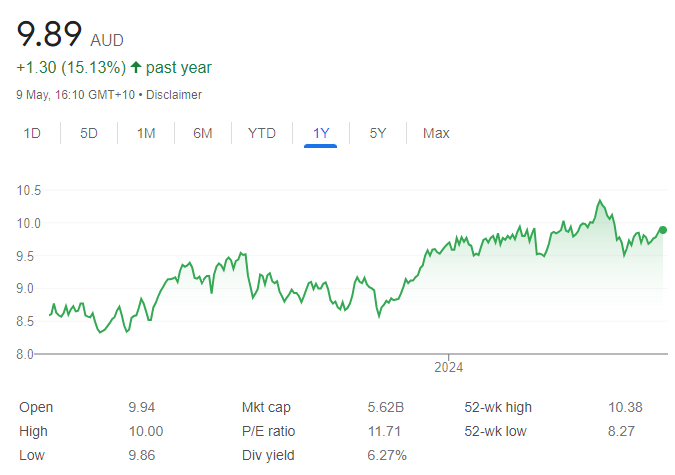

SELL – National Australia Bank (NAB)

First half cash earnings of $3.548 billion in the first half of fiscal year 2024 were down 12.8 per cent on the prior corresponding period. The company announced a $1.5 billion increase in the on-market share buy-back. The share price has performed strongly between the start of 2024 and May 9. Investors may want to consider taking a profit given the possibility of a slowing economy in a high interest rate environment.

SELL – Harvey Norman Holdings (HVN)

Seasonally adjusted Australian retail sales volumes fell 0.4 per cent in the 2024 March quarter. Cost of living pressures remain elevated, with the threat of a higher for longer interest rate environment adding more pressure. This discretionary retail giant operates in a fiercely competitive environment that’s directly exposed to shoppers reducing their spending. The shares have been drifting lower between late March and May 9.

Related Articles:

- How to Start Trading Stocks

- CFD Trading in Australia

- How to Trade Commodities in Australia

- How to Start Day Trading in Australia

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.