Christopher Watt, Bell Potter Securities

BUY RECOMMENDATIONS

BUY – WiseTech Global (WTC)

WTC provides software solutions to the global logistics industry. It services more than 12,000 customers, including 43 of the top 50 global third party logistics providers. The recent sell-off presents a buying opportunity after the company provided lower than expected underlying earnings guidance for fiscal year 2024. Logistics is typically managed by in-house businesses, so WiseTech’s platform offers customers significant cost savings and convenience.

BUY – Santos (STO)

This oil and gas explorer and producer has a diversified portfolio of mostly Australian and PNG assets. STO supplies domestic gas and sells LNG to international markets. STO’s Barossa project is expected to deliver first gas production in fiscal year 2025. We expect Barossa to be a growth catalyst. Risks are easing in relation to the company’s execution of key growth projects.

HOLD RECOMMENDATIONS

HOLD – Mader Group (MAD)

Mader provides specialised contract labour for maintenance of heavy mobile equipment in the resources and civil industries. Our MAD earnings outlook is underpinned by ongoing expansion of the company’s core and new service offerings across its mature Australian operations and large growth markets, including the US and Canadian mining and energy sectors. The company appears fairly valued off the continued rally in the share price.

HOLD – Brambles (BXB)

This integrated logistics supply chain company posted another strong result during the recent reporting season. Operating profit was up 19 per cent and at the top end of the guidance range. Revenue and earnings streams are relatively resilient. Looking forward, we expect cyclical tailwinds to ease, so upside appears limited.

SELL RECOMMENDATIONS

SELL – Liontown Resources (LTR)

LTR, an emerging tier-1 battery minerals producer, has received a non-binding indicative proposal from Albemarle Corporation to acquire all outstanding LTR shares for $3 each via a scheme of arrangement. Completing and commissioning the LTR project carries risk. Although there’s a chance of an alternative bid, investors can consider cashing in now, which removes uncertainty from the equation.

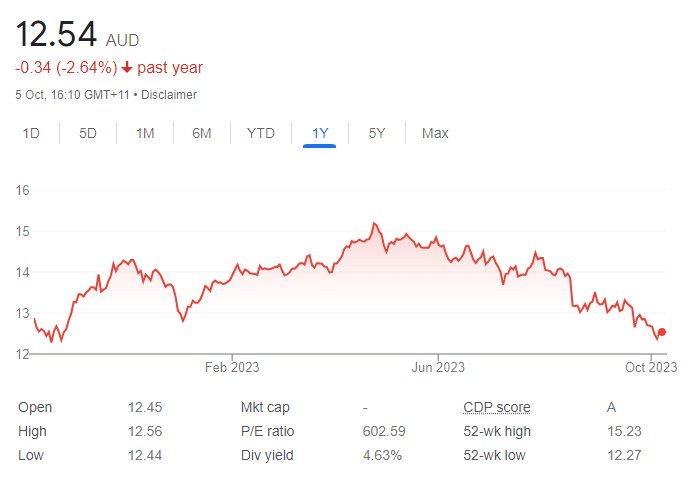

SELL – Telstra Group (TLS)

Telstra’s full year 2023 result fell short of our expectations and, in our view, forward guidance was subdued. Retaining the current ownership structure of the InfraCo Fixed division, at least in the medium term, disappointed some investors. Prior to releasing its result, Telstra closed at $4.25 on August 16. The shares were trading at $3.83 on October 5. In our view, Telstra is a relatively expensive defensive stock in the absence of a clear catalyst to excite investors.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Tim Haselum, Catapult Wealth

BUY RECOMMENDATIONS

BUY – Stockland (SGP)

Stockland is a diversified property group. SGP’s strategy includes expanding the industrial and residential community portfolios. The medium term outlook for residential communities remains strong given increasing rates of net overseas migration, low rental vacancy rates and a chronic shortage of new dwellings across key eastern seaboard markets.

BUY – Transurban Group (TCL)

We expect earnings for this toll road operator to grow at a moderate pace regardless of macroeconomic headwinds. A combination of growing traffic volumes, higher tolls and new projects are drivers of the share price. Most tolls are linked to inflation. Most debt is fixed. Declining bond yields should also support the share price in the medium term.

HOLD RECOMMENDATIONS

HOLD – Ansell (ANN)

Ansell makes protective medical and industrial gloves. The share price has fallen about 50 per cent since the heights of the COVID-19 pandemic. On a reported basis, full year 2023 sales declined 15.2 per cent compared to the prior corresponding period. Input costs have been volatile. However, at these price levels we’re much more comfortable about holding the stock, with business expansion across emerging markets providing growth opportunities.

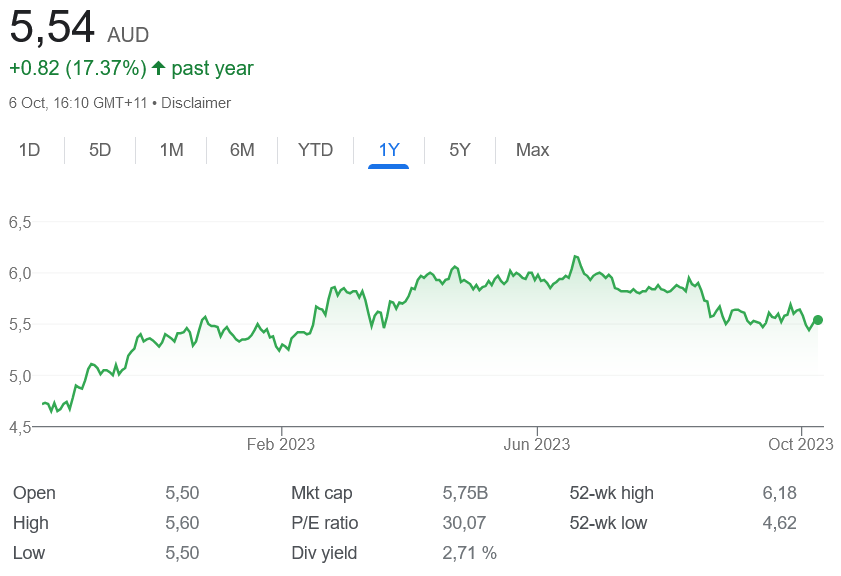

HOLD – Steadfast Group (SDF)

Steadfast is the biggest general insurance broker network in Australia, with growing operations overseas. SDF has generated consistent year-on-year growth driven by positive conditions for brokers, rising insurance premiums, customer policy churn and business acquisitions. Brokers don’t have the claims risk that underwriters carry, making SDF an attractive high margin business. The valuation has pushed up to fair value, so we retain a hold recommendation.

SELL RECOMMENDATIONS

SELL – Cochlear (COH)

COH is a high quality healthcare company and a global leader in the hearing implants sector, which is expected to continue enjoying tail winds. COH has outperformed the wider healthcare sector. The share price has risen significantly in calendar year 2023. In our view, COH is overvalued at a time when there’s many more attractively priced stocks to choose from in the healthcare sector.

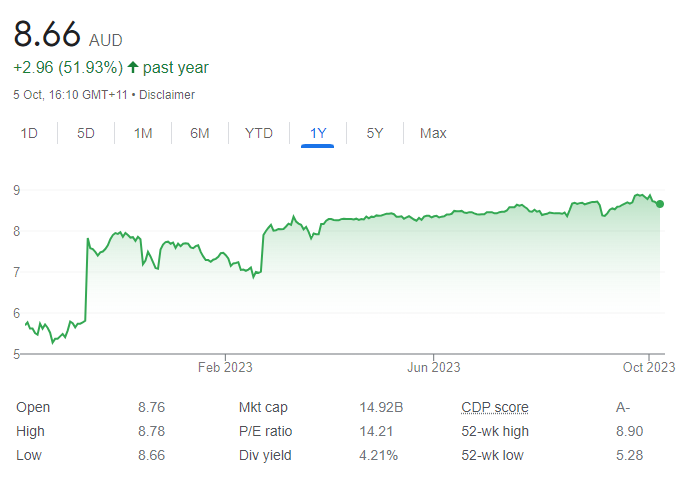

SELL – Origin Energy (ORG)

In November 2022, the energy giant announced it had received an indicative, conditional and non-binding proposal from a consortium to acquire all the shares in Origin. In March 2023, Origin announced it had entered into a binding Scheme Implementation Deed with the consortium, implying a total consideration of $8.912 a share prior to dividend adjustments. The proposed acquisition of Origin is progressing. However, investors may want to consider selling now to avoid potential regulatory issues. The shares were trading at $8.75 on October 5.

Angus Geddes, Fat Prophets

BUY RECOMMENDATIONS

BUY – Treasury Wine Estates (TWE)

Net sales revenue per wine case has risen strongly and is at an inflection point. Expanding premium label brands is a key to widening margins. Diversifying into South East Asia has materially strengthened the business. Meanwhile, the possible removal or easing of steep Chinese tariffs on Australian wines should benefit TWE and its outlook.

BUY – New Hope Corporation (NHC)

Strong near-term global demand for consistent base load electricity presents New Hope with an opportunity to deliver high calorific value thermal coal into a robust pricing environment. The company offers a strong growth profile and highly competitive unit costs. We expect substantial cash flows from anticipated higher coal prices for some time. It positions New Hope to report good financial performances going forward.

HOLD RECOMMENDATIONS

HOLD – Elders (ELD)

Elders is an Australian agribusiness. It enjoys a strong market position with a long-established presence and extensive network across rural Australia. The company’s size gives it economies of scale.The company has diversified revenue streams from operating across multiple sectors of the agricultural industry, including livestock, wool, grain and real estate. This mitigates seasonal fluctuations.

HOLD – Fortescue Metals Group (FMG)

Record iron ore shipments by Fortescue have been masked by market concerns over China’s appetite for the steel making commodity. Chinese authorities have undertaken a series of small stimulatory programs to reactivate a sagging economy, culminating in growth of around 5 per cent. Such a growth rate is sufficient to support China’s steel industry and its demand for iron ore.

SELL RECOMMENDATIONS

SELL – EML Payments (EML)

EML is a global payment solutions provider. Products include card payments, digital account payments and open banking. Regulatory issues stemming from its European business have weighed on the company. Takeover speculation persists, in our view. Investors pushed the stock higher following its full year result in late August. We believe the higher share price on October 5 enables investors to consider a timely exit opportunity.

SELL – Australian Unity Office Fund (AOF)

Australia’s office towers have come under pressure from increasing market valuation rates and declining rental yields. This real estate investment trust owns a portfolio of properties across metropolitan and CBD markets. Returning to the office after working from home has been a slow process, causing rental incomes to fall. In our view, other stocks appeal more at this stage of the economic cycle.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.