Tom Bleakley, BW Equities

BUY RECOMMENDATIONS

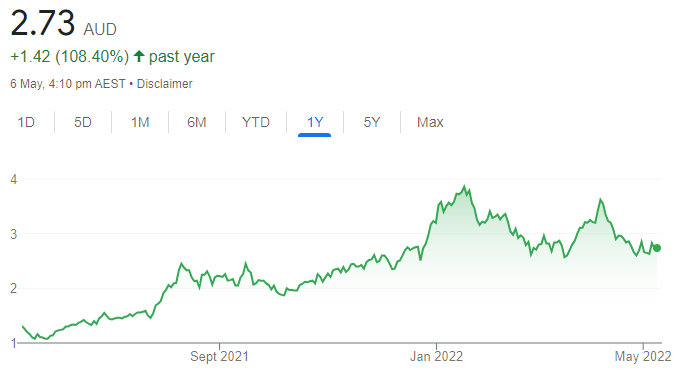

Elementos (ELT)

This tin explorer and development company is progressing projects in Australia and Spain. It’s focused on starting tin production by 2025. Tin is used for solder and extensively used in circuit boards and chips. We believe ELT offers a good long term growth opportunity, as its projects should assist in meeting what we expect will be increasing demand for tin.

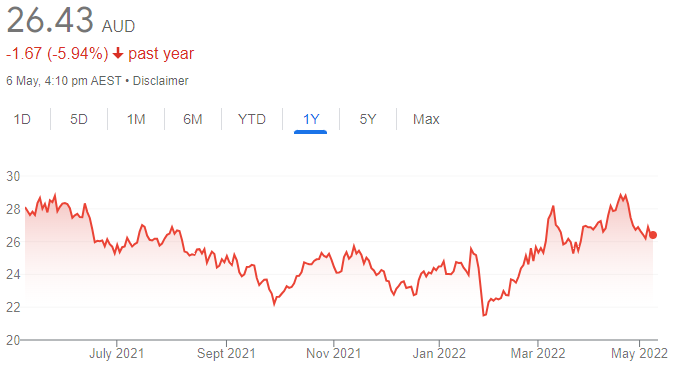

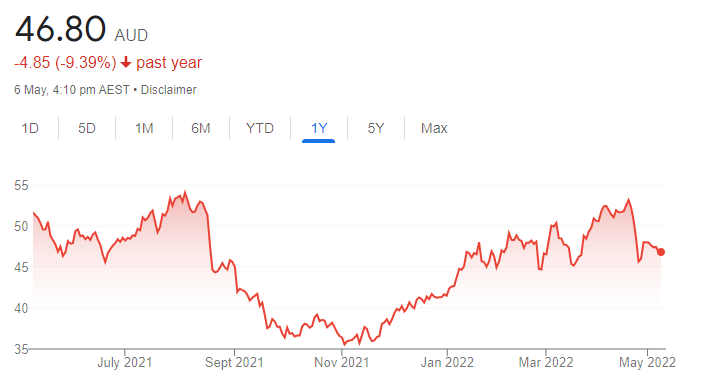

Metals X (MLX)

MLX is Australia’s biggest tin producer. Metals X has a 50 per cent stake in the quality Renison tin project in Tasmania. The resource continues at depth, giving us confidence about its long term viability. Tin prices comfortably exceed the company’s production costs.

HOLD RECOMMENDATIONS

Newcrest Mining (NCM)

The gold producer continues to operate some of the world’s most profitable mines. Acquisition and exploration success grew gold ore reserves by 10 per cent to 54 million ounces as at December 31, 2021. Newcrest offers exposure to a rising gold price. We like the company’s outlook.

Woolworths Group (WOW)

Despite supply chain issues, the supermarket giant continues to deliver good results. Group sales of $15.123 billion in the 2022 third quarter were up 9.7 per cent on the prior corresponding period. Solid trading momentum is continuing in the fourth quarter. The consumer staples sector has been a safe haven during recent market turbulence.

SELL RECOMMENDATIONS

Lake Resources N.L (LKE)

This lithium explorer has several projects in Argentina. The share price has risen from 93 cents on February 2 to trade at $1.75 on May 5. The lithium boom – in response to a bright outlook for electric vehicle sales – contributed to the share price rise, in our view. However, we believe the share price has risen too fast, too soon. Investors may want to consider cashing in some gains.

Zip Co (ZIP)

Competition in the buy now, pay later sector is fierce and volatile. Unaudited 2022 third quarter revenue fell by 4 per cent on the previous quarter. Unaudited third quarter revenue in the US fell by 13 per cent on the second quarter. Unaudited third quarter Australian and New Zealand revenue rose by 3 per cent. The share price has fallen from $12.35 on February 15, 2021 to trade at $1.065 on May 5, 2022. Better growth prospects exist elsewhere, in our view.

Peter Day, Sequoia Wealth Management

BUY RECOMMENDATIONS

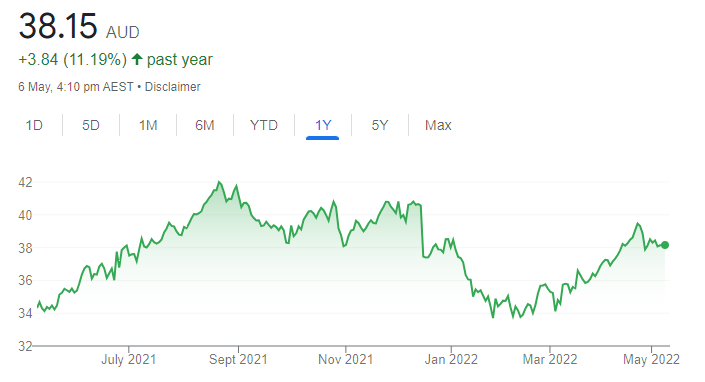

Endeavour Group (EDV)

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Endeavour, in partnership with Warakirri Asset Management, have acquired Josef Chromy Wines in Tasmania for $55 million. We view the acquisition as a positive step. It’s consistent with our view that EDV is seeking margin accretive opportunities. We expect the acquisition to be added to the Pinnacle Drinks division. Growth in Pinnacle brands and hotels are key opportunities underpinning our buy recommendation.

Wesfarmers (WES)

Owns a quality retail portfolio, including Bunnings, Kmart and Officeworks. Bunnings remains a solid performer, as people continue to invest in their homes. The WES management team is highly regraded and the balance sheet is healthy. We see the recent share price retreat providing a good entry point for investors.

HOLD RECOMMENDATIONS

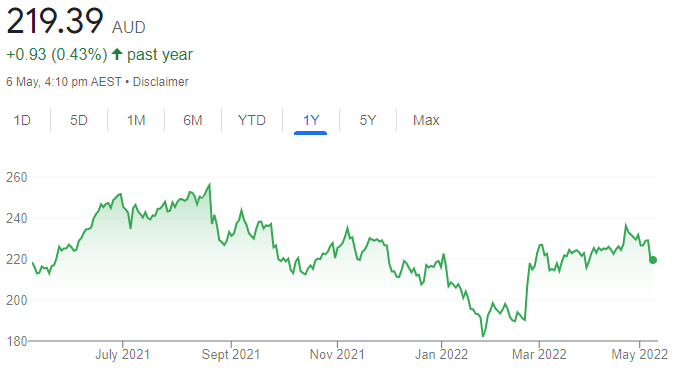

Ramsay Health Care (RHC)

Unaudited group net profit after tax of $201.6 million for the nine months to March 31 represented a 38.9 per cent fall on the prior corresponding period for this private hospital operator. Various non-recurring items and the impact from COVID-19 disruptions drove the fall. RHC confirmed it had received a conditional, non-binding indicative proposal from a consortium led by KKR at $88 a share. The stock is trading above our target price of $74, so we have downgraded to neutral. RHC stock was trading at $78.51 on May 5.

Origin Energy (ORG)

March quarter Australian Pacific LNG commodity revenue rose 15 per cent on the December quarter. Oil and gas markets remain tight. Energy companies are benefitting from an increase in electricity sales volumes. We retain our hold rating, as the company was recently trading above our price target of $6.71. ORG stock was trading at $7.105 on May 5.

SELL RECOMMENDATIONS

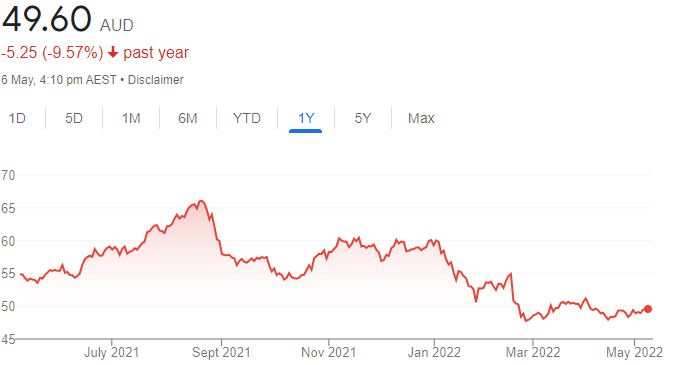

Cochlear (COH)

This hearing implants maker has agreed to acquire Oticon Medical for about $A170 million. We view the deal as an opportunity for COH to increase scale and share within the hearing loss market. However, our 2023 forecasts suggest the company was recently trading on a lofty price/earnings multiple. We prefer CSL at recent levels.

Capricorn Metals (CMM)

The gold producer’s third quarter operational result was solid. The company expects to produce towards the top end of its guidance for full year 2022. The company’s recent share price performance has been strong compared to peers. But we suspect the market is overvaluing the Mt Gibson project too early, as much work needs to be done. We hold an underperform recommendation.

Michael Gable, Fairmont Equities

BUY RECOMMENDATIONS

CSL (CSL)

The share price of this blood products group has been mostly range bound for the past two years. CSL recently bounced off the lower part of its trading range, and upward share price momentum paints a positive outlook. We expect buyer support in response to improving collections of plasma.

Pilbara Minerals (PLS)

This lithium company recently posted a solid March quarter activities report. Lithium prices continued to climb, while cash costs fell. Production is expected to increase during 2022. The share price has fallen from $3.62 on April 4 to trade at $2.765 on May 5. The price fall provides an appealing buying opportunity, in our view.

HOLD RECOMMENDATIONS

BHP Group (BHP)

We remain bullish on big resource stocks, such as BHP. Solid buyer support appears to be re-emerging after the stock was recently sold down from marginally above $53 on April 19 to $45.66 on April 26. Recent price action on the chart suggests BHP should recover from here and re-test its all time highs. BHP was trading at $47.64 on May 5.

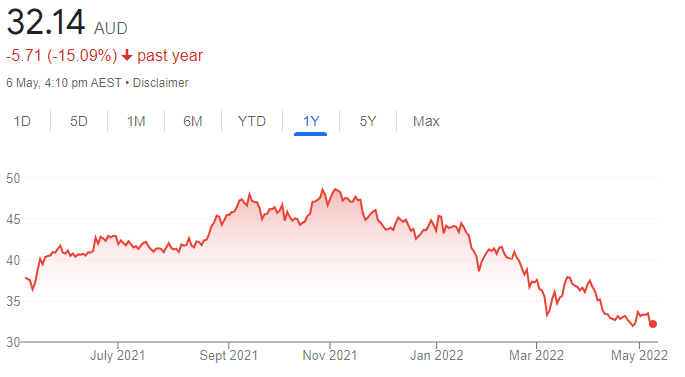

Aristocrat Leisure (ALL)

The share price of this gaming company has fallen substantially since peaking in November 2021. ALL is now attractively priced for a business generating double-digit earnings growth. Our analysis of the share price chart reveals potential for the stock to recover from here. The shares were trading at $33.65 on May 5.

SELL RECOMMENDATIONS

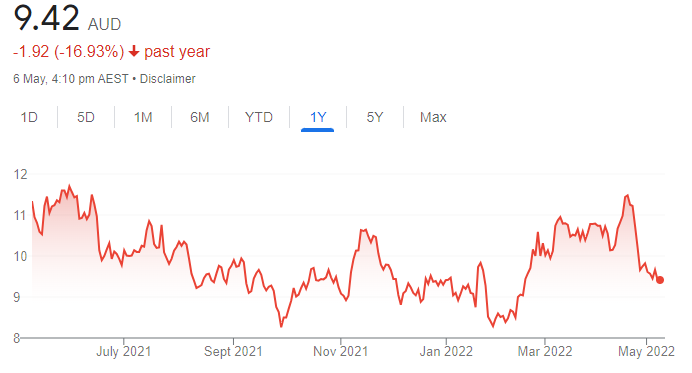

Northern Star Resources (NST)

The correlation between NST’s share price and the gold price is unreliable because of recent production issues. Our analysis suggests March quarter results were below the expectations of analysts, which may weigh on the share price. The share price has fallen from $11.48 on April 19 to trade at $9.655 on May 5.

Kogan.com (KGN)

Online retailers, such as KGN, are exposed to rising costs, stiffer competition and weakening demand for their goods. This adds risk to earnings and margins. KGN’s third quarter sales fell well short of the expectations of analysts, and the share price was punished. We expect retailers to face tougher times in light of interest rate rises before the environment improves.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.