Chris Batchelor, Spotee Connect

BUY RECOMMENDATIONS

Codan (CDA)

Codan produces metal detectors and communications equipment. Codan has grown into a global business. Revenue has significantly increased in the past five years to $437 million in fiscal year 2021. Statutory net profit after tax of $90.2 million is up 41 per cent on the prior corresponding period. The share price has fallen from above $19 in June to trade at $10.23 on November 4. The valuation is looking attractive. The author’s related parties have holdings in CDA.

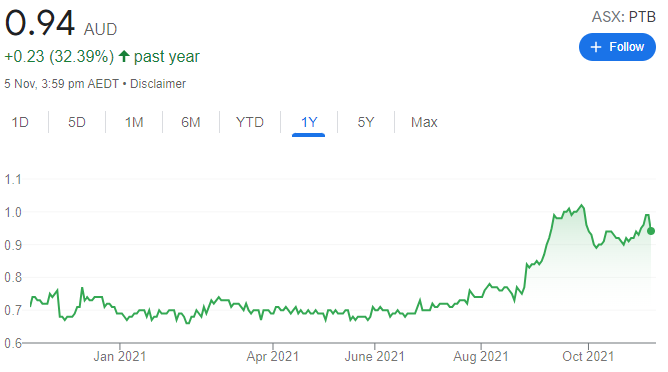

PTB Group (PTB)

This aviation company repairs turbo prop aircraft engines. The Australian business is well established and the company is rapidly expanding in the US. PTB continues to grow despite the pandemic impacting the aviation industry. The share price has risen strongly, but still trades on a modest price/earnings multiple.

HOLD RECOMMENDATIONS

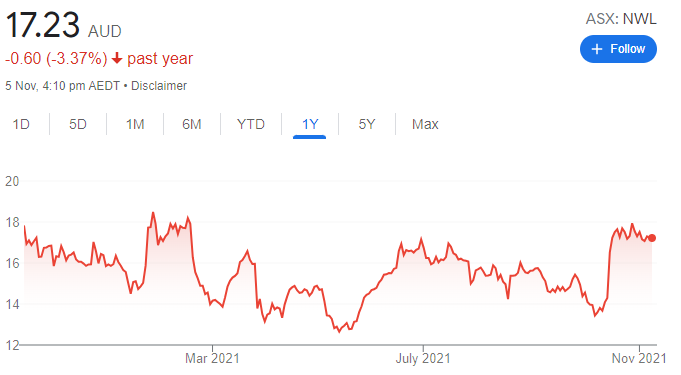

Netwealth Group (NWL)

This wealth management business provides portfolio services to investors and financial intermediaries. It reported funds under administration net inflows of $4 billion in the September quarter, an increase of 111 per cent on the prior corresponding period. This high quality business has an impressive growth record. Listed company Praemium has rejected a merger proposal from NWL, concluding it undervalues the business.

Adore Beauty Group (ABY)

This online beauty retailer posted revenue of $179.3 million in fiscal year 2021, an increase of 48 per cent on last year. Revenue continued to grow strongly in the September quarter. Apart from revenue, we’re looking for the business to show it can sustainably grow profits. The shares have risen from $4.61 on October 28 to trade at $5.20 on November 4.

SELL RECOMMENDATIONS

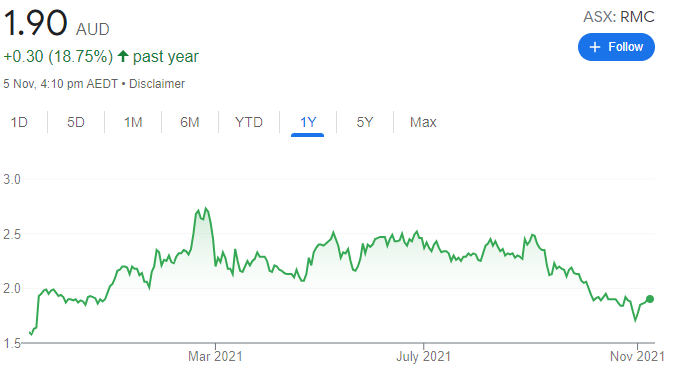

Resimac Group (RMC)

This non-bank lender focuses on residential mortgages. Interest rates may rise from record low levels sooner than expected. This is likely to drive up the cost of funding and may squeeze net interest margins. Also, if the housing market starts to cool, this may impact loan originations. Consequently, in our opinion, risk is to the downside.

Emeco Holdings (EHL)

Emeco supplies equipment to the mining industry. The company generated revenue of $620 million in fiscal 2021, an increase of 15 per cent on the previous year. However, we’re concerned about potential cost pressures. Also, the company is exposed to a fluctuating coal price, which recently fell. Given the risk exposures, we believe there’s better opportunities elsewhere.

Tim Haselum, Catapult Wealth

BUY RECOMMENDATIONS

Endeavour Group (EDV)

This retail liquor and hospitality business demerged from supermarket giant Woolworths and listed on the ASX on June 24, 2021. The company owns the Dan Murphy’s liquor chain and ALH Hotels. Alcohol retailing has been strong throughout the pandemic. Also, we see upside from its hotels and poker machines. We expect a stronger performance moving forward.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Appen (APX)

This language technology and data services company has reduced guidance. But the stock is trading at a discount on these valuations, in our view. APX recently completed the acquisition of mobile location company Quadrant Global. We expect strong demand for artificial intelligence products. We like the company and believe it’s undervalued. It has strong rebound potential.

HOLD RECOMMENDATIONS

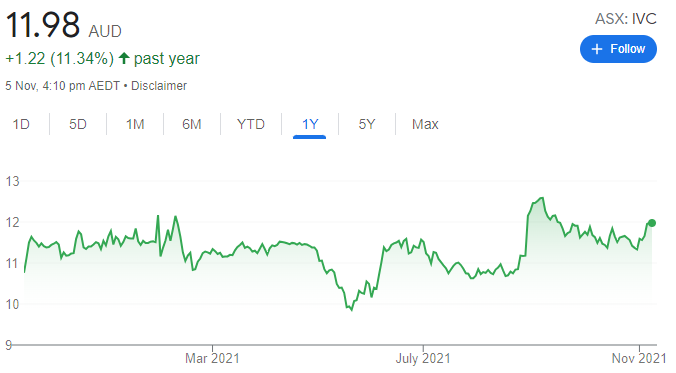

InvoCare (IVC)

Pandemic restrictions impacted margins of this funeral services provider. But the outlook is brighter as restrictions ease amid increasing COVID-19 vaccination rates. IVC enjoys a strong market position in a relatively defensive industry. We expect a further recovery in margins.

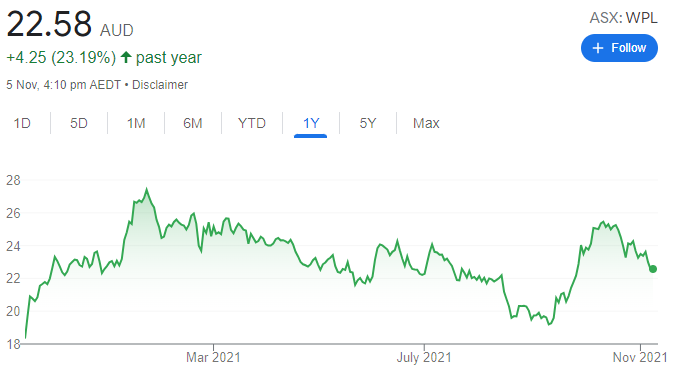

Woodside Petroleum (WPL)

We expect energy prices to continue rising. The company generated sales revenue of $1.531 billion in the third quarter to September 30, 2021, up 19 per cent on the second quarter. The merger commitment deed to combine BHP Group’s oil and gas portfolio with Woodside’s is a good move.

SELL RECOMMENDATIONS

GrainCorp (GNC)

This diversified agribusiness lifted guidance in August. The company is benefiting from favourable weather, bumper harvests and strong demand for Australian grain. The company is well managed. However, in our opinion, much of the good news is already priced into the stock. Our concern is the cyclical nature of the agricultural industry. Investors may want to consider taking some gains.

IOOF Holdings (IFL)

Investors pulled $2.3 billion from the company’s funds and platforms in the September quarter. But strong financial markets helped grow funds under management and administration to $321.1 billion in the September quarter. In our view, the MLC Wealth acquisition carries integration risk. The shares have fallen from $4.59 on October 27 to trade at $3.89 on November 4.

Jean-Claude Perrottet, Medallion Financial Group

BUY RECOMMENDATIONS

Alcidion Group (ALC)

ALC provides a suite of software products, with the objective of lifting efficiencies in hospitals. The company generated revenue of $25.9 million in fiscal year 2021, a 39 per cent increase on the prior year. Contracted revenue to be recognised in fiscal year 2022 was $17.2 million at the end of the first quarter, a 17 per cent increase on the prior corresponding period. Solid results amid possible future acquisitions are encouraging.

Fisher & Paykel Healthcare Corporation (FPH)

FPH designs and makes medical products for use in respiratory care. It recently revealed a new sleep apnea product following positive clinical trial results. We believe continuing expansion of the FPH product line paints a bright outlook. The company has a strong track record of generating consistent revenue growth.

HOLD RECOMMENDATIONS

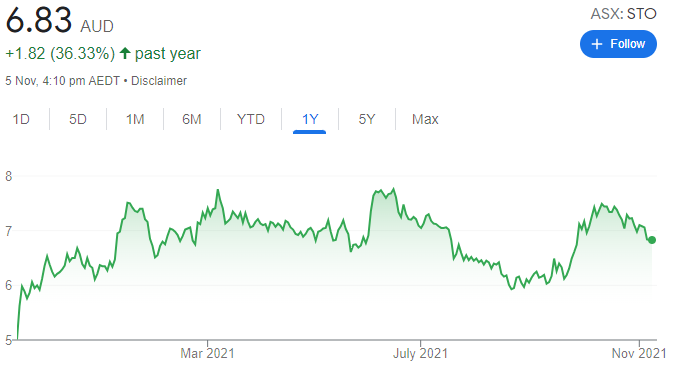

Santos (STO)

The gas supplier’s low cost operating model has improved the balance sheet, with the business generating $US931 million in free cash flow in the first nine months of 2021. The company posted sales revenue of $US1.14 billion in the third quarter, a 6 per cent increase. Expect the company to benefit from any LNG price rises.

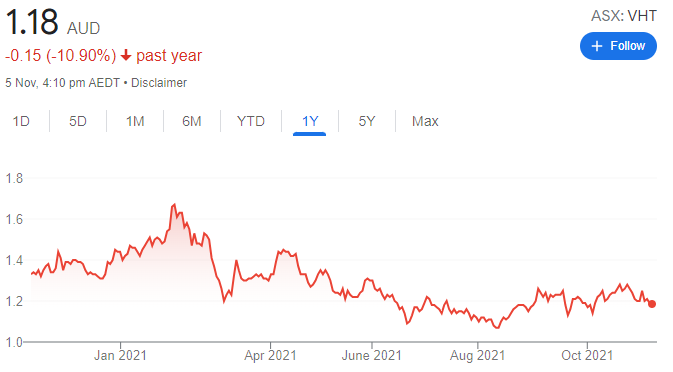

Volpara Health Technologies (VHT)

This health technology company is seeking to improve clinical decision making and the early detection of breast cancer. The company’s primary target market is the US. It recently signed a $US2.15 million contract with a US outpatient diagnostic imaging provider. Revenue has risen from $A1.7 million in fiscal year 2017 to $A18.1 million in fiscal year 2021. Gross profit margins increased to 91 per cent in fiscal year 2021. We believe Volpara offers continuing upside.

SELL RECOMMENDATIONS

The a2 Milk Company (A2M)

Sales to China marginally improved in the first quarter of fiscal year 2022. However, the infant formula market is gradually shrinking in response to a declining Chinese birth rate. COVID-19 has impacted the daigou re-selling channel. Continuing regulatory risk in China remains an issue. We prefer other stocks at this point.

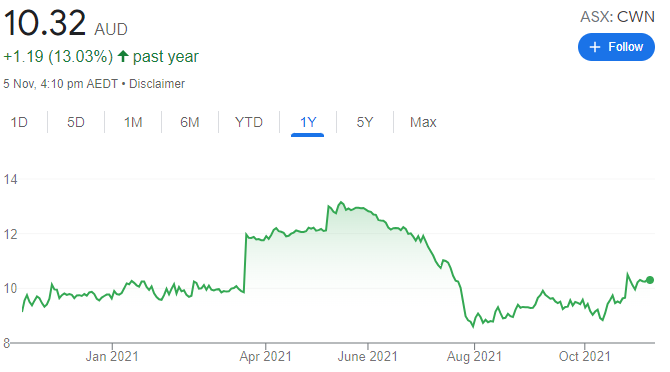

Crown Resorts (CWN)

The company can keep its licence to operate the Melbourne casino. Stringent conditions are likely to be imposed on the casino operator following a Victorian Royal Commission. Too much uncertainty about its outlook is behind our recommendation.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.