Tom Bleakley, BW Equities

BUY RECOMMENDATIONS

Dropsuite (DSE)

The company’s software platform provides cloud back up services and data protection. Annual recurring revenue of $28.2 million in the first quarter of fiscal year 2023 was up 66 per cent on the prior corresponding period and 11 per cent on the previous quarter. With a high growth rate and a durable customer base, we believe Dropsuite should be trading on higher multiples.

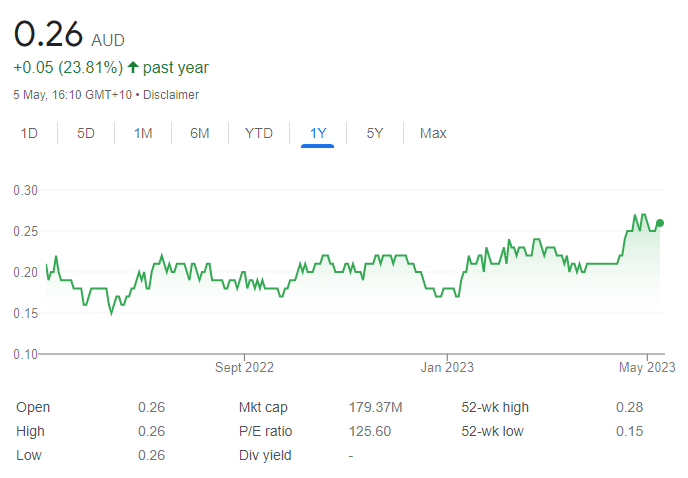

Sayona Mining (SYA)

SYA recently announced commercial spodumene concentrate production had resumed at the jointly owned North American Lithium project in Quebec. SYA is targeting annual production of 226,000 metric tonnes a year, with first commercial shipments expected in the third quarter of fiscal year 2023. Sayona is growing its resource base in Australia and Canada through an aggressive exploration campaign.

HOLD RECOMMENDATIONS

Tabcorp Holdings (TAH)

This wagering company’s recent results showed it holding digital revenue market share at 25.1 per cent, and is targeting 30 per cent by 2025. The company posted group revenue of $1.275 billion in the first half of fiscal year 2023, an increase of 11 per cent on the prior corresponding period. We retain a hold recommendation to see if TAH can deliver on forecasts and reduce costs.

Lindian Resources (LIN)

Lindian is exploring for rare earths in Malawi. Initial assay results from a phase 1 drilling program confirmed high grades at the Kangankunde project. Also, LIN has bauxite projects in Guinea and Tanzania, which is attracting interest to commercialise these assets.

SELL RECOMMENDATIONS

Renascor Resources (RNU)

The company has the world’s second biggest proven graphite reserve outside of Africa. It’s developing a vertically integrated operation in South Australia. RNU is aiming to become a strategically important supplier of graphite used in electric car batteries. Investing in explorers carries more risk than producers, particularly in a global economy with an uncertain outlook.

Lovisa Holdings (LOV)

Lovisa is one of the better listed businesses on the ASX and has been one of the top performers in the past few years. US retail sales are under pressure as consumer spending slows. The aggressive store rollout in the US and Europe carries risk as we expect a weaker retail outlook. The shares have performed strongly since mid March, so investors may want to consider taking some profits.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Jabin Hallihan, Morgans

BUY RECOMMENDATIONS

Imdex (IMD)

This global mining technology company recently acquired a 40 per cent interest in Krux Analytics Inc for $6 million. The deal enables Imdex to be part of cost effective operations from exploration drilling to production. Krux has developed cloud connected sensors and drilling optimisation products to improve the process of identifying and extracting mineral resources. Accurate sub-surface data can be obtained in real time. IMD offers a bright outlook.

Credit Corp Group (CCP)

Any increase in bad and doubtful debts can be beneficial for this debt collection and services company. The company operates in Australia, New Zealand and the US. We’re forecasting earnings per share to grow by 18.8 per cent in the next 12 months. Our share price target is $24.50. The shares closed at $17.25 on May 4.

HOLD RECOMMENDATIONS

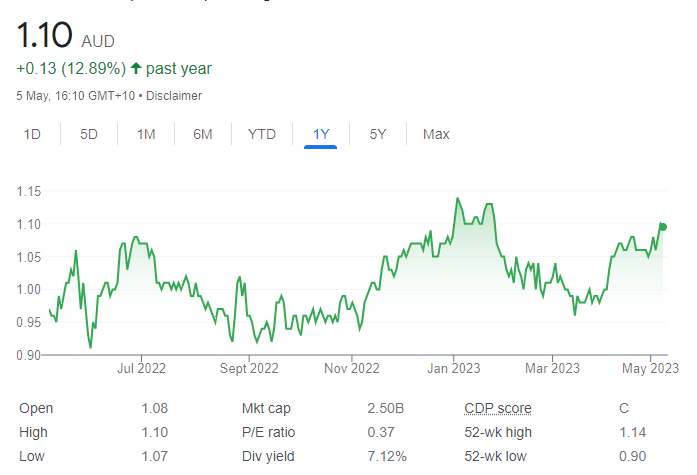

HomeCo Daily Needs REIT (HDN)

This Australian real estate investment trust has a portfolio value of about $4.7 billion in assets under management. It benefits from quality tenants and an occupancy rate of 99 per cent. The stock was recently trading below our valuation of $1.50. A discount to net tangible assets offers valuation protection if short-term uncertainties emerge.

GQG Partners Inc. (GQG)

GQG is a global equities fund manager. GQG’s solid investment outperformance remains in place across all strategies. This is a high quality franchise. The shares are trading on an undemanding valuation. GQG lifted total funds under management from $US90.8 billion on February 28, 2023 to $US94.5 billion on March 31, 2023.

SELL RECOMMENDATIONS

Link Administration Holdings (LNK)

LNK is a share registry and administration services business. Group revenue in fiscal year 2023 is expected to be towards the lower end of previous guidance of between $1.19 billion and $1.22 billion. The shares have fallen from $2.29 on February 28 to close at $2.06 on May 4. We hold a trim position.

Computershare (CPU)

Investors own CPU and other share registry businesses for leverage to the increasing interest rate cycle. We believe investors are focusing their attention beyond the existing interest rate cycle, so the best of that trade may be over. The shares have fallen from $25.20 on March 9 to close at $21.69 on May 4. Other more compelling opportunities have arisen on share price weakness, in our view.

Jed Richards, Shaw and Partners

BUY RECOMMENDATIONS

South32 (S32)

The miner increased production by 12 per cent in the first half of fiscal year 2023. However, the results were weaker than expected, and guidance has been downgraded at several operations. In my view, the recent share price retreat represents a buying opportunity, as S32 offers an appealing mix of raw material and base metal exposures. China re-opening its economy should boost commodity prices in the short term.

Xero (XRO)

The accounting software provider’s focus on profitability rather than growth should appeal to the market. The company dominates market share and has a solid growth pipeline. Central banks may be nearing the end of interest rate tightening, as inflation shows signs of cooling. Consequently, expect a brighter outlook for the high growth technology sector.

HOLD RECOMMENDATIONS

Domino’s Pizza Enterprises (DMP)

Challenging economic conditions can be positive for this fast food giant. During trying times, diners switch from restaurants to cheaper takeaway options. The brand’s popularity continues to grow in most markets, with more than 3000 stores across the globe. DMP has guided to more than 7000 stores by 2033.

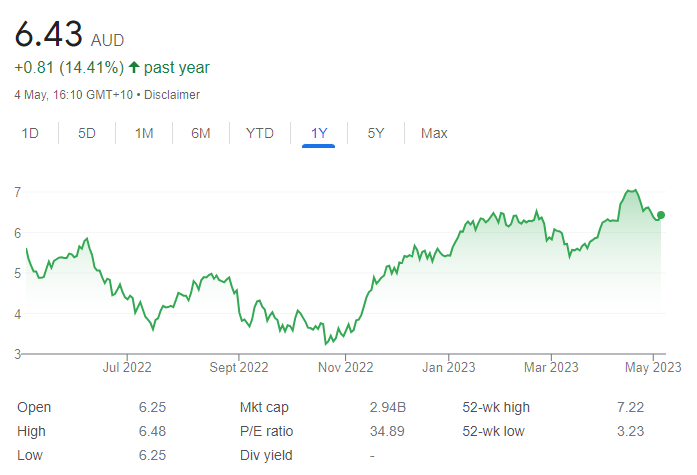

Sandfire Resources (SFR)

The share price has risen from $3.58 on November 1 to trade at $6.455 on May 4. Copper exposure on the ASX is limited after the BHP Group takeover of OZ Minerals. SFR has an attractive portfolio of global assets. Copper demand is forecast to grow exponentially as the shift towards electrification gathers pace at a time where new copper deposits are proving elusive.

SELL RECOMMENDATIONS

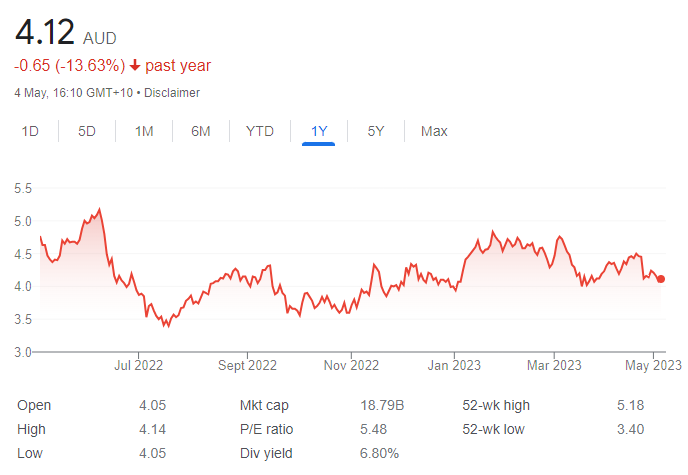

Rio Tinto (RIO)

The global miner’s share price has fallen from $128.43 on February 1 to trade at $110.71 on May 4. The iron ore price has held up despite significant economic pressures. However, the iron ore price could fall, and we see little upside during the next 12 months. Investors may want to consider cashing in some gains. We prefer BHP for large market capitalisation mining exposure because of its strong growth profile and more diversified product mix.

Bank of Queensland (BOQ)

The company disappointed the market by reducing its interim dividend to 20 cents a share in the first half of fiscal year 2023, down 9 per cent on the prior corresponding period. Tighter credit conditions and increasing competition are risks to the share price, in my view. I see better opportunities in the major banks considering recent share price weakness.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.