Julia Lee, Burman Invest

BUY RECOMMENDATIONS

Costa Group Holdings (CGC)

Chart: Share price over the year

Produces, packs and markets fruit and vegetables to retailers. Mushroom prices have been stronger than expected and helped offset a weaker citrus category due to hail damage. The international arm is also looking strong, particularly in Morocco and China. If current pricing trends continue, this company could see an upgrade.

GrainCorp (GNC)

Chart: Share price over the year

The drought has broken, water costs are falling, crop volumes are good and futures pricing suggests support. GNC has demerged the United Malt Group and sold its bulk liquid terminals business. Operations are improving and GNC has a strong balance sheet with no core debt. GNC should generate strong earnings and margins in the year ahead.

HOLD RECOMMENDATIONS

Rural Funds Group (RFF)

Chart: Share price over the year

This real estate investment trust owns a diversified portfolio of agricultural assets leased to tenants. The recent annual distribution yield was an attractive 5.4 per cent. Falling water costs is positive given lease terms require water supplies. Fewer farmers in financial stress amid what is expected to be a good cropping season paints a brighter outlook for land owners and tenants.

Woolworths (WOW)

Chart: Share price over the year

The supermarket giant appears expensive. However, its cash flow is stable and defensive. WOW benefited from customer stockpiling in March. I expect sales to normalise, but remain above pre-lockdown levels despite restaurants and bars gradually opening. I expect the cooking at home trend to continue during the next six months.

SELL RECOMMENDATIONS

Shopping Centres Australasia Property Group (SCP)

Chart: Share price over the year

The accelerating structural shift to online shopping is negative for shopping centre landlords. Shop rents are likely to fall below pre-Coronavirus levels. More retailers under pressure leads to rising bad debts, increasing vacancies and writing down of assets. Anchor tenants, such as Woolworths and Coles, means more than half of SCP’s income is stable. But with the unit price recently trading near net tangible asset value, the risks, at this point, outweigh the opportunities for SCP, in my view.

AusNet Services (AST)

Chart: Share price over the year

Owns and operates the Victorian electricity transmission network. Investors usually buy regulated assets, such as AST, for stable cash flows and dividends. In uncertain times, regulated assets usually trade at a premium. However, AST has signalled distributions are likely to fall around 10 per cent next financial year. I prefer APA Group or Spark Infrastructure Group in the utilities sector.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Tony Locantro, Alto Capital

BUY RECOMMENDATIONS

AdAlta (1AD)

Chart: Share price over the year

This biotechnology company’s lead compound is AD-214 to potentially treat idiopathic pulmonary fibrosis. A human phase 1 clinical trial is expected to start in mid 2020. 1AD is also progressing an alliance with GE Healthcare on its library of antibodies. 1AD is a high risk speculative buy, in my view. The shares have risen from a 52 week low of 4 cents on March 25 to finish at 7.3 cents on June 4.

Nanollose (NC6)

Chart: Share price over the year

The company is advancing clean technology to utilise liquid waste from the food and agricultural sectors to grow a highly sustainable raw material called cellulose. This is used to make tree-free fibre destined for the textile industry and fashion brands. The company is establishing a supply path on the road to commercialisation. NC6 technology is an exciting prospect, but a speculative buy for those with an appetite for risk. The shares closed at 3.7 cents on June 4.

HOLD RECOMMENDATIONS

Crown Resorts (CWN)

Chart: Share price over the year

As COVID-19 restrictions are eased across Australia, CWN is poised to benefit from a gradual re-opening of its casinos and entertainment facilities. Australians are keen gamblers in good and challenging times. The shares have been moving up since hitting a 52 week low of $5.84 on March 24. The shares closed at $10.29 on June 4.

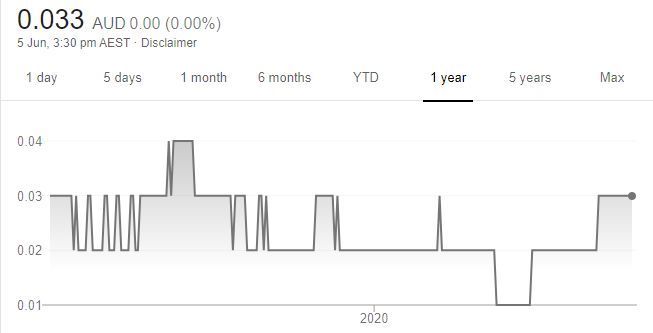

Hammer Metals (HMX)

Chart: Share price over the year

HMX is my preferred small cap gold stock. The share price has recovered from about a cent during the market sell off and is now trading above its placement price of 2.2 cents. HMX has built a strong exploration portfolio, and has an alliance with a Japanese oil and gas entity for its Queensland projects. Hammer offers experienced senior management in the gold sector. The stock finished at 3.3 cents on June 4.

SELL RECOMMENDATIONS

Zoono Group (ZNO)

Chart: Share price over the year

Provides a range of antimicrobial solutions. Part of the company range includes hand and surface sanitisers. Prior to the COVID-19 epidemic, the shares were priced at a 52 week low of 6.3 cents on August 29, 2019. The shares closed at $2.39 on June 4, 2020. We believe investors should consider taking profits.

Fortescue Metals Group (FMG)

Chart: Share price over the year

The share price has surged on the back of higher iron ore prices and supply disruptions in Brazil. We believe bulk commodity prices will be pressured during a global recession. The stock finished at $14.60 on June 4. Consider locking in some profits leading into further market volatility.

Nathan Lodge, Securities Vault

BUY RECOMMENDATIONS

Vmoto (VMT)

Chart: Share price over the year

Electric scooter sales soared 84 per cent in fiscal and calendar year 2019 to 19,971 units after management refocused on the higher margin European market. Momentum continued in the first quarter of fiscal year 2020, with scooter sales increasing 8 per cent on the prior corresponding period to 4121 units. We expect VMT to sell more than 27,000 units in fiscal year 2020. Our 12 month price target is 51 cents a share. The shares finished at 24.5 cents on June 4.

Mach7 Technologies (M7T)

Chart: Share price over the year

The company specialises in medical imaging data management solutions. It recently announced a five year agreement to provide continuing support to the Hamad Medical Centre (HMC) in Qatar. The total value of the contract is worth $A4.2 million and provides $A840,000 in annual revenue. This renewal increases contract annual recurring revenue to $A9.2 million a year. We believe the company offers value and a bright outlook.

HOLD RECOMMENDATIONS

Spirit Telecom (ST1)

Chart: Share price over the year

The company’s Spirit X platform is a digital aggregator of business internet products. The company recently launched the NBN Enterprise Ethernet (NBN EE) range to its resellers and direct customers via its sales platform. NBN EE is an enterprise grade fibre service, and, via Spirit X, is said to be capable of reaching two million businesses. Consequently, the NBN EE range expands the market opportunity across Australia.

Austal (ASB)

Chart: Share price over the year

The global ship builder recently upgraded fiscal year 2020 group revenue guidance to about $2 billion, up from $1.9 billion. Group earnings before interest and tax have been upgraded from $110 million to at least $125 million. COVID-19 had less impact on performance in April and May than initially anticipated.

SELL RECOMMENDATIONS

Afterpay (APT)

Chart: Share price over the year

We believe recent board changes were positive for this buy now, pay later company. The company now has 5 million active customers in the US. The stock has soared from $8.01 on March 23 to finish at $52.20 on June 4. The stock has risen too rapidly in a relatively short time, in our view. Investors who enjoyed the rise from low levels may want to consider taking profits.

Cooper Energy (COE)

Chart: Share price over the year

Commissioning of the Orbost gas processing plant had resumed on May 20 following a shutdown. APA Group owns and operates the plant on COE’s Sole gas field. Commissioning of the gas plant is ongoing, but the plant has proven it’s capable of producing sales specification gas. The shares finished at 43.5 cents on June 4, and we suggest investors may want to consider selling into recent strength.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing.

Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.