Chris Batchelor, Spotee Connect

BUY RECOMMENDATIONS

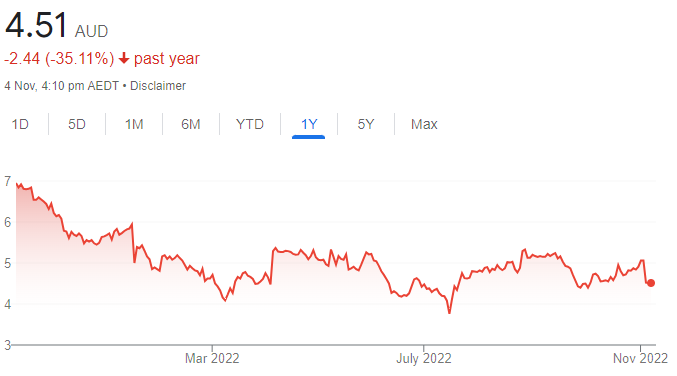

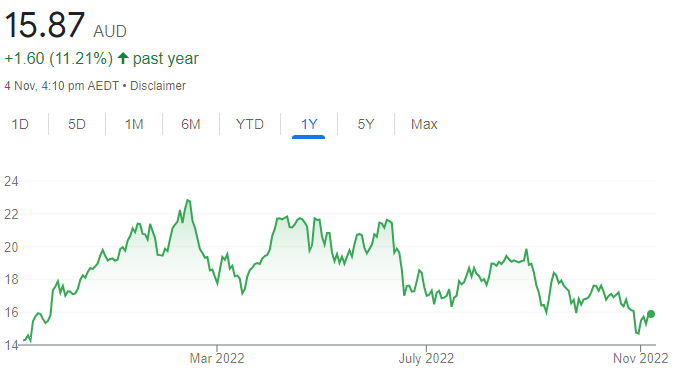

Grange Resources (GRR)

The producer sells iron ore pellets from its Savage River mine in Tasmania. The iron ore price has been declining recently following concerns of slowing activity in China. We believe the Grange share price fall has been excessive given the higher quality ore it produces. Therefore, we rate GRR a buy at these levels.

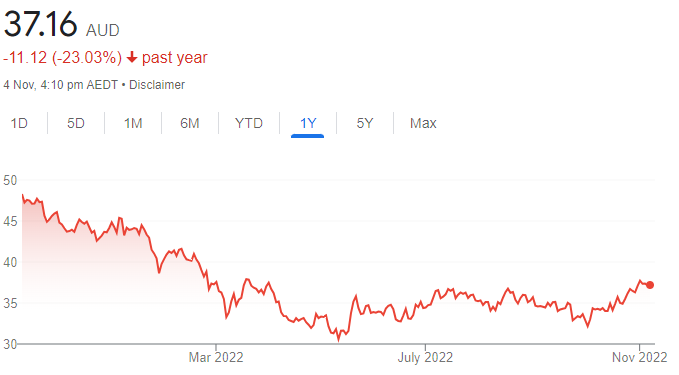

JB Hi-Fi (JBH)

The consumer electronics giant operates a successful business. Revenue has increased at a compound average annual rate of 11.4 per cent for the past 10 years. The market is concerned about economic headwinds dampening consumer demand. But we believe a share price at low $40 levels represents good value. The shares were trading at $42.55 on November 3.

HOLD RECOMMENDATIONS

Pendal Group (PDL)

The past year has been a tough time for listed fund managers, with share prices falling in line with funds under management. Listed fund manager Perpetual (ASX: PPT) has made a takeover offer for rival PDL. The offer includes shares in Perpetual and cash. We recommend holding until more information emerges about the likely success of the offer.

NRW Holdings (NWH)

NRW Holdings is a contract services provider to the resources and infrastructure sectors. The share price has been a relatively good performer in the past few months following good revenue and earnings growth in financial year 2022. The price/earnings ratio and other valuation metrics are about average compared with the industry, so we recommend holding before possibly buying at a cheaper entry point.

SELL RECOMMENDATIONS

Frontier Digital Ventures (FDV)

Frontier Digital Ventures operates a portfolio of online real estate and automotive classified businesses in emerging markets of Asia, Africa and Central America. Sales have been growing, but losses have also been expanding. We believe risks are to the downside given the company’s high valuation and, so far, the unprofitable nature of the business.

Adore Beauty Group (ABY)

The online beauty retailer listed at an issue price of $6.75 about two years ago. The company was trading at $1.60 on November 3. In our view, the company has been expensive relative to profits. It trades on narrow profit margins. We expect sales and profits to remain under pressure moving forward. In our view, the company is still trading on a lofty price/earnings ratio despite the share price fall.

Peter Day, Sequoia Wealth Management

BUY RECOMMENDATIONS

NextDC (NXT)

Data centre services revenue of $291 million in fiscal year 2022 rose 18 per cent on the prior corresponding period. Underlying EBITDA was up 26 per cent to $169 million. Investment in cloud computing should remain robust. We expect the company’s earnings base to remain resilient in a potentially slowing economy.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Super Retail Group (SUL)

Company brands include Supercheap Auto, rebel, BCF and Macpac. The latest trading update showed a positive start in the first 16 weeks of fiscal year 2023. Despite management’s cautious outlook for consumer spending, we remain positive about the company’s resilience. Share price momentum has been to the upside between early October and November 3.

HOLD RECOMMENDATIONS

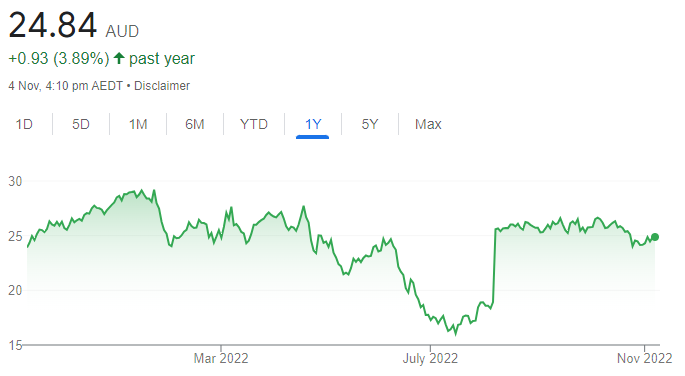

Oz Minerals (OZL)

This copper and gold company has rejected a conditional and non-binding takeover proposal from BHP Group at $25 a share. The bid remains a price support for OZL. Our price target is $25 a share. The shares were trading at $24.41 on November 3. Keep an eye on the news flow.

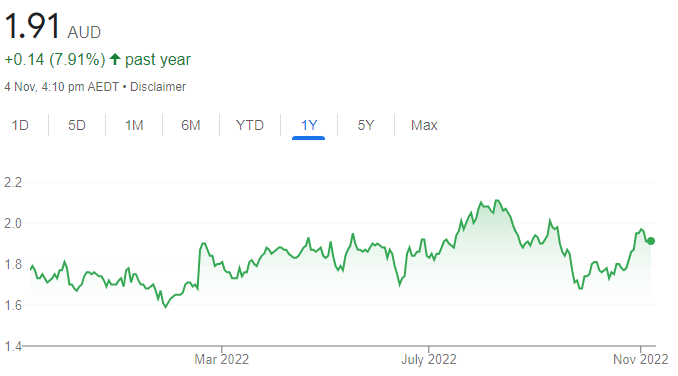

Vicinity Centres (VCX)

The retail property group posted a strong first quarter report for fiscal year 2023. The company reported a marginal increase in occupancy to 98.4 per cent. Retail sales are driving a continuing improvement in operational metrics. The group’s balance sheet and hedging profile provide strong defensive characteristics. We view the valuation as fair relative to peers.

SELL RECOMMENDATIONS

Genworth Mortgage Insurance Australia (GMA)

GMA is the leading provider of lenders mortgage insurance in the Australian residential mortgage market. The on-market buy-back continues and should support the stock in the short term. However, property prices have fallen from their peak. Longer term, we’re concerned about the impact of rising interest rates.

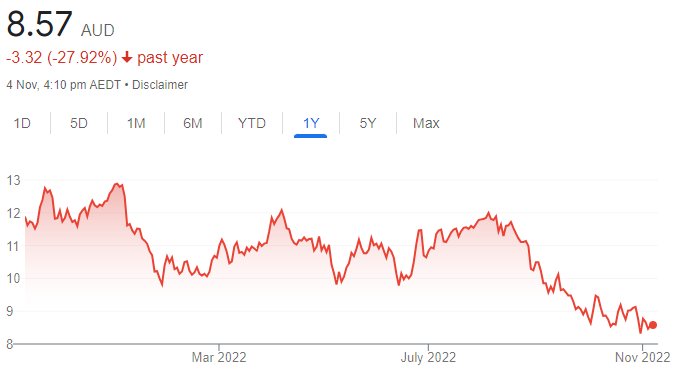

Fortescue Metals Group (FMG)

Iron ore shipments of 47.5 million tonnes in the first quarter of fiscal year 2023 were up 4 per cent on the prior corresponding period. Cash costs of $US17.69 per wet metric tonne were up 3 per cent on the previous quarter. The cost increases at FMG are comparable, or at the lower end of inflation forecasts across the sector. FMG’s decarbonisation strategy is the key driver in reducing our valuation by 19 per cent. We downgrade to a sell recommendation.

Michael Gable, Fairmont Equities

BUY RECOMMENDATIONS

James Hardie Industries PLC (JHX)

This global building materials supplier is well positioned to benefit when slowing economies recover. If the recent share price fall is already pricing in tough times, then we believe it’s time to consider buying JHX. The share price has fallen from $56.80 on January 4 to close at $33.05 on November 3. The share price charts show a stock that’s potentially bottomed.

CSL (CSL)

The share price of this blood products company has been relatively flat in the past two years. Because CSL is a growth stock, interest rate rises have kept a lid on the share price. However, the recent acquisition of Vifor Pharma should add to CSL’s earnings next year, and a topping out in interest rates should also assist a share price recovery.

HOLD RECOMMENDATIONS

Aristocrat Leisure (ALL)

The gaming company’s share price is down in 2022 in response to rising interest rates impacting stocks on relatively high price/earnings ratios. However, the company continues to grow its earnings, as gaming revenue exceeds pre-pandemic levels. The chart shows the price may have bottomed in May and is starting to edge higher again.

Woodside Energy Group (WDS)

After merging with BHP Group’s energy assets, WDS is a giant in the energy space. We believe emerging supply constraints in the US and the Middle East should lead to higher crude oil prices and a rising WDS share price. The share price has remained in an uptrend since late September and continues to look strong.

SELL RECOMMENDATIONS

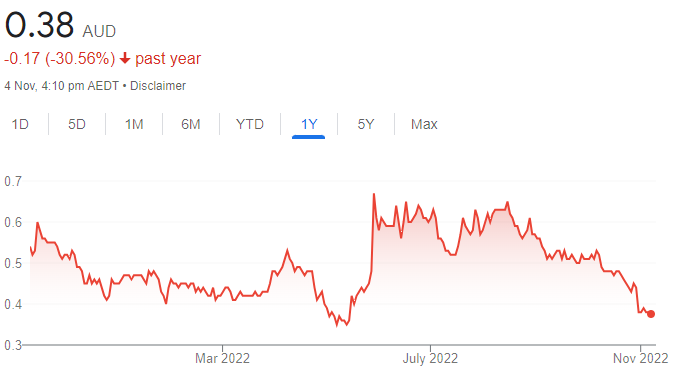

Bubs Australia (BUB)

This infant nutrition company has lodged a letter of intent with the US Food and Drug Administration for permanent access to the US market. The share price has fallen from 65 cents on August 16 to close at 38 cents on November 3. We were disappointed with the latest quarterly activities report and view momentum to the downside.

Sandfire Resources (SFR)

The share price of this copper producer has fallen from $4.94 on August 26 to close at $3.58 on November 3. Recently, copper prices have been weaker. We expect the share price to remain under pressure – at least in the short term. Until a clearer picture emerges about the global copper outlook, we prefer others.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.