Julia Lee, Burman Invest

BUY RECOMMENDATIONS

CSR (CSR)

Demand for this company’s building products is driven by a favourable housing cycle and government stimulus. CSR typically benefits in the second half. Careful cost control began at the start of a cycle, which enhances operating leverage. The risks are increasing costs and a softening housing market impacting demand.

GrainCorp (GNC)

The agricultural cycle is favourable for this bulk grain handler. The soil has adequate moisture levels, and the outlook for winter rain is ideal for crop planting. Global prices remain strong, which supports margins. GNC recently upgraded underlying EBITDA guidance to between $255 million and $285 million for fiscal year 2021.

HOLD RECOMMENDATIONS

Wesfarmers (WES)

Retailers Bunnings and Kmart have been driving outperformance. The home renovation sector is likely to remain buoyant during the next 12 to 18 months, painting a bright outlook for the Bunnings hardware chain. Digital capabilities at Bunnings offer another avenue of growth. Households are likely to spend more on their homes, cars and appliances as COVID-19 outbreaks continue to impact domestic and international travel.

Tabcorp (TAH)

Apollo Global Management, Entain and BetMakers Technology Group have lodged bids for the wagering and media businesses. Multiples already reflect takeover interest. TAH is conducting a strategic review to evaluate all structural and ownership options. The lottery business is doing well. Lottery pools are tracking higher compared to the previous corresponding period.

SELL RECOMMENDATIONS

AGL Energy (AGL)

Regulatory approval for an interconnector between South Australia and New South Wales is likely to drive down wholesale electricity prices in the longer term. AGL plans to separate into two entities. A dual structure should afford AGL more flexibility to grow with the market. However, a structural shift away from coal still remains a headwind for AGL.

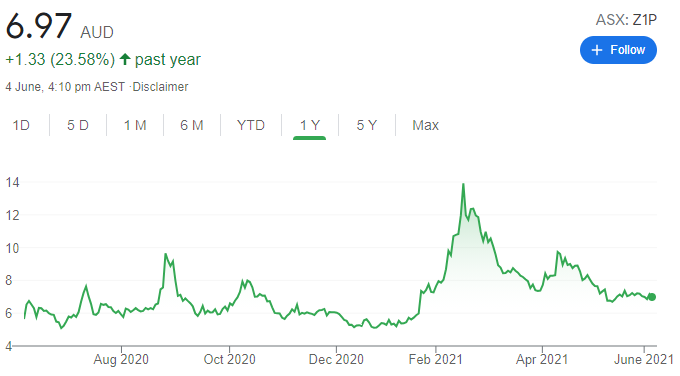

Zip Co (Z1P)

Competition is intensifying in the buy now, pay later space. It makes US expansion more difficult for Z1P. While the sector is growing, fierce competition is likely to lead to increasing marketing costs and thinner margins, in our view. Z1P’s share price has fallen from $9.73 on April 13 to close at $7.16 on June 3.

Tom Bleakley, BW Equities

BUY RECOMMENDATIONS

Imricor Medical Systems, INC (IMR)

IMR sells medical devices used in heart surgery. It’s believed to be the first company in the world to develop the cardiac ablation device that can be used with MRI (magnetic resonance imaging) machines to improve accuracy and reduce radiation for medical staff and patients. Sales were slow in Europe due to COVID-19 lockdowns. But I expect stronger sales and more procedures as European economies open.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Telix Pharmaceuticals (TLX)

This clinical stage bio-pharmaceutical company is developing therapies and imaging products to treat cancer. Its lead product for detecting prostate cancer has been filed for approval with the US Food and Drug Administration. The FDA is expected to announce a decision before September 23. We expect the company to generate significant revenue if the FDA approves the product. TLX has established distribution channels across the US pending the FDA findings.

HOLD RECOMMENDATIONS

Leaf Resources (LER)

LER has developed an efficient technique to extract high value pine rosins and terpenes from tree stumps. Tree stumps are a remnant waste product of the logging industry. They are difficult and costly to remove. The company expects to generate $29 million in sales from a production target of 8000 tonnes by the end of June. The company can rapidly scale up production volumes.

Bluechiip (BCT)

BCT develops and sells wireless tracking solutions that function in extreme temperatures and environments. It has sales agreements with medical storage companies to track vials and tubes in cryogenic storage. The company has potentially big sales opportunities in the US. The shares closed at 3.3 cents on June 3.

SELL RECOMMENDATIONS

Latitude Group Holdings (LFS)

Latitude operates in the buy now, pay later and personal lending space. The buy now, pay later sector is becoming increasingly crowded and competition is fierce. Building market share in a crowded sector is a challenge. We would prefer to take a wait and see approach with LFS, while gauging its performance over the longer term.

Harmoney Corp (HMY)

HMY provides personal loans to customers in Australia and New Zealand. It offers a direct-to-consumer automated loan approval system. The company reported solid loan growth for the month of April 2021 compared to the prior corresponding period. However, we believe building meaningful scale during a pandemic is difficult, particularly among those thrifty consumers concerned about taking on new personal debt. There are easier sectors to invest in.

Thomas Wegner, Marcus Today

BUY RECOMMENDATIONS

Uniti Group (UWL)

This diversified provider of telecommunication services is growing its wholesale and consumer internet-based businesses. UWL generated revenue of $54.6 million in the 2021 first half, an increase of 148 per cent on the prior corresponding period. The company completed three accretive acquisitions in the first half. Its core fibre infrastructure unit should continue to generate growth.

Accent Group (AX1)

This footwear retailer recently acquired the Glue Store, a youth apparel, shoe and accessory retailer. New store openings, brand offerings and store formats targeted at healthcare and hospitality workers are the pillars supporting its growth ambitions. The company reported a 2021 first half net profit after tax of $52.8 million, up 57.3 per cent on the prior corresponding period. Total digital sales were strong. We expect AX1 to continue its strong performance.

HOLD RECOMMENDATIONS

Hansen Technologies (HSN)

The share price of this billing software provider has risen from $3.71 on January 4 to trade at $5.30 on June 3. Hansen Technologies has a strong track record of growing revenues. It’s now targeting revenue of $500 million in the 2025 financial year. Long term contracts with big utilities provide stability.

Mineral Resources (MIN)

This diversified miner has benefited from soaring commodity prices. Drivers include a global economic recovery, Chinese demand, decarbonisation and electrification. MIN is a leading pit-to-port mining services provider, a global top five lithium miner and Australia’s fifth biggest iron ore producer. First half 2021 revenue was up 55 per cent on the prior corresponding period to $1.5 billion.

SELL RECOMMENDATIONS

EML Payments (EML)

The share price of this payment solutions provider has fallen from $5.71 on April 30 to trade at $3.32 on June 3. Investors punished the stock in May after an EML update regarding its Irish subsidiary PFS Card Services (PCSIL). The Central Bank of Ireland raised regulatory concerns relating to PCSIL’s anti-money laundering/ counter-terrorism financing compliance. In our view, negative sentiment is likely to weigh on the share price.

Redbubble (RBL)

RBL operates a global online market for artwork prints. RBL was a pandemic beneficiary, but the share price has fallen from $7.09 on January 25 to trade at $3.49 on June 3. In our view, strong sales during 2020 are unlikely to be repeated in the near future as shopping trends revert to pre-COVID-19 levels. We believe sustaining earnings and margins will be challenging.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.