Tom Bleakley, BW Equities

BUY RECOMMENDATIONS

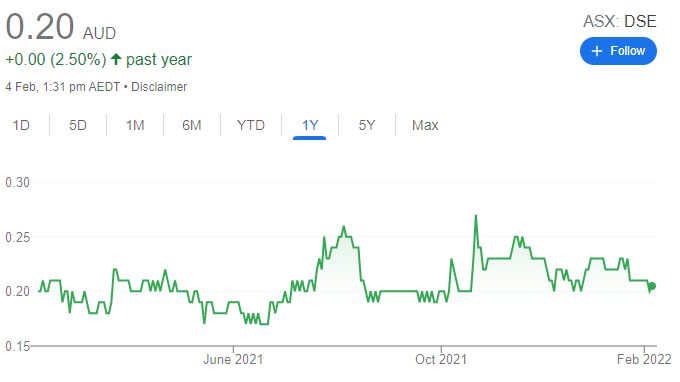

Dropsuite (DSE)

This company’s software platform enables cloud back up and data protection. The company’s December activities report highlights strong quarter on quarter growth from its loyal customer base. The company has a low customer churn rate below 3 per cent. Cash on hand of $21.6 million enables opportunities for the company to deliver on its growth ambitions.

Tombador Iron (TI1)

TI1 is a developing Brazilian based iron ore producer. Iron ore prices have been strong. Western Australian miners are concerned about COVID-19 related production disruptions, so iron ore prices could move higher. We believe the share price could rise if the market factors in Tombador’s potential production growth. The shares closed at 4.3 cents on February 3.

HOLD RECOMMENDATIONS

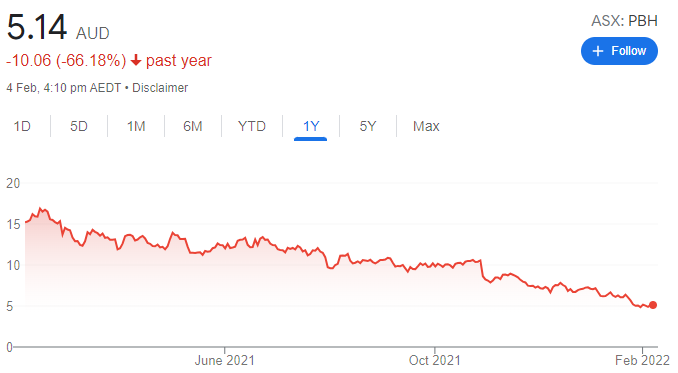

PointsBet Holdings (PBH)

The corporate bookmaker operates in Australia, Canada and the US. The company is growing net win rates strongly in the US. PBH continues to build a strategic position as it rolls out its offering to more US states.

Metals X (MLX)

MLX owns 50 per cent of the Renison tin operation in Tasmania. The tin price has risen with the recent run in electric vehicle minerals. In its December quarter update, MLX reported the operation had imputed net cash flow of $60.86 million. While the tin price stays high, Metals X will continue to benefit.

SELL RECOMMENDATIONS

Block Inc. (SQ2)

Buy now, pay later company Afterpay has been removed from the ASX after it was acquired by US technology and payments giant Block. SQ2’s share price has been most volatile since it started trading on the ASX on January 20. The SQ2 business model also involves a Bitcoin strategy. The Block acquisition changes the risk profile for former Afterpay investors.

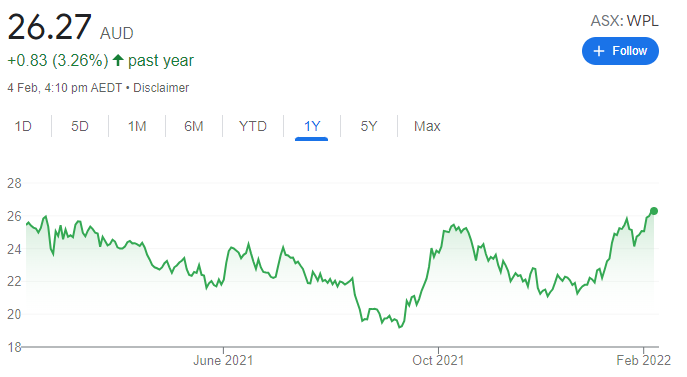

Woodside Petroleum (WPL)

The energy giant has benefited from strong oil and gas prices. We don’t believe energy prices are sustainable, so we’re factoring in a correction. WPL’s share price has risen from $21.93 on December 31 to close at $25.98 on February 3. Investors may want to consider locking in some gains by selling into strength.

Braden Gardiner, Tradethestructure.com

BUY RECOMMENDATIONS

Mount Gibson Iron (MGX)

The share price of this iron ore producer has been under pressure since July 2021. The share price fall was a response to China attempting to control iron ore prices. MGX is finding buyer interest between 35 cents and 45 cents. In my view, the shares have been oversold. The shares were trading at 44 cents on February 3. I expect bargain hunters to fuel a share price rise.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Tietto Minerals (TIE)

TIE is a developing gold miner, focusing on its Abujar Gold Project in West Africa. It’s targeting first gold production from September this year. It’s forecasting production of 260,000 ounces in its first year. The shares have risen from 39.5 cents on December 21 to trade at 54.5 cents on February 3. The company’s outlook is brighter and would be enhanced if gold prices rise.

HOLD RECOMMENDATIONS

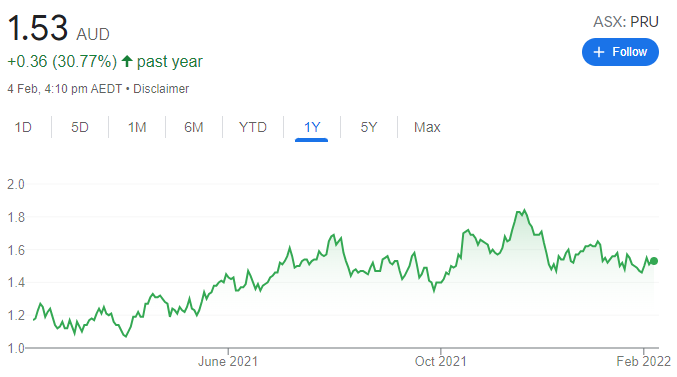

Perseus Mining (PRU)

The gold company lifted production to 128,378 ounces in the December quarter, representing a 14 per cent increase on the prior quarter. Notional cash flow from operations was up 21 per cent quarter-on-quarter to $US94 million. I expect the company to generate more buying interest on a healthier outlook.

Lake Resources NL (LKE)

This lithium exploration company has several projects in Argentina. A recent report revealed a definitive feasibility study production base case had increased to 50,000 tonnes per annum of lithium carbonate equivalent (LCE) for the Kachi Lithium Project. Production at Kachi is targeted to start in 2024. The share price surged in 2021. The stock was trading at 87.5 cents on February 3 and is searching for support.

SELL RECOMMENDATIONS

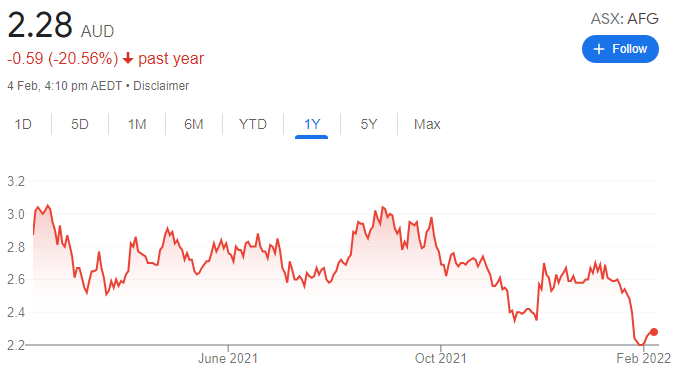

Australian Finance Group (AFG)

The share price of this mortgage broking group was priced at $2.80 on February 3, 2021. The shares have retreated several times after breaching $3. The stock was trading at $2.29 on February 3, 2022. My technical analysis suggests the share price is likely to trend lower from here.

WAM Capital (WAM)

Shares in this investment manager continue to struggle. The stock was priced at $2.20 on February 4, 2021. The shares were trading at $2.175 on February 3, 2022. We’re concerned that the potential impact from rising interest rates may lead to a correction on US and European equity markets.

Peter Moran, Wilsons

BUY RECOMMENDATIONS

ReadyTech Holdings (RDY)

The share price of this software-as-a service business has fallen significantly in the past three months due to missing out on a government licensing project combined with general weakness among technology companies. However, we see this as a buying opportunity. RDY has a strong track record of profitability and can still be expected to generate double digit earnings growth for at least the next few years. We hold an overweight rating.

CSL (CSL)

The pandemic negatively impacted the company’s core plasma collection business. Performance is steadily improving amid increasing demand for CSL products. Also, the company has a pipeline of new products. The recent acquisition of pharmaceutical company Vifor Pharma, which specialises in renal disease and iron deficiency, should provide additional growth streams. We hold an overweight rating.

HOLD RECOMMENDATIONS

Universal Store Holdings (UNI)

This specialty retailer of casual and youth apparel is well managed. We expect solid cash flows to grow over the long term via store and online sales. The company was negatively impacted during lockdowns in Sydney and Melbourne last year. Despite stores re-opening, consumers are cautious about spending, so were retain a market weight recommendation for now.

SomnoMed (SOM)

SomnoMed develops, makes and sells oral devices for treating sleep apnea. The company has announced plans to launch a new oral appliance. The device’s nightly impact on each user can be examined. Moving forward, this technology may generate increasing interest in the US. However, at this stage, it’s still too early to know how successful the new product will be, so we retain a market weight rating.

SELL RECOMMENDATIONS

Damstra Holdings (DTC)

This provider of software solutions for workplace safety and compliance experienced challenging times in calendar 2021. Issues included several downgrades and former client Newmont internalising its hardware and site access away from Damstra. The company raised capital late last year. We hold an underweight rating.

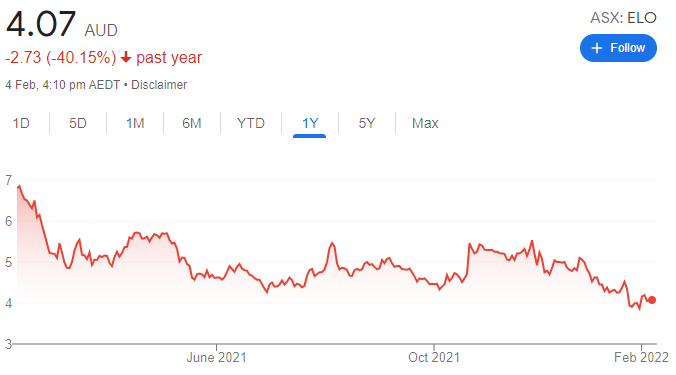

ELMO Software (ELO)

Late last year, this cloud based solutions provider announced an $11 million increase in its debt facility. Also, the cash component of the Webexpenses earn-out, estimated to be more than $9 million in October 2021, will be settled through an issue of shares. The stock has fallen from $5.08 on December 1 to trade at $4.08 on February 3. We hold an underweight rating.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.