Braden Gardiner, Tradethestructure

BUY RECOMMENDATIONS

Ainsworth Game Technology (AGI)

The gaming machine company delivered revenue of $124.1 million for the six months ending December 31, 2022. Revenue was up 23.4 per cent on the prior corresponding period. Underlying profit before tax, adjusted for currency impacts and significant one off items outside ordinary business activities, was up 8.8 per cent to $18.8 million. In my view, the company offers a brighter outlook. Technically, a move above $1.14 would attract more buyers. The shares were trading at $1.052 on March 2.

oOh! Media (OML)

The out-of-home media company posted revenue of $592.6 million in calendar year 2022, up 18 per cent on the prior corresponding period. Statutory gross profit was up 14 per cent to $422.8 million. The shares have risen from $1.30 on January 3 to trade at $1.582 on March 2. We expect the company to benefit in line with a recovery in advertising spending.

HOLD RECOMMENDATIONS

SRG Global (SRG)

SRG is a diversified industrial services company. The share price has been in a solid uptrend since 2020. SRG is cashed up after an institutional placement raised $46.4 million. The proceeds will partially fund the acquisition of ALS Asset Care. The company is aiming to raise a further $5 million via a share purchase plan. I expect the company to continue performing, as there’s no sign of any technical weakness.

Silex Systems (SLX)

The company raised $120 million via an institutional placement at $4.05 a share. The company is aiming to raise a further $20 million via a share purchase plan. The proceeds will go towards accelerating commercialisation of Silex laser enrichment technology and working capital. Silex Systems enjoyed a strong share price run in 2022. The outlook is potentially brighter, but not without risk.

SELL RECOMMENDATIONS

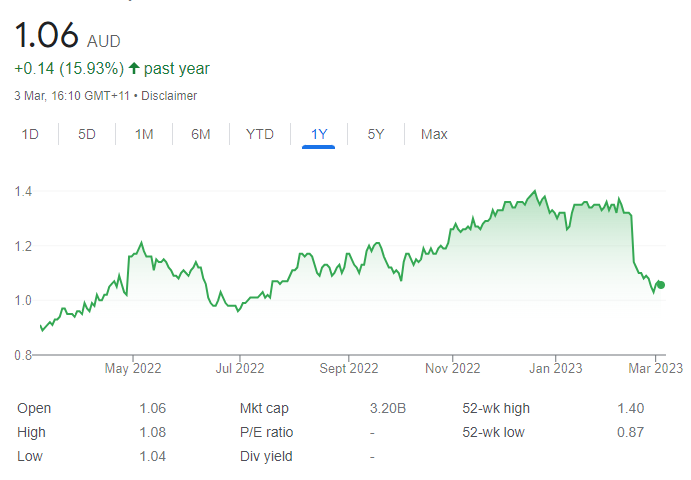

Coronado Global Resources Inc. (CRN)

The metallurgical coal producer delivered a strong full year result. Revenue of $US3.572 billion was up 66.2 per cent on the prior corresponding period. Net income rose 307.4 per cent to $US771.7 million. The results didn’t meet analyst estimates. The shares have fallen from $2.17 on February 16 to trade at $1.92 on March 2. Investors may want to consider reducing exposure and cash in some gains.

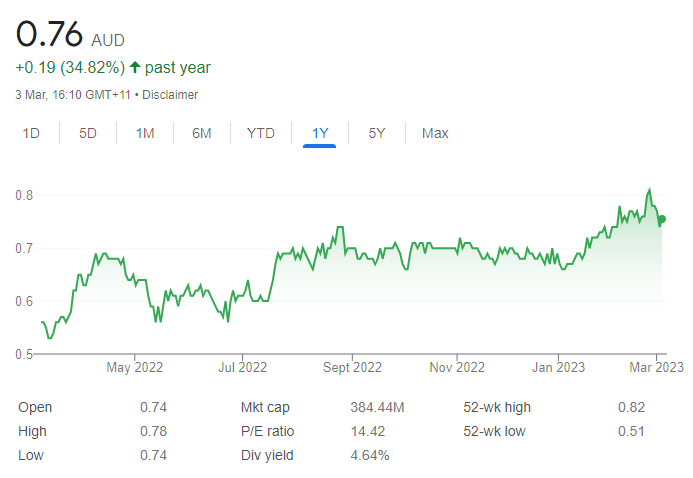

AMP (AMP)

The share price of this diversified financial services company closed at $1.31 on February 15, a day prior to releasing its fiscal year 2022 results. The share price fell after the results and was trading at $1.067 on March 2. In my view, it will take time for investors to regain confidence. Other stocks appeal much more for capital growth.

Top Australian Brokers

- IG – Extensive product array and user-friendly platforms – Read our review

- eToro – market-leading social trading platform – Read our review

- IC Markets – experienced and highly regulated – Read our review

- Quadcode Markets – multi-asset CFD broker – Read our review

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- City Index - Aussie shares from $5 - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Tony Paterno, Ord Minnett

BUY RECOMMENDATIONS

Nine Entertainment Co. Holdings (NEC)

The diversified media giant posted group revenue of $1.403 billion in the first half of fiscal year 2023. This represented a 5 per cent increase on the prior corresponding period. Net profit after tax of $190 million was down 16 per cent. But group fundamentals are strong, backed by a solid balance sheet. In our view, the shares were trading at a discount at $1.91 on March 2. We retain our $2.80 fair value estimate.

The Star Entertainment Group (SGR)

The company raised $595 million from a placement and institutional entitlement offer at $1.20 a share. SGR expects to raise about $205 million from its retail entitlement offer. The offer will close on March 13. The capital initiatives will dilute our fair value estimate, but we believe the offer is appealing on valuation grounds. The proceeds will be used to pay down debt and provide liquidity headroom. New South Wales and Queensland regulators have imposed fines totalling $200 million on SGR. Shareholders should examine the retail entitlement offer before investing.

HOLD RECOMMENDATIONS

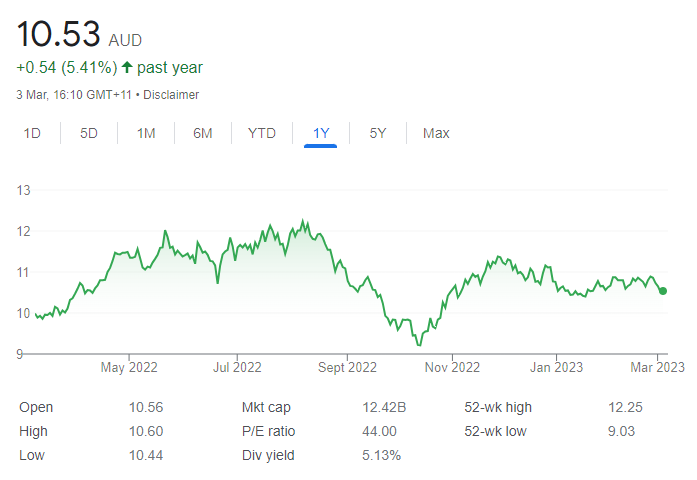

APA Group (APA)

APA is an energy infrastructure business. Underlying EBITDA of $878.9 million in the first half of fiscal year 2023 was up 2.5 per cent on the prior corresponding period. Reported net profit after tax was up 23.8 per cent to $190.7 million. The company offers a bright outlook as it benefits from consumer price index-linked tariffs. APA has a sound balance sheet.

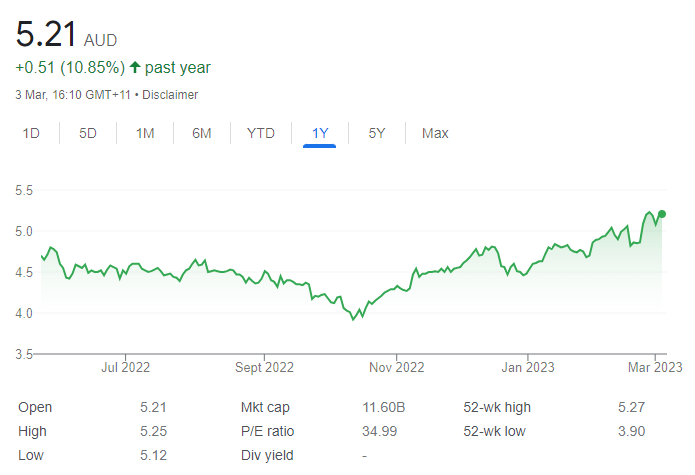

The Lottery Corporation (TLC)

The company delivered a better than expected interim result, in our view. The bulk of the increase to our fair value estimate was due to a stronger Keno business. We’ve also upgraded our profitability forecasts for the lottery business. Jackpots are a key revenue driver, as they retain regular punters and attract new customers drawn to large prize pools. A Powerball price increase is planned for May 2023, subject to regulatory and other approvals.

SELL RECOMMENDATIONS

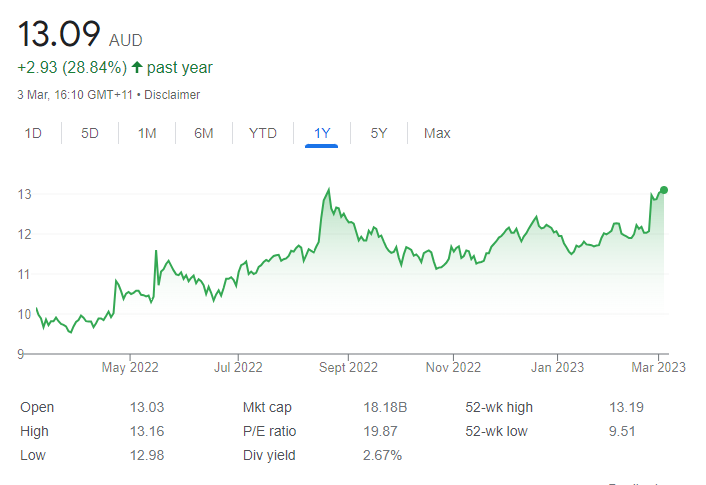

Coles Group (COL)

The supermarket giant delivered total sales revenue of $20.8 billion from continuing operations in the first half of fiscal year 2023. This represented a 3.9 per cent increase on the prior corresponding period. But we expect wage, energy and rent costs to continue increasing. We also expect the positive effect from food price inflation on sales growth and gross profit margins to moderate in the second half. We believe the shares are overvalued.

Alumina (AWC)

The company’s full year 2022 result was weak, in our view. Statutory net profit after tax fell by 45 per cent to $US104 million. The alumina market deteriorated during the second half. The company didn’t declare a final dividend. The shares have fallen from $1.71 on February 3 to trade at $1.555 on March 2. Our fair value estimate is $1.20 a share.

Jabin Hallihan, Morgans

BUY RECOMMENDATIONS

Mineral Resources (MIN)

While the first half 2023 result didn’t meet consensus expectations, we expect a stronger second half as we anticipate lower costs. MIN recently announced binding agreements with Albemarle Corporation. We expect an equal joint venture conversion agreement to obtain a capacity of producing 100,000 tonnes of lithium chemicals a year from 2025. It’s a significant development amid increasing demand for lithium. We increase our valuation to $102 a share.

Silk Logistics Holdings (SLH)

The integrated logistics provider posted revenue of $253.6 million in the first half of fiscal year 2023, an increase of 39.1 per cent on the prior corresponding period. Underlying net profit after tax of $9.8 million represented an increase of 32.4 per cent. The company is well managed and we expect it to achieve revenue guidance of between $480 million and $500 million for the full year. Our valuation is $3.80 a share. We forecast a gross dividend yield of about 5 per cent.

HOLD RECOMMENDATIONS

Brambles (BXB)

This supply chain logistics company operates in more than 60 countries. It specialises in CHEP branded reusable pallets. The company’s first half 2023 result was above our expectations. Management has upgraded fiscal year 2023 guidance. It expects sales revenue growth of between 12 per cent and 14 per cent at constant currency. We have increased our underlying EBIT forecasts to between 7 per cent and 9 per cent.

IDP Education (IEL)

The company provides international student placements and testing services. International students are returning Australia. The company reported an adjusted net profit after tax of $84.4 million in the first half of fiscal year 2023, an increase of 59 per cent on the prior corresponding period. We’re attracted to the market share opportunity in student placements as the company leverages the group’s presence in countries like India.

SELL RECOMMENDATIONS

Blackmores (BKL)

This vitamins and supplements company posted group revenue of $338 million in the first half of fiscal year 2023, a fall of 1.6 per cent on the prior corresponding period. Underlying group EBIT fell by 5.5 per cent on the prior corresponding period to $36.2 million. The shares were trading at $77.57 on March 2. Our valuation is $72 a share. Investors may want to consider trimming their portfolios.

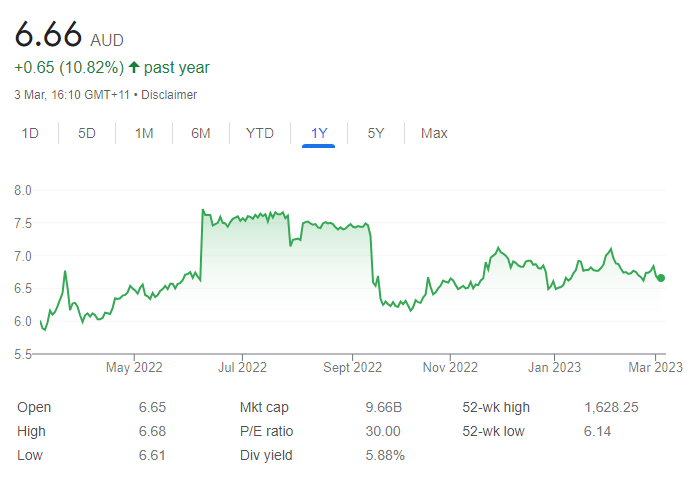

Atlas Arteria (ALX)

ALX is a global owner, operator and developer of toll roads. The company’s latest full year 2022 result met our expectations, with guidance remaining unchanged. The shares have fallen from $7.10 on February 3 to trade at $6.67 on March 2. We retain a trim rating, as we believe the stock is fully valued and recently trading above our valuation.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.