Angus Geddes, Fat Prophets

BUY RECOMMENDATIONS

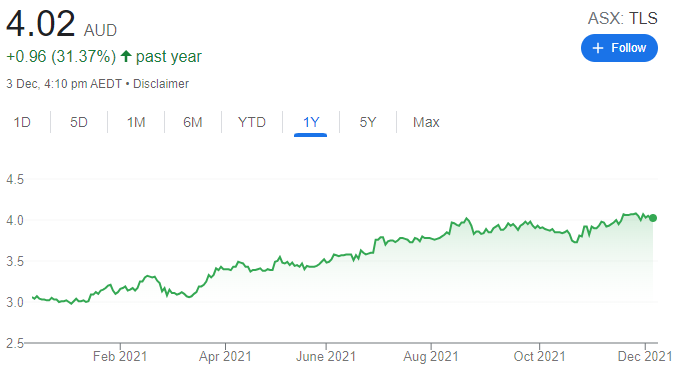

Telstra Corporation (TLS)

Management has revealed new, more upbeat financial targets, along with operational plans and strategic priorities through to fiscal year 2025. The company’s vision should have a positive impact on the business if successfully executed. We believe the business is poised to grow. We expect improving profitability and a return to higher dividends within the outlined time frame.

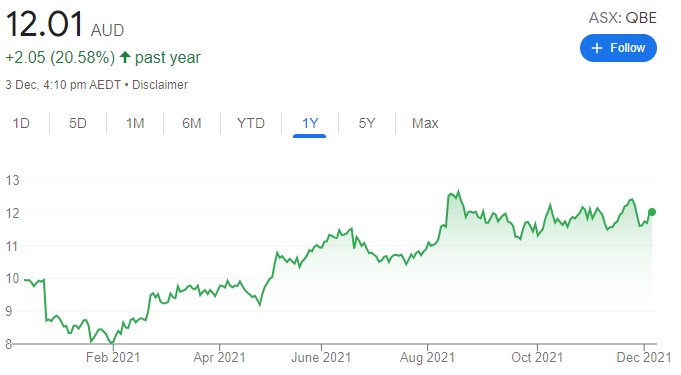

QBE Insurance Group (QBE)

This insurer has made substantial improvements to its business in recent years. Narrowing its focus has simplified the business and led to improving underwriting outcomes. The insurance pricing market has become more rational, and QBE’s premiums have firmed considerably, which should continue, in our view. The business should be a major beneficiary ahead of a steepening yield curve.

HOLD RECOMMENDATIONS

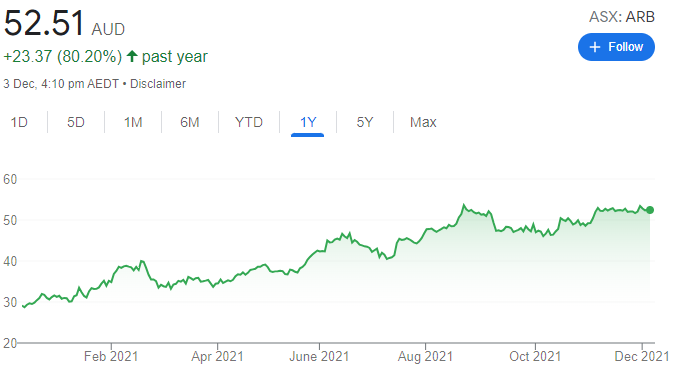

ARB Corporation (ARB)

This manufacturer of 4-wheel drive accessories was recently trading at an elevated valuation, but we believe it’s justified. ARB is leveraged to the long term structural trend of motorists increasingly buying sports utility and 4-wheel drive vehicles. ARB has a tremendous track record of generating value for shareholders. A store rollout in the US going forward offers an appealing new growth path.

Amcor PLC (AMC)

The company’s packaging plants were an essential service and continued to operate during the pandemic. Amcor acquired US packaging company Bemis in 2019. AMC is on track to exceed its original $180 million cost synergy target by at least 10 per cent. Free cash flow for fiscal year 2022 is expected to be almost double pre-acquisition levels. The company will search for more acquisitions in the future.

SELL RECOMMENDATIONS

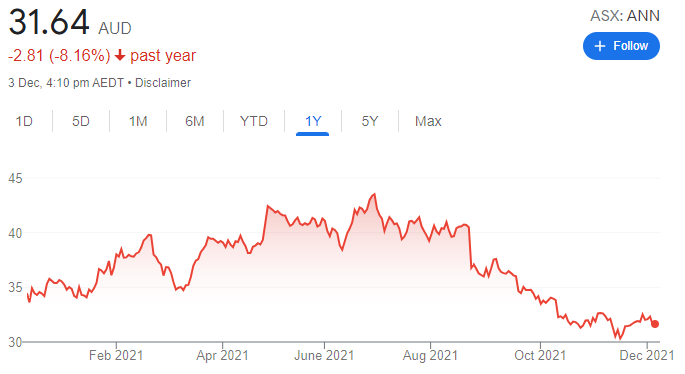

Ansell (ANN)

The company was a pandemic beneficiary given soaring demand for protective clothing and gloves. Capacity has been added across the industry, but we believe demand is set to decline from peak levels. In our view, ANN sales and earnings have peaked. We expect pressure on the top line amid possible increasing input costs in a business with high operational leverage.

Nearmap (NEA)

NEA delivers high definition aerial imaging services. NEA is an innovative business. But we see intensifying competition and growing risks from new technological advances. In our view, the company trades on a relatively lofty valuation. Rising bond yields on the horizon could pressure this valuation amid revenue growth possibly slowing from high levels.

Tim Haselum, Catapult Wealth

BUY RECOMMENDATIONS

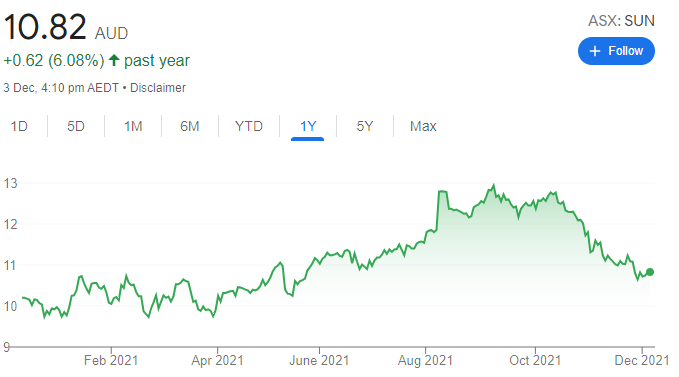

Suncorp Group (SUN)

The share price of this diversified financial services group has been hit by an increase in natural disaster costs due to storms on the east coast. Offsetting higher costs are rising premiums and bond yields, which should lead to an increase in earnings in the absence of significantly more claims. Historically, SUN is at a point in the claims and premium increase cycle where investors can consider taking advantage of share price weakness.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

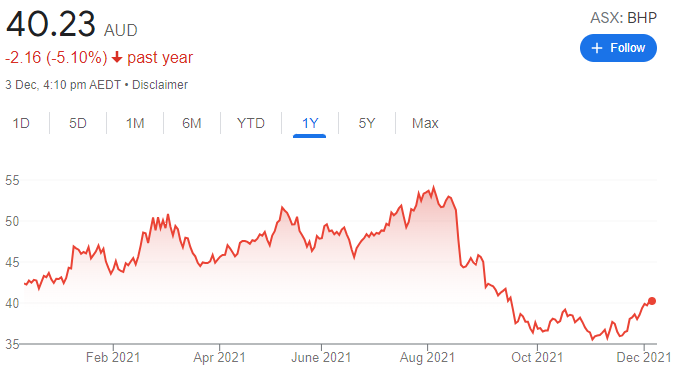

BHP Group (BHP)

The iron ore price has fallen from highs, and BHP has recently been subjected to short selling. But we believe the company offers value. China’s growth numbers are slowing, and we believe it will steadily lift activity after the winter Olympics. Chinese growth generally involves steel production, which paints a brighter outlook for iron ore producers.

HOLD RECOMMENDATIONS

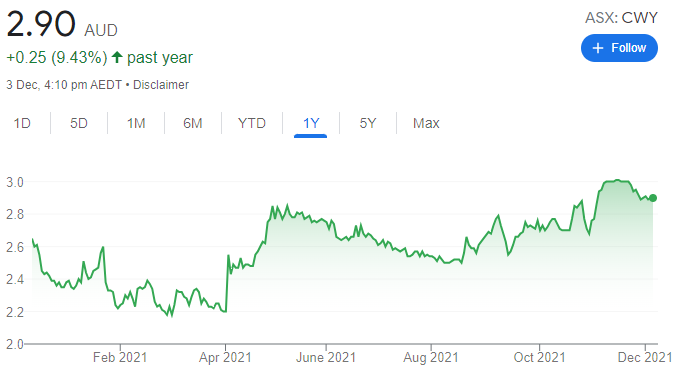

Cleanaway Waste Management (CWY)

This waste management solutions provider offers defensive earnings underpinned by long term local government contracts. The market is clearly looking through the noise as the share price climbed in November. We see strength in Cleanaway’s commercial and industrial operations in the short term. Longer term, we expect the company to benefit from population and urban growth.

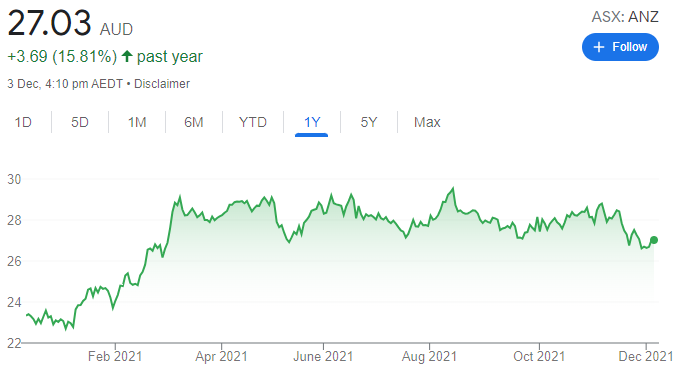

ANZ Bank (ANZ)

The major banks are struggling with margin pressure due to heightened competition. Judo Bank is attacking with competitive term deposit rates and Macquarie Group is winning more market share in residential mortgages. Banks are still what you want for income, and ANZ has the right balance between quality and the share price, so it should be able to hold up here relative to the other big players.

SELL RECOMMENDATIONS

James Hardie Industries PLC (JHX)

The building products company posted a strong 2021 half year result mixed with positive guidance. A strong housing market in Australia and abroad contributed to the result. US interest rates are expected to rise during the next two years, so building activity may cool. It may be prudent for investors to consider locking in some profits. In our view, this is a cyclical stock with a lot of expectations priced in at current valuations.

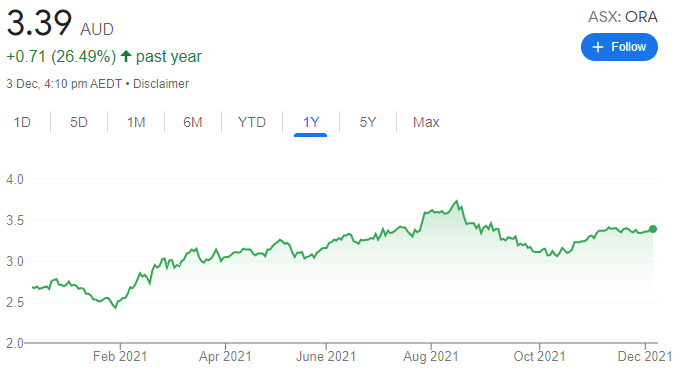

Orora (ORA)

This packaging company delivered a decent 2021 full year result. It posted underlying net profit after tax before significant items of $156.7 million, up 23.7 per cent on the prior corresponding period. But we’re concerned more stringent competition will lead to increasing pressure on costs. In our view, better growth options exist elsewhere at this point in the cycle.

Thomas Wegner, Marcus Today

BUY RECOMMENDATIONS

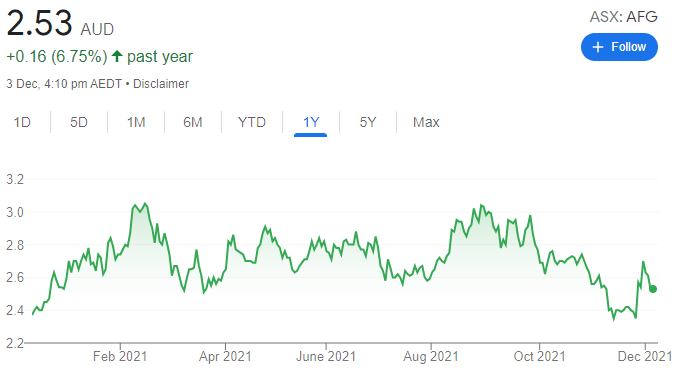

Australian Finance Group (AFG)

This mortgage broking group lodged $24.1 billion in home loans in the first three months of financial year 2022, a 33 per cent increase on last year’s prior corresponding period. We expect earnings growth in the near term to be supported by an underlying shift to higher margin products. As interest rates start to rise, the role of a mortgage broker will become more important to borrowers.

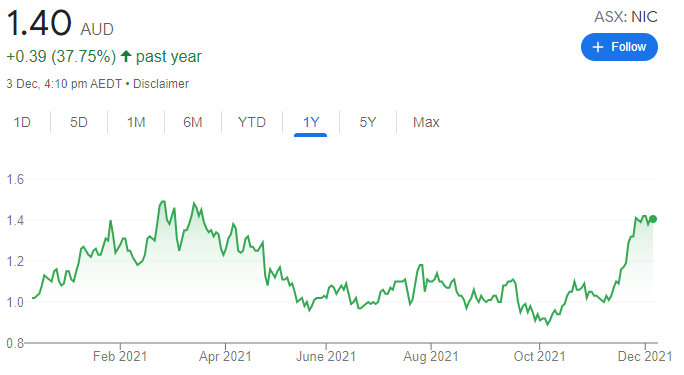

Nickel Mines (NIC)

This nickel miner recently bought a 70 per cent interest in the Oracle Nickel Project in Indonesia, which is expected to add 43,000 tonnes a year to nickel production by 2024. We expect the deal to be accretive earnings. NIC is on track to become a global top ten nickel miner. The shares have risen from 99.5 cents on November 8 to trade at $1.40 on December 2.

HOLD RECOMMENDATIONS

Mineral Resources (MIN)

This diversified miner is aiming to grow production of spodumene concentrate, which is integral to batteries in electric vehicles. Spodumene prices recently reached a record high of $US2060 a tonne, a year-to-date increase of more than 400 per cent. Volume growth from MIN planning to resume its Wodgina lithium operations is also expected to support its valuation.

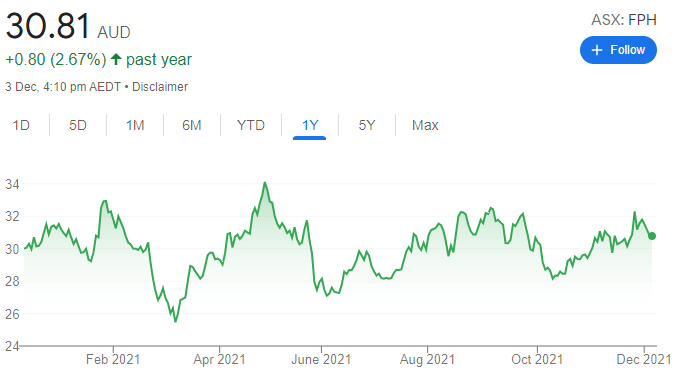

Fisher & Paykel Healthcare Corporation (FPH)

First half profit for financial year 2022 beat consensus estimates by 7 per cent. Demand for hospital hardware was particularly strong outside of North America and Europe in the first half and costs were also well managed. We expect demand for Fisher & Paykel’s products to remain above pre-COVID-19 levels.

SELL RECOMMENDATIONS

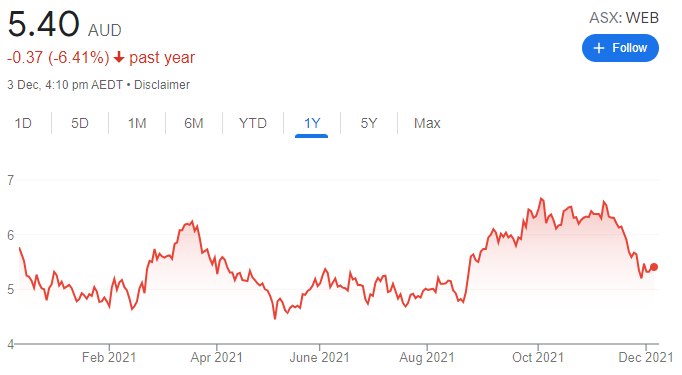

Webjet (WEB)

The COVID-19 variant Omicron is creating short term uncertainty in the travel industry. At this point, this online global travel agency isn’t expecting a return to pre-COVID-19 booking levels until the second half of fiscal year 2023. In our view, the threat of border closures and travel restrictions across the world are likely to weigh on traveller demand.

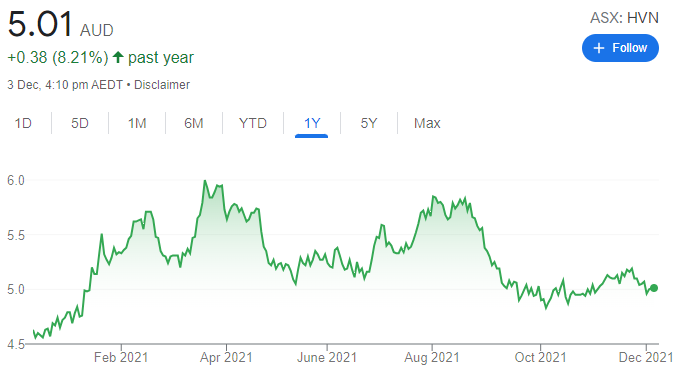

Harvey Norman Holdings (HVN)

Aggregated sales revenue between July 1 and November 21, 2021 fell 8.8 per cent on the prior corresponding period. No forward earnings guidance was provided in its trading update as the pandemic continues to generate uncertainty about the outlook for the economy. We’re not expecting the share price of this retail giant to outperform in fiscal year 2022. The shares have fallen from $5.59 on July 2 to trade at $5.01 on December 2.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.