Mattew Lattin, Marcus Today

BUY RECOMMENDATIONS

BUY – Ventia Services Group (VNT)

VNT is an essential infrastructure services provider in Australia and New Zealand. It reported strong fiscal year 2022 results, surpassing $5 billion in revenue for the first time. Net profit after tax and amortisation of $179.6 million was up 22.4 per cent on the prior corresponding period. Company growth guidance of between 7 per cent and 10 per cent has been reaffirmed, instilling confidence about its ability to meet expectations. VNT has a solid track record of delivering results, so it’s worth considering adding to portfolios.

BUY – IPD Group (IPG)

IPD Group is an Australian electrical equipment distributor and service provider. It has a growing cash balance. It achieved strong 2023 first half revenue of $110.9 million, up 35.7 per cent on the prior corresponding period. It maintained robust margins by passing on supplier price increases. The growth outlook is favourable and a solid balance sheet enables potential acquisitions.

HOLD RECOMMENDATIONS

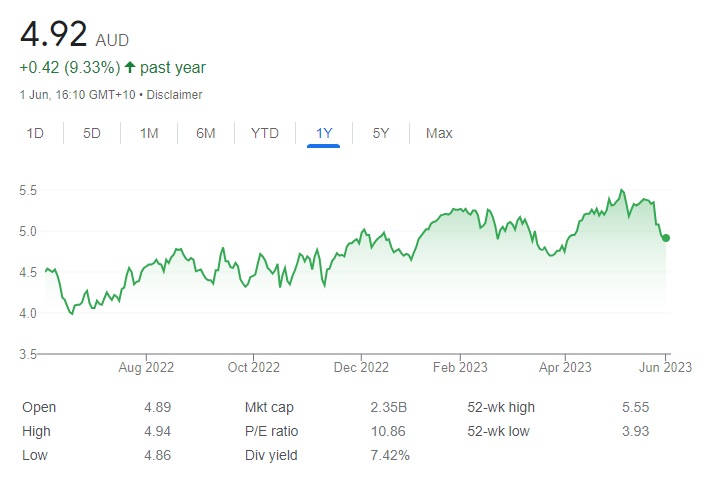

HOLD – CSR (CSR)

The share price of this building products company has risen from $4.06 on July 1, 2022 to trade at $4.94 on June 1, 2023. This is despite concerns about a housing construction slowdown. Sales growth may have peaked at this stage of the cycle, but CSR is a solid conservative, mid-capitalisation stock that provides a steady income stream and potential for long term capital appreciation.

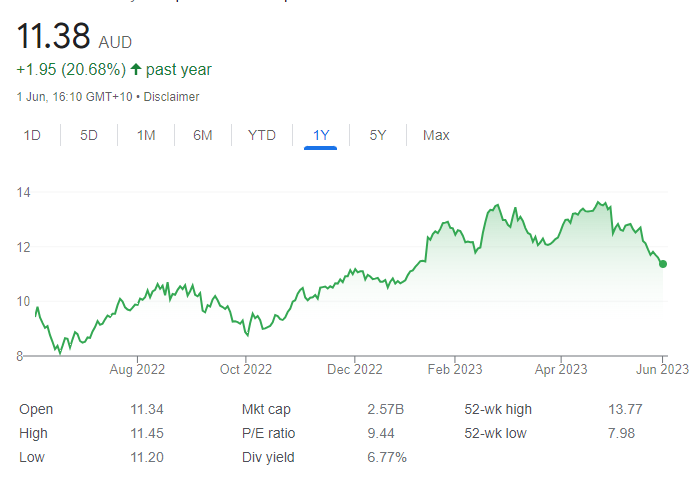

HOLD – Alliance Aviation Services (AQZ)

The company provides allied aviation and maintenance services to the mining, energy and government sectors as well as wet lease services for other airlines. While total revenue has been increasing steadily since 2017, profits were impacted by COVID-19 challenges in 2022. However, this established company is well managed. In April, the Australian Competition and Consumer Commission opposed Qantas acquiring AQZ, leaving Qantas to seek more information.

SELL RECOMMENDATIONS

SELL – Latitude Group Holdings (LFS)

Latitude is a digital payments, instalments and lending business. The company is still addressing the repercussions of a cyber attack in March, resulting in provisions for associated costs. Due to the cyber attack, a first half 2023 statutory loss after tax from continuing operations is expected to range between $95 million and $105 million, The full year statutory result is expected to be a loss. It’s unlikely Latitude will declare a dividend for the six months to June 30, 2023.

SELL – Kogan.com (KGN)

The online retailer posted gross sales of $188.7 million for the three months ending March 31, 2023, a decline of 28 per cent year-on-year. Performance was impacted by weaker market conditions in response to interest rate increases and inflationary pressures. In our view, KGN faces challenges if consumer spending tightens further due to increasing cost of living pressures and potentially rising interest rates. We prefer others at this point in the cycle.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Tony Paterno, Ord Minnett

BUY RECOMMENDATIONS

BUY – Lendlease Group (LLC)

Lendlease is a diversified global real estate group. The group is seeking better returns on capital, accelerating its development pipeline and shifting focus outside its home base of Australia. Our base case is Lendlease grows its development revenue rapidly during the next five years as the group recovers from COVID-19 interruptions. Crystallising profits in existing development projects enables LLC to increase its production rate on new projects.

BUY – Bapcor (BAP)

Bapcor is Asia Pacific’s leading provider of vehicle parts, accessories, equipment and service. We believe continuing earnings growth will be driven by strong underlying demand and sales growth in the core Burson Auto Parts business. Bapcor is expanding its store network in Australia and New Zealand and we expect operating margins to improve. Bapcor is also developing operations in Asia, which offers longer term upside.

HOLD RECOMMENDATIONS

HOLD – Mineral Resources (MIN)

We expect the company to rely more on lithium production moving forward. Earnings streams have been materially diversified and the investment strategy has consistently generated high returns on invested capital. We expect the lithium market to be adequately supplied in the longer term. However, we believe Mineral Resources can drive earnings per share growth on bigger volumes.

HOLD – National Australia Bank (NAB)

Cash earnings of $4.070 billion in the first half of fiscal year 2023 were up 12.3 per cent on the second half of 2022. Increasing cash rates was the key driver, shown by an improving net interest margin when compared to the first half of 2022. The bank is well capitalised. Short term headwinds include fierce mortgage competition and rising customer deposit pricing. We view the dividend payout ratio, ranging between 65 per cent and 75 per cent, as sustainable.

SELL RECOMMENDATIONS

SELL – Super Retail Group (SUL)

The company’s brands include Supercheap Auto, rebel, BCF and macpac. We believe the shares are overvalued. We expect SUL sales momentum to wane from intensifying competition in the near term. The group’s gross margin declined by 10 basis points in the second half up until the end of April, 2023 when compared to the first half. The cost of doing business has been increasing. Rising interest rates are designed to curtail consumption.

SELL – Premier Investments (PMV)

Premier retail sales of $905.2 million in the first half of fiscal year 2023 were up 17.6 per cent on the prior corresponding period. Statutory net profit after tax of $174.3 million was up 6.5 per cent. However, we expect Premier’s sales growth in Australia to weaken in the second half of fiscal year 2023. We’re forecasting global sales to increase by only low single digits. We expect higher interest rates to impact consumer demand. The shares were recently trading at a premium to our intrinsic valuation.

Nathan Lodge, Securities Vault

BUY RECOMMENDATIONS

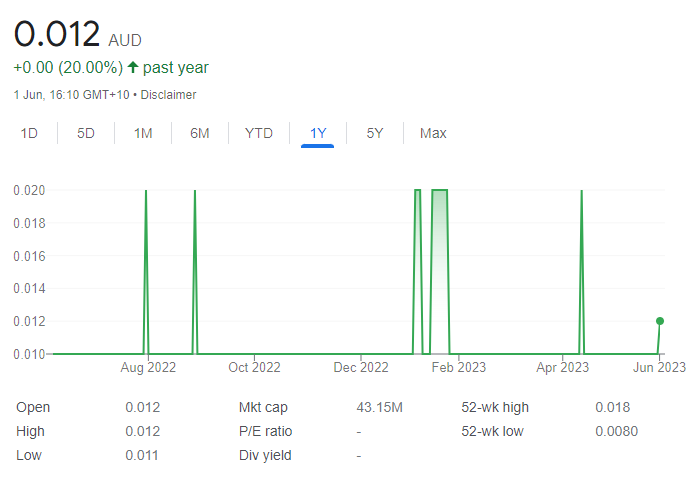

BUY – Spenda (SPX)

Spenda supplies industries with a broad range of business-to-business payment services. The Capricorn Society has selected Spenda to deliver the first phase of its digital service delivery initiative for eight weeks. It’s anticipated SPX will receive $152,000 for each four-week cycle. I believe SPX has been undervalued for some time. The shares were trading at 1.1 cents on June 1.

BUY – Jayride Group (JAY)

Jayride offers an online service that helps travellers find transport at airports. Rather than searching different websites, JAY offers the services of more than 3700 ride servicing companies at more than 1600 airports across the globe. Cash receipts from customers grew to $1.65 million in the third quarter of fiscal year 2023, up 198 per cent on the prior corresponding period. I believe the company offers growth. The shares were priced at 12.5 cents on June 1.

HOLD RECOMMENDATIONS

HOLD – Spacetalk (SPA)

The company recently launched Adventurer 2, an all-in-one smartwatch, phone and GPS safety device for children aged between five and 12. The Adventurer 2 is the first of many product initiatives as part of the company’s growth strategy. The shares were trading at 3.1 cents on June 1.

HOLD – TechGen Metals (TG1)

TG1 is an active junior explorer. It owns the Ashburton Basin and Paterson Orogen copper and gold projects in Western Australia. It also owns the John Bull gold project in New South Wales containing two stages of mineralisation. Mineralisation was recently confirmed in the Monzonite Intrusive at the John Bull gold project. Recent results were impressive. Investors should keep an eye on the stock.

SELL RECOMMENDATIONS

SELL – Micro-X (MX1)

MX1 is a technology company developing and commercialising products based on proprietary cold cathode, carbon nanotube emitter technology. MX1 recently announced it had successfully completed first field testing of its Argus IED X-ray camera. The company has potential. However, the price has risen rapidly from 8.8 cents on May 25 to trade at 12.5 cents on June 1. Investors may want to consider taking profits.

SELL – TruScreen Group (TRU)

TRU is a medical device company. It has developed and manufactured an artificial intelligence enabled device for detecting abnormalities in cervical tissue. The company recently announced its technology had been endorsed in the Chinese Society for Colposcopy and Cervical Pathology, a cervical cancer screening management guideline. The shares have risen from 2.1 cents on April 27 to be priced at 2.6 cents on June 1, so investors may want to consider cashing in some gains.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.