Elio D’Amato, Spotee Connect

BUY RECOMMENDATIONS

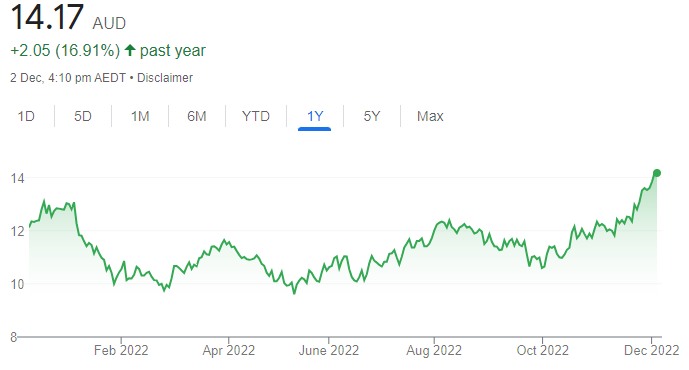

Technology One (TNE)

Supported by its loyal and expanding client base, this cloud-based software solutions provider delivered an excellent full year report. While some may be quick to point to its lofty valuation, TNE remains one of the highest quality companies on the ASX, in our opinion. It offers a strong balance sheet. TNE’s objective is more than $500 million in recurring revenue by fiscal year 2026.

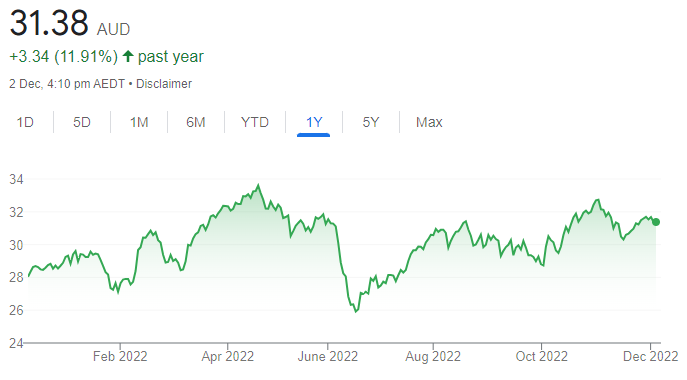

National Australia Bank (NAB)

The bank delivered a strong fiscal year 2022 result. It generated revenue and cash earnings growth on the prior corresponding period, and the business banking division led the way. The company widened its net interest margin in the 2022 second half when compared to the first half. The second half net interest margin was above analyst expectations. We remain optimistic that NAB can deliver double digit earnings growth and increasing dividends in fiscal year 2023.

HOLD RECOMMENDATIONS

QBE Insurance Group (QBE)

The insurance giant recently warned investors of a potential hit to earnings due to higher catastrophe costs from bad weather. However, with gross written premiums still rising strongly and interest rate rises improving the yield on fixed income investments, we feel the update isn’t a disaster, so the stock remains a hold.

Webjet (WEB)

In our view, the online travel agency is a much stronger company today than when it entered the COVID-19 crisis. Its latest half year result revealed total transaction volumes (TTV) rose 217.1 per cent, with the company returning to profitability. Cash flows grew strongly and margins improved. The outlook is bright, with analysts upgrading their expectations.

SELL RECOMMENDATIONS

GrainCorp (GNC)

This diversified Australian agribusiness delivered a record full year result in fiscal year 2022. We’re not expecting a repeat in fiscal year 2023 due to floods impacting the current crop, which may pressure earnings. The impact may be cushioned if grain prices remain high. However, in our view, risk is to the downside.

Hawsons Iron (HIO)

The company has decided to slow the pace of work on the Hawsons Iron Project Bankable Feasibility Study (BFS) in response to escalating global costs and deteriorating economic conditions. Finding a resource isn’t enough. Extracting resources from the ground is costing more these days. Hawsons Iron isn’t an isolated case. I expect other junior miners to experience similar pressures.

Jed Richards, Baker Young

BUY RECOMMENDATIONS

Treasury Wine Estates (TWE)

The global wine giant posted impressive fiscal year 2022 results. Net profit after tax and earnings per share were both up 4 per cent on the prior corresponding period. We rate its management team highly. Trading at a material discount to our valuation and other luxury brand owners, TWE is well placed to deliver strong growth during the next few years, in our view.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Newcrest Mining (NCM)

Newcrest Mining is a big gold producer. Gold has historically been an inflation hedge and store of value. But even with inflation at multi decade highs, the gold price has fallen this year. Newcrest has rallied from its lows recently on the latest US inflation figures, which were lower than expected, leading to a weaker US dollar. Gold does have a place in portfolios in uncertain times.

HOLD RECOMMENDATIONS

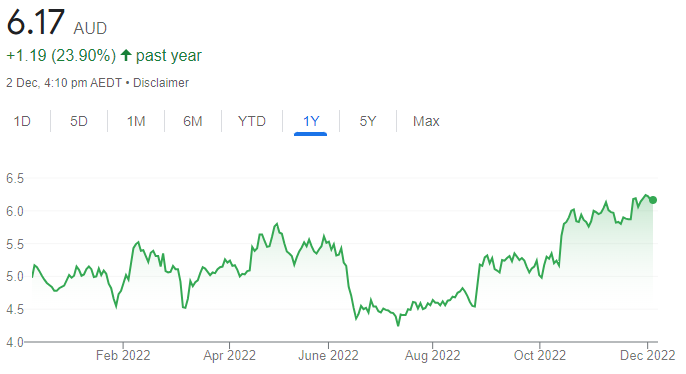

Qantas Airways (QAN)

There aren’t enough planes in the air to meet demand, so ticket prices will remain high. The share price has risen from $4.54 on August 24 to trade at $6.27 on December 1. The ongoing share buy-back will support the price over the shorter term.

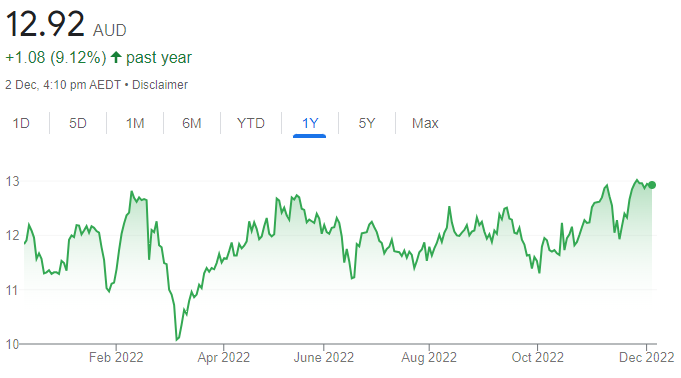

Woolworths Group (WOW)

The supermarket giant’s scale gives it advantages over smaller rivals in terms of bargaining power and greater capital for growth. WOW is exposed to the defensive markets of food and everyday needs, so it should hold up relatively well if economic conditions weaken.

SELL RECOMMENDATIONS

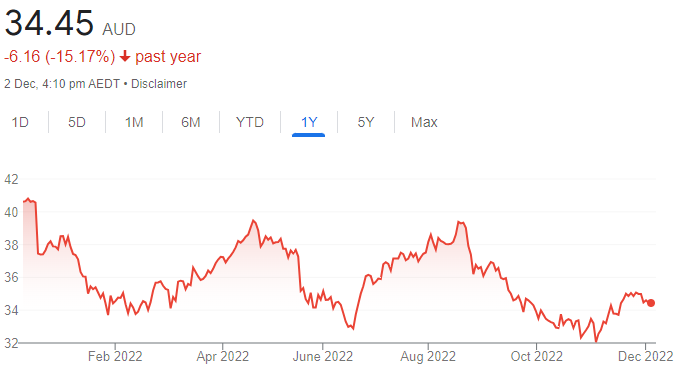

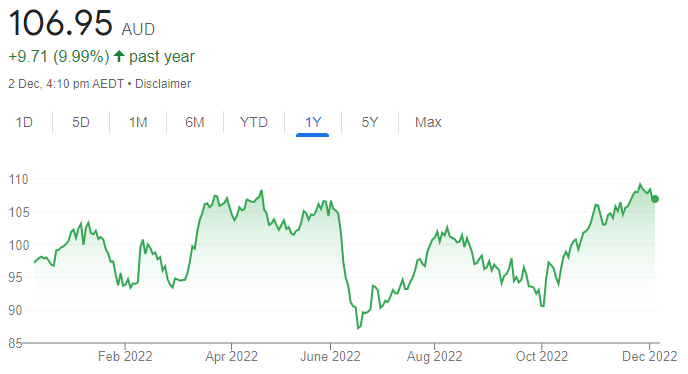

Commonwealth Bank of Australia (CBA)

CBA has remained strong this year. The shares have risen from $90.70 on September 30 to trade at $108.475 on December 1. However, the company is trading on a significant multiple relative to the other major banks. Investors may want to consider cashing in some gains and examine cheaper opportunities elsewhere in the banking sector.

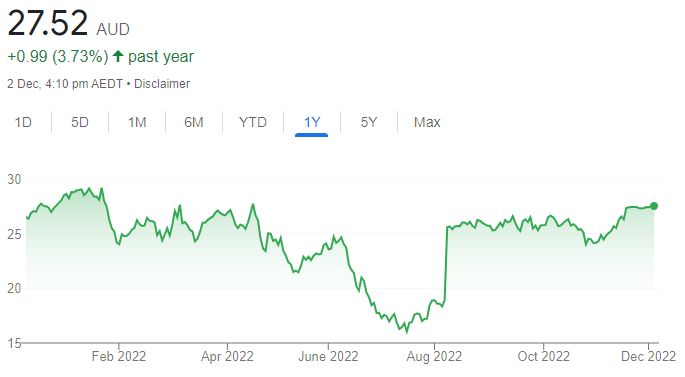

Oz Minerals (OZL)

BHP Group recently made a revised takeover bid for OZL at $28.25 a share in a deal that is unlikely to be completed until the middle of 2023, in our view. The initial bid was $25 a share. With OZL shares recently trading at a discount to the bid price, we believe this presents a good opportunity to take a profit. BHP is undertaking due diligence. The OZL board intends to recommend the bid in the absence of a superior proposal. The shares were trading at $27.46 on December 1.

Harrison Massey, Argonaut

BUY RECOMMENDATIONS

Global Lithium Resources (GL1)

GL1 recently raised $120 million to acquire the remaining 20 per cent of the Manna Lithium project from Breaker Resources. GL1 has an existing resource of 20.4 million tonnes of lithium oxide across its two assets. We’re anticipating a substantial mineral resource upgrade at the Manna Lithium project in December 2022. GL1 also has an impressive register with Mineral Resources owning 9.9 per cent of the company.

Auteco Minerals (AUT)

The gold explorer owns and operates the Pickle Crow project. The existing gold resource stands at 2.2 million ounces at 7.8 grams a tonne of gold and is located in the tier 1 Thunder Bay region in Canada. The asset has historical underground production of 1.5 million ounces at 16.1 grams a tonne of gold. Experienced geologist Darren Cooke leads AUT. The company is progressing its 50-kilometre drill program.

HOLD RECOMMENDATIONS

Pilbara Minerals (PLS)

The company produced 377,902 dry metric tonnes of spodumene concentrate in fiscal year 2022. PLS has benefited from strong lithium prices and generated revenue of $1.2 billion in fiscal year 2022. The share price has risen from $2.24 on July 1 to trade at $4.75 on December 1. We anticipate it will pay a substantial maiden dividend in 2023.

Gold Road Resources (GOR)

GOR owns and operates the Gruyere gold project. The company expects to produce between 300,000 and 340,000 ounces of gold in fiscal year 2022. The company’s share price has benefited from a better than expected spot gold price. It’s also a low cost producer. In our view, it offers significant production and exploration upside.

SELL RECOMMENDATIONS

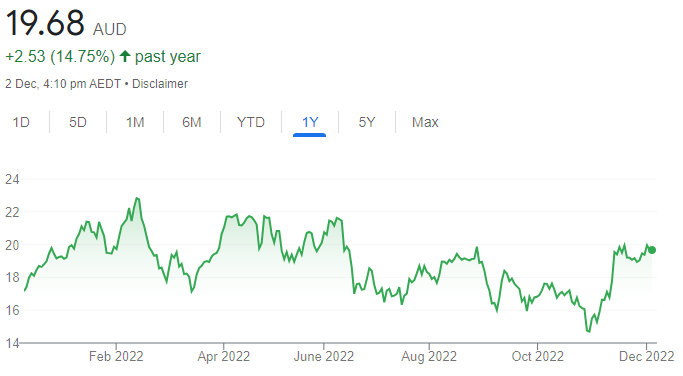

Fortescue Metals Group (FMG)

Better than anticipated iron ore spot prices have contributed to the share price rising from $14.70 on October 31 to trade at $19.89 on December 1. China’s zero COVID-19 policy can impact demand for iron ore and slow its economy. We don’t expect China’s pandemic policy to be removed in the short term. Investors may want to consider taking a profit at these levels.

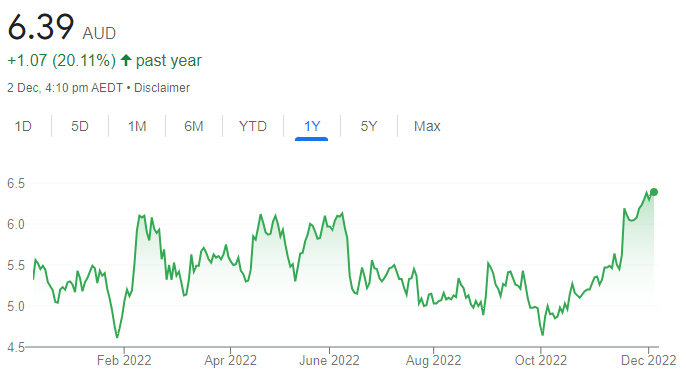

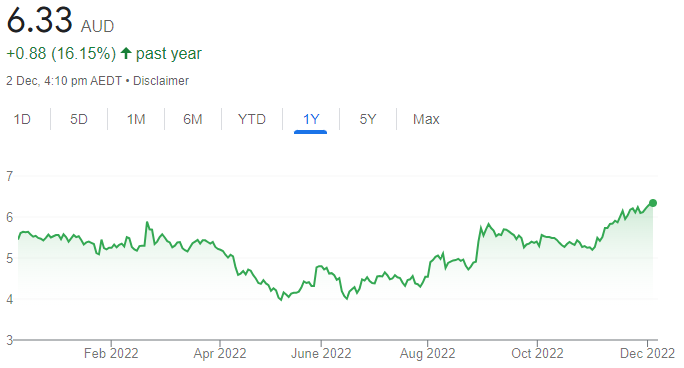

The a2 Milk Company (A2M)

This infant formula company has received US Food and Drug Administration approval to supply its products in the US. Investors responded positively to the news, sending the price up from $5.27 on November 2 to trade at $6.29 on December 1. Competition in the infant formula and dairy products market in Australia and abroad is fierce. Investors may want to consider cashing in some gains.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.