Tom Bleakley, BW Equities

BUY RECOMMENDATIONS

Ramelius Resources (RMS)

The company’s share price has drifted lower with the physical gold price. The company reported a statutory net profit after tax of $126.8 million in fiscal year 2021, up 12 per cent on the prior corresponding period. Ramelius had about $234 million in cash and gold on hand at the end of June. It has built a war chest to target acquisitions and increase production in future years. We see RMS as a counter-cyclical buy at a time when resource investors are focusing on different commodities.

Toys “R” Us ANZ (TOY)

Management has extensive experience in the sector. The toy business has experienced strong growth, driven by its extensive range of products. The company recently launched an online baby store, which is likely to be a strong competitor in a shrinking Australian bricks and mortar market, as many retail competitors have closed.

HOLD RECOMMENDATIONS

The A2 Milk Company (A2M)

This infant formula company has struggled in past 15 months, with lower cross border sales of Australian label products into Asia. The company is focusing on developing export markets for its Chinese domestic label. The stock has plunged from a closing price of $19.52 on July 20, 2020 to close at $6.24 on September 30, 2021. There’s ample room for the stock to move higher on any good news.

BHP Group (BHP)

The stock has fallen from a closing price above $54 on August 4 in response to lower iron ore prices. The shares closed at $37.61 on September 30. In the past 12 months, BHP generated a significant proportion of its revenue from iron ore sales. The iron ore price has fallen from about $US233 a tonne in May to recently below $US100 a tonne. This global miner remains most profitable despite lower iron ore prices.

SELL RECOMMENDATIONS

Pro Medicus (PME)

PME provides medical imaging software and services to hospitals, imaging centres and health care groups across the globe. Several quality products generate gross profit margins above 80 per cent, which is the type of business we look to invest in. The company delivered a fiscal year 2021 profit after tax of $30.85 million, up 33.7 per cent on the prior corresponding period. However, we believe it’s time to consider taking some money off the table, as the company has been trading on lofty price/earnings multiples.

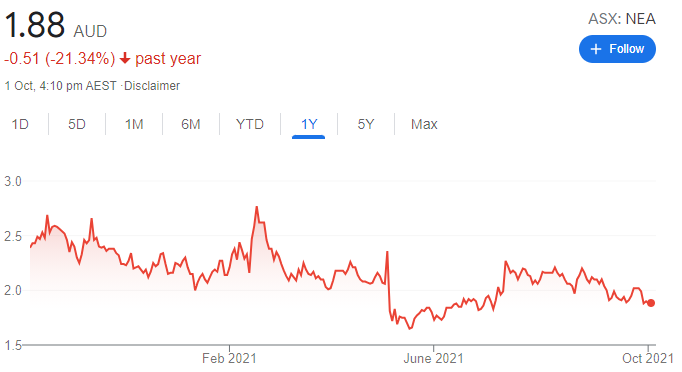

Nearmap (NEA)

NEA delivers high definition aerial imaging services. The company delivered fiscal year 2021 revenue growth above 20 per cent, with 75 per cent gross margins. The company made a loss after tax as it continues to invest in longer term growth. NEA faces increasing competition from advances in satellite technology. In our view, rising bond yields provide an opportunity to consider cashing in some gains.

Thomas Wegner, Marcus Today

BUY RECOMMENDATIONS

Collins Foods (CKF)

The owner of KFC Australia boosted revenue by 13.8 per cent in fiscal year 2021 to $900.4 million. Growth should continue as CKF is expected to open 66 new stores by 2028. CKF expects to open between nine and 12 new Taco Bell stores in fiscal year 2022. Category data suggests chicken and Mexican-style fast food is growing faster than pizza, which paints a bright outlook for CKF.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

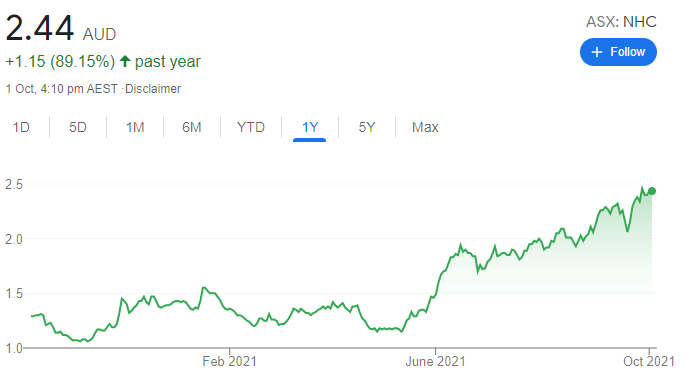

New Hope Corporation (NHC)

This diversified energy company has transitioned to a net profit after tax of $79 million in fiscal year 2021 following a loss of $157 million in 2020. The main driver for the turnaround was stronger coal prices on the back of global supply shortages. We believe favourable coal prices are likely to continue in the next few months, which, in turn, should support the business.

HOLD RECOMMENDATIONS

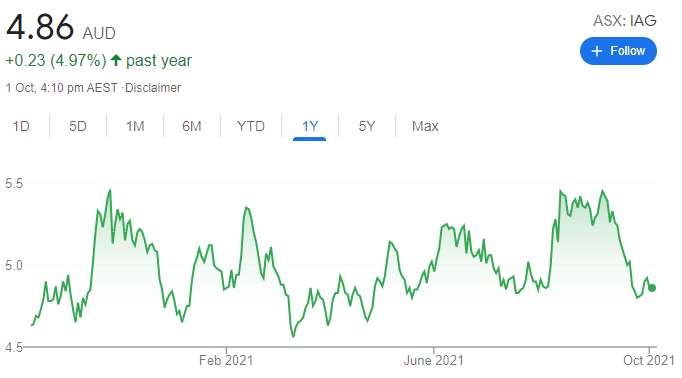

Insurance Australia Group (IAG)

Following the earthquake in Victoria on September 22, IAG isn’t expected to exceed its event allowance of $169 million. The company appears oversold as it closed at $5.42 on September 7. The shares were trading at $4.93 on September 30. We expect growth in premiums and rising global bond yields to provide tailwinds for the business during the next few months.

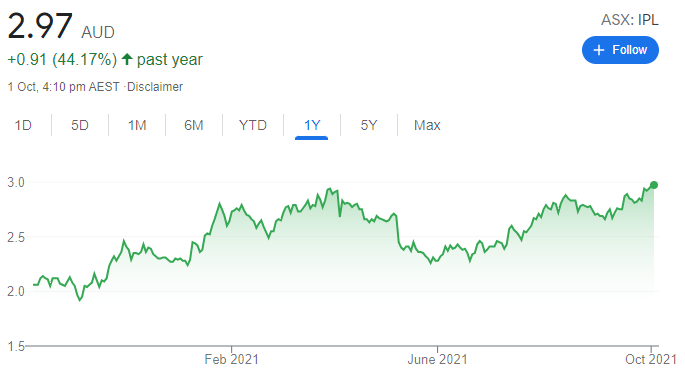

Incitec Pivot (IPL)

This fertiliser and chemicals business is expected to benefit from fewer competitors and production cuts in Europe and North America in response to higher gas prices. We believe higher fertiliser prices and a potentially weaker Australian dollar are likely to support IPL earnings.

SELL RECOMMENDATIONS

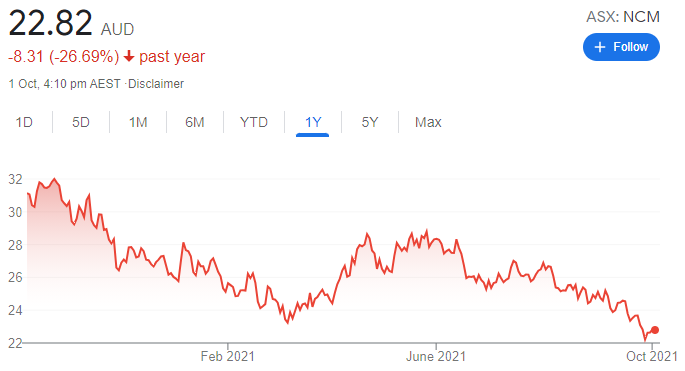

Newcrest Mining (NCM)

Weaker gold prices recently have contributed to a retreating NCM share price. The NCM price has fallen from $25.20 on September 6 to trade at $22.57 on September 30. Dwindling inflation fears amid expectations of a higher US dollar are likely to weigh on the gold price – at least in the short term.

Appen (APX)

This data solutions and machine learning provider revealed a 55 per cent fall in statutory net profit after tax to $6.7 million in the 2021 first half. It lowered full year underlying EBITDA guidance at the end of August. We expect rising bond yields to present challenges, as high growth technology companies are typically sensitive to higher interest rates.

Stuart Bromley, Medallion Financial Group

BUY RECOMMENDATIONS

Volpara Health Technologies (VHT)

This health software provider has grown revenue from $A1.7 million in fiscal year 2017 to $A18.1 million in fiscal year 2021. The share price has been under pressure during the pandemic. However, we’re encouraged by its software-as-a-service subscription model generating gross profit margins of about 90 per cent. We expect the company’s outlook to improve when personalised screening levels to detect early breast cancer increase as the pandemic winds down.

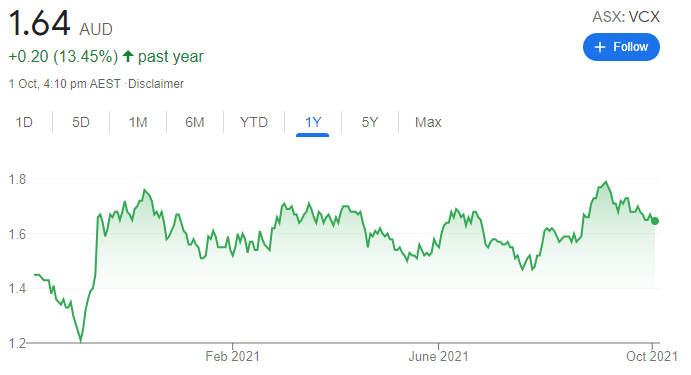

Vicinity Centres (VCX)

This retail property group has been impacted by the pandemic. But management acted quickly to vary leases and support tenants. These measures, among others, enabled Vicinity to retain occupancy rates of 98.2 per cent and position the business to benefit quickly when shops re-open. Transitioning to office towers also generates additional upside potential.

HOLD RECOMMENDATIONS

CSL (CSL)

This blood products group opened 25 new plasma collection centres in the US in fiscal year 2021. Another 40 are expected to open in fiscal year 2022. We’re confident the business will benefit from these investments. Also, management continues to invest heavily in research and development, which should generate new products and revenue streams.

Credit Corp Group (CCP)

Fiscal year 2021 total revenue was down by 1 per cent to $374.8 million. But net profit after tax rose by 11 per cent to $88.1 million, indicating the business is selecting and collecting debt more efficiently. The US remains a primary growth market. CCP has the flexibility take on further opportunities as they arise.

SELL RECOMMENDATIONS

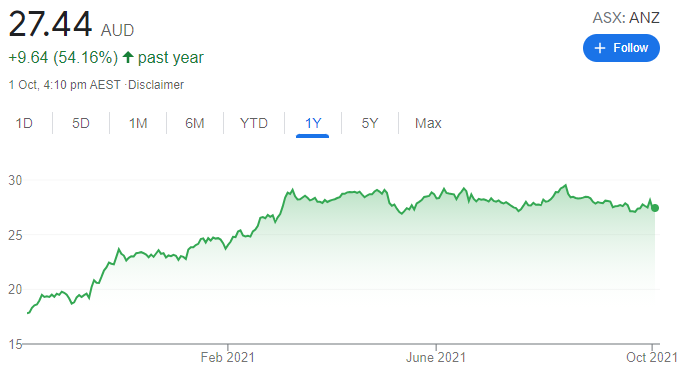

ANZ Bank (ANZ)

The share price of the ANZ recovered to pre-COVID-19 levels above $29 in March 2021. But the share price has since retreated. Growth prospects are limited unless it can write more home loans, in our opinion. Investors satisfied with the dividend in the absence of meaningful capital growth can hold. Others chasing capital growth may want to consider taking a profit and investing elsewhere.

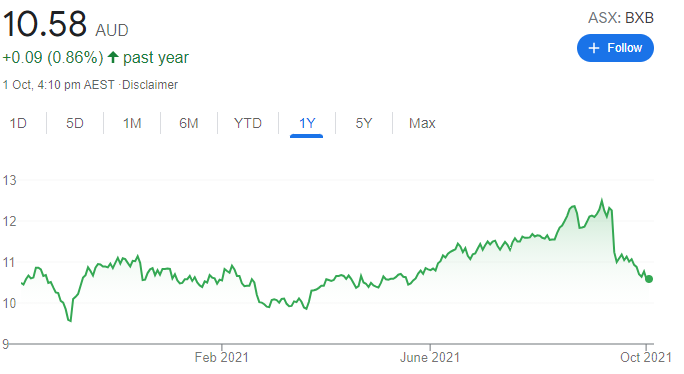

Brambles (BXB)

In our view, this supply chain logistics company disappointed investors at a September briefing. It’s targeting high single digit growth in underlying profit from fiscal year 2023. But we expect profit growth in fiscal year 2022 will be far more modest. Also, the company needs to generate higher levels of sales growth to capture investor attention. The shares continue to struggle at this point in time.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.