John Anderson, Bell Potter Securities

BUY RECOMMENDATIONS

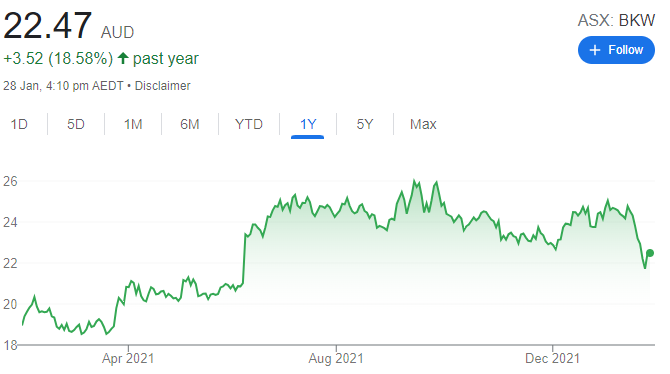

Brickworks (BKW)

Australia’s largest brick manufacturer also owns a significant holding in Washington H Soul Pattinson’s defensive portfolio of listed and unlisted assets. BKW has extensive industrial property assets with joint venture partner Goodman Group. In our view, BKW is not only trading at a discount to its sum-of-the-parts valuation, but the parts are growing in value.

Perpetual (PPT)

This diversified financial services firm operates an asset management business. Its private wealth advice business and corporate trust service also add material value. We’re optimistic that the acquisitions of Trillium and Barrow Hanley will improve Perpetual’s growth prospects. We’re also attracted to its recent fully franked dividend yield of around 5.6 per cent.

HOLD RECOMMENDATIONS

Netwealth Group (NWL)

The company’s investment platform provides a range of superannuation and wrap based portfolio solutions to individual investors and financial intermediaries. We expect the company to continue building market share, as was highlighted in its recent quarterly update. However, it’s trading as an expensive growth stock.

JB Hi-Fi (JBH)

A low cost of doing business model enables this consumer electronics giant to discount prices. We believe sales are likely to slow this year due to the Omicron variant and a possible cooling in demand for household and home office goods. The share price has fallen from $49.84 on January 18 to trade at $43.76 on January 27.

SELL RECOMMENDATIONS

Scentre Group (SCG)

This vertically integrated retail property group owns, develops and manages shopping centres in Australia and New Zealand. The company’s assets are widely regarded as high quality. But we expect the pandemic to continue impacting shopping at bricks and mortar outlets. The share price has fallen from $3.25 on January 4 to trade at $2.80 on January 27.

GrainCorp (GNC)

GNC provides handling, storage, marketing and logistic services to the east coast grain industry. The company delivered a strong fiscal year 2021 result on the back of bumper harvests. We’re expecting strong earnings in fiscal year 2022. But favourable conditions can rapidly change in the agricultural industry, so investors may want to consider locking in some gains.

Angus Geddes, Fat Prophets

BUY RECOMMENDATIONS

Rio Tinto (RIO)

The global miner is positioned to capitalise on what we expect will be a period of rising commodity prices in 2022. Despite RIO reporting a challenging operational 2021, management has emphasised its product mix will focus on near term brownfield opportunities to drive future growth. As a low cost products producer, RIO generates significant cash flows from its operations, which will support growth aspirations.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Incitec Pivot (IPL)

Incitec Pivot has increased its explosives exposure with the timely acquisition of European business Titanobel. The acquisition should generate new market opportunities by increasing its footprint in the European region. A new Federal Government contract to supply refined urea, used to produce the diesel additive AdBlue, will also add a new revenue stream. Meanwhile, Incitec Pivot’s existing explosives and fertiliser businesses face good market conditions in 2022.

HOLD RECOMMENDATIONS

Australian Agricultural Company (AAC)

As a leading cattle producer, the company is poised to benefit from rising beef prices driven by increasing demand and changing global weather patterns over grazing land. AAC has endured droughts and floods across its vast land holdings in Australia in the past few years. Yet it posted an increase in operating profit to $30 million for the half year ending September 30, 2021.

Australian Strategic Materials (ASM)

ASM is an emerging mine to metal producer. The company’s Dubbo project is a potential resource for rare earths and zirconium. ASM has been advancing its Dubbo project with pilot production. A Korean consortium has successfully completed due diligence on the project, which is likely to generate investment funding through a new strategic alliance.

SELL RECOMMENDATIONS

Beforepay Group (B4P)

The pay-on-demand lender enables customers early access to a portion of their next pay in exchange for a 5 per cent fixed fee. The product doesn’t generate compounding interest or late fees. B4P recently completed its initial public offering at $3.41 a share. The listing occurred at a time when the buy now, pay later sector fell out of favour with investors. The pay-on-demand concept is relatively new in Australia and, in our view, will take time to promote. The shares were trading at $1.85 on January 27.

McPherson’s (MCP)

This health and beauty products supplier posted a statutory loss before interest and tax of $3.3 million in fiscal year 2021. We expect product margins to be pressured from online competition moving forward. The shares were priced at $1.115 on August 18, 2021. The shares were trading at 79.5 cents on January 27, 2022. We prefer others for growth.

Jabin Hallihan, Morgans

BUY RECOMMENDATIONS

Silk Logistics Holdings (SLH)

We buy SLH for exposure to the growing container logistics market in Australia. The company offers strong earnings growth and is trading on an attractive price/earnings multiple below 10 times. It recently announced the acquisition of 101Warehousing for $10.5 million. The acquisition multiple looks attractive, and the purchase is funded mostly from issuing shares, so the balance sheet isn’t put under undue pressure. We have a $3.19 share price valuation.

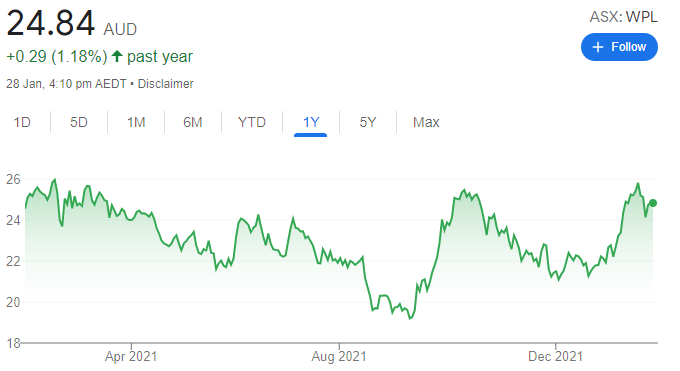

Woodside Petroleum (WPL)

This energy giant has been performing strongly in 2022. Management has provided a bright outlook, with sales guidance above of our expectations. The proposed merger with BHP’s oil and gas portfolio is good for WPL’s fundamentals. We retain an add rating, with a $30.55 valuation.

HOLD RECOMMENDATIONS

Super Retail Group (SUL)

The company sells auto parts, sports equipment and camping gear via its retail network. The businesses have performed well, but earnings may moderate from elevated levels. The shares have fallen from $13.29 on November 22 to trade at $11.06 on January 27. We retain a hold rating, but keep a close eye on the news flow. Our valuation is $13.80 a share.

Cochlear (COH)

This hearing implants maker is a quality stock. However, we believe it will take COH longer than expected to fully recover from COVID-19 based disruptions. We expect margins to remain under pressure in the medium term. However, the stock was trading materially below our $214 valuation on January 27.

SELL RECOMMENDATIONS

ASX Limited (ASX)

The share price closed at $92.90 on December 31, 2021. The shares were trading at $80.64 on January 27. But the stock is still trading above our valuation of $68.95. Investors may want to consider taking some gains as we expect relatively flat earnings growth moving forward. In our view, other companies appeal more for growth at this point.

Fortescue Metals Group (FMG)

The iron ore producer recently announced a strong quarter in operational and sales terms. The company also increased spending on renewable-related investments. In our view, these renewable investments will struggle to match the returns of the iron ore business. The company has enjoyed a strong share price run, but was continuing to trade above our valuation of $16.90 on January 27. Investors may want to consider taking some profits.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.