Peter Day, Sequoia Wealth Management

BUY RECOMMENDATIONS

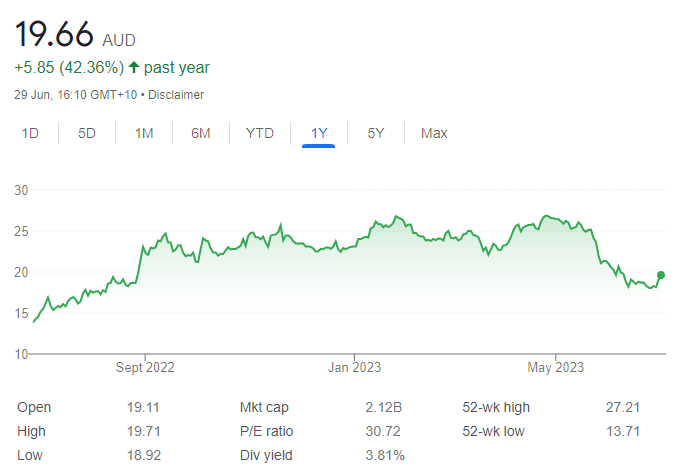

BUY – Lovisa Holdings (LOV)

This fashion jewellery and accessories retailer has generated strong sales growth on the back of persistent store growth across existing and new markets. Offering highly competitive price points is proving resilient. However, despite a relatively attractive position, we expect like-for-like sales growth to moderate in 2023. We retain a buy rating due to significant store growth potential across multiple markets.

BUY – Regis Healthcare (REG)

The aged care operator has announced the sale of vacant land and the Hollywood retirement village at Nedlands in Western Australia for $53 million. This transaction results in a pro forma reduction in net debt of 58 per cent, providing flexibility for growth, including acquisitions. Combined with favourable industry fundamentals and improved funding, we believe REG offers a bright outlook.

HOLD RECOMMENDATIONS

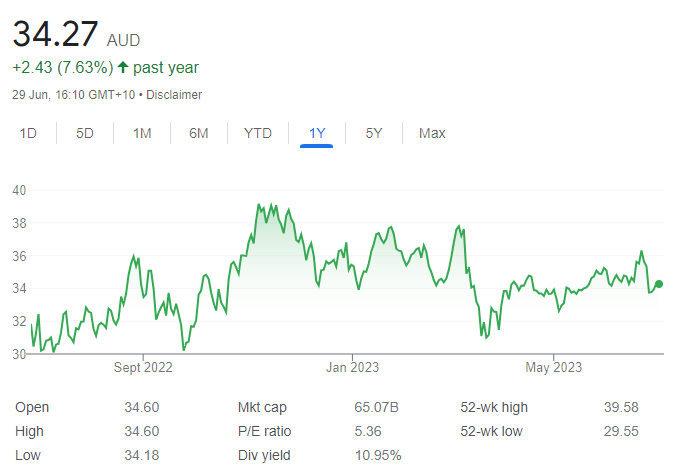

HOLD – Woodside Energy Group (WDS)

The energy giant has decided to develop the deep water Trion oil project in Mexico. The Trion development is subject to joint venture and regulatory approvals of the field development plan that’s expected in the fourth quarter of 2023. Woodside would hold a 60 per cent participating interest, and first oil production is targeted for 2028. Total forecast capital expenditure for the joint venture development is $US7.2 billion. In our view, Trion investment metrics are acceptable.

HOLD – Johns Lyng Group (JLG)

This integrated building services group forecasts revenue to increase by $110 million, excluding commercial construction, in fiscal year 2023. Revenue from commercial construction has been forecast to fall by $7.9 million. The group has announced it would exit commercial construction. The company expects the increase in catastrophe activity during fiscal year 2023 to continue into fiscal year 2024.

SELL RECOMMENDATIONS

SELL – Accent Group (AX1)

The footwear company operates more than 800 stores, has 34 brands and more than 35 online platforms. It enjoys strong demand for products. Total sales of $825 million in the first half of fiscal year 2023 were up 39 per cent on the prior corresponding. Sustaining sales is a challenge, with discretionary spending likely to be impacted by higher interest rates. The shares have fallen from $2.51 on May 15 to trade at $1.655 on June 29.

SELL – Harvey Norman Holdings (HVN)

Shares in the retail giant have fallen from $4.50 on January 19 to trade at $3.445 on June 29. Australian franchisee sales in January 2023 were down 10.2 per cent on January 2022. Competition in the discretionary retail sector is fierce, particularly at a time of higher interest rates and soaring cost of living increases. Other stocks appeal more at this stage of the cycle.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Toby Grimm, Baker Young

BUY RECOMMENDATIONS

BUY – Amcor PLC (AMC)

This high quality packaging company has underperformed the broader market by more than 20 per cent in the past 12 months. Net sales decreased by 1 per cent for the three months ending March 31, 2023 when compared to the prior corresponding period. However, Amcor’s inherently defensive characteristics appeal in the current environment.

BUY – Endeavour Group (EDV)

Despite delivering a solid third quarter update in May, this beverage industry leader has fallen below our valuation. Sales in the hotels and retail divisions grew in the third quarter of fiscal year 2023 when compared to the prior corresponding period. Moving forward, we see quality defensive attributes in Endeavour’s retail channel.

HOLD RECOMMENDATIONS

HOLD – APA Group (APA)

This energy infrastructure heavyweight has recently underperformed major peers. In our view, the company is undervalued. However, rising costs and regulatory risks remain. Following a spate of takeovers in recent years, Australian investors have been left with limited large-scale listed infrastructure options. The stability of APA’s end-user demand remains attractive.

HOLD – Select Harvests (SHV)

The almond producer reported a net loss after tax of $96.2 million for the first half of fiscal year 2023. The result was impacted by La Nina weather patterns affecting crop production in 2022 and 2023. It appears the weather and almond price outlooks are improving. But SHV is vulnerable to any further negative events and news.

SELL RECOMMENDATIONS

SELL – Megaport (MP1)

Megaport provides elastic interconnection services. The company expects normalised EBITDA to be above market consensus. MP1 is expecting normalised EBITDA to range between $16 million and $18 million in fiscal year 2023 and between $41 million and $46 million in fiscal year 2024. The share price has risen from $3.96 on March 29 to trade at $7.01 on June 29. We believe the share price has been overdone, so investors may want to consider taking a profit.

SELL – Panoramic Resources (PAN)

PAN owns the Savannah nickel project in the East Kimberley region of Western Australia. The company has experienced interruptions at the Savannah project due to repairs on a processing circuit. Any further production issues or commodity price weakness would come at a difficult time for PAN, as it’s now required to make debt repayments. The shares have fallen from 16 cents on March 23 to trade at 9.2 cents on June 29.

Philippe Bui, Medallion Financial Group

BUY RECOMMENDATIONS

BUY – Boss Energy (BOE)

This company is one of our preferred exposures to the uranium space. BOE owns and operates the Honeymoon uranium project in South Australia. The mine is set to resume production in the December 2023 quarter. The uranium price has been steadily increasing, as supply is tight after a decade of low investment.

BUY – Johns Lyng Group (JLG)

This building services group operates in the restoration space in Australia and the US. A recent company update revealed the restoration services business was outperforming, while commercial construction was underperforming. Management was positive about the volume of work in hand for fiscal year 2024. We’re comfortable about the company’s outlook.

HOLD RECOMMENDATIONS

HOLD – Pilbara Minerals (PLS)

Pilbara Minerals is the biggest ASX-listed lithium miner. After a tumultuous first six months, the lithium price seems to have bottomed in late April. Although the share price is volatile, PLS has high quality assets, with a long mine life. In March, It paid a maiden fully franked dividend of 11 cents a share ahead of schedule. On a payout ratio of 30 per cent of free cash flow, there’s room for this to grow over time, in our opinion.

HOLD – PolyNovo (PNV)

PNV is a dermal regeneration solutions company. Total unaudited revenue of $59.1 million for the 11 months to May 31 is up 54.5 per cent on the same time last year. We don’t regard the stock as cheap, but it trades on a much more attractive valuation than it has in the past.

SELL RECOMMENDATIONS

SELL – Breville Group (BRG)

The broader retail space is a tough operating environment for a number of ASX-listed businesses. Elevated cost pressures have continued to impact margins. BRG is a kitchen appliance company. It re-affirmed guidance in May. But BRG was recently trading on a price/earnings multiple of about 25 times, which we consider too high at this stage of an economic cycle that includes higher interest rates. The shares have fallen from $23.31 on February 2 to close at $19.97 on June 29.

SELL – Omni Bridgeway (OBL)

The company provides dispute and litigation finance and recovery across markets. The group reported a net loss after tax of $30.1 million in the first half of fiscal year 2023, down $21.4 million from the previous corresponding period. The company hasn’t paid dividends for two years. The share price has been pressured down since its half year result. The stock has fallen from $3.88 on February 22 to close at $2.67 on June 29.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.