John Athanasiou, Red Leaf Securities

BUY RECOMMENDATIONS

Hazer Group (HZR)

The company utilises iron ore in the process of converting natural gas and methane into hydrogen. The company is commercialising the process. It considers clean hydrogen to be a key fuel in the transition to a low carbon economy. HZR is the only pure play hydrogen company listed on the ASX. The shares have risen from 79 cents on January 4 to close at $1.11 on March 25. We consider HZR a speculative buy for those with an appetite for risk.

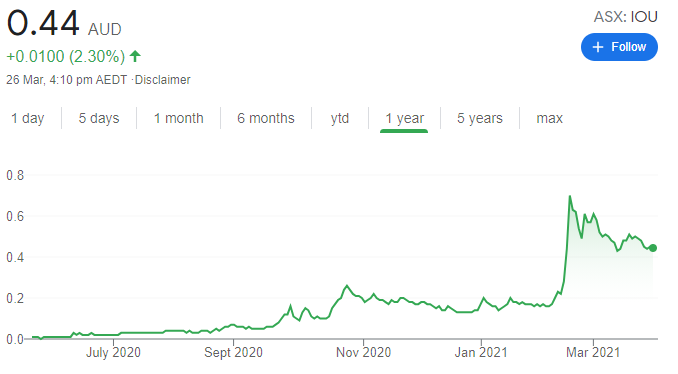

IOUpay (IOU)

This financial technology and digital commerce software company is targeting customers in South East Asia. IOU’s platform enables mobile banking, authentication and payment services. Customers include major Malaysian banks and leading corporate telecommunication companies in Indonesia. We like its growth potential in a relatively untapped buy now, pay later market.

HOLD RECOMMENDATIONS

Lovisa Holdings (LOV)

This specialist fast fashion jewellery retailer offers a strong business with solid margins. It has more than 400 stores across the globe. The company’s performance is reflected in a strong share price. The company could be re-valued even higher. We retain a hold recommendation until we see the results of global expansion plans.

Flight Centre Travel Group (FLT)

Flight Centre is focusing more on online retailing and cost cutting, leaving the global travel agency in a potentially stronger financial position post the pandemic. The company is exposed to international travel restrictions. We will re-examine our recommendation when a clearer picture emerges about the outlook for global international travel.

SELL RECOMMENDATIONS

REA Group (REA)

This online property advertising company is among our preferred stocks on the ASX. REA is a market leader and generates attractive margins. However, REA appears almost fully priced, in our view. Investors may want to consider taking some profits while the property market remains hot. The shares finished at $138.22 on March 25.

Treasury Wine Estates (TWE)

Re-directing wine sales from China to other international markets, including the US, pleasantly surprised Australian investors. The challenge in the US is to retain margins. A fiercely competitive US wine market pressures prices. In our view, better growth opportunities exist elsewhere.

Thomas Wegner, Marcus Today

BUY RECOMMENDATIONS

oOh!media (OML)

Revenue in this outdoor media company’s key formats has recovered strongly. First quarter revenue in calendar year 2021 was recently pacing at 80 per cent of the corresponding period in 2019. Risk is to the upside as vaccines and managing COVID-19 opens up markets weighed down by the pandemic. The company appears well positioned to capitalise on the out-of-home advertising recovery.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Macquarie Group (MQG)

This diversified financial services group updated guidance in February after extreme weather conditions in North America lifted short term client demand for Macquarie’s services. The company expects an increase in full year profit of between 5 per cent and 10 per cent for the year ending March 31, 2021. This positive outlook is encouraging as Macquarie is usually conservative.

HOLD RECOMMENDATIONS

Woodside Petroleum (WPL)

The energy giant delivered record full year production of 100.3 million barrels of oil equivalent at a low cost base in fiscal year 2020. But strong production outcomes weren’t enough to offset impairments and a lower dividend. The company is well positioned to benefit from higher oil prices anticipated in fiscal year 2021.

REA Group (REA)

This digital advertising company specialising in property delivered a net profit of $172.1 million in the first half of fiscal year 2021, up 13 per cent on the prior corresponding period. EBITDA of $290.2 million represented a 9 per cent increase that was ahead of consensus. The interim dividend of 59 cents was up 7 per cent. We expect an increase in listing volumes on the back of an already strong and improving residential cycle.

SELL RECOMMENDATIONS

The A2 Milk Company (A2M)

First half results for this infant formula company missed market expectations. Revenue guidance was downgraded given a slower than anticipated recovery in the daigou/re-seller channel. The outlook for fiscal year 2021 relies on a significant improvement in the daigou/re-seller channel. We believe any material improvement in the near term is unlikely.

Service Stream (SSM)

Service Stream provides network services to the telecommunications and utility sectors. First half 2021 results missed consensus estimates. Group revenue of $409.9 million was down 17.7 per cent on the prior corresponding period. Statutory net profit after tax of $16.2 million represented a fall of 40.5 per cent. Margins were weaker, and the company expects second half results to be about in line with the first six months.

Peter Day, Sequoia Wealth Management

BUY RECOMMENDATIONS

Telstra (TLS)

This telecommunications giant has good subscriber growth, a strong mobile services brand and an attractive valuation. Key catalysts for the stock include cost savings in fixed broadband and continuing gains in mobile subscribers, noting this segment contributes more than 50 per cent of forecast earnings. As the shares are trading substantially below our revised price target, we have upgraded our recommendation from accumulate to buy.

Whispir (WSP)

This software-as-a-service company provides a communications workflow platform that automates interactions between people and organisations. The company recently raised more than $45 million at $3.75 a share via a placement and share purchase plan. Proceeds will go towards accelerating the company’s product roadmap, driving new and existing customer growth in Australia, New Zealand and Asia and market expansion in North America. The company is aiming to generate between 25 per cent and 30 per cent of revenue in the US by the end of 2023.

HOLD RECOMMENDATIONS

Westpac Bank (WBC)

WBC has combined its consumer and business divisions. The combined division will simplify banking and help to reduce costs by consolidating support functions. This initiative should enable more efficient use of common assets, such as branches and call centres. According to our analysis, the new division will account for about 70 per cent of group earnings.

Treasury Wine Estates (TWE)

TWE has agreed to a long term deal with US wine producer The Wine Group. Under the terms, TWE has licensed Beringer Main & Vine, Beringer Founders’ Estate, Coastal Estates and Meridian brands to sold in the Americas in return for about $A100 million. We have reduced TWE from accumulate to hold following a solid share price rise since its interim result in February.

SELL RECOMMENDATIONS

Boral (BLD)

The first half 2021 result for this building products maker was impacted by COVID-19 and bushfires. We have downgraded our recommendation from hold to lighten, as we believe the $300 million earnings improvement target seems too ambitious amid what appears to be a stretched valuation.

Auswide Bank (ABA)

ABA’s share price has almost doubled in the past 12 months. In our view, the company’s earnings have benefited from a rebounding Queensland economy, record low interest rates driving higher residential property prices and the First Home Loan Deposit Scheme. Conditions are good, but we think it’s time for investors to consider taking some profits.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.