Tony Paterno, Ord Minnett

BUY RECOMMENDATIONS

BUY – Endeavour Group (EDV)

The company operates liquor outlets, hotels and gaming facilities. Group net profit after tax of $529 million beat our estimates by 3 per cent, and was largely driven by stronger-than-expected operating profit margins in the hotels segment. We think liquor demand is defensive relative to discretionary retailing categories, such as household goods and fashion. We expect demand for liquor to be underpinned by population growth.

BUY – Westpac Banking Corporation (WBC)

We expect WBC to increase home loans in line with the market at around 3.5 per cent a year. Investments to automate processes and in additional staff are helping Westpac approve loans more quickly. Based on a 70 per cent payout ratio, WBC’s recent dividend yield above 6 per cent is attractive. If earnings prove weaker than our forecasts, the bank can also use its surplus capital to support dividends.

HOLD RECOMMENDATIONS

HOLD – Charter Hall Long Wale REIT (CLW)

CLW is an Australian real estate investment trust. CLW’s fiscal year 2023 result was in line with expectations. But we believe there is downside risk to operating earnings per security in fiscal year 2024 given potential assets sales. Gearing remains within debt covenants, but we expect CLW to make divestments in fiscal year 2024 to retain current gearing levels. The company has a diversified portfolio with blue chip tenants.

HOLD – Commonwealth Bank of Australia (CBA)

The bank posted a record net profit after tax of $10.2 billion in fiscal year 2023. Bad debts, which include provisions for future losses, are still well below normal levels at 0.12 per cent of loans. Full year dividends of $4.50 a share increased 17 per cent on the prior year. The outlook for dividend growth remains positive, in our view. The bank is sitting on $3.1 billion in surplus capital above the top end of its target range.

SELL RECOMMENDATIONS

SELL – Premier Investments (PMV)

Premier owns retail conglomerate Just Group. Brands include Smiggle, Just Jeans, Peter Alexander and Portmans, among others. The company’s shares have risen from $21.75 on August 18 to trade at $25.06 on August 24. The shares are trading at a premium to our intrinsic valuation, which we believe reflects the market’s more positive outlook on consumer demand. Investors may want to consider cashing in some gains.

SELL – QBE Insurance Group (QBE)

The insurance giant recently revealed higher catastrophe claims. But they were offset by higher premiums and investment income. We remain cautious about increasing exposure to North American crop insurance, which could potentially pressure earnings. The full year allowance for catastrophe costs has increased from $US1.18 billion to $US1.33 billion.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Tony Locantro, Alto Capital

BUY RECOMMENDATIONS

BUY – Mayfield Group Holdings (MYG)

Mayfield provides electrical and telecommunication solutions across Australia’s power infrastructure. The company recently declared a fully franked dividend of 1 cent a share due to a strong financial performance, no debt and an extensive order pipeline. The latest dividend was on top of the fully franked 0.71 cent dividend in February. MYG is a speculative stock. The shares were priced at 42 cents on August 24.

BUY – Red Metal (RDM)

The company recently announced drilling assays confirmed a new rare earth oxide discovery at its Sybella project near Mt Isa in north-west Queensland. The stock is highly speculative, but offers potentially significant upside on exploration success and the longer term advancement of the Maronan lead-silver-copper-gold project in the Cloncurry region of Queensland.

HOLD RECOMMENDATIONS

HOLD – Stavely Minerals (SVY)

After further target delineation, deep drilling has started on the porphyry target at the Thursday’s Gossan prospect in Victoria. SVY’s valuation is underpinned by the Cayley Lode discovery that hosts 9.3 million tonnes at 1.23 per cent copper, 0.23 grams a tonne of gold and 7.1 grams a tonne of silver. The stock is highly speculative on deep drilling, but offers potential growth through existing resource advancements.

HOLD – Copper Search (CUS)

The company recently announced that drill hole 23PK01 on the Target AC23 within the Peake Project in South Australia has successfully intersected shallow IOCG (iron-oxide-copper, gold) style mineralisation. CUS has a suite of speculative high risk and high reward targets that may deliver upside on exploration success. This stock mostly suits investors with a higher tolerance for this style of exploration.

SELL RECOMMENDATIONS

SELL – JB Hi-Fi (JBH)

The consumer electronics giant recently reported total sales of $9.626 billion in fiscal year 2023, up 4.3 per cent on the prior corresponding period. Group net profit after tax fell 3.7 per cent to $524.6 million. The company lifted sales in its New Zealand operations to $NZ292.1 million, up 11.3 per cent on the prior corresponding period. With consumer spending expected to slow and cost of living pressures intensifying through higher interest rates, JBH provides an opportunity to lock in profits.

SELL – Collins Foods (CKF)

The KFC and Taco Bell operator posted revenue of $1.3495 billion in fiscal year 2023, an increase of 14.2 per cent on the prior corresponding period. KFC Australia posted revenue of more than $1 billion for the first time. KFC Europe revenue of $249.5 million was up 31 per cent. Taco Bell’s same store sales declined by 4.8 per cent. The overall solid financial performance and share price growth provides a profit taking opportunity.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2023.

We’re giving away this valuable research for FREE.

Click below to secure your copy

John Athanasiou, Red Leaf Securities

BUY RECOMMENDATIONS

BUY – Viva Energy Group (VEA)

The energy company supplies about 25 per cent of Australia’s liquid fuel requirements. The company lifted fuel sales by 11 per cent in the half year ending June 30, 2023. The company is working towards completing the acquisition of the OTR Group by the end of 2023. Viva also owns the Coles Express network. The OTR Group generates much more revenue than Coles Express. Viva offers impressive management.

BUY – Paladin Energy (PDN)

Uranium is starting to become a politically acceptable part of the global energy mix. Federal Opposition calls to include nuclear power in Australia’s future energy mix have again put uranium on the national agenda. Paladin holds a 75 per cent interest in the Langer Heinrich mine in Namibia. First volumes are targeted to resume in the first quarter of calendar 2024. The share price has been trending up since May. Paladin offers a brighter outlook.

HOLD RECOMMENDATIONS

HOLD – DroneShield (DRO)

The company provides artificial intelligence based platforms for protection against threats, such as drones and autonomous systems. DroneShield was recently awarded a $33 million contract from a US Government agency. Management has proven its ability to win significant contracts.

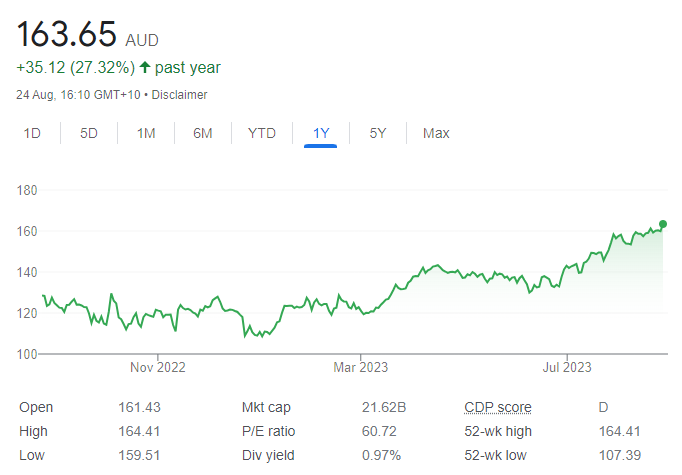

HOLD – REA Group (REA)

REA is a global digital business specialising in property. Group revenue of $1.183 billion grew 1 per cent in fiscal year 2023. REA India revenue of $79 million was up 46 per cent. However, group net profit of $372 million fell 9 per cent. The company’s key Australian residential site attracts an average 12.1 million visitors a month. The company posted a resilient result.

SELL RECOMMENDATIONS

SELL – Cettire (CTT)

Cettire is an online luxury goods retailer. The company posted a statutory net profit after tax of $16 million in fiscal year 2023. Company founder and chief executive Dean Mintz recently sold $100 million worth of CTT stock, but still remains Cettire’s biggest shareholder. The shares have risen from $1.39 on January 4 to close at $2.82 on August 24. Investors may want to consider taking a profit.

SELL – SkyCity Entertainment Group (SKC)

The casino and hotel operator reported revenue from continuing operations of $NZ926.2 million in fiscal year 2023, up 44.9 per cent on the prior corresponding period. Reported net profit after tax was $NZ8 million. We like SKC’s New Zealand assets, but regulatory risks remain in Australia in relation to unresolved proceedings at August 24 involving AUSTRAC, which may result in penalties for the company.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.