Philippe Bui, Medallion Financial Group

BUY RECOMMENDATIONS

XRF Scientific (XRF)

Recent half year results from this equipment and chemicals manufacturer were impressive. Sales revenue of $27.1 million was up 46 per cent on the prior corresponding period. Net profit after tax of $3.7 million was up 34 per cent. The capital equipment part of the business seems to have strong tailwinds heading into fiscal year 2024. Despite share price strength, the business was recently trading on a reasonable price/earnings multiple of 18 times.

Johns Lyng Group (JLG)

This insurance building and restoration services company has forecast an upgrade in revenue guidance of 11.2 per cent for fiscal year 2023. First half 2023 group sales revenue of $635.6 million was up 71.2 per cent on the prior corresponding period. We believe the market is yet to fully price in the significant uptick to full year guidance. Work volumes in the next six months may surprise to the upside.

HOLD RECOMMENDATIONS

PolyNovo (PNV)

A strong entry in new markets helped generate first half 2023 total revenue of $29.5 million, an increase of 62.2 per cent on the prior corresponding period. Relative to its all-time high in December 2020, PNV was recently trading at a steep discount despite a significant revenue increase over the same period. This dermal regeneration solutions company has a strong balance sheet to generate growth initiatives.

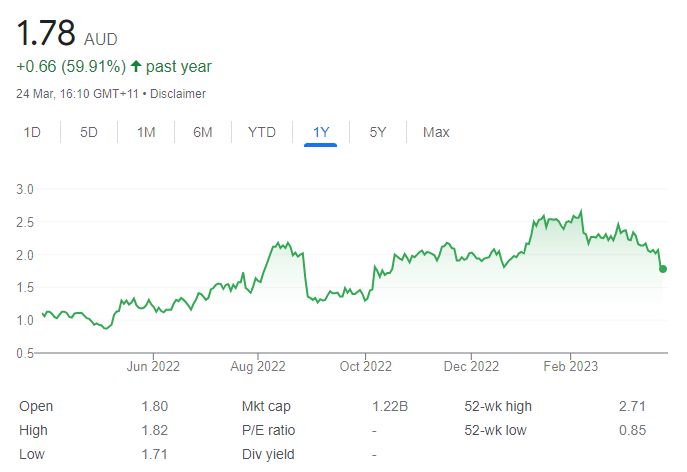

Gratifii (GTI)

This customer engagement technology company has grown substantially in the past 18 months, both organically and via strategic acquisitions. GTI has substantially reduced cash burn. Notwithstanding execution risk, there remains substantial potential at these levels. The shares were trading at 1.7 cents on March 23.

SELL RECOMMENDATIONS

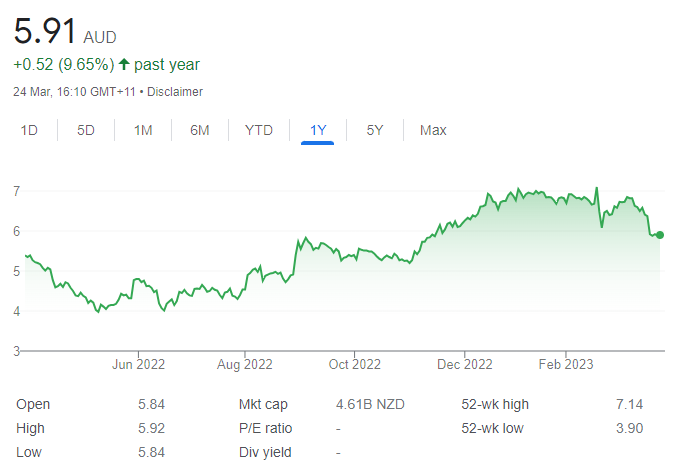

The a2 Milk Company (A2M)

This infant formula company generated group revenue of $NZ783.3 million in the first half of fiscal year 2023, up 18.6 per cent on the prior corresponding period. Revenue growth was driven by sales in China and Asia. Australian and New Zealand sales were down. In our view, the decline in Chinese birth rates continues to impede the value of A2M’s addressable market, which diminished by 12.5 per cent in the first half of fiscal year 2023.

Vulcan Energy Resources (VUL)

The share price of this renewable energy producer has been disappointing. The shares have fallen from $10.22 on March 25, 2022 to trade at $5.63 on March 23, 2023. At this point in the cycle, we prefer lithium producers that generate meaningful revenue.

Top Australian Brokers

- IG – Extensive product array and user-friendly platforms – Read our review

- eToro – market-leading social trading platform – Read our review

- IC Markets – experienced and highly regulated – Read our review

- Quadcode Markets – multi-asset CFD broker – Read our review

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Harrison Massey, Argonaut

BUY RECOMMENDATIONS

Silver Lake Resources (SLR)

The gold producer posted a solid half year result. It reported sales of 115,790 ounces of gold equivalent at a realised gold price of $A2516 an ounce. The company had cash and bullion of $253 million at the end of the half year. The company is poised to take advantage of what we expect will be a stronger gold price in the near term.

Pilbara Minerals (PLS)

Sales revenue of $2.18 billion in the first half of fiscal year 2023 was up 647 per cent on the prior corresponding period. It also declared a maiden fully franked dividend of 11 cents a share. The company produced more than 300,000 dry metric tonnes of spodumene concentrate at an average realised sales price of $US4993 a dry metric tonne. PLS remains an attractive investment in response to strong lithium demand.

HOLD RECOMMENDATIONS

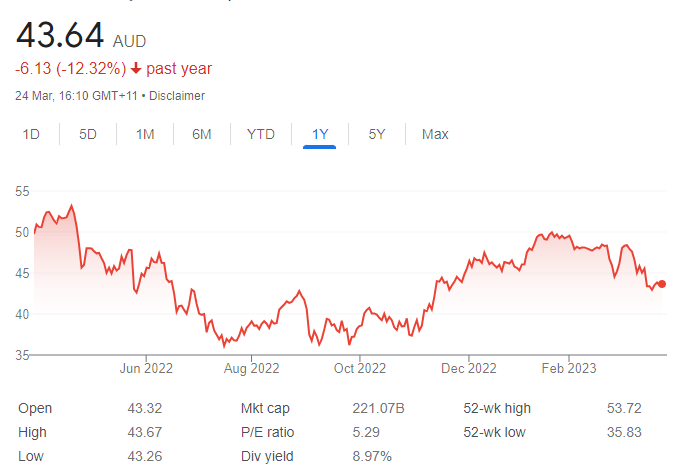

BHP Group (BHP)

The half year result disappointed the market after a 32 per cent fall in profit after tax. This was compounded by a 40 per cent cut in its dividend. The potential unlocking of China’s economy in the near term is likely to lift demand for bulk commodities, such as iron ore. The prospect of acquiring OZ Minerals appears to be a bargain in a market searching for copper exposure.

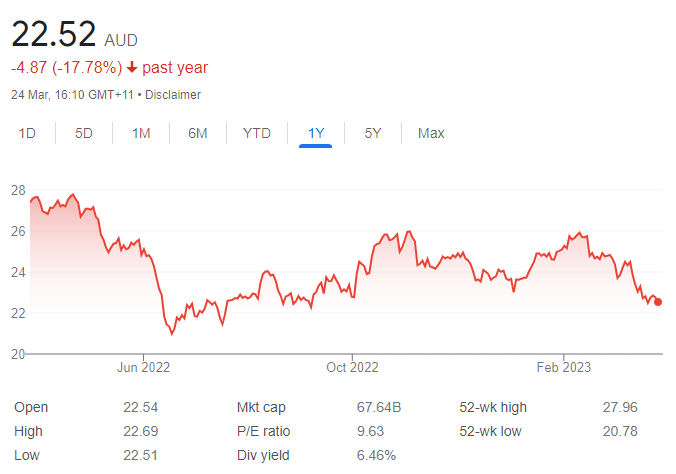

ANZ Group Holdings (ANZ)

The Silicon Valley Bank collapse in the US and the fallout from the likely acquisition of Credit Suisse had a negative impact on the Australian banking sector. Australian banking sector regulations are much more stringent than international banks. ANZ remains in a relatively solid position. Short term expectations of further interest rate rises should benefit the bank’s net interest margin and profits.

SELL RECOMMENDATIONS

Block Inc. (SQ2)

Block is a buy now, pay later operator. A possible global economic slowdown may negatively impact consumer confidence and spending. The share price has risen from $92.40 on January 3 to close at $108.99 on March 23. Investors may want to consider taking a profit.

Coles Group (COL)

Total sales revenue of $20.8 billion in the first half of fiscal year 2023 represented a 3.9 per cent increase on the prior corresponding period. Net profit after tax of $616 million was up 11.4 per cent. The supermarket giant’s profit may be pressured in the second half of the financial year as we expect slowing inflation. Investors may want to consider cashing in some gains.

Christopher Watt, Bell Potter Securities

BUY RECOMMENDATIONS

Pilbara Minerals (PLS)

PLS is one of our preferred lithium plays. It recently announced an inaugural fully franked dividend of 11 cents a share, supported by higher spodumene prices and volumes. Spodumene concentrate production of 309,255 dry metric tonnes in the first half of fiscal year 2023 was up 83 per cent on the prior corresponding period. A surge in revenue saw a big improvement in the company’s cash balance. The company offers a bright outlook.

Life360 Inc. (360)

Life360 provides a market-leading app for families. Features include driving safety and location sharing. The company has more than 30 million active users a month and is becoming a dominant brand in the US and internationally. Despite COVID-19 disruptions in 2021 and 2022, Life360 continues to grow its subscriber base.

HOLD RECOMMENDATIONS

Qube Holdings (QUB)

The logistics and infrastructure division was the main contributor to the company’s strong earnings growth in the first half of fiscal year 2023. The company expects the second half to be strong, but softer than the first half due to potentially slower import volumes and the impact from severe weather in New Zealand earlier this year. However, Qube remains an expensive stock, in our view.

Lendlease Group (LLC)

LLC is a global integrated real estate group. LLC has a big development pipeline of more than $121 billion. In our view, uncertainty remains into fiscal year 2024, but even a conservative approach to the numbers indicates the stock is trading at a significant discount.

SELL RECOMMENDATIONS

Harvey Norman Holdings (HVN)

The retail giant’s first half 2023 profit before tax was 14 per cent below consensus estimates. We expect demand for consumer goods to soften in line with lower household savings and higher interest rates. The shares have fallen from $4.50 on January 30 to trade at $3.715 on March 23.

Scentre Group (SCG)

The shopping centre giant owns and operates 42 Westfield Living Centres across Australia and New Zealand. We remain bearish on the outlook for bricks and mortar retail, and view the rise of e-commerce as a permanent trend in a post COVID-19 world. Exposure to the performance of its retailer tenants ultimately influences rent levels and portfolio occupancy.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.