Arthur Garipoli, Seneca Financial Solutions

BUY RECOMMENDATIONS

BUY – James Bay Minerals (JBY)

This recently listed lithium explorer holds a 100 per cent interest in prospective lithium projects within the James Bay region of Quebec in Canada. The area covers 224 square kilometres. Also, the company is focusing on an extensive exploration program in the highly prospective La Grande sub province. With an experienced management team and quality neighbours, we believe the possibility of exploration success is potentially high. JBY is more suited to the higher risk investor.

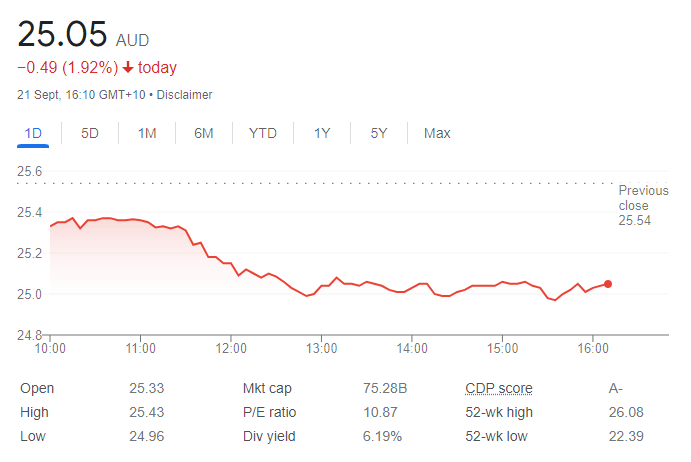

BUY – Viva Energy Group (VEA)

The share price of this petroleum distributor and operator of Coles Express has been weaker recently amid a major shareholder Vitol Investment Partnership selling a 16 per cent stake in VEA. Vitol Investment Partnership remains the biggest shareholder in Viva Energy and has indicated it doesn’t intend to sell any further stake in VEA in the short to medium term. The share price fall provides long term investors with a buying opportunity in a high quality business seeking growth. The historical fully franked dividend yield is about 7.55 per cent.

HOLD RECOMMENDATIONS

HOLD – Johns Lyng Group (JLG)

This company operates in the insurance building and restoration space in Australia and the US. The company recently reported results ahead of expectations. The company posted a net profit after tax of $62.8 million in fiscal year 2023, up 64.3 per cent on the prior corresponding period. The company also reported strong cash flows and improving margins. The balance sheet is strong and net cash has increased substantially on the prior corresponding period.

HOLD – Sims Limited (SGM)

The metals recycler reported statutory net profit after tax of $181.1 million in fiscal year 2023, a fall of 69.8 per cent on the prior corresponding period. Sims released a trading update recently, noting challenging conditions are continuing. It expects 2024 first quarter earnings before interest and tax to be approximately breakeven. Short term headwinds are likely to persist, but we expect stronger market dynamics moving forward.

SELL RECOMMENDATIONS

SELL – Chalice Mining (CHN)

Chalice Mining is a green metals explorer and developer. The company recently released results on a scoping study for its Gonneville nickel-copper and platinum group element project in Western Australia. The findings disappointed the market. The shares have fallen from $5.04 on August 29 to trade at $2.60 on September 21.

SELL – Carsales.com (CAR)

The share price has risen from the $23.86 on July 3 to trade at $29.29 on September 21. Private and dealer listings continue to remain strong, and the company has enjoyed a solid start in the new financial year. However, at these price levels, it may be time to consider taking some profits.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Jed Richards, Shaw and Partners

BUY RECOMMENDATIONS

BUY – ANZ Group Holdings (ANZ)

The Australian Competition and Consumer Commission (ACCC) has rejected ANZ’s bid of $4.9 billion to acquire Suncorp Group’s banking arm on the basis it would likely reduce lending competition. The ANZ is seeking a review of the decision from the Australian Competition Tribunal (ACT). We see scope for a buyback if the ACT upholds the decision by the ACCC.

BUY – ResMed (RMD)

RMD makes medical devices to treat sleep disordered breathing. The shares were sold off following its fiscal year 2023 result, which showed lower margins. Investors appear concerned about the early success of obesity medicines reducing the need for sleep apnoea products. We believe this risk has been more than priced into the stock. Consequently, we believe RMD provides a buying opportunity.

HOLD RECOMMENDATIONS

HOLD – Santos (STO)

We expect crude oil prices to continue rising on the back of stronger demand and from Russia and Saudi Arabia extending cuts in oil supplies for the remainder of calendar year 2023. STO has lagged the oil price and sector peers. The company has pieced together an attractive collection of growth assets, which provide a brighter outlook.

HOLD – National Storage REIT (NSR)

This big self-storage provider operates in Australia and New Zealand, with more than 230 centres servicing residential and commercial customers. The company delivered total revenue of $330 million in fiscal year 2023, up 18 per cent on the prior corresponding period. We believe we have reached the peak of the interest rate cycle, which should be positive for NSR.

SELL RECOMMENDATIONS

SELL – James Hardie Industries PLC (JHX)

This building products supplier has been a strong performer in 2023. Despite a significant increase in interest rates, the US housing market has performed better than expected due to a supply shortage that resembles the Australian housing market. JHX shares have risen from $26.12 on January 3 to trade at $42.03 on September 21. We’re trimming our holdings to invest in other opportunities.

SELL – Altium (ALU)

This multinational is an electronics design software company. The company generated revenue of $US263.3 million in fiscal year 2023, an increase of 19.2 per cent on the prior corresponding period. Profit after tax of $US66.3 million was up 19.6 per cent. The share price has risen from $36.88 on August 21 to trade at $43.96 on September 21. We’re trimming our positions in ALU. Investors may want to consider cashing in come gains.

Harrison Massey, Argonaut

BUY RECOMMENDATIONS

BUY – Auteco Minerals (AUT)

AUT recently announced the acquisition of the Green Bay Copper-Gold project in Newfoundland, Canada. The asset has a current resource of 39.2 million tonnes at 1.83 per cent copper and 0.5 grams a tonne of gold. The company has a clear strategy of drilling out this highly prospective asset to add to the existing resource. In our view, the company offers a brighter outlook. I own shares in AUT.

BUY – GR Engineering Services (GNG)

GNG generated revenue of $551.4 million, EBITDA of $44.4 million and an EBITDA margin of 8.1 per cent in fiscal year 2023, which beat analyst forecasts. The company has a strong future pipeline of work, and the current order book includes BHP Group’s $312 million West Musgrave mine project. The company has a history of distributing attractive dividends to shareholders and paid out 19 cents in fiscal year 2023.

HOLD RECOMMENDATIONS

HOLD – Genesis Minerals (GMD)

Genesis recently acquired 100 per cent of St Barbara’s Leonora gold assets. Group ore reserves increased to 3.9 million ounces. A group mineral resource is 15 million ounces. The company aims to produce 300,000 ounces of gold a year within five years. We highly rate company management. The share price has performed strongly since March, but offers solid exposure for investors seeking gold diversification.

HOLD – Wesfarmers (WES)

The industrial conglomerate posted revenue of $43.55 billion in fiscal year 2023, up 18.2 per cent on the prior corresponding period. Net profit after tax of $2.465 billion was up 4.8 per cent. WES expects its lithium business to start producing by 2024, which should provide good upside for long-term holders. The company declared a full year, fully franked dividend of $1.91 a share in fiscal year 2023. We believe WES is worth holding for diversified exposure to the retail sector and future mining operations.

SELL RECOMMENDATIONS

SELL – Qantas Airways (QAN)

Australian Competition and Consumer Commission allegations that Qantas had advertised flights it had already cancelled in 2022 have negatively impacted the company’s reputation and its share price. The ACCC has launched legal proceedings against Qantas. The fallout may be worse than expected for shareholders. The share price has fallen from $6.24 on August 25 to trade at $5.36 on September 21.

SELL – Rio Tinto (RIO)

The global miner’s interim net profit after tax of $US5.117 billion was down 43 per cent on the prior corresponding period. Free cash flow of $US3.769 billion fell 47 per cent. The company retained a solid fully franked dividend of $A2.608. Concerns about Chinese growth levels may negatively impact iron ore prices moving forward. It might be worthwhile taking some profits at these levels.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.