Angus Geddes, Fat Prophets

BUY RECOMMENDATIONS

Domain Holdings Australia (DHG)

Domain’s pending acquisition of real estate campaign management platform Realbase will accelerate its agency solutions strategy and increase market penetration to about 50 per cent of all Australian transactions. This deal delivers value strategically and financially and provides the opportunity for Domain to distribute higher value solutions to customers. The deal is a significant advance in the evolution of the Domain marketplace strategy.

Nexus Minerals (NXM)

Nexus Minerals is enjoying exploration success at its Wallbrook gold project in Western Australia. Assays to date from extensive shallow and deep drilling at its Crusader-Templar prospect have returned high grade gold results. A significant number of assay results are pending, which may result in more success.

HOLD RECOMMENDATIONS

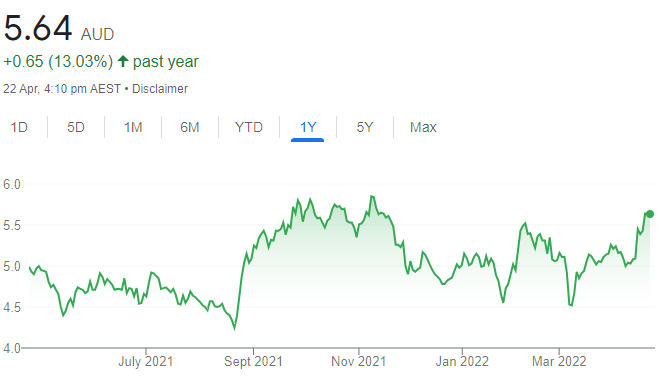

HUB24 (HUB)

HUB24 operates an investment and superannuation platform. It reported solid March quarter growth, delivering platform net inflows of $2.6 billion, up 36.4 per cent on the prior corresponding period. We retain a positive long term view on HUB24’s journey to enlarge its market share.

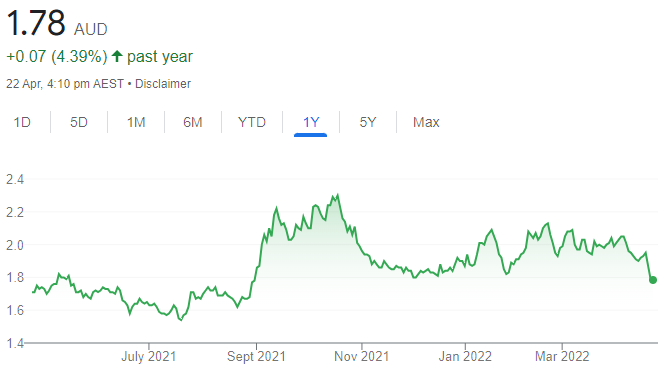

Medusa Mining (MML)

Medusa reported a soft interim result, with operations and a weaker gold price delivering falls in key metrics. The balance sheet lost structural quality, in our view. Medusa has the ground and the financial capacity to lift gold production amid improving its growth profile. Achieving these should be positive catalysts.

SELL RECOMMENDATIONS

ARB Corporation (ARB)

Shares in this 4-wheel drive accessories company have remained under pressure as ARB battles supply chain issues and cost inflation. We question whether ARB can retain attractive margin levels it has enjoyed in Australia and during US expansion, as competition in the US is fierce. Longer term investors may want to consider locking in some gains.

Amcor (AMC)

This global packaging company is well managed. But possible short term challenges include supply chain disruptions, input price volatility and higher labour and transport costs. In our view, these potential challenges may not be fully reflected in the share price. Investors may want to consider taking a profit.

Jean Claude Perrottet, Medallion Financial Group

BUY RECOMMENDATIONS

Xero (XRO)

Xero is a big provider of cloud accounting software, primarily across Australia, New Zealand, the UK and the US. Xero has genearted strong growth since 2006 and now has more than three million subscribers. The company reported operating revenue of $NZ505.7 million in its first half result, an increase of 23 per cent on the prior corresponding period. In our view, the share price offers value as it was recently trading well below its highs.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

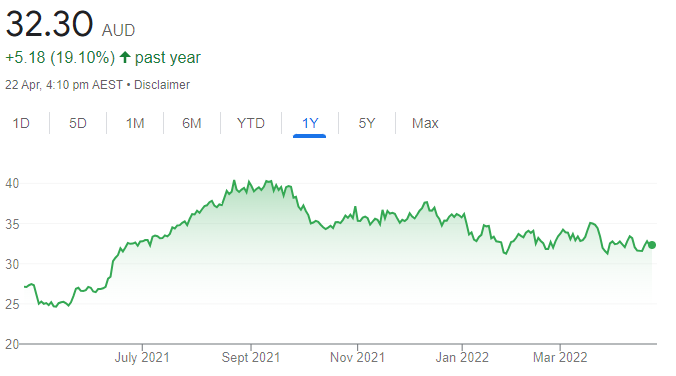

Goodman Group (GMG)

This industrial property group is a quality business, with about $68.2 billion in assets under management. The business has high calibre tenants and an occupancy rate of 98.4 per cent. GMG delivered a strong 2022 first half result, with growth in key metrics. Operating profit of $786.2 million was up 28 per cent on the prior corresponding period. The company has increased earnings per share guidance in fiscal year 2022.

HOLD RECOMMENDATIONS

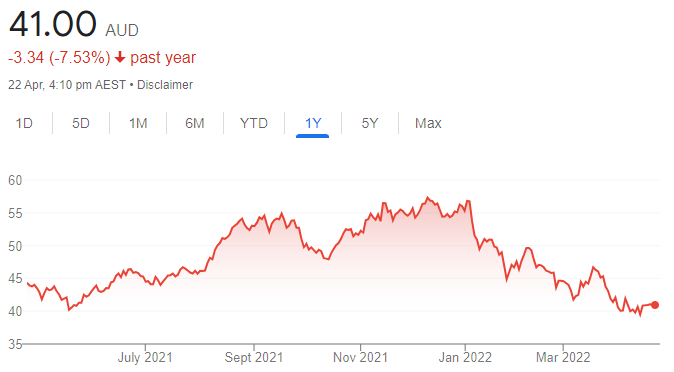

Aristocrat Leisure (ALL)

The gaming company reported revenue of $4.736 billion in fiscal year 2021, up 14.4 per cent in reported terms on the prior corresponding period. EBITDA of $1.542 billion was up 43 per cent in reported terms. A strong recovery in North American gaming operations contributed to the result. We expect digital revenue to grow in future years.

ResMed Inc (RMD)

ResMed provides medical devices and cloud-based software applications that diagnose and treat sleep apnea. The company reported a strong second quarter result, with revenue increasing 12 per cent to $894.9 million. We like the company’s outlook and expect it to generate increasing sales in full year 2022.

SELL RECOMMENDATIONS

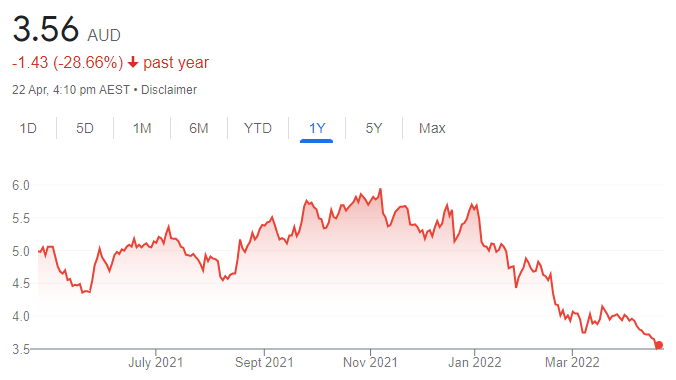

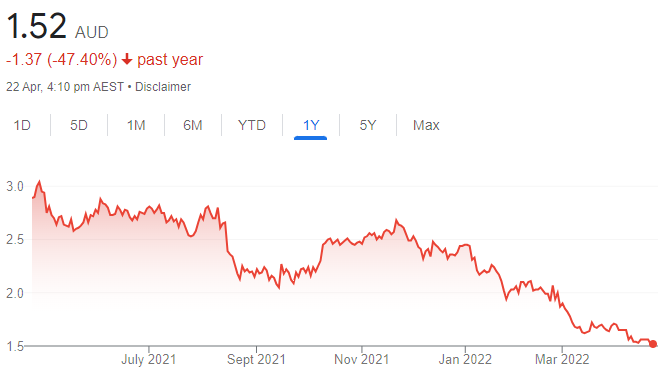

Appen (APX)

The share price of this language technology and artificial data services company has fallen from $40.08 on August 17, 2020 to trade at $6.69 on April 21, 2022. Its full year 2021 underlying net profit after tax was below forecasts in response to slower growth in the new markets business. Other stocks offer more appealing growth prospects, in our view.

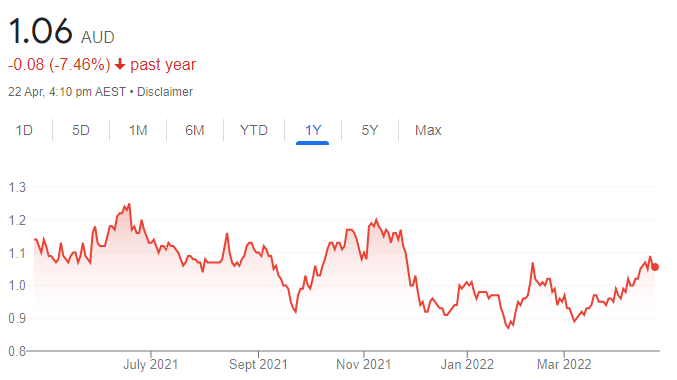

AMP (AMP)

This wealth manager recently confirmed it’s in discussions with multiple parties regarding the potential sale of assets and businesses belonging to its new brand name Collimate Capital. AMP’s share price has risen from 89 cents on March 7 to trade at $1.085 on April 21. Given uncertainy about future plans, we believe better opportunities exist elsewhere.

Christopher Watt, Bell Potter Securities

BUY RECOMMENDATIONS

Accent Group (AX1)

Accent owns an impressive portfolio of footwear businesses, including The Athlete’s Foot, Platypus and Timberland. AX1 continues to build a positive point of difference across its broad retail landscape. The company has more than 500 stores and more than 20 online platforms. It pays fully franked dividends. The stock looks attractive given recent levels of price weakness.

James Hardie Industries PLC (JHX)

This building products company has a dominant share of the US fibre cement market amid immense exposure to the attractive US housing market. Strong pricing power enables the company to pass on increasing manufacturing costs, which protects profitability.

HOLD RECOMMENDATIONS

Qantas Airways (QAN)

The outlook for Qantas continues to improve, although uncertainty remains as to when international travel will return to pre-pandemic levels. We retain a hold recommendation until a clearer picture emerges as to how rapidly travel demand recovers in line with international borders continuing to open.

Alumina (AWC)

Alumina’s main asset is a 40 per cent interest in Alcoa World Alumina and Chemicals (AWAC) – the world’s largest producer of alumina and a relatively low cost aluminium producer. Continuing global economic growth drives demand for Alumina. Electric transport is increasing demand for aluminium. The stock offers an attractive dividend yield.

SELL RECOMMENDATIONS

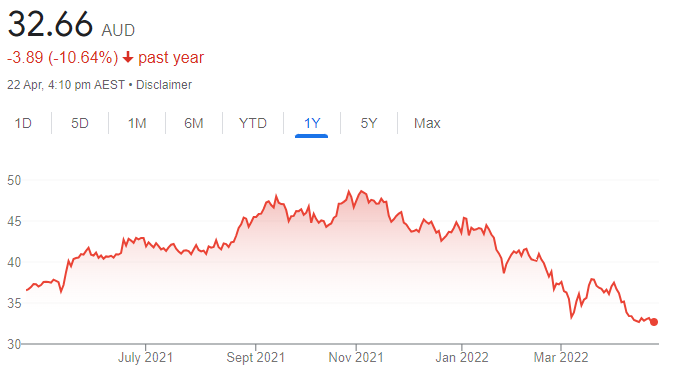

Platinum Asset Management (PTM)

The global fund manager experienced net outflows of about $222 million in March 2022. Recent underperformance relative to global indices has been a key driver. In our view, Platinum continues to struggle among its peers in terms of fund performance and fund flows.

Nanosonics (NAN)

The company’s trophon device provides high disinfection levels of ultrasound probes used in semi critical procedures. NAN enjoys substantial market share in the US, Australia and New Zealand, so it faces challenges to generate more growth. Also, in our view, the stock appears expensive at recent levels.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.