Arthur Garipoli, Seneca Financial Solutions

BUY RECOMMENDATIONS

ResMed Inc (RMD)

This manufacturer of medical devices for respiratory disorders recently reported results that beat market expectations. Revenue of $US1.0337 billion for the three months ending on December 31, 2022 was up 16 per cent on the prior corresponding period. We retain a positive view on RMD given an improving supply chain. It will enable RMD to meet additional demand for respiratory units, leading to revenue growth.

Deterra Royalties (DRR)

Deterra holds a 1.232 per cent royalty in BHP Group’s Mining Area C (MAC) involving iron ore operations in the Pilbara region of Western Australia. It gives DRR price and volume exposure to a world class asset without taking on mining risk. The company’s first half result showed production growth at BHP’s flagship asset. We believe the stock is undervalued due to the quality of the asset, its discount to peers and providing investors with a forecast fully franked dividend yield of 6.6 per cent.

HOLD RECOMMENDATIONS

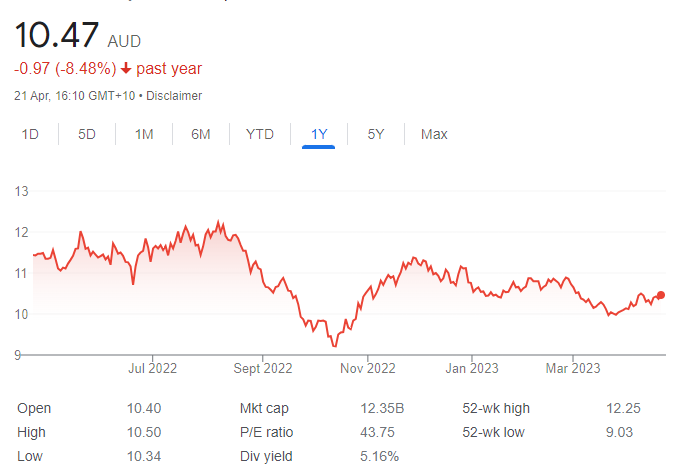

APA Group (APA)

The company’s transmission pipelines connect about 1.4 million Australian homes and businesses to natural gas. The stock exhibits defensive characteristics as earnings are mostly contracted and regulated. It can pass on inflation protected price increases to customers. The company has a good track record of growing dividends over time.

NextDC (NXT)

This data centre operator’s recent contract wins have increased company contracted utilisation by 35.9 megawatts (MW) since December 31, 2022 to 120MW. The company’s new S3 data centre has benefited the most and is now at 46 per cent of total planned capacity. NXT has lifted contracted MW above forecasts. We expect more deals in the future.

SELL RECOMMENDATIONS

29Metals (29M)

An extreme rainfall event in early March has suspended operations at the Capricorn copper mine, which will impact production. The company reported a statutory loss after tax of $47 million in the 12 months to December 31, 2022. In our view, the company will need copper prices to remain elevated to return to profit.

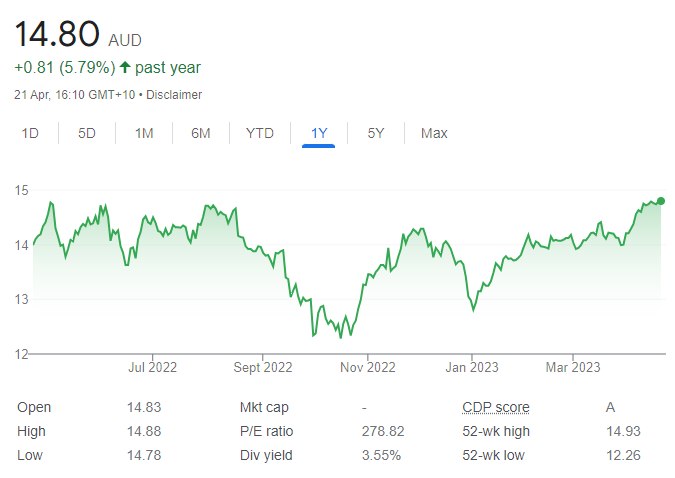

Transurban Group (TCL)

The share price of this toll road operator has risen from $13.99 on March 28 to close at $14.79 on April 20. The share price appears fully valued, in our view. There was no franking attached to the last dividend. The stock was recently trading on a modest annual dividend yield of 3.55 per cent. Investors may want to consider locking in some profits.

Top Australian Brokers

- IG – Extensive product array and user-friendly platforms – Read our review

- eToro – market-leading social trading platform – Read our review

- IC Markets – experienced and highly regulated – Read our review

- Quadcode Markets – multi-asset CFD broker – Read our review

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

John Athanasiou, Red Leaf Securities

BUY RECOMMENDATIONS

Adelong Gold (ADG)

ADG announced that assay results from an exploratory drilling program in October 2022 show potential for major deposits at Gibraltar. A drilling program started in March 2023 to better define mineralisation at Gibraltar. Results from the latest Gibraltar drilling are expected in coming weeks. Arranging finance to resume production is realistic given a strong gold price and encouraging drilling results. This speculative stock is more suited to investors with an appetite for risk.

Lightning Minerals (L1M)

This lithium explorer has tenements near Liontown Resources (LTR) and Essential Metals (ESS). This is positive, in our view. Also, iron ore giant Fortescue Metals Group (FMG) is a shareholder in this lithium hopeful. L1M will start a comprehensive drilling campaign soon. This speculative stock was priced at 16.5 cents on April 20. We consider L1M a high risk, high reward play.

HOLD RECOMMENDATIONS

Domino’s Pizza Enterprises (DMP)

The global pizza giant has raised prices in response to inflation. Management is confident it can grow order volumes, sales and earnings in the second half of fiscal year 2023. Investors may want to consider holding to see if management can deliver on its outlook. The company increased its store network by 11 per cent in the first half of fiscal year 2023.

The Star Entertainment Group (SGR)

The group’s recent update revealed a significant and rapid deterioration in operating conditions at its Sydney and Gold Coast casinos. The group says the deterioration was largely driven by the compounding impact of regulatory operating restrictions and exclusions, and by an emerging weakness in discretionary consumer spending. The share price has been punished in the past 12 months. Investors may want to consider holding to see if the company’s share price can recover. Or, sell on fears of a possibly weaker performance moving forward.

SELL RECOMMENDATIONS

Corporate Travel Management (CTD)

The company recently won a material contract from the UK Home Office. The share price has performed strongly this calendar year. However, we believe CTD is overvalued, as it was recently trading on a lofty price/earnings multiple of 112 times. In our view, the market has overestimated demand for travel in a period of cost cutting. Investors may want to consider cashing in some gains.

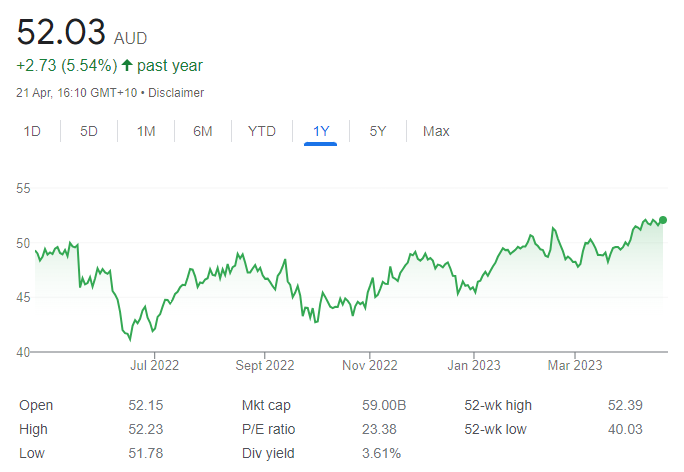

Wesfarmers (WES)

Wesfarmers can be considered one of the better managed retailers, operating iconic Australian brands, such as Officeworks, Bunnings and Kmart. Company managing director Rob Scott recently sold a portion of his Wesfarmers shares for more than $9 million to fund tax obligations. So, we prefer others, as we believe better opportunities exist outside the retail sector.

Damien Shaw, Marcus Today

BUY RECOMMENDATIONS

Beach Energy (BPT)

Third quarter production fell by 5 per cent to 4.5 million barrels of oil equivalent. The decrease can be attributed to planned and unplanned outages. Guidance remains on target. Progress is continuing at the Waitsia gas plant, with first gas targeted by the end of 2023. The company’s balance sheet is robust. We remain optimistic that BPT will achieve its full year production targets, supported by expanding existing projects and a new gas plant.

Karoon Energy (KAR)

The oil and gas producer recently suspended production at its Bauna project in Brazil. Also, the Brazilian Government announced a tax increase on oil exports. These events caused the stock price to marginally slip. In our view, it’s presented a buying opportunity, as KAR offers strong management and high growth potential.

HOLD RECOMMENDATIONS

Tabcorp Holdings (TAH)

The wagering company announced group revenue of $1.275 billion in the first half of fiscal year 2023, an increase of 11 per cent on the prior corresponding period. Total wagering revenue market share was also up on the prior corresponding period. Despite a solid balance sheet, TAH faces heightened online competition.

Wesfarmers (WES)

The company’s investment in the lithium sector presents a positive growth opportunity. Company diversification across several sectors reduces risk. However, uncertain global economic conditions may impact the retail sector. We recommend holding Wesfarmers until more clarity emerges on the outlook for the retail industry.

SELL RECOMMENDATIONS

Evolution Mining (EVN)

EVN is among Australia’s largest publicly listed gold mining companies. A weather event at the Ernest Henry mine will cut gold and copper production in fiscal year 2023. Red Lake production metrics improved, but were below ideal levels, in our view. We believe a gold production target of 800,000 ounces in fiscal year 2024 is too optimistic at this point.

ASX Limited (ASX)

The Australian Securities and Investments Commission (ASIC) is investigating the ASX for suspected contraventions of the ASIC Act 2001 and the Corporations Act 2001 regarding the failed CHESS replacement program. The ASX says it takes its obligations very seriously and will fully co-operate with ASIC. The share price has fallen from $90.52 on August 2, 2022 to trade at $68.96 on April 20, 2023. The ASIC investigation will take time, so we prefer other stocks at this stage.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.