Tim Haselum, Catapult Wealth

BUY RECOMMENDATIONS

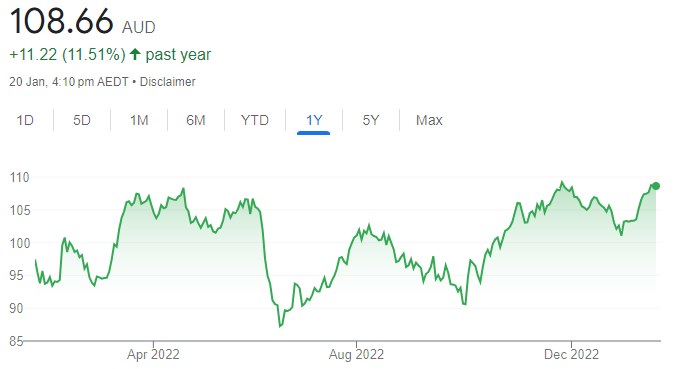

Telstra Group (TLS)

Telstra is the dominant telecommunications player in Australia. Asset sales have reduced debt. It increased its dividend and forecast earnings growth should be met. The company has forecasted total income of between $23 billion and $25 billion in fiscal year 2023. The company is a fierce competitor and we like its outlook.

Woolworths Group (WOW)

Several disruptions and abnormal costs during the past two years appear to be ending. We expect COVID-19 costs to continue falling. The company offers a strong balance sheet. The shares also appeal for their defensive qualities. Any price weakness represents a buying opportunity, in our view.

HOLD RECOMMENDATIONS

Endeavour Group (EDV)

EDV operates liquor outlets, including Dan Murphy’s and BWS. The company has a big portfolio of hotels and operates gaming facilities. The prospect of cashless gaming cards and capped spending limits being introduced into New South Wales is a negative, but any impact should be slow. Retail liquor offers defensive qualities and EDV enjoys a strong market position.

ASX Limited (ASX)

Last year, Australia’s largest securities exchange announced an impairment charge of between $245 million and $255 million for the first half of fiscal year 2023 after abandoning the CHESS replacement project. The pre-tax charge will have no impact on dividends. This ASX decision reduces uncertainty, so we expect it to be a net positive moving forward.

SELL RECOMMENDATIONS

Commonwealth Bank of Australia (CBA)

Bad loans remain low and the bank appears on track to meet consensus forecasts. My concern is the CBA trades at a significant premium compared to the other big banks. In my view, CBA’s return on equity doesn’t justify the lofty premium. Investors may want to consider reducing their holdings on share price strength.

Santos (STO)

Brent crude oil prices appear to be trending down. Russia is sending more crude oil produced in the Arctic region to India and China, so we believe crude oil concerns about sufficient supplies will fade as investors focus more on fears of a possible economic slowdown overseas. Santos has been a strong performer this calendar year, so investors may want to consider cashing in some gains by trimming their holdings.

Braden Gardiner, Tradethestructure

BUY RECOMMENDATIONS

OM Holdings (OMH)

OMH is a manganese and silicon smelting company. The share price moved lower for most of calendar year 2022 before finding technical support around 62.5 cents. The price is now starting to hold higher levels, which I expect is the beginning of a new upward trend. The shares closed at 76 cents on January 19. The technical chart looks bullish.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Dreadnought Resources (DRE)

DRE is a multi commodity explorer. Assays recently confirmed Sabre and Y8 rare earth ironstone discoveries at its Mangaroon project in Western Australia. The shares have risen from 4.8 cents on July 1, 2022 to close at 9.3 cents on January 19, 2023. DRE offers a quality management team, so I believe the stock presents a good buying opportunity for those willing to accept risk.

HOLD RECOMMENDATIONS

Evolution Mining (EVN)

The gold mining stock is continuing to benefit from a recent rally in the gold spot price. The share price was recently trading around technical resistance at $3.30, before closing at $3.24 on January 19. The stock isn’t showing any signs of major weakness, although I expect profit taking in the short term. I believe any price retreat represents a buying opportunity before the stock moves higher.

Northern Star Resources (NST)

The share price of this gold producer has risen from $6.81 on July 1, 2022 to close at $12.16 on January 19, 2023. The company sold 404,000 ounces of gold in the 2022 December quarter. Group operations met expectations. The company has completed 42 per cent of its $300 million on-market share buy-back program. I expect the company to perform well.

SELL RECOMMENDATIONS

Cronus Australia (CAU)

This medicinal cannabis company recently announced that physical CDA clinics on the Gold Coast, Sunshine Coast and in Brisbane would close by March 31. The shares fell below the technical support level following the news. I expect a recovery will take time, so it may be prudent to consider selling holdings and look elsewhere for capital growth. The stock closed at 50 cents on January 19.

Core Lithium (CXO)

The share price of this lithium explorer has fallen from $1.86 on November 14, 2022 to close at $1.05 on January 19, 2023. Investors appear concerned that lithium prices may fall in 2023 in response to potentially more supply. CXO breached technical support at $1.70. I expect the share price to remain under pressure, so investors may want to consider cashing in some gains.

Angus Geddes, Fat Prophets

BUY RECOMMENDATIONS

Azure Minerals (AZS)

A global lithium company, via its wholly owned subsidiary SQM Australia, is investing up to $20 million to acquire a 19.9 per cent interest in Azure through a two stage transaction. We believe the investment endorses Azure’s lithium potential at its Andover project. The investment enables exploration to be accelerated amid following up surface readings of high-grade lithium assays in the range of 1.13 per cent to 3.32 per cent.

Treasury Wine Estates (TWE)

The wine giant suffered after China imposed big tariffs on imported Australian wine several years ago. The company has developed new overseas markets and is performing well. Operating margins are improving on the back of premium wine sales enjoying fresh tailwinds. We believe the company offers value as it’s trading at a discount.

HOLD RECOMMENDATIONS

Domino’s Pizza Enterprises (DMP)

The fast food giant recently raised capital to acquire outstanding shares in its German joint venture. The acquisition fits comfortably with its strategic expansion strategy. Germany should offer strong long-term growth. Guidance for fiscal year 2023 was reaffirmed, with store numbers expected to swell to 3,900. Same store sales are expected to increase between 3 per cent and 6 per cent in three to five years.

Nine Entertainment Co. Holdings (NEC)

The media giant lifted group revenue by 15 per cent in fiscal year 2022 when compared to the prior corresponding period. Net profit after tax rose 35 per cent. The company’s diverse assets across traditional and digital media appeal as they offer a wide array of choice to readers and viewers. Brand awareness is strong.

SELL RECOMMENDATIONS

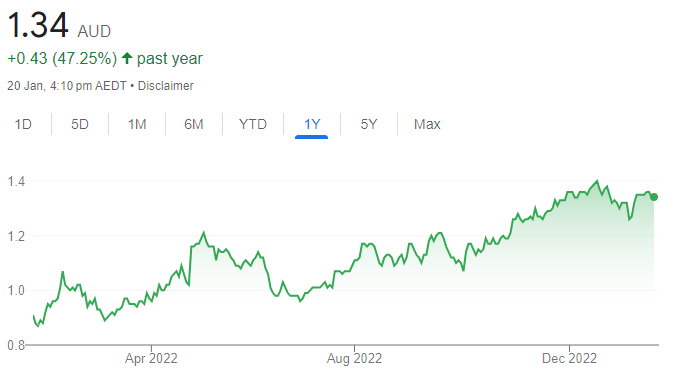

AMP (AMP)

The share price of this wealth manager has risen from $1.065 on October 3, 2022 to trade at $1.352 on January 19, 2023. AMP’s retail banking arm operates in a competitive and margin slim market. As at January 19, 2023, the sale of its Collimate Capital domestic real estate and infrastructure equity business to Dexus may be delayed. Other stocks appeal more in volatile times.

Appen (APX)

The artificial intelligence provider operates in a crowded and fiercely competitive market. In October 2022, APX flagged lower EBITDA and margins for fiscal year 2022. The shares have fallen from $10.29 on January 20, 2022 to trade at $2.635 on January 19, 2023. A share price recovery will take time. We prefer others for capital growth.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.