Niv Dagan, Peak Asset Management

BUY RECOMMENDATIONS

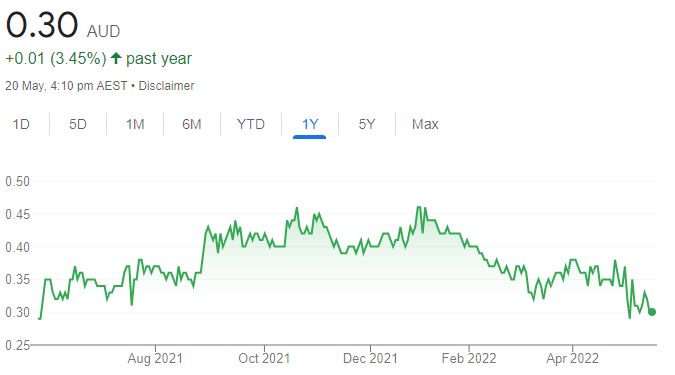

Dotz Nano (DTZ)

The share price of this technology company has fallen from 45.5 cents on January 5 to trade at 29 cents on May 19. Cash burn appears to have spooked investors. DTZ needs to increase operational revenue to build investor confidence. An agreement with Theracell Labs is expected generate at least $5 million in revenue in the first year. Recent prices may be a cheap entry point if DTZ can generate more contracts. Investors can consider DTZ a speculative buy.

Volt Resources (VRC)

The graphite producer’s latest deal with alkaline battery producer Urban Electric Power is a shrewd move. The recent $2 million placement will support VRC’s development strategy in the US and Europe and advance the Bunyu graphite project in Tanzania. VRC is involved in multiple collaborations. In our view, VRC is positioned to become a key battery materials manufacturer in response to increasing demand for electric vehicles. The shares were trading at 2.1 cents on May 19.

HOLD RECOMMENDATIONS

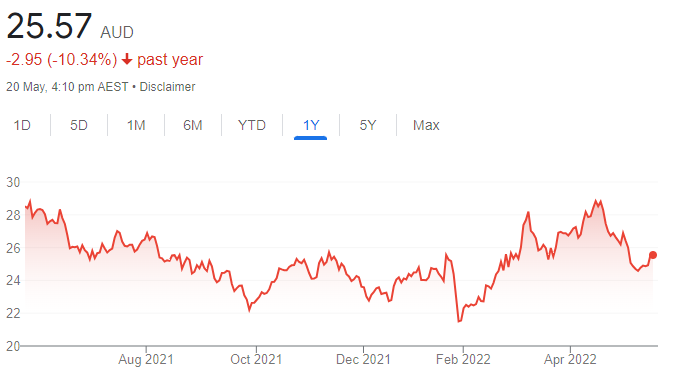

Brambles (BXB)

A company update has advised that private equity firm CVC Capital Partners won’t be lodging a proposal to acquire logistics firm Brambles. Investors may want to consider holding for any potential developments from other parties. The past year has been challenging for BXB due to supply chain constraints and inflationary cost pressures. The company has invested in automation to deliver efficiencies.

Newcrest Mining (NCM)

Newcrest offers investors exposure to the gold price in a volatile market. The company is likely to produce around 2 million ounces of gold a year over the next decade. Cash costs are below the industry average and among the lowest of global gold miners, underpinned by improvements at its Lihir and Cadia assets. Organic growth options include its Havieron prospect, the Red Chris mine and the high grade Wafi-Golpu copper-gold prospect.

SELL RECOMMENDATIONS

Kogan.com (KGN)

The online retailer is up against rising interest rates, supply chain disruptions, increasing competition and inflationary pressures. The share price has fallen from $8.62 on January 4 to trade at $3.56 on May 19. Gross sales and gross profit declined in the 2022 third quarter when compared to the prior corresponding period.

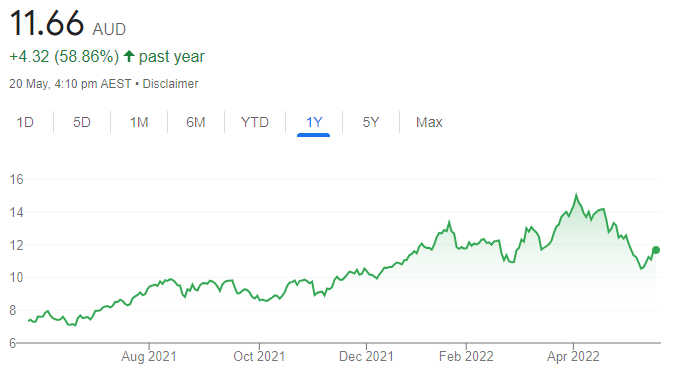

IGO Limited (IGO)

Strong demand for electric vehicles has supported battery metal companies. In our view, progress on making battery grade lithium hydroxide at the Kwinana plant has been too slow. The share price has fallen from $15 on April 4 to trade at $10.955 on May 19. Other stocks offer more appeal, in our opinion.

Braden Gardiner, Tradethestructure.com

BUY RECOMMENDATIONS

Select Harvests (SHV)

This almond producer hit a high of $8.92 on September 6, 2021. It was relentlessly sold down to $5.07 on March 23, 2022 before buyers started providing support. Technically, the $5 level offers major support. The shares were trading at $6.13 on May 19. The company is generating positive momentum, so I expect the share price to move higher from here.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Brainchip Holdings (BRN)

The share price of this global technology company surged from 68 cents on December 31, 2021 to $2.13 on January 19, 2022. Profit takers sent the share price back to 86 cents on April 12, 2022. A recent flurry of increasing volumes has generated excitement in the stock. My technical view is upward price momentum will continue and move the stock to new short term highs. The shares were trading at $1.12 on May 19.

HOLD RECOMMENDATIONS

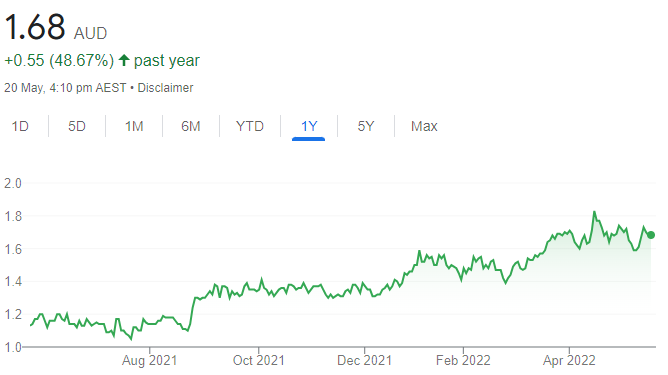

Ridley Corporation (RIC)

This animal nutrition solutions provider doubled its profit in the 2022 first half. I remain bullish on the stock in the short term. Technically, I expect upward momentum to continue and the price to comfortably hold above support at $1.45. The shares were trading at $1.70 on May 19.

Whitehaven Coal (WHC)

The share price of this coal miner and operator has enjoyed a solid run higher in response to increasing demand from Europe amid trade constraints involving China and Russia. The share price may be extended, but I don’t see any reason for profit taking in the near term. The shares may rise from here.

SELL RECOMMENDATIONS

PWR Holdings (PWH)

PWR Holdings provides customised cooling solutions to the global motorsports and wider automotive industries. The share price has fallen from $10.32 on May 3 to trade at $8.24 on May 19. The company appears to be out of favour with investors. The share price may come under more pressure if longer term holders lock in gains.

Genworth Mortgage Insurance Australia (GMA)

The share price moved up from a closing price of $2.18 on January 25 to trade at $3.03 on May 19. I suspect the move higher was on the back of news that GMA was selected as an exclusive lenders mortgage insurance provider for the Commonwealth Bank. In our view, the good news may already be priced into GMA. The share price has struggled to consistently trade above $3.10. Investors may want to consider locking in some gains.

Harrison Massey, Argonaut

BUY RECOMMENDATIONS

De Grey Mining (DEG)

The company’s Mallina gold project in the Pilbara region of Western Australia has a current global resource of 6.8 million ounces. Recent gold discoveries at Diucon and Eagle enhance exploration potential and growth at the deposit. The company is intending to release an upgraded resource update before the end of this financial year. Also, It intends to release a pre-feasibility study before the end of 2022.

Lunnon Metals (LM8)

LM8 owns and operates the Kambalda Nickel Project in the goldfields region of Western Australia. The asset has a pre-existing JORC-compliant nickel resource of 39,000 tonnes at 3.2 per cent nickel, with significant exploration upside. The company recently raised $30 million to acquire the nickel rights for the highly prospective Silver Lake and Fisher nickel deposits, which significantly enhances the resource potential of the company.

HOLD RECOMMENDATIONS

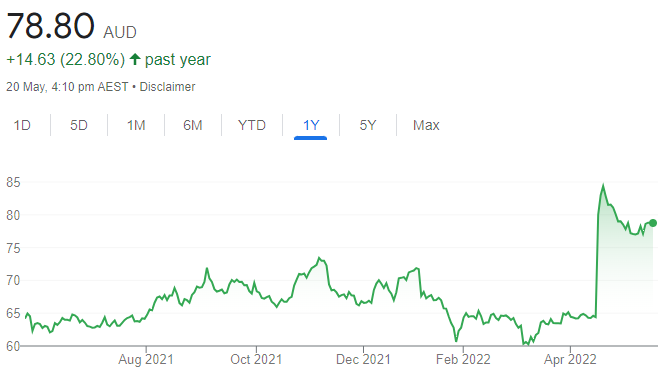

Ramsay Health Care (RHC)

The private hospital operator was impacted by COVID-19 restrictions. Unaudited group net profit after tax of $201.6 million for the nine months to March 31 represented a 38.9 per cent fall on the prior corresponding period. The company has received a non-binding conditional bid from a consortium of investors led by KKR at $88 a share. The shares were trading at $78.68 on May 19.

Coles Group (COL)

Group sales revenue of $9.1 billion in the 2022 third quarter represented a 3.6 per cent increase on the prior corresponding period despite supply chain disruptions. The company’s share price has risen from $15.74 on January 27 to trade at $17.73 on May 19. Investors can consider holding, as investors continue to seek a safe haven in the consumer staples sector.

SELL RECOMMENDATIONS

Flight Centre Travel Group (FLT)

FLT remains one of Australia’s prominent travel retailers. The travel industry has faced significant headwinds since the outbreak of COVID-19 and continues to struggle given uncertainty across the globe. Increasing vaccination rates and easing travel restrictions have led to a stronger FLT share price. But investors may want to consider taking some gains due to ongoing uncertainty surrounding global travel.

Block Inc. (SQ2)

This multinational provider of buy now, pay later services operates in a highly competitive and saturated market. Consumers may cut unnecessary spending in an environment of inflationary pressures, rising interest rates and increasing cost of living expenses. This may lead to downside pressure on the company in the short term.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.