Chris Batchelor, Spotee Connect

BUY RECOMMENDATIONS

Nine Entertainment Co. Holdings (NEC)

Nine’s diversified media business comprises television, newspapers, radio and streaming services. It also owns 55 per cent of real estate advertising business Domain. The company’s diversity leaves it cushioned to the volatile advertising industry. The company appeals, as it’s trading on an undemanding price/earnings ratio and an attractive dividend yield.

Australian Clinical Labs (ACL)

The pathology services provider benefited from providing testing services during the pandemic. COVID-19 revenue grew by 205 per cent in fiscal year 2022, while non-COVID-19 revenue grew by 8 per cent. COVID-19 revenue is expected to decline from here, but this has been factored into expectations. The forward price/earnings ratio and dividend yield paint a bright outlook.

HOLD RECOMMENDATIONS

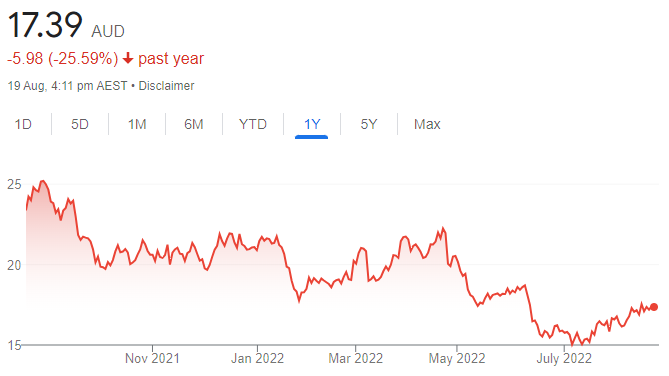

Magellan Financial Group (MFG)

The fund manager experienced net outflows of $2.5 billion in July. It’s been a difficult year, with funds under management significantly declining in the past 12 months. In our view, the company appears cheap on an undemanding forward price/earnings ratio and a recent dividend yield of 12 per cent. We recommend holding until funds under management have clearly stopped declining. The author’s related parties have holdings in MFG.

BlueScope Steel (BSL)

The steelmaker reported net profit after tax of $2.81 billion in fiscal year 2022, a 135 per cent increase on the prior corresponding period. BlueScope generates about half its profits from its US operations. Concerns exist about US steel prices starting to decline amid disruption to Australian energy markets. We suggest holding to see how these factors play out during the next few months.

SELL RECOMMENDATIONS

James Hardie Industries PLC (JHX)

The global building materials supplier recently announced a downgrade in profit expectations for fiscal year 2023. The company is coming under pressure from higher energy, freight and pulp costs, which are crimping margins, according to our analysis. Rising interest rates are likely to impact housing sector demand.

Splitit Payments (SPT)

This buy now, pay later company enables customers to pay for purchases in multiple instalments. The share price has fallen from 51.5 cents on August 19, 2021 to close at 22.5 cents on August 18, 2022. While revenue has been improving, the company reported a loss in full year 2021. The buy now, pay later sector is fiercely competitive. Other stocks appeal more at this time of the cycle.

Peter Day, Sequoia Wealth Management

BUY RECOMMENDATIONS

South32 (S32)

We’re expecting solid full year results to be driven by a strong performance from its coal division. On our forecasts, S32 is expected to generate strong cash flows in the near term, supporting additional shareholder returns and growth. The shares have risen from $3.40 on July 19 to trade at $4.14 on August 18.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Computershare (CPU)

This financial administration company reported management revenue of $2.6 billion in full year 2022, up 12.2 per cent on the corresponding period. Margin income of $186.5 million was up 74.3 per cent. The company has a strong balance sheet. The share price has enjoyed a strong run in the past 12 months. We retain our outperform recommendation.

HOLD RECOMMENDATIONS

Telstra Corporation (TLS)

The communications giant reported total income of $22 billion for full year 2022, down 4.7 per cent on the prior corresponding period. It lifted its final dividend to 8.5 cents a share. It’s the first time the company has increased its dividend in seven years. The company is forecasting total income of between $23 billion and $25 billion in fiscal year 2023.

News Corporation (NWS)

The company lifted its News Media segment EBITDA to $US217 million in fiscal year 2022, up from $US52 million on the prior year. It was helped by growth in digital advertising revenues. Net income for the full year was $US760 million, a 95 per cent increase on the prior year. The company is positioning to lift revenue moving forward. We retain a neutral recommendation at this point.

SELL RECOMMENDATIONS

Bendigo and Adelaide Bank (BEN)

The company reported total income on a cash basis of $1.709.9 billion in fiscal year 2022, a 0.4 per cent rise on the prior corresponding period. Operating expenses of $1.0163 billion were down 1.1 per cent. However, inflationary pressures are building. Given the strong performance to date, BEN’s valuation is stretched, in our view.

Commonwealth Bank of Australia (CBA)

We expect revenue performance to improve in 2023, underpinned by higher interest rates. Medium term headwinds include deposits and mortgage competition. In our view, the company is trading on a lofty premium compared to its history. We struggle with CBA’s valuations. Investors may want to consider taking a profit.

Arthur Garipoli, Seneca

BUY RECOMMENDATIONS

DGL Group (DGL)

The company is involved in chemical manufacturing, warehousing and distribution. Since listing in May 2021, the company has beaten prospectus forecasts and continued to grow aggressively via organic acquisitions. All acquisitions are, or have the potential to be earnings per share accretive, adding growth to the company going forward.

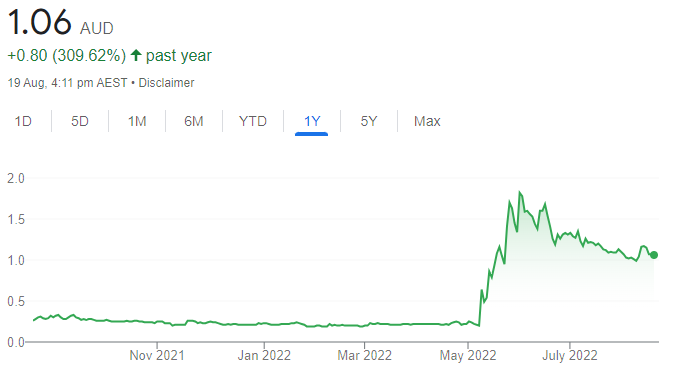

Galileo Mining (GAL)

The base metals explorer has tenements in Western Australia. In early May, GAL announced a significant discovery of palladium and platinum, which has since resulted in a soaring share price. The company recently completed a placement at $1.20 a share, with cornerstone investments from major shareholders Mark Creasy and IGO Limited. We believe the company is set up for an extended, uninterrupted period of drilling, assays and results.

HOLD RECOMMENDATIONS

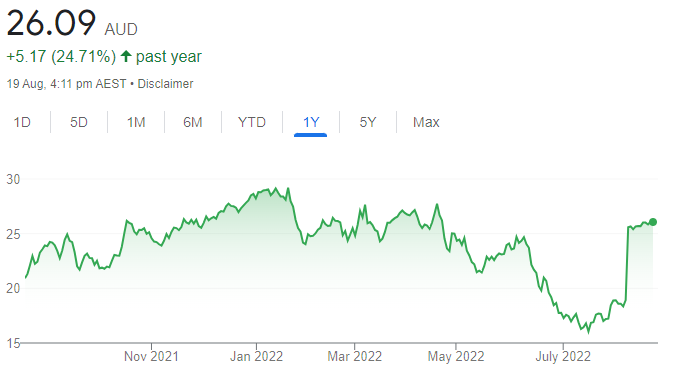

Oz Minerals (OZL)

This copper and nickel company has rejected a conditional and non-binding takeover proposal from BHP Group at $25 a share. The OZL board believes BHP’s proposal significantly undervalues its company. We believe BHP will need to offer a higher price to get this deal over the line. Or, another suitor may emerge and start a bidding war.

CSL (CSL)

The blood products company delivered net profit after tax of $US2.255 billion in fiscal year 2022, down 6 per cent at constant currency on the prior corresponding period. The company is forecasting a higher net profit after tax of between $US2.4 billion and $US2.5 billion at constant currency in fiscal year 2023. We expect CSL should be able to extract synergies from the recent Vifor Pharma acquisition. We’re also seeing an increase in blood plasma collections after challenging times during COVID-19.

SELL RECOMMENDATIONS

Appen (APX)

A challenging operating environment has led this artificial intelligence data provider to downgrade unaudited underlying EBITDA by 69 per cent to $US8.5 million in the 2022 first half. Weaker digital advertising demand and customers reducing their spending contributed to the downgrade. In our view, there’s too much uncertainty regarding advertising spending in the second half.

Commonwealth Bank of Australia (CBA)

Cash earnings of $9.595 billion in fiscal year 2022 were up 11 per cent on the corresponding period and ahead of expectations. Fundamentals and loan volume growth remains robust. There’s scope for a rebound in margins. However, it remains the most expensive bank in the sector, trading on significantly higher price/earnings multiples compared to its peers. The company’s valuation is behind our recommendation.