Chris Batchelor, Spotee Connect

BUY RECOMMENDATIONS

Hansen Technologies (HSN)

HSN design and provide customer information and data management software systems for the utilities, energy and communications sectors. A target is to grow forecast revenue from about $300 million in fiscal year 2022 to $500 million by fiscal year 2025, partially via strategic acquisitions. HSN is highly profitable and was recently trading on an attractive price/earnings multiple of 17 times.

Nick Scali (NCK)

The furniture retailer has a network of stores in Australia and New Zealand. It recently acquired Plush-Think Sofas, lifting its store footprint by 75 per cent. Sales boomed during the pandemic, as people diverted their spending from travel to sprucing up their homes. A recent share price retreat leaves NCK looking attractive on a recent price/earnings multiple of 11.5 times. My related parties have holdings in NCK.

HOLD RECOMMENDATIONS

Supply Network (SNL)

SNL supplies aftermarket replacement parts for trucks and buses via a network of outlets in Australia and New Zealand under the Multispares brand. The business has been growing strongly, with revenue increasing about 23 per cent in the most recent half year. About 70 per cent of the stock is owned by strategic investors, leaving it illiquid. We recommend holding to see if the price retreats further to enable a cheaper entry point.

Appen (APX)

Appen prepares training data for use in artificial intelligence applications. It generates 86 per cent of revenue from big Silicon Valley technology firms. The share price has declined markedly in the past 18 months, as it fell short of meeting earnings targets. However, it generated good revenue growth in the most recent results, especially from the rapidly growing China segment. We suggest holding to see if this translates to a return to earnings growth. My related parties have holdings in APX.

SELL RECOMMENDATIONS

Air New Zealand (AIZ)

The airline was severely impacted by a pandemic imposing some of the strictest travel restrictions in the world. We expect revenue in fiscal year 2022 to be significantly lower than pre-COVID-19 levels. Also, in our view, risks are to the downside given a soaring crude oil price due to the war in Ukraine.

Domino’s Pizza Enterprises (DMP)

The share price of this fast food giant has almost halved in the past six months to March 17, 2022. The company owns pizza store franchises in Australia, Asia and Europe. Even after the steep decline in the share price, the company was recently trading on a price/earnings ratio of about 40, which, in our view, is high for a stock on a reducing growth trajectory.

Christopher Watt, Bell Potter Securities

BUY RECOMMENDATIONS

GUD Holdings (GUD)

GUD owns a diversified portfolio of leading companies in the water and automotive aftermarket parts sectors. Following several successful acquisitions, we view GUD as a high quality business leveraged to the fast growing addressable automotive market. A strong balance sheet enables GUD to make further accretive acquisitions, while paying attractive fully franked dividends.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Costa Group Holdings (CGC)

Costa Group is the largest fresh produce company in Australia, with an estimated market share above 15 per cent. It supplies fresh fruit and vegetables to the major Australian supermarkets. We view CGC as an attractive investment, given international berry expansion to China is running according to Costa’s original five-year plan, and appears set for significant growth. Further, Costa is well positioned to capitalise on high growth in emerging product categories, such as blackberries.

HOLD RECOMMENDATIONS

Treasury Wine Estates (TWE)

We believe wine consumption in Asia should continue growing at high rates over the long term, which is a high margin business for Treasury given its focus on luxury and mid range wine. Despite the favourable long term outlook, we rate TWE as a hold given the uncertainty around China’s tariffs on Australian wine, which closes off a critical growth market.

AGL Energy (AGL)

AGL is one of Australia’s largest retailers of electricity and gas. The company’s share price has underperformed in the past few years in response to declining wholesale electricity prices. With a healthy balance sheet and defensive earnings, we believe downside risks are already priced into the current share price, and view the company as fairly valued.

SELL RECOMMENDATIONS

Scentre Group (SCG)

SCG owns, develops and manages shopping centres in Australia and New Zealand. Operating under the Westfield brand, Scentre has direct exposure to bricks and mortar retail outlets, which, in our view, will continue to struggle under the challenging operating outlook. Also, retail leasing continues to struggle at this time.

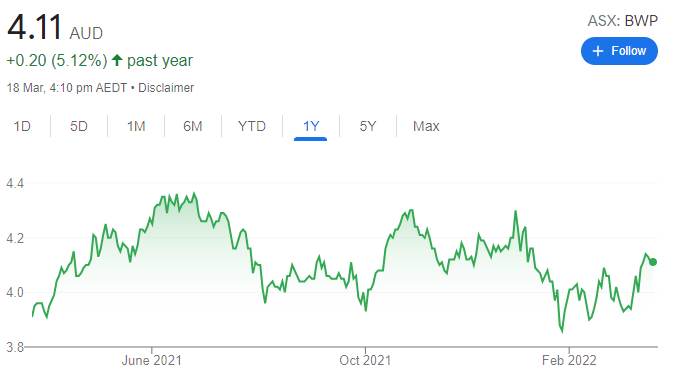

BWP Trust (BWP)

This real estate investment trust comprises a portfolio of properties on long term leases, including the Bunnings hardware chain. COVID-19 may lead to softer market rent reviews. Also, Bunnings continues to vacate some of BWP’s older and smaller properties, resulting in higher vacancies and a drag on earnings. We retain a sell rating.

Angus Geddes, Fat Prophets

BUY RECOMMENDATIONS

Adore Beauty Group (ABY)

We expect this online beauty retailer to benefit from the economy re-opening. The company will launch on its apps a new, profit accretive, private label brand. We expect the company’s beauty subscription business to generate earnings growth. Importantly, the company’s apps and products are wide reaching, generating quality profits and cash flows.

ABX Group (ABX)

ABX Group is converting clay into a valuable resource, as it released excellent assay results for its Tasmanian rare earth element project. The latest results support the potential of its rare earth element project, with the best reads released to date. New regional discoveries are potentially adding future blue sky value.

HOLD RECOMMENDATIONS

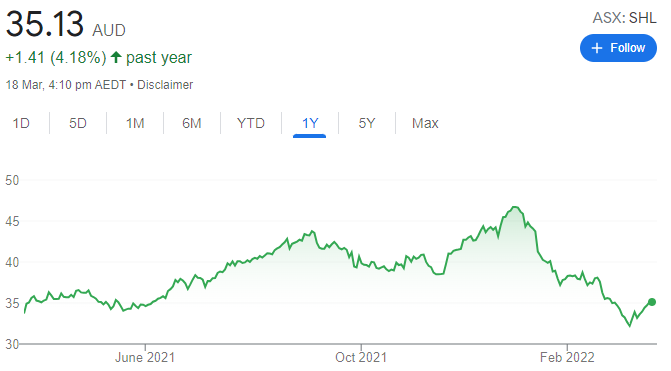

Sonic Healthcare (SHL)

The shares have retreated from all time highs on uncertainty about future revenue growth from COVID-19 related testing. We expect top line growth to moderate. But we also expect the company to benefit from patients returning to regular medical visits and elective surgeries. Drivers of its core business remain intact.

James Hardie Industries PLC (JHX)

The building products company surprised the market by dismissing chief executive Jack Truong in early January. The shares have taken a hit in the fallout, as the financial performance of the business under Truong was impressive, in our view. An interim chief executive was appointed on January 7. The company lifted global net sales by 22 per cent in the third quarter compared to the prior corresponding period.

SELL RECOMMENDATIONS

Xero (XRO)

The share price of this accounting software company has fallen from $146.22 on January 4 to trade at $99.78 on March 17. We see rising interest rates moving forward weighing on near term valuations for growth. In our view, the company’s earnings quality is poor.

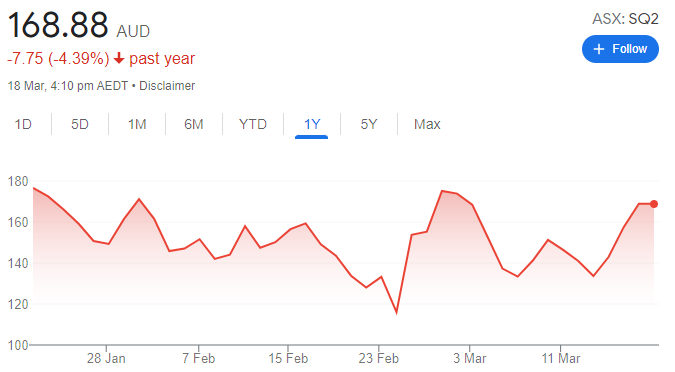

Block Inc. (SQ2)

This technology and payments giant is showing earnings and balance sheet quality. However, in our view moving forward, an improvement in earnings quality in the latest quarter isn’t sufficient to offset valuation fatigue and share price pressure, as interest rates rise.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.