John Anderson, Bell Potter Securities

BUY RECOMMENDATIONS

Goodman Group (GMG)

Goodman is a global industrial property group, with operations in Australia, New Zealand, Asia, Europe, the UK, North America and Brazil. The long term outlook is favourable given increasing online retail sales and a growing middle class in developing countries. With more than $5 billion of pre-committed work in progress and exposure to a rapidly growing warehouse industry, we view GMG as a core portfolio holding.

EROAD (ERD)

This transport technology services company sells its products to customers operating commercial vehicle fleets in Australia, New Zealand and North America. ERD is expanding its platform and sales initiatives in North America and Australia. In our view, the high growth telematics industry is still fragmented, so potential exists for ERD to become a strategic target in the future.

HOLD RECOMMENDATIONS

Transurban Group (TCL)

Transurban is one of the world’s leading toll road businesses. The income it generates is genuinely defensive and tolls typically grow at rates higher than inflation. TCL has proven it can deliver significant infrastructure projects on time and on budget. It has a strong pipeline of future developments. We’re forecasting it to pay a distribution yield above 2.5 per cent.

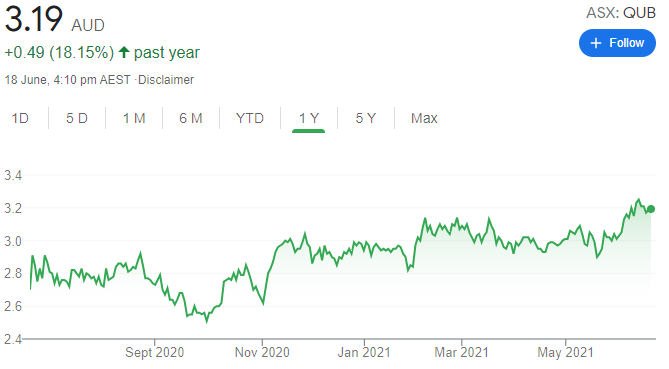

Qube Holdings (QUB)

Qube is Australia’s biggest vertically integrated provider of import and export logistics services. Ports, logistics and bulk businesses generate about 80 per cent of earnings. Qube has announced the potential sale of its warehousing and property components at Moorebank Logistics Park for $1.65 billion, which would radically transform its balance sheet. While volume growth is expected to be strong, we see some downside risk, as it was recently trading on a 2021 price/earnings multiple of 39 times. We retain a hold rating.

SELL RECOMMENDATIONS

Metcash (MTS)

Metcash is a distribution and marketing company in the grocery and liquor wholesaling industries. It’s the third largest player in the Australian food and liquor market. Supermarket competition is fierce, and we believe rivals Coles and Woolworths are more likely to sustain underlying food sales growth.

Spark Infrastructure (SKI)

Spark invests in energy infrastructure businesses within Australia. Looking forward, we believe revenue is likely to be impacted in response to regulatory changes leading to cheaper power in Victoria and South Australia. Distributions to shareholders may come under pressure. Despite the company’s defensive characteristics, we believe better growth options exist elsewhere.

Chris Batchelor, Spotee.com.au

BUY RECOMMENDATIONS

Ansell (ANN)

Demand soared for ANN’s personal protection equipment during the pandemic. COVID-19 heightened awareness about the importance of personal hygiene, which we expect will be maintained beyond the pandemic. Following a 20 per cent earnings upgrade at the end of April, the stock still appears attractive given its outlook.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Dusk Group (DSK)

The specialty retailer sells its candles and home fragrance products via its store network and online. The share price has doubled since the company listed in November 2020. Since listing, DSK has announced several positive updates on the back of strong sales. If earnings can be sustained, then a forecast price/earnings multiple of below 9 times appears to be good value. The shares finished at $3.56 on June 17.

HOLD RECOMMENDATIONS

ARB Corporation (ARB)

This 4-wheel drive accessories supplier is a well managed business. It continues to generate strong cash flow. There hasn’t been any significant capital raisings for more than a decade. The company generated sales revenue of $283.9 million for the six months ending December 31, 2020, a 21.6 per cent increase on the prior corresponding period. The shares have enjoyed a substantial rise this calendar year to close at $45.60 on June 17.

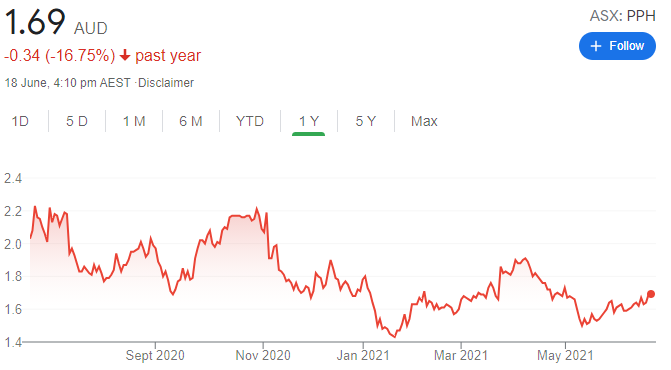

Pushpay Holdings (PPH)

Provides a donor management system to churches, non-profit organisations and education providers. COVID-19 was a tailwind, as people were restricted from attending church and turned to digital giving. The company generated revenue of more than $US181 million for the year ending March 31, 2021, an increase of 39 per cent on the prior corresponding period. In our view, the share price already factors in strong growth.

SELL RECOMMENDATIONS

AMA Group (AMA)

This auto repair group reported increasing vehicle repairs as road traffic volumes recovered. Popular domestic drive holidays and people reluctant to use public transport led to repair growth. But, in our view, improving car safety features, such as automatic braking and sensor warning systems, should result in fewer crashes in the longer term. This, in turn, is likely to impact demand for panel repair services.

Austal (ASB)

Corporate watchdog, the Australian Securities and Investments Commission has launched civil proceedings against Austal, alleging it breached continuous disclosure obligations in relation to its US shipbuilding business in 2016. ASIC also alleged that Austal engaged in misleading or deceptive conduct. On June 10, 2021, Austal said it was considering ASIC’s documentation before deciding on its next steps. Also, this shipbuilder recently downgraded revenue and earnings guidance.

The author’s related parties have holdings in ANN, ARB and PPH.

Peter Day, Sequoia Wealth Management

BUY RECOMMENDATIONS

Marley Spoon AG (MMM)

Marley Spoon delivers fresh ingredients to the door so people can cook at home. It operates in Australia, the US and Europe. Menus offer a wide range of choices. Marley’s first quarter revenue in fiscal year 2021 rose by 81 per cent on the prior corresponding period. The company upgraded guidance and expects fiscal year 2021 revenue to increase by 30 per cent to 35 per cent year-on-year.

Leaf Resources (LER)

The company is set to become a leading supplier of pine chemicals. It announced that initial batch production runs of rosin and terpenes at its Apple Tree Creek plant were successful. Results confirmed expected extractive yields. The plant has moved to a continuous operation to meet its target of 8000 tonnes per annum by the end of June. We expect sales to ramp up quickly.

HOLD RECOMMENDATIONS

Premier Investments (PMV)

Premier owns a portfolio of retail brands. Premier Retail recently announced that total global sales grew by 70 per cent in the first 18 weeks of the second half compared to the prior corresponding period. We expect gross margin expansion in the second half. We upgrade retail earnings by 9 per cent in 2021, by 11 per cent in 2022 and by 4 per cent in 2023. We retain our neutral rating.

Domino’s Pizza Enterprises (DMP)

The fast food giant has entered into a binding agreement with Formosa International Hotels Corporation to acquire the second biggest pizza chain in Taiwan for about $79 million. DMP remains a high quality business, with a diversified earnings mix from global businesses. However, the benefits from this acquisition will take time. Also, the stock is trading marginally above our price target. We retain our hold recommendation.

SELL RECOMMENDATIONS

Boral (BLD)

Boral has recommended investors reject the Seven Group Holdings takeover offer of $6.50 a share, claiming it materially undervalues the company. This building products supplier also provided a trading update with revised guidance. Full year 2021 earnings before interest and tax (EBIT) guidance of between $430 million and $450 million is $35 million below our forecast and $20 million below market consensus. Boral expects to update the market on the sale of its US building products business later this month. We retain a lighten recommendation. The shares closed at $6.73 on June 17.

IGO Limited (IGO)

IGO has transitioned to a clean energy metals company. The business has generated a strong cash position. However, the market’s implied value of the company’s lithium business is about 15 per cent higher than our valuation. We have downgraded to a sell recommendation, with a new price target of $6.35 a share. The shares closed at $7.11 on June 17.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.