Michael Gable, Fairmont Equities

BUY RECOMMENDATIONS

Newcrest Mining (NCM)

We’ve been positive on gold stocks for the past few months, and still believe NCM is a buy at current levels. The share price has been trending higher since September 2022 and we expect it to continue moving forward. Any fall in the US dollar will be positive for gold prices. Potential exists for a new takeover bid after NCM rejected an offer from Newmont Corporation in February.

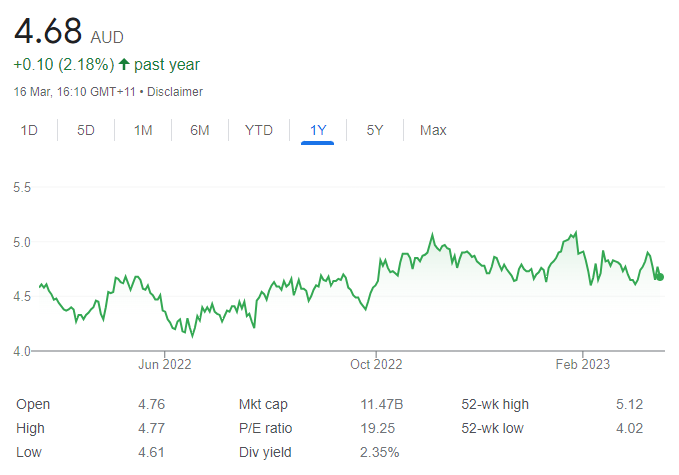

South32 (S32)

The share price has fallen from $4.76 on March 3 to trade at $4.035 on March 16. In our view, this can be considered a buying opportunity for this diversified mining company trading at a discount. Low inventories in base metals should lead to a spike in prices. We expect increasing demand for base metals in later 2023.

HOLD RECOMMENDATIONS

Fortescue Metals Group (FMG)

We believe iron ore prices can remain strong as the Chinese economy recovers and undertakes further restocking. The company has a solid track record of consistently delivering returns to shareholders. Recently, FMG enjoyed solid buying support and we believe the technical chart continues to look bullish.

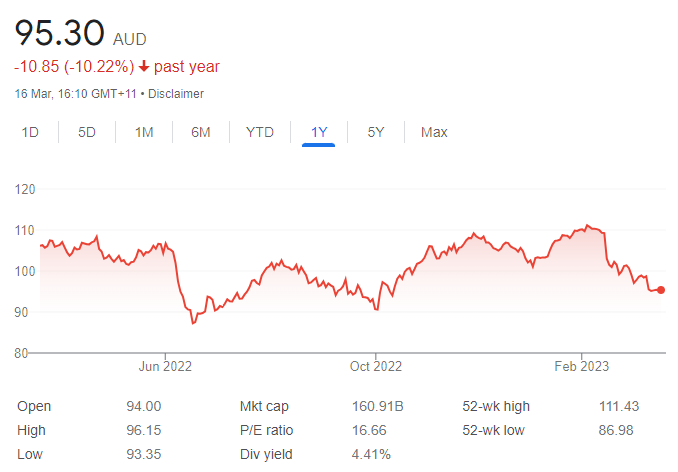

Commonwealth Bank of Australia (CBA)

The shares closed at $111.15 on February 3. The shares were trading at $95.065 on March 16. Although CBA is the most expensive bank, we believe the price premium is justified because of its quality. Over the longer term, it outperforms the other major banks.

SELL RECOMMENDATIONS

Bank of Queensland (BOQ)

The share price has been disappointing, in our view. It has fallen from $8.26 on January 3, 2022 to trade at $6.50 on March 16, 2023. We believe other banks appeal more during this challenging higher interest environment. Investors may want to consider selling BOQ stock and investing the proceeds elsewhere.

Collins Foods (CKF)

The company operates KFC and Taco Bell restaurants in Australia, Germany and the Netherlands. We don’t believe earnings growth justifies what we consider a high price/earnings multiple. The shares have fallen from $10.40 on November 7, 2022 to trade at $7.93 on March 16, 2023. In our view, the share price will remain under pressure in the absence of catalysts to spark a recovery.

Top Australian Brokers

- IG – Extensive product array and user-friendly platforms – Read our review

- eToro – market-leading social trading platform – Read our review

- IC Markets – experienced and highly regulated – Read our review

- Quadcode Markets – multi-asset CFD broker – Read our review

Mattew Lattin, Marcus Today

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

BUY RECOMMENDATIONS

QBE Insurance Group (QBE)

QBE’s recent underwriting performance against a backdrop of heightened inflation, geopolitical tensions and elevated catastrophes demonstrates resilience. Gross written premiums of $US20.054 billion in fiscal year 2022 were up 13 per cent on the prior corresponding period. Statutory net profit after tax rose from $US750 million in fiscal year 2021 to $US770 million in fiscal year 2022. We anticipate organic growth and increasing premiums moving forward.

TPG Telecom (TPG)

The company delivered a relatively strong fiscal year 2022 result boosted by the Vodafone Hutchison Australia merger. Service revenue of $4.439 billion was up 1.5 per cent on the prior corresponding period. Mobile subscribers grew by 300,000 in 2022. Average revenue per user for mobiles was up 1.9 per cent to $32.40 a month, mostly reflecting higher international roaming levels. In our view, TPG has significant growth potential.

HOLD RECOMMENDATIONS

Baby Bunting Group (BBN)

Total sales of $254.9 million in the first half of fiscal year 2023 were up 6 per cent on the prior corresponding period. However, statutory net profit after tax was down 67 per cent to $2.7 million. The company incurred significant costs establishing its New Zealand business. Short to medium term risks remain unclear as the macro environment weakens, but the company is a category leader on scale and has the potential to disrupt discount stores.

Domino’s Pizza Enterprises (DMP)

DMP faces challenges, including addressing declining global food sales and lower dividends reported in its result for the six months ending December 31, 2022. Inflation poses challenges for the company, but management has a solid track record in dealing successfully with operating issues. The pricing structure remains above pre-COVID-19 levels.

SELL RECOMMENDATIONS

Adore Beauty Group (ABY)

Adore is an Australian-based online beauty retailer. Revenue of $93.6 million in the first half of fiscal year 2023 was down 17 per cent on the prior corresponding period. Adore doesn’t expect double-digit revenue growth in the second half of fiscal year 2023. The company faces inflationary pressures and subdued consumer sentiment.

Reece (REH)

Reece distributes plumbing products in Australia, New Zealand and the US. Volumes softened progressively in Australia and the US during the first half of fiscal year 2023. REH faces an unfavourable macro environment and increasing price pressures. REH anticipates volumes to contract further in the second half of fiscal year 2023.

Jed Richards, Shaw and Partners

BUY RECOMMENDATIONS

ASX Limited (ASX)

At March 16, 2023, the share price was significantly down from its August 2022 highs. This represents a good buying opportunity, as the ASX is a market leader with limited competition. Our analysis shows ASX is a high margin business that’s grown earnings at a modest but consistent rate over time. We like the recent grossed up dividend yield of about 5 per cent and defensive characteristics in today’s market conditions.

Harvey Norman Holdings (HVN)

In our view, the market is underestimating the value of Harvey Norman’s property portfolio, which represents a large portion of the company’s entire market capitalisation. The recently reported 2023 first half profit was down on the prior corresponding period. However, excess sales during the pandemic skew these numbers. The company is trading on a solid fully franked dividend yield.

HOLD RECOMMENDATIONS

Duxton Farms (DBF)

DBF directly invests in and operates a diversified portfolio of farmland assets. The stock was recently sold down and trading well below asset backing. The ongoing share buyback will provide support at current levels. As farming can be volatile, we don’t consider the first half loss in fiscal year 2023 as indicative of the company’s valuation.

QBE Insurance Group (QBE)

The insurance giant’s latest result was better than expected. The company successfully managed broader insurance sector headwinds, including rising catastrophe and re-insurance costs. The company trades at an attractive valuation relative to global peers.

SELL RECOMMENDATIONS

Megaport (MP1)

Megaport provides elastic interconnection services. The company’s chief executive Vincent English resigned in early March. The company reported a net loss after tax of $US9.208 million for the six months to December 31, 2022, a significant improvement on the prior corresponding period. The shares have fallen from $7.68 on January 30 to trade at $4.42 on March 16. Other stocks appeal more.

Insurance Australia Group (IAG)

The company lifted gross written premiums by 7.5 per cent in the first half of fiscal year 2023 when compared to the prior corresponding period. But according to IAG, natural peril costs of $524 million were $70 million above the allowance. Factors, such as global warming continue to drive more volatile weather patterns and rising claims across the broader Australian insurance industry. We see better opportunities elsewhere.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.