John Athanasiou, Red Leaf Securities

BUY RECOMMENDATIONS

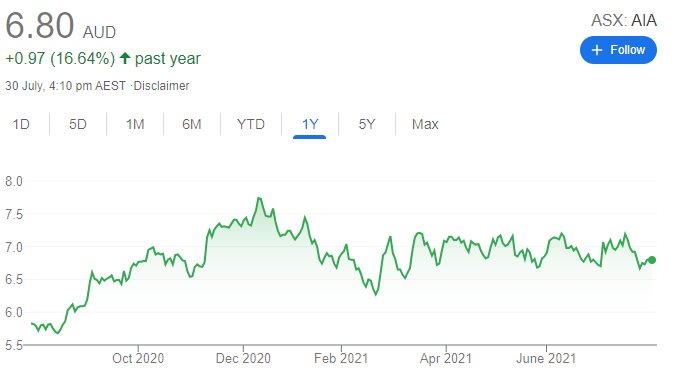

Auckland International Airport (AIA)

The recent takeover bid for Sydney Airport (SYD) highlights the global demand for quality infrastructure assets impacted by COVID-19 travel restrictions. The decision by the New Zealand Government to suspend the travel bubble with Australia provides investors with an opportunity to invest in AIA at a relatively attractive level.

Brookside Energy (BRK)

Brookside Energy is developing oil and gas plays in the Anadarko Basin in the US state of Oklahoma. The company recently increased its Swish area of interest (AOI) acreage by 13 per cent, which will significantly improve the economics of its soon to be drilled Rangers Well project. Also, BRK anticipates sales from its Jewell well. We believe the stock may be positively re-rated. The shares closed at 3.1 cents on July 29.

HOLD RECOMMENDATIONS

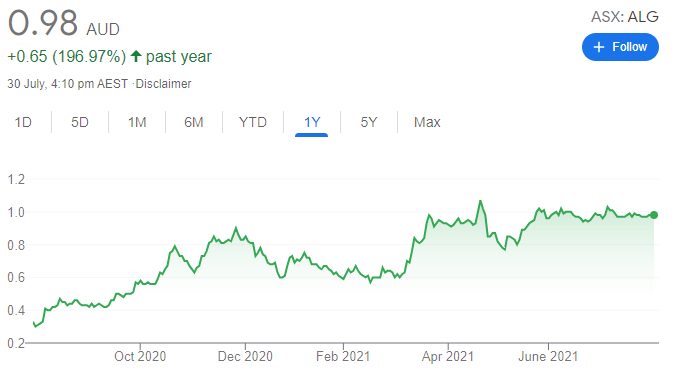

Ardent Leisure Group (ALG)

ALG owns theme parks in Australia and the Main Event business in the US. We believe the share price has rallied on the US re-opening its economy. The outlook is brighter if the US economy can remain open, particularly during spring and winter. The shares have risen from 76.5 cents on May 6 to close at 98 cents on July 29.

Virgin Money UK PLC (VUK)

Shares in this UK financial institution have performed well in the second half of July. The price has risen from $3.28 on July 20 to close at $3.74 on July 29. We expect VUK to perform well if the UK economy remains open and continues to recover from COVID-19 lockdowns.

SELL RECOMMENDATIONS

Evolution Mining (EVN)

The miner produced almost 681,000 ounces of gold in fiscal year 2021. It was 2 per cent below the bottom end of revised guidance of between 695,000 ounces and 710,000 ounces issued in April 2021. The share price has fallen from $4.95 on July 15 to close at $4.22 on July 29.

Dexus (DXS)

Shares in this real estate group have been recently under pressure. The price has retreated from $10.89 on July 6 to close at $10.20 on July 29. The company’s net profit after tax fell substantially in the 2021 first half compared to the prior corresponding period. In our view, better growth opportunities exist elsewhere until a clearer picture emerges about the pandemic amid Sydney’s extended lockdown and potential outbreaks elsewhere.

Jabin Hallihan, Morgans

BUY RECOMMENDATIONS

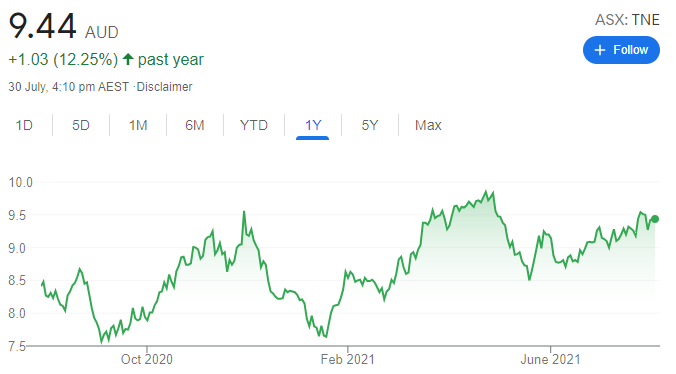

Technology One (TNE)

We like this software company for capital growth potential. TNE aspires to double in size every five years. The company has loyal clients and its defensive earnings are also appealing. With a pipeline of new clients to on-board, management can keep expense growth in line with revenue growth to ensure a high level of profitability.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

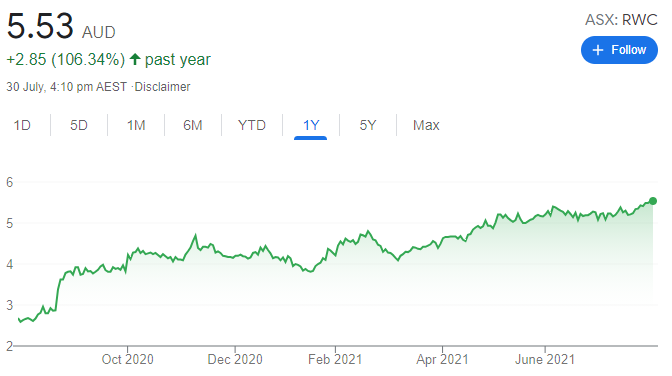

Reliance Worldwide Corporation (RWC)

This plumbing products company enjoys a strong and defensive market position. The company offers an experienced management team with a proven track record of generating earnings growth. The company’s earnings profile appeals for its diversity, so it doesn’t need to solely rely on cyclical residential repairs and renovations. This gives us comfort that earnings growth is sustainable through the cycle.

HOLD RECOMMENDATIONS

Sydney Airport (SYD)

SYD recently rejected an indicative takeover proposal at $8.25 per stapled security from a consortium of infrastructure investors. The SYD board believes the offer undervalues the company and isn’t in the best interests of shareholders. We believe Sydney Airport remains a highly attractive asset and it’s possible a higher bid will emerge. Also, we expect revenue to recover when travel restrictions are eased.

ANZ Bank (ANZ)

We’re happy to hold ANZ Bank as it’s underpinned by a forecast gross dividend yield of 8.4 per cent next financial year. We’re also expecting ANZ profit margins to improve as management continues to focus on cutting costs in the medium term. The bank recently announced an on-market share buyback of up to $1.5 billion, which is good for the share price. Also, a capital return to shareholders is possible, in our view.

SELL RECOMMENDATIONS

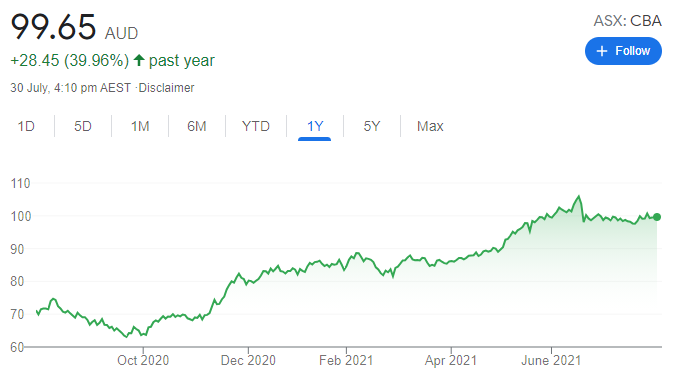

Commonwealth Bank of Australia (CBA)

CBA is a premier bank. The share price of Australia’s biggest bank trades at a lofty premium compared to its peers. Rival bank ANZ trades on a modest price/earnings multiple compared to CBA. ANZ’s dividend yield is also more attractive, in our opinion. It may be prudent for shareholders to consider trimming their CBA holdings and re-investing the proceeds into ANZ, or the other two major banks.

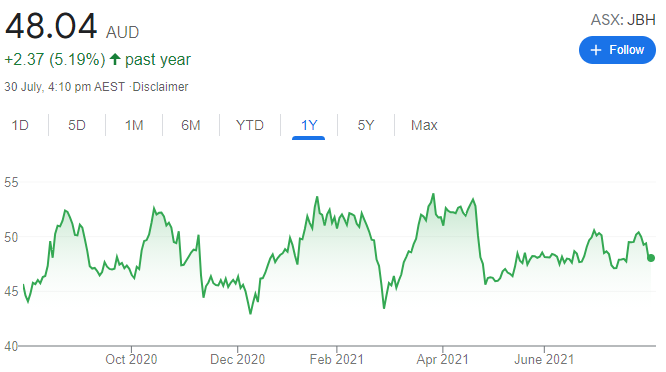

JB Hi-Fi (JBH)

The share price of this consumer electronics giant has risen from $45.59 on July 30 last year to trade at $49.47 on July 29, 2021. In our view, the stock is priced to perfection, so it’s exposed to a fall if it doesn’t meet the lofty expectations of investors. Strong demand for home office products was partially driven by the Federal Government’s JobKeeper program, which ended earlier this year. Future demand for home office products may soften. Investors may want to consider taking a profit by trimming their portfolios.

Tony Paterno, Ord Minnett

BUY RECOMMENDATIONS

Cimic Group (CIM)

This engineering-led construction and mining firm reported a first half 2021 net profit of $208 million. This is a solid result, with work levels and margins recovering strongly after a softer calendar year in 2020. Management estimates it should be able to secure more than $18 billion of new work for the full year. Calendar year 2021 net profit guidance of between $400 million and $430 million is retained. Guidance appears to be conservative.

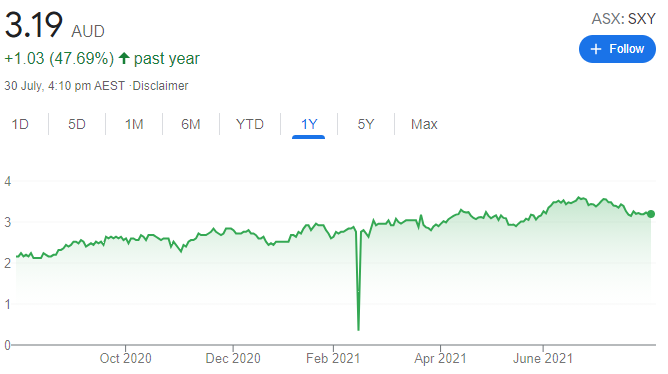

Senex Energy (SXY)

June quarter production contributed to 3 million barrels of oil equivalent in fiscal year 2021. No guidance was provided for fiscal year 2022, but we expect production to grow by 20 per cent, driven by the imminent expansion of the Roma North plant. Among the exploration and production companies in the small capitalisation sector, Senex remains our preference due to its attractive valuation, production growth profile and its exposure to a tightening east coast gas market.

HOLD RECOMMENDATIONS

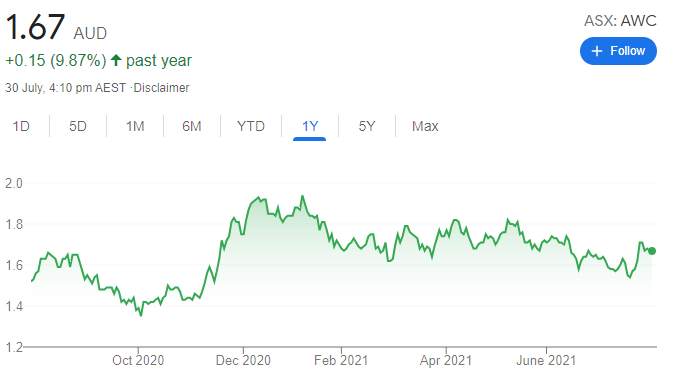

Alumina (AWC)

Alumina owns 40 per cent of Alcoa World Alumina and Chemicals (AWAC). Alcoa Corp, which owns the other 60 per cent, recently released second quarter results. AWAC alumina costs rose $US2 a tonne on the first quarter to $US231 a tonne. The realised price of $US282 a tonne fell 5 per cent quarter-on-quarter. Combined bauxite and alumina EBITDA of $US165 million in the second quarter was broadly as expected. Hold for the longer term.

Stockland (SGP)

This diversified property group announced it would acquire land lease operator and developer Halcyon Group for $620 million. Stockland will fund the acquisition from existing liquidity and flagged introducing third party capital into the business over time. The land lease model is more aligned with Stockland’s skill set, in our view. We estimate the transaction is 1 per cent accretive to earnings and increases gearing by 2 per cent.

SELL RECOMMENDATIONS

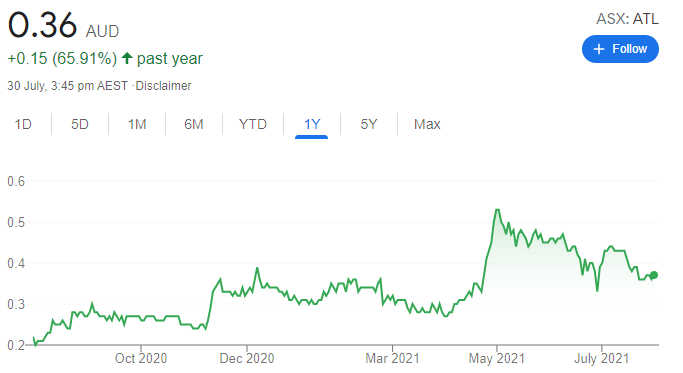

Apollo Tourism & Leisure (ATL)

Apollo makes, rents and sells recreational vehicles. COVID-19 impacted performance and the company posted a statutory net loss after tax of $7.5 million in the 2021 first half. International and domestic border closures and travel restrictions impacted the company’s global rental operations. The company reported strong retail sales demand for recreational vehicles, but the earnings benefit was modest because of supply chain issues. The shares have fallen from 52.5 cents on May 3 to close at 36 cents on July 29.

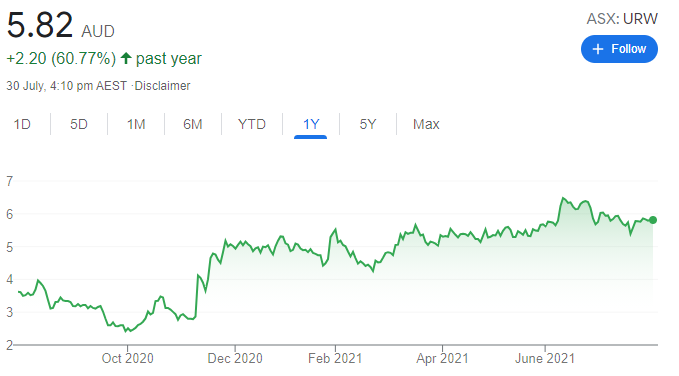

Unibail-Rodamco-Westfield (URW)

URW owns and operates shopping centres in Europe and the US. In our view, the earnings outlook is difficult to quantify in response to a challenging underlying rental outlook and a potential variation in the cost of debt moving forward. We expect values to remain under pressure. We prefer others at this point.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.