Michael Gable, Fairmont Equities

BUY RECOMMENDATIONS

Aristocrat Leisure (ALL)

The gaming company is a high quality business. It’s established a solid track record of double-digit earnings growth over the years. Although the broader sharemarket bottomed in June, Aristocrat stock was already rising from its low point in May. Since then, the share price has continued to edge higher despite broader market volatility. This is a bullish sign from a charting point of view.

Santos (STO)

Santos will continue to benefit from what I believe will be increasing energy prices for some time. The share price is down from its June peak in response to a short-term retreat in the crude oil price. However, this presents a buying opportunity, as the share price has recently firmed and is starting to resume its uptrend.

HOLD RECOMMENDATIONS

TerraCom (TER)

This company is benefiting from higher thermal coal prices that I believe will continue to remain elevated moving forward. TER’s valuation continues to appeal when compared to other larger listed companies. The share price uptrend is strong and sustainable, in my view.

Worley (WOR)

The earnings outlook remains positive as capital expenditure in the oil and gas sectors generate demand for Worley’s services. The share price has been recently retreating from the strong uptrend in the first half of this calendar year. However, good buying support is now evident at these levels and we expect the share price to resume its uptrend.

SELL RECOMMENDATIONS

Pilbara Minerals (PLS)

Trading stocks within the lithium sector have been rewarding. But sometimes share prices can reflect too much optimism about lithium’s future. The share price of PLS has risen from $2.24 on July 1 to close at $4.69 on September 15. I believe vertical share price moves higher are unsustainable, particularly when profit takers make their move.

Nanosonics (NAN)

The share price of this infection prevention company still looks expensive based on NAN’s expected earnings growth. Any potential benefits from a change in the company’s distribution model will take time. The charting profile looked relatively weak due to a lack of buying support at recent prices.

Tim Haselum, Catapult Wealth

BUY RECOMMENDATIONS

Bank of Queensland (BOQ)

We believe the banks are facing reducing loan volumes, but we aren’t concerned about impairments, as households appear to be in sound financial shape. We like the ME Bank recovery story and see further synergies ahead. Potential net interest margin improvements amid the company’s undemanding price/earnings multiple presents a buying opportunity.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Seek (SEK)

Investors can consider buying this employment and education company on weakness, as it was recently trading below pre-COVID-19 levels at a time of tight labour markets. The company is investing in its IT systems. Revenue from continuing operations grew by 47 per cent in fiscal year 2022. The shares have fallen from $24.64 on August 11 to trade at $20.96 on September 15. We believe SEK offers value at these levels.

HOLD RECOMMENDATIONS

GrainCorp (GNC)

This diversified Australian agribusiness expects underlying net profit after tax (NPAT) to range between $365 million and $400 million for the full year ending September 30, 2022. It was previously forecasting NPAT to range between $310 million and $370 million. However, GNS operates in a cyclical sector, so earnings can be negatively impacted by unfavourable weather conditions and external events, such as the war in Ukraine.

The a2 Milk Company (A2M)

The share price of this infant formula company has enjoyed a strong run since mid June. The company is progressing its international strategy, but, in our view, a lot of upside has been factored into the share price. The company operates in competitive markets, which could potentially pressure margins. Keep an eye on the news flow.

SELL RECOMMENDATIONS

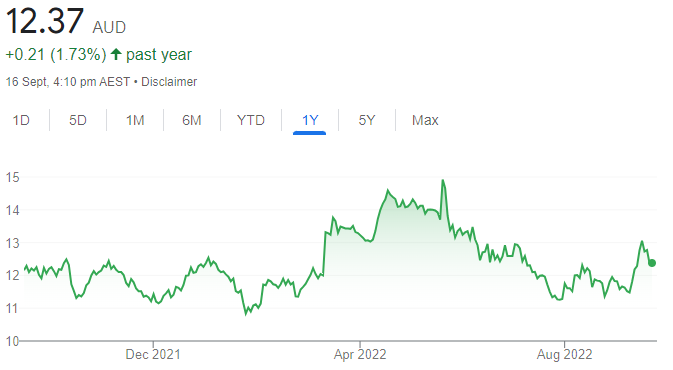

Elders (ELD)

The Australian agribusiness delivered a strong first half result. Sales revenue of $1.541 billion was up 38 per cent on the prior corresponding period. The share price has risen from $11.52 on August 4 to trade at $12.77 on September 15. Given the cyclical nature of the sector, investors may want to consider locking in some profits.

Lendlease Group (LLC)

This integrated international property and investment group reported a statutory loss after tax of $99 million for the year ending June 30, 2022. We’re concerned about the outlook for the construction industry given higher interest rates, supply constraint issues and the potential impacts from COVID-19.

Peter Moran, Wilsons

BUY RECOMMENDATIONS

ARB Corporation (ARB)

This 4-wheel drive accessories supplier has been impacted by a shortage of new vehicles, supply chain issues and staff sick leave due to COVID-19. However, growth is expected to resume as these issues subside. There is potential for additional growth through a recently announced commercial partnership with Toyota North America. This adds to its partnership with Ford, which is still in its early stages. We retain an overweight rating.

Pepper Money (PPM)

This non-bank lender reported a pro-forma net profit after tax of $73.1 million in the 2022 first half, an 11 per cent increase on the prior corresponding period. This was despite a 30 basis points fall in the net interest margin. We expect increasing interest rates should contribute to a partial recovery in margins during the second half. While a general slowdown in the economy is a potential risk for lenders, we see this as being excessively priced in with the shares recently trading on 4.5 times earnings. We retain an overweight rating.

HOLD RECOMMENDATIONS

The a2 Milk Company (A2M)

The infant formula company produced a strong result in fiscal year 2022. Revenue was up 20 per cent compared to the previous corresponding period. Net profit after tax jumped 42.3 per cent. However, market conditions remain challenging due to increasing competition and a low birth rate in China. Consequently, we view the company as currently trading around fair value. We retain a market weight rating.

Motorcycle Holdings (MTO)

Australia’s largest motorcycle dealer announced a respectable fiscal year 2022 result given COVID-19 disruptions. Underlying EBITDA fell by 4 per cent and the underlying EBITDA margin was down 11 per cent. The shares appear to be reasonably valued at current levels. However, with discretionary spending likely to be under pressure next year, we rate MTO as market weight.

SELL RECOMMENDATIONS

Bravura Solutions (BVS)

This provider of software services to the wealth management and funds administration industries hasn’t met investor growth expectations, in our view. The company has experienced delays in expected new sales, which has been made worse by increasing costs. This has led to a strategic review. Our rating is underweight.

PolyNovo (PNV)

The shares closed at $2.02 on August 25, a day prior to its full year result. The shares have tumbled to trade at $1.39 on September 15. Sales growth of the company’s core wound treatment in the June quarter appears to have fallen short of investor expectations, in our opinion. We believe investors still appear too optimistic about the outlook at current prices. We retain an underweight rating.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.