Tony Langford, Seneca

BUY RECOMMENDATIONS

Dexus (DXS)

This fully integrated real estate group manages an Australian property portfolio valued at $44.3 billion. The industrial and office portfolios retain high occupancy and rent collection rates above 95 per cent. During the September quarter, it transacted about $900 million across the group, predominantly divestments. It was recently trading on an appealing dividend yield above 6 per cent.

ANZ Bank (ANZ)

The ANZ is a quality business. ANZ’s statutory profit after tax of $7.119 billion in fiscal year 2022 was up 16 per cent on the prior corresponding period. The return on equity was 10.4 per cent. Acquiring Suncorp Group’s banking division will make ANZ stronger, but the $4.9 billion deal is subject to government and regulatory approvals. We believe the bank offers relative value when compared to peers.

HOLD RECOMMENDATIONS

PolyNovo (PNV)

PolyNovo is involved in dermal regeneration solutions via its patented NovoSorb technology. The company’s recent capital raising is aimed at accelerating growth in the US, Canada, India and Hong Kong. The company is profitable in the key US market and aims to substantially increase production capacity. Patient investors can consider holding for new developments. Keep an eye on the news flow.

Trajan Group Holdings (TRJ)

TRJ is a global analytical science and device company. It has built a strategic market position in componentry via a combination of targeted complementary acquisitions and investment in product development. It has established long term relationships with global customers. The company reported normalised EBITDA of $12.5 million in fiscal year 2022, up 26 per cent on the prior corresponding period.

SELL RECOMMENDATIONS

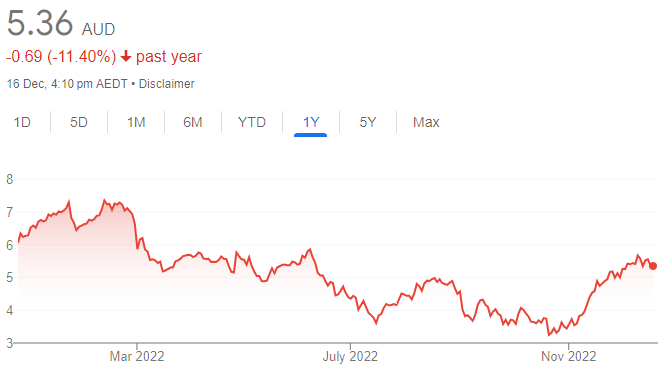

BHP Group (BHP)

The global miner has submitted a revised non-binding indicative proposal for Oz Minerals at $28.25 a share. The initial offer was $25 a share. BHP’s share price has risen from $37.36 on October 31 to trade at $46 on December 15. We believe the shares look expensive at these levels. Investors may want to consider trimming their exposure to cushion any potential correction in the iron ore price.

Telstra Group (TLS)

Telstra is Australia’s dominant telecommunications provider. Telstra appeals for its defensive qualities and dividend yield in volatile markets. At its full year results, Telstra forecast total income to range between $23 billion and $25 billion in fiscal year 2023. But we believe investors can find more attractive share price growth elsewhere. The shares were priced at $4.26 on January 18. The shares were trading at $4.04 on December 15.

Nathan Lodge, Securities Vault

BUY RECOMMENDATIONS

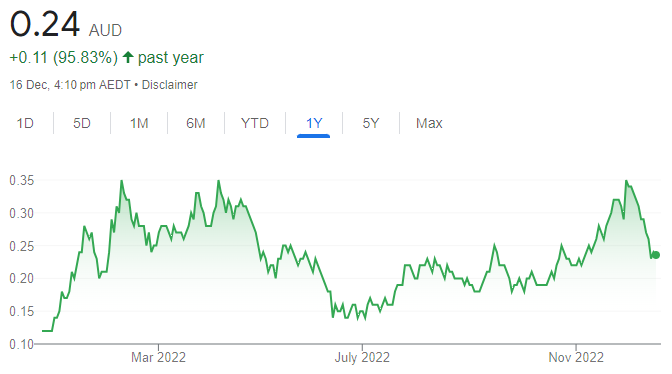

ENRG Elements (EEL)

EEL is focusing on exploring and developing its uranium and copper projects, commodities essential for a carbon-neutral and electric future. The company recently announced high priority drill targets had been identified at the Ghanzi West Copper-Silver project in Botswana. The share price has recently been enjoying favourable momentum to close at 2.6 cents on December 15. Keep an eye on the news flow. The stock remains a speculative buy.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Aston Minerals (ASO)

This nickel-cobalt-gold explorer is focusing on the Edleston project in Ontario, Canada. The company is significantly progressing its Bardwell operations and recent results are encouraging. We expect a maiden mineral resource estimate to be positive. The share price has risen from 6.6 cents on November 2 to close at 8.9 cents on December 15. The stock remains a speculative buy.

HOLD RECOMMENDATIONS

Celsius Resources (CLA)

CLA is a copper and gold explorer. It recently updated a JORC compliant mineral resource estimate at the MCB Copper-Gold project for its subsidiary company in the Philippines. The global revised mineral resource estimate is 338 million tonnes at 0.47 per cent copper and 0.12 grams a tonne of gold. Drilling is progressing well. Keep an eye on the news flow.

Alara Resources (AUQ)

AUQ is a precious and base metals explorer and developer with projects in Oman. It recently announced construction has substantially progressed at its 51 per cent owned Al Wash-hi Majaza Copper-Gold Project in Oman. The project should be completed in the June 2023 quarter. Watch for updates.

SELL RECOMMENDATIONS

Sandfire Resources (SFR)

The company recently announced it had initiated a formal sale process for its DeGrussa copper operations and related exploration tenure in Western Australia. The share price of this copper producer has enjoyed favourable momentum, rising from $3.25 on October 20 to close at $5.55 on December 15. Investors may want to consider taking a profit.

Bass Oil (BAS)

This oil producer recently announced it had identified a significant gas discovery at its PEL 182 permit in South Australia’s Cooper Basin. Investors responded positively to the news. The shares have risen from 3.5 cents on November 11 to close at 6.5 cents on December 15. Bass is a well managed company. Given the share price rise, investors may want to consider cashing in some gains.

Jean-Claude Perrottet, Medallion Financial Group

BUY RECOMMENDATIONS

Sandfire Resources (SFR)

The copper producer posted record sales revenue of $922.7 million in fiscal year 2022, up 52 per cent on the prior corresponding period. The MATSA copper operations in Spain delivered a positive operational performance. We remain optimistic about the longer term outlook for copper producers given the shift towards cleaner energy.

Renascor Resources (RNU)

The graphite explorer recently completed a $70 million institutional placement to accelerate development of its Siviour Battery Anode Material Project. The company has the world’s second biggest graphite reserve. RNU aims to become a supplier of purified spherical graphite (PSG) for lithium-ion battery anode makers across the world. RNU will reach a final investment decision in 2023. Keep an eye on the news flow.

HOLD RECOMMENDATIONS

Paladin Energy (PDN)

This uranium company owns 75 per cent of the Langer Heinrich mine in Namibia. In July, the company announced production would resume at the mine, with first volumes targeted for the March quarter of calendar year 2024. We’re encouraged by the global shift towards nuclear energy, particularly in China and India.

CSL (CSL)

This blood products company has a strong track record of performance. CSL Behring increased revenue by 2 per cent to $US8.598 billion in fiscal year 2022. Net profit after tax of $US2.255 billion fell 6 per cent, but this was still at the top end of guidance. The shares have risen from $267.50 on October 21 to trade at $297.99 on December 15.

SELL RECOMMENDATIONS

Dusk Group (DSK)

Specialty retailer Dusk Group (DSK) sells home fragrance products. Total sales of $138.4 million in fiscal year 2022 were down 6.9 per cent on the prior corresponding period. Net profit after tax of $18.4 million was down 31.3 per cent. The gross margin fell by 7.5 per cent. Moving forward, we expect sales growth to weaken for most Australian discretionary retailers given higher interest rates and cost of living increases.

Adairs (ADH)

This furniture and homewares company reported group sales of $564.5 million in fiscal year 2022. This represented an increase of 12.9 per cent on fiscal year 2021. However, underlying earnings before interest and tax fell by 30 per cent to $76.4 million. The share price has fallen from $4.05 on January 5 to trade at $2.24 on December 15. Other stocks appeal more for capital growth in these challenging economic times.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.