Toby Grimm, Baker Young

BUY RECOMMENDATIONS

BUY – ResMed Inc. (RMD)

ResMed makes medical devices to treat sleep disordered breathing. The share price of RMD has significantly fallen since the company posted fourth quarter results in early August. Concerns about profit margins have overshadowed strong sales. Also, investors appear concerned that diabetes and obesity medicines may reduce the need for sleep apnoea products. We believe the weaker share price creates a good buying opportunity in what we consider to be a high quality, long-term growth company that was recently trading well below fair value.

BUY – APA Group (APA)

This energy infrastructure business owns and operates a portfolio of gas, electricity, solar and wind assets around Australia. It recently completed a $675 million institutional placement to partly fund the proposed acquisition of Alinta Energy Pilbara. In our view, APA offers a brighter outlook for long-term investors, as it was recently trading at a 10 per discount to our valuation.

HOLD RECOMMENDATIONS

HOLD – Audinate Group (AD8)

The audio-visual networking software developer delivered a top full year 2023 result during the recent reporting season. It beat revenue and earnings estimates by around 10 per cent. The stock rallied strongly enough for AD8 to opportunistically raise $50 million, which will help support its strong growth in video products in 2024.

HOLD – Cochlear (COH)

The hearing implants maker posted an impressive 2023 fiscal year result in August. Sales growth easily surpassed expectations, helping offset higher costs. The share price rose swiftly as investors responded positively to the result. The valuation isn’t as appealing at current levels, but we feel operational momentum should continue and we remain comfortable about keeping COH in portfolios.

SELL RECOMMENDATIONS

SELL – Bega Cheese (BGA)

The dairy products manufacturer reported a disappointing full year 2023 result, in our view. Weakness in the bulk processing division more than offset solid consumer brand performance. We see limited scope for a near term improvement given excess capacity in the industry. The shares have fallen from $3.23 on August 24 to trade at $2.815 on September 14.

SELL – Healius (HLS)

The healthcare company provides pathology and diagnostic imaging services. COVID-19 testing revenue declined substantially in fiscal year 2023. We’re concerned about future operating costs. In July, the Australian Competition and Consumer Commission outlined significant preliminary competition concerns about the proposed acquisition of Healius (HLS) by Australian Clinical Labs. We see better value elsewhere in the sector.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Braden Gardiner, Tradethestructure

BUY RECOMMENDATIONS

BUY – Paladin Energy (PDN)

With the uranium price moving higher, we expect Paladin Energy’s share price to move to new short-term highs. The uranium miner has spent the past two years in a broad range between support at 53 cents and resistance of around $1. Federal Opposition calls to include nuclear power in Australia’s energy mix have ignited debate to the benefit of PDN. The shares have risen from 53.5 cents on May 30 to trade at 94.2 cents on September 14. Moving forward, we see the shares increasing to well beyond $1.

BUY – ANZ Group Holdings (ANZ)

Australian banks are widely regarded among the most reliable in the world in terms of balance sheet strength. Offering an attractive dividend yield, ANZ is a favourite among many long-term investors. ANZ appears to be building momentum for a move above $26. From a technical perspective, I expect the support level at $22.50 to hold and a new bullish trend to start from here. The shares were trading at $25.34 on September 14.

HOLD RECOMMENDATIONS

HOLD – ALS Limited (ALQ)

The company provides analytical data testing services to assist engineering firms, industry and government. The share price has been volatile in calendar year 2023. However, the share price has been supported below $10.90. I expect to see this support continue, although investors may want to consider locking in some gains on any rally around $13.50 levels. The shares have risen from $10.60 on July 10 to trade at $11.63 on September14.

HOLD – Bannerman Energy (BMN)

Bannerman is a uranium development company. Its flagship is the Etango project in Namibia, which is considered one of the world’s biggest undeveloped uranium assets. The share price has risen from $1.19 on May 31 to trade at $2.62 on September 14. I expect positive sentiment towards the uranium price to provide continuing support for the company.

SELL RECOMMENDATIONS

SELL – Fortescue Metals Group (FMG)

Fortescue is one of the top iron ore miners and exporters in Australia. The share price has been trending down since closing at $23.73 on July 26. Investors are concerned about Chinese growth levels. In my view, the technical outlook remains negative, and I believe the share price will continue to drift lower at this stage of the cycle. Investors may want to consider trimming their exposure. The share price was trading at $20.17 on September 14.

SELL – Azure Minerals (AZS)

This explorer and developer is focusing on copper, lithium and gold, among other minerals. The company recently raised capital at $2.40 a share. The share price rose from 52 cents on June 1 to close at $2.92 on September 7. The shares were trading at $2.82 on September 14. The soaring share price since June provides an opportunity for investors to consider locking in some gains.

Mattew Lattin, Marcus Today

BUY RECOMMENDATIONS

BUY – Jumbo Interactive (JIN)

JIN is a digital lottery specialist that provides its lottery software platforms and expertise to the charity and government sectors in Australia and globally. JIN recently secured a four-year extension of its software-as-a-service (SaaS) agreement with Lotterywest. The extended relationship with Lotterywest provides opportunities for further growth in the Western Australia lottery market.

BUY – Woolworths Group (WOW)

The giant supermarket group reported impressive fiscal year 2023 results. Group sales, before significant numbers, of $64.294 billion represented a 5.7 per cent increase on the prior corresponding period. Group earnings before interest and tax of $3.116 billion, and before significant items, were up 15.8 per cent year-on-year. Moreover, WOW’s dividend payout is sustainable, with the company declaring a final, fully franked dividend of 58 cents a share.

HOLD RECOMMENDATIONS

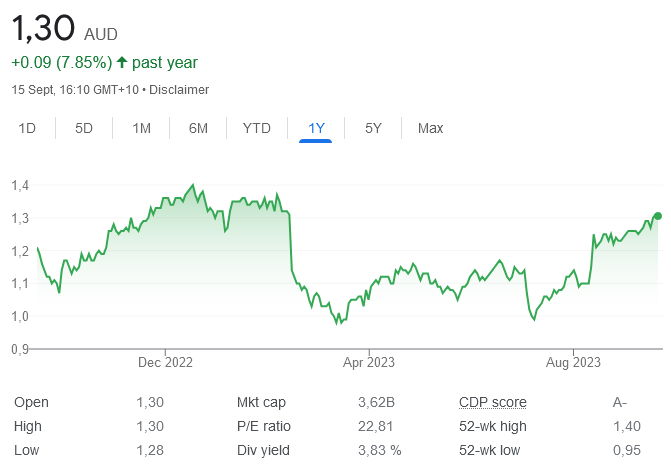

HOLD – AMP (AMP)

The share price of this diversified financial services company has gathered momentum following its recent half-year results. AMP returned $610 million in capital to shareholders in the past 12 months and resumed paying dividends. Underlying earnings per share of 3.8 cents was up 11.8 per cent on the prior corresponding period. The future appears brighter.

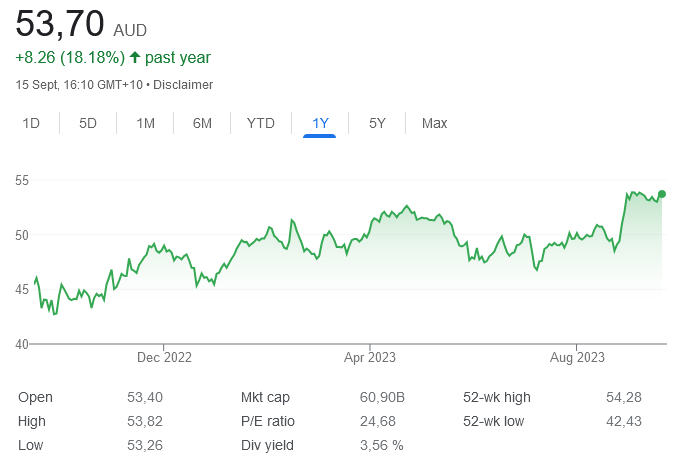

HOLD – Wesfarmers (WES)

The fiscal year 2023 performance demonstrated resilience against economic headwinds, particularly with its robust retail brands, such as Bunnings, Kmart Group and Officeworks. WES has improved its balance sheet by reducing net debt to $4 billion. The company exceeded dividend expectations by paying $1.91 a share for the full year.

SELL RECOMMENDATIONS

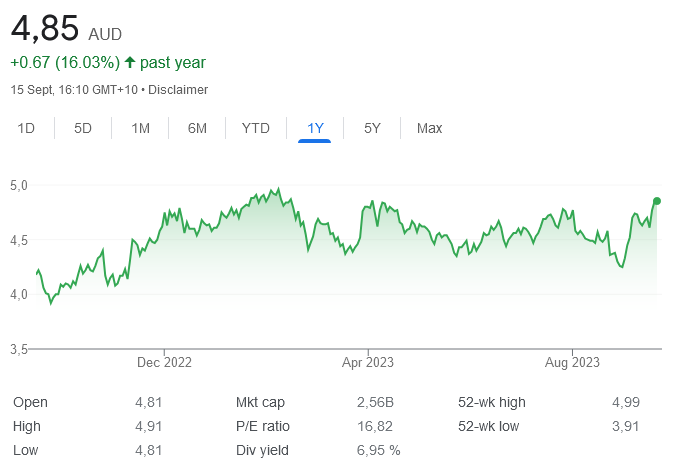

SELL – Coles Group (COL)

The company’s sales revenue increase of 5.9 per cent in fiscal year 2023 aligned with expectations. The group EBIT (earnings before interest and tax) margin of 4.6 per cent in fiscal year 2023 was moderately lower than the prior corresponding period. Despite the supermarket group retaining a healthy balance sheet, COL’s net debt position, excluding lease liabilities, has moderately increased to $521 million. Net profit after tax of $1042 million was down from $1045 million in the prior corresponding period. We prefer Woolworths.

SELL – Deterra Royalties (DRR)

The company manages a portfolio of resource royalties across a range of commodities. The company’s payout ratio from net profit after tax (NPAT) is 100 per cent. It declared a total fully franked dividend of 28.85 cents a share in fiscal year 2023. NPAT in fiscal year 2023 fell 15 per cent on the prior corresponding period and revenue was down 14 per cent. The company can be exposed to volatile commodity prices.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.