Elio D’Amato, Spotee Connect

BUY RECOMMENDATIONS

HRL Holdings (HRL)

HRL is a profitable laboratory services provider. It generates positive operating cash flow and is targeting between $45 million and $50 million in what it terms industry leading margins by fiscal year 2024. Former chief executive of ALS Limited Greg Kilmister chairs HRL and knows the sector. Australian Super is also on the HRL registry, holding a 10 per cent interest in the business.

Renascor Resources (RNU)

The company’s graphite deposit in South Australia is the world’s largest reserve outside Africa. It plans to manufacture purified spherical graphite. The manufacturing process is eco-friendly. Completing large scale flotation trials and signing a memorandum of understanding with South Korean-based firm POSCO – the largest manufacturer of anodes outside of China – paints a brighter outlook.

HOLD RECOMMENDATIONS

EML Payments (EML)

This digital payments enabler delivered an update on the continuing investigation by the Central Bank of Ireland (CBI) into the operations of its acquired PFS Card Services business. The share price was recently savaged in response to investor concerns the CBI may curb the growth ambitions of the firm’s European arm. However, the company is likely to retain its European licence, which paints a brighter outlook.

Beamtree Holdings (BMT)

BMT provides health data insights and coding solutions to health organisations. The shares have risen from 35.5 cents on February 1 to close at 57.5 cents on October 14. The company is in the early stages of generating cash. News flow is solid. It recently signed a proof of concept agreement with the Central Adelaide Local Health Network. If the agreement proves successful, it could be a catalyst for other health care networks adopting the technology.

SELL RECOMMENDATIONS

Harvey Norman Holdings (HVN)

The quality retail giant offers an attractive yield. But from a charting perspective, HVN is in downtrend territory. If it can’t hold current levels, we expect the stock to fall to between $4.13 and $4.15, which is the inverse of the neckline to a recent double top. The stock closed at $5.08 on October 14. Investors may want to consider taking some money off the table.

Magellan Financial Group (MFG)

Since recommending the stock as a sell in TheBull.com.au in early 2021, the price has fallen from $48.85 on February 11 to finish at $32.89 on October 14. The price fall is a response to this global fund manager underperforming the broader market. In our view, other stocks offer more appealing growth prospects at this point in time.

Braden Gardiner, TradeDirect365

BUY RECOMMENDATIONS

Calidus Resources (CAI)

The company is building the Warrawoona gold project in the east Pilbara district of Western Australia. It has regulatory approvals and finance. The company is on schedule to produce gold in the June quarter of 2022. Buyers supporting higher price levels provide an encouraging outlook. The shares have risen from 38 cents on April 30 to close at 62.5 cents on October 14. We expect positive momentum to drive the price through 75 cents.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Western Areas (WSA)

The share price of this nickel miner has moved higher since mid August as investors responded to preliminary discussions between WSA and IGO Limited in relation to a change of control proposal. IGO has started the due diligence process in relation to WSA. However, it remains uncertain whether any transaction between the two companies will proceed. A deal is likely to be positive for WSA’s share price. Alternatively, WSA’s share price may be pressured if a deal doesn’t proceed.

HOLD RECOMMENDATIONS

Macquarie Group (MQG)

This diversified financial services giant remains a market darling to investors. The shares have risen from $140 on January 4 to close at $182.87 on October 14. The company’s strong track record of meeting or exceeding expectations attracts investors. We expect favourable momentum to continue provided MQG remains above support at $170 a share.

HUB24 (HUB)

The share price of this investment and superannuation platform provider has been fluctuating for most of 2021 after a strong run up into the end of 2020. Lately, the share price has been moving higher. It’s risen from $24.75 on October 6 to close at $31.25 on October 14. The price looks stretched, so I suggest holders wait and see if more buyer confidence emerges before adding risk.

SELL RECOMMENDATIONS

Uniti Group (UWL)

The share price of this telecommunications company has risen from $1.75 on January 4 to finish at $3.91 on October 14. In my view, the shares have moved too rapidly and appear expensive at this point. The price leaves little room for error in an industry that is becoming more competitive. Investors may want to consider cashing in some gains.

Technology One (TNE)

This software as a service provider posted a strong 2021 half year result. The shares have enjoyed a solid run up from late August, with the price rising from $9.76 on August 27 to close at $12.30 on October 14. My analysis of the technical chart suggests the shares may consolidate then fall following a rapid climb. Buyers may want to consider taking some profits.

Harrison Massey, Argonaut

BUY RECOMMENDATIONS

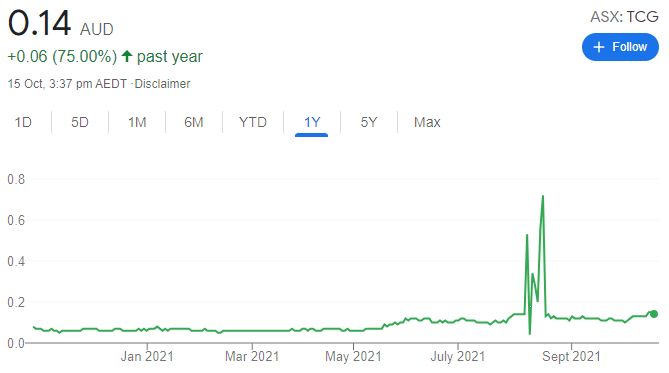

Turaco Gold (TCG)

Turaco has gold projects in Cote d’Ivoire. The company is progressing its 9000 metre air core drilling program, testing three kilometres of northern and southern strike extensions at Nyangboue. The company is led by an experienced mining team. Recently, the shares have been enjoying favourable momentum, rising from 9.8 cents on September 30 to close at 15 cents on October 14. Explorers carry risk, but any encouraging results should paint a brighter outlook.

Noronex (NRX)

Noronex recently acquired the Snowball copper project in the Kalahari copper belt in Namibia. What we find appealing is the Kalahari copper belt already hosts mining giants Rio Tinto and Sandfire Resources. The Snowball project has similar geological patterns to existing projects. It lies below shallow sand cover that has never previously been drilled. Targets are defined and drilling is expected to start soon.

HOLD RECOMMENDATIONS

Ramelius Resources (RMS)

The company’s projects produced more than 270,000 ounces of gold in fiscal year 2021. According to our analysis, 1.1 million ounces of reserves are yet to be replaced this financial year. In our view, Ramelius will need to decide whether to push forward with the Edna May stage 3 development, or potentially acquire a new asset to reach expectations. The company reported a net profit after tax of $126.8 million in fiscal year 2021, up 12 per cent on the prior corresponding period.

Fortescue Metals Group (FMG)

The share price of this iron ore producer enjoyed a solid run up earlier this year on rising iron ore spot prices. However, FMG’s share price has corrected in line with weaker iron ore prices. The company increased total dividends by 103 per cent in fiscal year 2021 to $3.58 a share. In our view, FMG will continue to pay one of the best dividends on the market regardless of short term iron ore spot prices.

SELL RECOMMENDATIONS

Computershare (CPU)

The price of this share registry business has enjoyed a strong run, rising from $13.19 on March 1 to close at $17.75 on October 14. Despite a steady flow of new entrants to the ASX, the company’s 2021 full year result fell marginally short of our expectations. Earnings per share fell in fiscal year 2021, mostly due to low interest rates. Investors may want to consider taking a profit at these levels.

WiseTech Global (WTC)

WTC is a leading provider of software solutions to the logistics industry. The company produced a strong fiscal year 2021 result in response to increasing demand for WiseTech’s software. The share price has soared since the company released its results on August 25. The shares closed at $53.51 on October 14. It may be prudent to consider locking in a profit around these levels.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.