Michael Gable, Fairmont Equities

BUY RECOMMENDATIONS

Mineral Resources (MIN)

We aren’t as excited about lithium stocks compared to others in the market, but they can be good to trade on a short-term basis. Recently, MIN fell below its February low, before bouncing strongly again. From a charting perspective, this can be bullish, and we believe we’re likely to see a short-term recovery in the MIN share price.

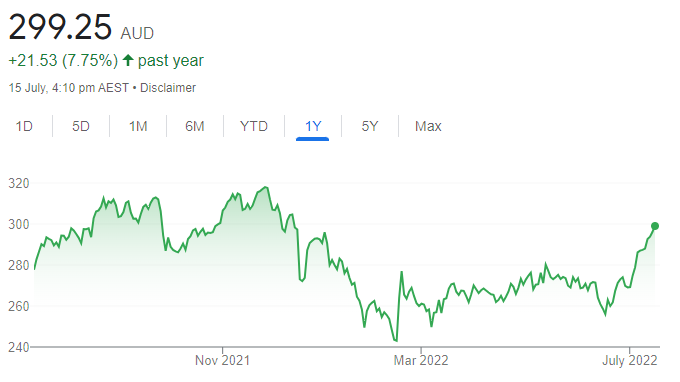

CSL (CSL)

Since the share price hit a low in February, it’s been moving higher despite a falling broader market. Health care stocks have recently found solid buying support because of reliable earnings. The share price of this blood products company recently pushed through a major resistance level near $280. Consequently, we expect the price to rally towards last year’s peak near $320.

HOLD RECOMMENDATIONS

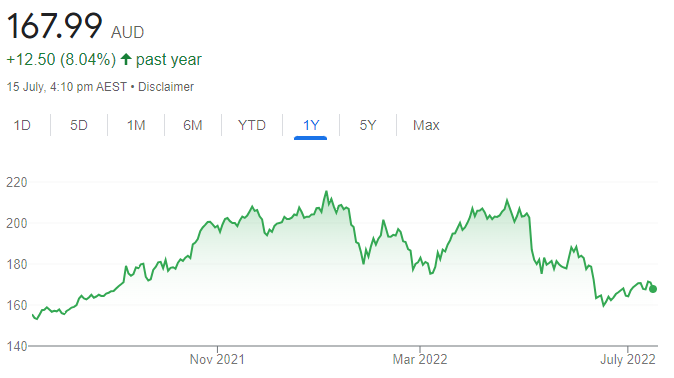

Macquarie Group (MQG)

The share price of this diversified financial services group has fallen from $206.98 on April 29 to trade at $170 on July 14. We believe MQG offers value at recent prices. We have seen good buying on price dips since mid June, and momentum indicators are turning positive again.

Goodman Group (GMG)

The share price of this integrated commercial and industrial property group has fallen significantly since late April in response to rising interest rates and fears about slowing economies. As a property stock, it remains sensitive to rising rates, but we believe it’s been oversold. Recent price action suggests good buying support at these levels.

SELL RECOMMENDATIONS

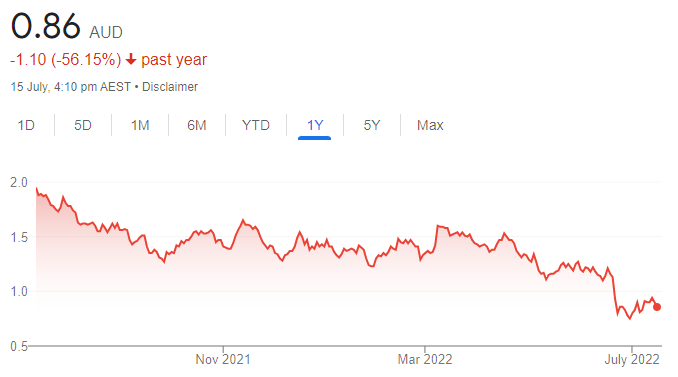

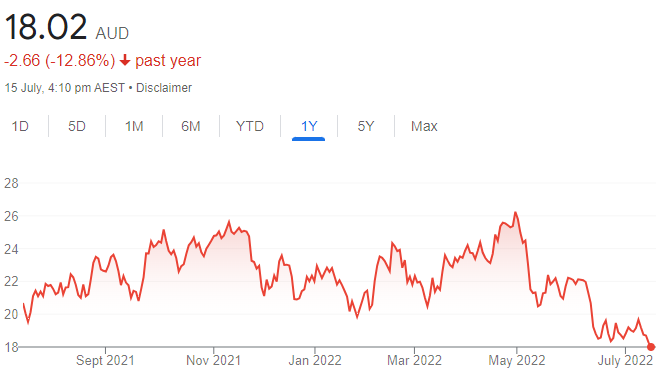

Zip Co (ZIP)

The share price of this buy now, pay later company has fallen from $12.35 on February 15, 2021 to trade at 53.5 cents on July 14, 2022. It reported a cash EBTDA loss of $108.1 million in the 2022 first half. Competition within the sector is fierce. Other stocks appeal more given recent sharemarket weakness.

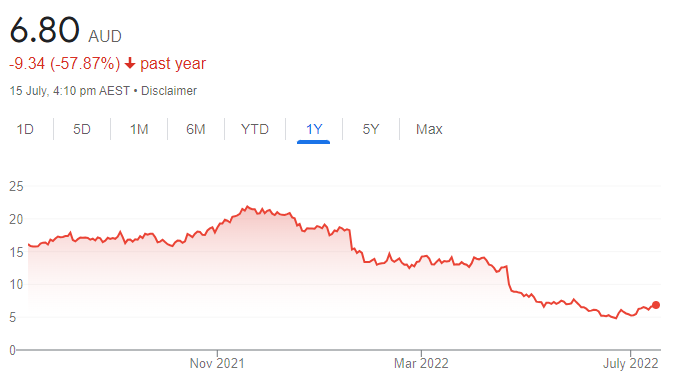

Megaport (MP1)

MP1 provides elastic interconnection services. The share price has fallen from $21 on November 29, 2021 to trade at $6.81 on July 14, 2022. In our view, revenue growth and cost control have been disappointing. The broader market doesn’t have the appetite to pay high prices for technology stocks while interest rates continue to rise.

Angus Geddes, Fat Prophets

BUY RECOMMENDATIONS

Praemium (PPS)

This wealth management technology company sold its international operations for £35 million. The company will focus on its Australian operations and core strengths. Praemium will scale up in Australia in a bid to capture a bigger share of the independent advisory services market. The board has resolved to return about $50 million to shareholders via a special dividend and on-market buyback.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- City Index - Aussie shares from $5 - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Collins Foods (CKF)

The KFC operator delivered strong revenue and net profit growth in fiscal year 2022 after successfully navigating COVID-19 lockdowns and growing inflationary pressures. Growth in new stores and increasing same store traffic delivered the top-flight performance. Collins Foods has the right ingredients to deliver strong performances over the longer term.

HOLD RECOMMENDATIONS

Australian Agricultural Company (AAC)

AAC delivered a strong fiscal year 2022 result. The company reported stronger sales revenue and higher operating profit. Higher beef prices lifted operating margins. The company has built its herd numbers to deliver premium brands to the market. Momentum remains positive to deliver value.

St Barbara (SBM)

SBM has announced it would meet total group gold production guidance of 281,000 ounces in fiscal year 2022. In our view, St Barbara warrants holding following news it was in discussions with Genesis Minerals about a potential business combination regarding consolidation of the Leonora Province.

SELL RECOMMENDATIONS

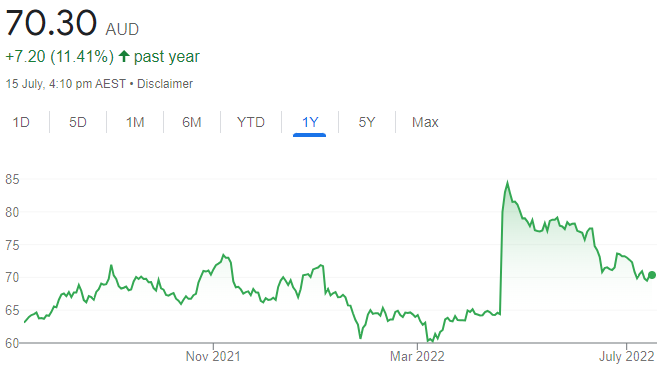

Yancoal Australia (YAL)

YAL has benefited from higher coal prices. It produced 36.7 million tonnes of coal in fiscal year 2021, down 4 per cent on 2020. Unit costs jumped around 14 per cent to $A67 a tonne. Investors can consider selling Yancoal, as it’s been subjected to takeover negotiations by major shareholder Yankuang Energy. It’s uncertain whether a transaction will proceed.

Grange Resources (GRR)

Grange produces iron ore pellets. We’re concerned about volatile iron ore prices, Chinese demand and central banks raising interest rates. The share price has risen from 37 cents on February 8, 2021 to trade at $1.18 on July 14, 2022. Longer term investors may want to consider cashing in some gains.

Toby Grimm, Baker Young

BUY RECOMMENDATIONS

Corporate Travel Management (CTD)

The business and leisure travel sector is expected to gradually recover to pre-pandemic levels. CTD’s share price has fallen from $26.25 on April 29 to trade at $18.40 on July 14. We believe a value buying opportunity exists, as we expect the stock to outperform in the medium term. The company is well managed.

Ramsay Health Care (RHC)

The private hospital operator offers quality defensive exposure to ageing populations and expanding healthcare services. While still working through pandemic headwinds, we see strong recovery potential ahead, as suggested by a non-binding, conditional takeover bid from a consortium of investors led by US private equity giant KKR at $88 a share. The shares were trading at $69.72 on July 14.

HOLD RECOMMENDATIONS

Santos (STO)

Given high crude oil prices and significant production growth opportunities, we believe this energy producer has been oversold, particularly compared to major domestic peers. Cash flow should still support attractive dividend payments. The company is well managed.

Panoramic Resources (PAN)

This Western Australian based nickel producer owns the long-life Savannah mine. We believe recent falls in nickel prices have been factored into the stock. Savannah should generate good profits at lower prices. The long term outlook for the critical batteries metal remains attractive.

SELL RECOMMENDATIONS

Orora (ORA)

The share price of this packaging giant has fallen from $4 on April 29 to trade at $3.36 on July 14. While domestic demand remains well supported, we’re mindful of rising operating costs. We see better value elsewhere in this volatile market.

OZ Minerals (OZL)

OZL has attractive long term copper and gold assets in South Australia. The company’s recent operational update revealed higher operating costs and continuing equipment issues. The share price has fallen from $24.71 on June 3 to trade at $16.72 on July 14. The stock may fall further before it improves.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.