Elio D’Amato, Spotee Connect

BUY RECOMMENDATIONS

Rhythm Biosciences (RHY)

The ColoSTAT screening test achieved a high sensitivity rate in detecting colorectal cancer. It’s estimated the test is 35 per cent more accurate than current global standards. RHY is preparing a submission for approval by the Therapeutic Goods Administration. Another positive is the company has five candidates for detecting other cancers and diseases.

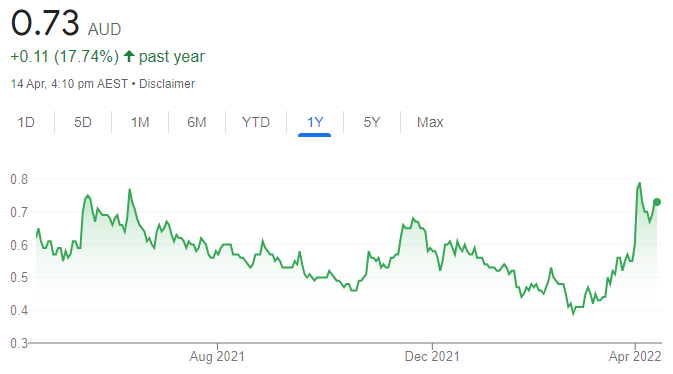

Sovereign Metals (SVM)

Discovering tier 1 mining assets is rare. The company’s recent update classifies the Kasiya asset in Malawi as the biggest rutile and second largest graphite deposit ever discovered. Rutile is a valuable source of titanium, while graphite is used as an anode in lithium-ion batteries. Funding is required. The next step is crucial, particularly choosing a suitable partner for this project.

HOLD RECOMMENDATIONS

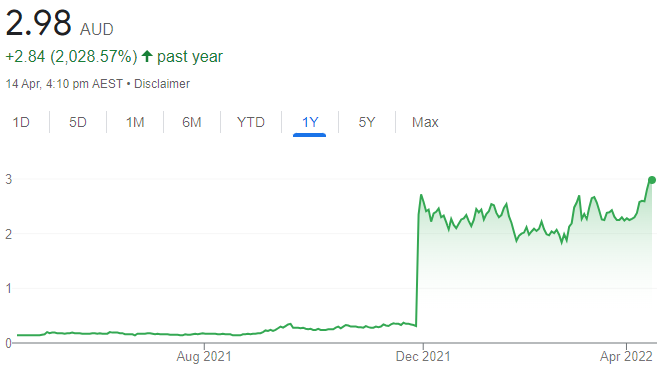

Boss Energy (BOE)

The company has a uranium mine in South Australia. It’s poised to make an investment decision on whether to proceed with its Honeymoon uranium project. BOE recently raised $120 million. It has all relevant approvals, a plant that is operational, an experienced team and physical uranium already in the bank. It’s ready, in our view.

Agrimin (AMN)

After recommending AMN as a buy in TheBull.com.au in August, the company continues to execute its plan of developing a big and low cost sulphate of potash project in Western Australia. A main competitive advantage is that AMN’s reserve is based solely on shallow brine resources using surface trenches and gravity flow. The project has a net present value of $1 billion and a mine life of more than 40 years.

SELL RECOMMENDATIONS

Bravura Solutions (BVS)

BVS provides software solutions via a range of applications to the local and international financial services sectors. The increasing complexity and cost of managing a diverse range of offers in this intensely competitive market leaves challenges ahead for BVS, in our view. The share price has fallen from $2.44 on January 4 to trade at $1.777 on April 14. We prefer others for growth prospects.

PointsBet Holdings (PBH)

PBH is aggressively expanding in the US and Canada with its sports betting solution. Operating in a ruthlessly competitive environment is draining cash, according to our analysis. The share price remains under pressure, falling from $7.17 on January 4 to trade at $3.16 on April 14. If the company raises funds moving forward, it’s likely to be dilutive, in our opinion.

Peter Moran, Wilsons

BUY RECOMMENDATIONS

Resimac Group (RMC)

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

RMC is one of Australia’s largest non-bank financial lenders. The company’s flexile and attractively priced loans have resulted in solid loan origination growth in recent years. The lending environment is competitive and we expect a slight decrease in profitability for the current financial year. However, RMC is well positioned to compete in this environment and we expect profit growth to resume next financial year. We hold an overweight recommendation.

Costa Group Holdings (CGC)

The outlook is improving for Australia’s biggest grower and marketer of fresh fruit and vegetables. Positive catalysts include increasing table grape exports and higher domestic pricing in the key categories of mushrooms, blueberries and tomatoes. The international business is benefiting from increasing demand from China and from supply issues for competitors based in Chile. We have upgraded to an overweight recommendation.

HOLD RECOMMENDATIONS

Breville Group (BRG)

The kitchenware company recently announced the acquisition of LELIT, an Italian specialist designer and manufacturer of coffee machines. It’s a good fit with existing brands. Breville has a solid track record of developing and growing its brands and deserves to trade at a premium to competitors. BRG is fairly priced. We retain a market weight recommendation.

Ramsay Heath Care (RHC)

The private hospital operator was impacted by COVID-19 as a result of lockdowns, staff losses and restrictions on elective surgery. The company is well positioned to recover and return to profitability growth. But it will take time as hospitals are impacted by continuing staff shortages and higher costs. We hold a market weight rating.

SELL RECOMMENDATIONS

Elders (ELD)

This agricultural products and services provider has been benefiting from favourable agricultural conditions in rural Australia. ELD recently provided guidance of a 20 per cent to 30 per cent increase in underlying earnings before interest and tax in fiscal year 2022. This resulted in a share price jump of more than 10 per cent. However, we continue to believe the market is ignoring the cyclical nature of the agricultural industry. In our view, the shares are overpriced at current levels. We hold an underweight rating.

ELMO Software (ELO)

This cloud-based solutions provider has enjoyed a steady increase in top line growth. However, cash burn remains an issue, in our view. According to our analysis at this point, it’s possible that capital will need to be raised at some future time. We hold an underweight rating.

Tim Haselum, Catapult Wealth

BUY RECOMMENDATIONS

The a2 Milk Company (A2M)

This infant formula company has been facing supply chain issues and margin pressure from increasing competition, resulting in a major valuation decline in recent years. Even without strong growth in China, A2M is expanding in New Zealand and the US. Also, new markets in Malaysia, Singapore and Vietnam could lead to a recovery in 2023 and beyond. With a strong net cash position, A2M has plenty of firepower for mergers and acquisitions.

Pro Medicus (PME)

This medical imaging software provider is aggressively expanding overseas, particularly in the US, which accounts for about 70 per cent of revenue. The company announced a first half 2022 net profit of $20.68 million, up 52.7 per cent on the prior corresponding period. Given new contract wins and renewals, we believe PME can justify its relatively high price/earnings ratio.

HOLD RECOMMENDATIONS

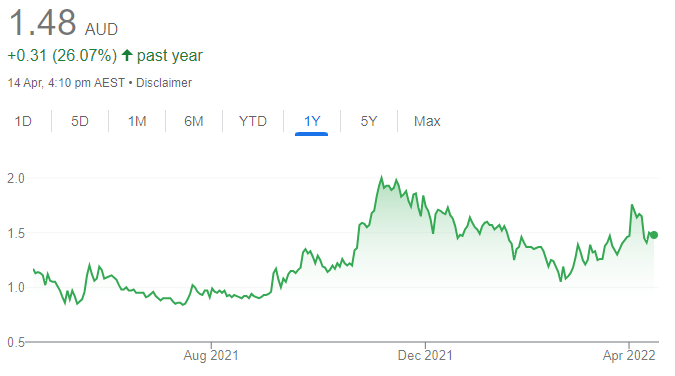

Magellan Global Fund (MGF)

This wholly owned subsidiary of Magellan Financial Group invests in global equities and global listed infrastructure. According to our analysis, the company is trading at a steep discount to net tangible assets. The share price has drifted from $1.80 on December 31, 2021 to trade at $1.485 on April 14, 2022. We expect value to emerge moving forward.

IDP Education (IEL)

This English testing and student placements provider is a dominant player in the industry. The acquisition and integration of the British Council’s Indian operations provides growth. The company reported total revenue of $397 million in the 2022 first half, an increase of 47 per cent on the prior corresponding period. EBITDA was up 43 per cent to $96.6 million. We retain a hold recommendation given what we consider a lofty forward price/earnings ratio.

SELL RECOMMENDATIONS

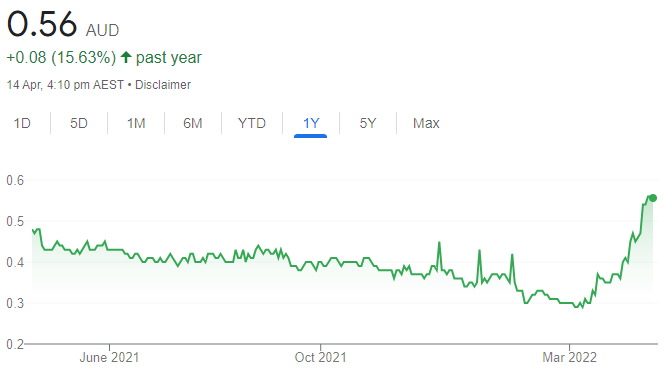

National Storage REIT (NSR)

Underlying earnings of $58.2 million in the 2022 first half represented a 48 per cent increase on the prior corresponding period. The company has also reduced gearing to help fund future acquisitions.

Although housing prices may stay strong, building activity could slow, which is a key driver for NSR. It may be prudent for investors to consider locking in some gains.

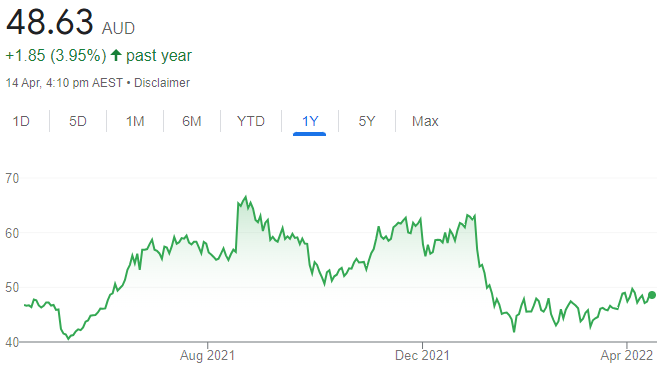

Rio Tinto (RIO)

The company has benefited from increasing iron ore prices in response to supply side issues flowing from the war in Ukraine. The share price of this global miner has risen from $106.75 on March 15 to trade at $120.46 on April 14. We view RIO as a cyclical stock that could come under pressure if pending higher interest rates lead to a global slowdown. Investors may want to consider locking in some gains at these prices.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.