John Athanasiou, Red Leaf Securities

BUY RECOMMENDATIONS

Ansell (ANN)

During inflation, companies with pricing power tend to outperform. Ansell, a leading manufacturer of protective industrial and medical gloves, has been able to pass on increasing production costs without any material impact on demand. As a result, we’re expecting the share price to outperform.

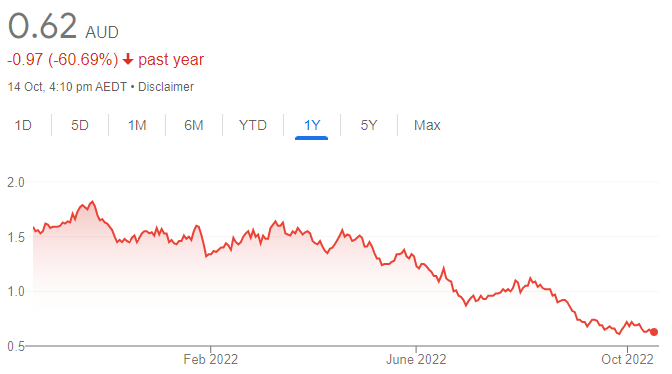

Paladin Energy (PDN)

The uranium company owns a 75 per cent stake in the Langer Heinrich mine in Namibia. The share price is highly correlated to the uranium price. The political momentum towards uranium as a clean and reliable energy source, particularly in Europe, is gathering pace. Consequently, we expect increasing uranium prices to be reflected in an improving share price moving forward.

HOLD RECOMMENDATIONS

Whitehaven Coal (WHC)

The coal producer’s share price has soared from $2.76 on January 4 to trade at $10.80 on October 13. Energy supply issues arising from the conflict in Ukraine have contributed to the rise. Although we don’t expect energy supply issues to be resolved in the short term, we wouldn’t recommend chasing WHC at these prices. Best to hold and monitor the energy supply crisis prior to altering your position, in our view.

Transurban Group (TCL)

The company owns and operates toll roads in Australia and overseas. More than half its revenue is linked to consumer price index escalations. Motorists may cut vehicle travel in response to increasing fuel prices and higher cost of living expenses. Best to hold and evaluate the economic outlook moving forward, in our view.

SELL RECOMMENDATIONS

Pilbara Minerals (PLS)

The share price of this Australian lithium producer has risen from $2.28 on June 2 to trade at $5 on October 13. The company’s been benefiting from higher lithium prices. In fiscal year 2022, the company generated sales revenue of $1.2 billion, a 577 per cent increase on the prior corresponding period. Investors may want to consider cashing in some gains.

West African Resources (WAF)

This unhedged gold producer is based in Burkina Faso, where there’s been a change in military leadership. The share price has fallen from $1.40 on August 10 to trade at $1.047 on October 13. Risk is an investment consideration. We prefer more appealing and stable opportunities elsewhere.

Harrison Massey, Argonaut

BUY RECOMMENDATIONS

Centaurus Metals (CTM)

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Centaurus owns and operates the Jaguar nickel project in Brazil. Jaguar has a JORC nickel resource of 80.6 million tonnes at 0.91 per cent nickel. The company is planning to release an updated mineral resource estimate at the end of October. The update may upgrade the resource. The company is well funded with $50 million in cash reserves.

Ramelius Resources (RMS)

This Australian gold producer has flagship assets in Western Australia. Despite producing 258,625 ounces of gold in fiscal year 2022 at a competitive all-in-sustaining cost of $1523 an ounce, the company has been sold down on smaller profit margins and increasing input and labour costs. We believe RMS will have a stronger fiscal year 2023 by bringing forward new reserves. We expect better than anticipated cash returns.

HOLD RECOMMENDATIONS

Newcrest Mining (NCM)

Increasing cost pressures in fiscal year 2022 reduced the gold producer’s profit margin compared to previous periods. An environment of high inflation and rising interest rates is typically tough for gold producers. But given Newcrest’s size and scale, we believe it’s still worth holding for exposure to gold.

Pilbara Minerals (PLS)

Pilbara owns and operates the Pilgangoora lithium project in Western Australia. The company produced 377,902 dry metric tonnes of spodumene concentrate in fiscal year 2022. It generated sales revenue of $1.2 billion, a 577 per cent increase on the prior corresponding period. The share price had doubled between July and October 13. It may not be worth adding more shares at this point, but we suggest holding for exposure to lithium.

SELL RECOMMENDATIONS

Harvey Norman Holdings (HVN)

The retail giant posted a net profit after tax of $811.53 million in fiscal year 2022, a fall of 3.6 per cent on the prior corresponding period. Inflationary pressures and rising interest rates is likely to impact discretionary consumer spending moving forward. It may be worthwhile for investors to consider reducing exposure to the retail sector.

Temple & Webster Group (TPW)

The share price of this online furniture and homewares retailer has risen from $2.97 on July 12 to trade at $5.26 on October 13. It may be time for investors to consider cashing in some gains given the economic outlook points to a likely reduction in discretionary spending as consumers grapple with higher cost of living increases.

Jed Richards, Shaw and Partners

BUY RECOMMENDATIONS

CSL (CSL)

This blood products company has demonstrated for more than 25 years that it can generate a high rate of return. It’s been leading the global plasma industry and dominates the market. The company’s research and development program will enable CSL to retain its market leading position in innovation. The healthcare sector performs well during various economic conditions, as it’s a non-discretionary expense.

ResMed Inc (RMD)

The popularity of this respiratory device company has grown after competitor Philips announced a product recall last year. The Philips recall has been factored into RMD’s share price. But, longer term, we still expect the impact from the recall to enable RMD to increase and sustain market share in the respiratory devices market.

HOLD RECOMMENDATIONS

Brambles (BXB)

The share price of this global logistics supply chain company has fallen from $13.10 on August 22 to trade at $11.28 on October 13. However, the company’s defensive earnings are appealing. And, the ability to pass on higher input costs make BXB an attractive investment proposition in this inflationary and volatile environment. We expect automation benefits to further improve profit margins over the medium term.

Telstra Corporation (TLS)

The company’s infrastructure generates predictable annuity-like cash flows. TLS dominates the Australian telecommunications market. It has the best network and a mobile market share of about 50 per cent. While company earnings are reliable, we believe the stock is fully priced at these levels.

SELL RECOMMENDATIONS

Pilbara Minerals (PLS)

We believe in the lithium story. Supply shortages have been driving higher lithium prices. But the PLS share price is up by more than 100 per cent between early June and October 13. In our view, the stock is overvalued. More appealing opportunities exist elsewhere. Recession fears may impact commodity prices over the next 12 months.

Woodside Energy Group (WDS)

WDS has strongly outperformed the market this year. It has benefited from higher energy prices in response to the war in Ukraine. High crude oil prices are likely to fall if the Ukraine conflict is resolved. Longer term, we expect crude oil prices to fall as the transition to renewables gathers pace.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.